Decentralized finance, at its most basic sense, is a philosophy in which financial products are made usable through a distributed decentralized blockchain network, rendering them accessible to everyone instead of going through a middleman such as banks or brokerages.

Unlike with a bank or investment account, DeFi does not require a govt ID, phone number, or social security card.

DeFi applies to a mechanism in which buyers and sellers, lenders, and creditors connect peer to peer or with a purely software-based intermediary rather than an organization or entity facilitating a trade using software developed on blockchains.

Source

To accomplish the aim of decentralization, a variety of technology and protocols are employed. A decentralized framework, for example, may be made up of open-source systems, blockchain, or proprietary applications.

These financial goods are made possible by smart contracts, which simplify deal conditions between sellers and buyers or borrowers and lenders. DeFi systems are programmed to eliminate mediators between processing transactions parties, regardless of the infrastructure or platform utilized.

Although the amount of trading coins and resources locked in blockchain technology in DeFi's ecosystem has been slowly growing, the market is still in its early stages, with technology still being established.

DeFi is subject to little or no enforcement or supervision. DeFi, on the other hand, is projected to seize over and overtake the rails in modern finance in the future.

The Layers of DeFi

A software stack contains many of the elements of a decentralized finance structure. Each layer's characteristics are designed to serve a particular role in the construction of a DeFi structure. Composability is a distinguishing feature of the stack since each layer's components may be combined to create a DeFi app.

The layers that make up the DeFi stack are described below.

1.The settlement layer is also called Layer 0 because it serves as the foundation for all other DeFi transactions. It is made up of a shared blockchain and a payment system or cryptocurrency. This money, which can be exchanged on stock exchanges, is used to settle transactions on DeFi applications.

Ethereum, as well as its native cryptocurrency ether (ETH), which is traded on crypto exchanges, are an example of a settlement layer. Tokenized copies of money, such as the USD, or assets that are digital equivalents of alternative investments, may be included in the settlement layer. A real estate token, for example, may reflect the possession of a piece of property.

2.Software protocols are written specifications and guidelines that regulate particular tasks or operations. This will be a collection of standards and policies that all actors of a specific sector have committed to obeying as a prerequisite to participating in the industry, similar to real-world organizations.

DeFi protocols are interchangeable, which means several organizations can utilize them to create a service or app at the same time. The protocol layer gives the DeFi ecosystem liquidity. Synthetix, an Ethereum-based derivatives trading protocol, is an illustration of a DeFi protocol. It's used to make digital replicas of real-world properties.

3.The device layer, as its name implies, is where customer apps are processed. The fundamental protocols are abstracted into essential customer services in these implementations. This layer houses most of the crypto ecosystem's apps, such as decentralized digital currencies and lending facilities.

4.The layer of Aggregation: Aggregators bind multiple programs from the previous stage and deliver a service to investors in the aggregation layer. They could, for example, make it possible to move capital seamlessly between various financial instruments in order to optimize returns. Such exchanging activities will necessitate a lot of documentation and planning in a physical setup.

Source

On the other hand, a technology-based architecture could smooth the investment rails, enabling traders to migrate between various services easily. On the aggregation layer, lending and borrowing are two examples of services. Other representations include banking systems and cryptocurrency wallets.

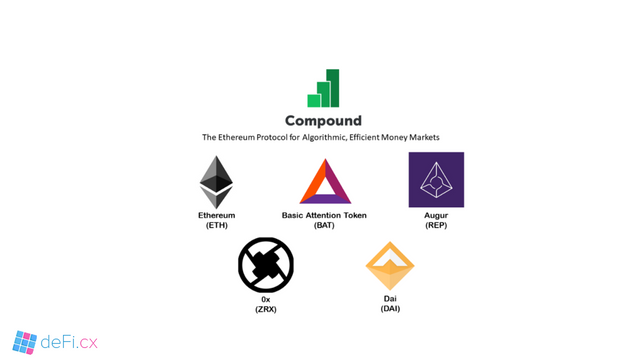

Compound Protocol in DeFi Ecosystem

Ethereum, a blockchain that allows smart contracts on which other blockchain-based applications with specific cryptocurrencies can be developed, is the critical cornerstone of today's DeFi movement. The Compound protocol is mainly associated with financial resources such as investing and borrowing your cryptocurrency.

This is how it happens. Compound allows for the investing and lending of a limited number of cryptocurrencies. They are DAI, ETH, USDC, ZRX, USDT, WBTC, BAT, REP, and SAI. Anyone with crypto can now lend and borrow crypto instantly, without the time, commitment, or expense of working with a conventional financial intermediary.

Source

If you own either of the cryptocurrencies listed above, you may send, lock, deposit, or lend – both of these terms imply the same thing – any sum to the Compound protocol.

Compounding the cryptocurrency is close to placing capital in a bank account, except with a decentralized, blockchain-based protocol. You are sending the cryptocurrency to the Compound wallet rather than depositing it in a branch.

And, much like lending to a mortgage, you start earning interest on your crypto right away. The interest you receive is denominated in the same token that you borrowed – so if you sent BAT, you make BAT interest. If you send DAI, you earn DAI interest, and so on.

The crypto you send is linked to a vast pool of the same token in a Compound protocol smart contract submitted by thousands of other citizens all around the planet.

Borrowing is the opposite half of the coin. You can invest against your crypto until you've locked it to Compound. Compound does not need a credit check, so someone with crypto from everywhere in the world will borrow.

Compounding dictates how much you will repay depending on the asset's rating. So, if you send 1000 BAT valued $600 and Compound has fixed the borrowing cap for BAT at 20%, you can borrow $120 worth of some other cryptocurrency supported by the Compound protocol (see list above). You would still pay the return on the amount you invest, much as you would if you lent it from a store.

And we have lending and investing, all of which are dealing with interest rates. You gain interest through lending. Borrowers must incur interest. Let's take a moment to explore how the Compound protocol measures and dynamically implement interest rates.

Remember that if you are borrowing or investing, you must first lock-in cryptocurrency with Compound. In exchange, you will receive Compound tokens, which reflect the amount of your cryptocurrency.

CTokens are ERC-20 tokens developed from Ethereum and are among the significant advantages and inventions in a blockchain-based cryptocurrency financial markets; they can be sold, sold, or coded into specific Dapps throughout the DeFi ecosystem in the same way as other Ethereum tokens do, all while receiving (or paying) interest. You control these cTokens using your keys in the same manner as regulating every other digital object on the Ethereum blockchain.

Proposals to amend the procedure may be introduced and decided on by someone who holds at least 1 percent of the overall COMP stock. Each COMP token represents a single vote. The amendments are executable code that would be voted on over three days.

Suppose the society approves a governance update to the procedure. In that case, that will take place two days later, allowing anyone the opportunity to fill some vacant vacancies until the adjustments take effect. As a consequence, Compound is a fully self-governing blockchain.

Jangan Lupa Bahagia

Thanks for being a part of my class and for participating in this week's assignment. I hope you learned from the class as the aim of the school is to teach and allow people to learn alongside.

Rating 9

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Shared On Twitter : https://twitter.com/LEVYCORE/status/1376152189412864003

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

bahasa aceh jeut droe neuh? hehehehe.....

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

gak bisa bahsa egreeehh... :D

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hahahahahaha.... hanco aneuk muda

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nicely explain about 4 layers of decentralized finance. in this modern era it's the advantage for us that we are getting such kind of financial platform for us. thanks for sharing your opinion about it

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit