Define Line charts in your own words and Identify the uses of Line charts.

Line chart can be said to be a chart like every other chart but has it own distinct feature such that it graphically represent the price and also show the time frame of the price displayed graphically. The unique feature of this chart is that the both the opening and closing price and interwoven into a single line on the chart display.

In a line chart,the closing price is more visible for traders to see and make viable moves in the market. This makes it very easy to comprehend and also helps in a way to reduce distractions and noise in the market which could mislead trader.

It is also imperative to understand the interface. The horizontal part shows price action or movement while the vertical part show the price at a given period of time

It also important to say that line chart can help get a clear picture of market trend when compared to candle sticks.This line chart can help you take advantage of the current trend in market and make profit out of it.

It's amazing how one line can so clearly defined the direction and the present state of the market. It a bit complex when trying to use candle stick to derive all these but with a line chart everything is made less complicated band straight forward.

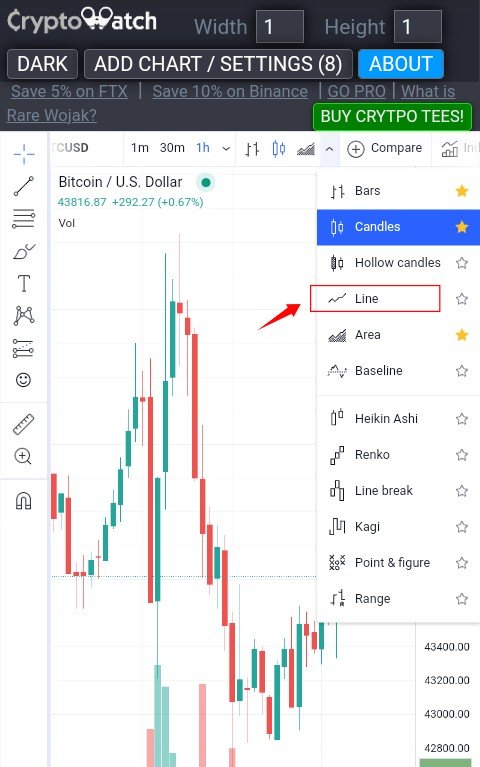

A good example of a line chart and how to set it up is shown below

How to Identify Support and Resistance levels using Line Charts (Demonstrate with screenshots)

Support and resistance are terms that every trader should get acquainted with,you can't have a good knowledge and understand about the market and it structure if you're not conversant with support and resistance. It is the bed rock of technical analysis a lot depends on it.

Support.

I will love to use a layman term to explain what a support is. Support means to aid or assist something such that it is sustained and upheld. In crypto,it's no different. The support areas are those areas in a chart (line chart) where buyer mount pressure for upward price movement. With the support level in place,price will not go below the support but when sellers persist and fights the pressure consistently,the support break and then there is a downward movement of price.

Here is a typical example of support in line chart. Using a 4hrs time frame for ADA/USDT

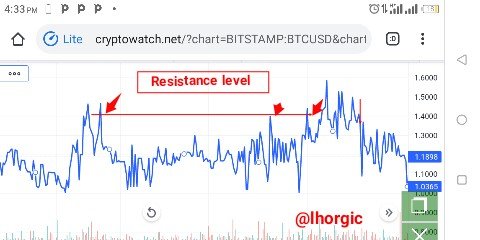

Resistance

A resistant in a layman terms mean opposing or resisting. It is also applicable to crypto. The resistance area or level are those point on the chart where there is a strong selling pressure such that price doesn't go upward beyond that point and that point is usually maintained by the seller such price bounces backward each time it get to that point. It will take a very tenacious set of buyers to break the resistance line and then price shoots up from that point and a new support is formed from that point. Here is a typical example of resistance line on our chart.

Using a 4hrs time frame for ADA/USDT

Note: Drawing a support or resistance line is pretty easy,all you need do is to connect the point where price keep bouncing back consistently on the chart thereby forming swings

Differentiate between line charts and Candlestick charts.( Demonstrate with screenshots)

| Line chart | Candlestick |

|---|---|

| Very easy to understand and comprehand | less easy to undersand |

| Has a very brief and less information | Has a very detailed information |

| Very good in filtering noise in the market | Has a lot of distractions and noise |

| Shows a clear picture of the market at a glance | does not show as much as line does |

| Ideal for higher time frame | cool with all timeframe even for scalpers |

| Tells more about the closing price which is like a summary | shows bother the opening and closing in a well detailed form. |

Explain the other Suitable indicators that can be used with Line charts.(Demonstrate with screenshots)

In the lessons learnt,I will like to follow my teacher in saying moving average should be used together with the line chart as it help to show how strong a trend is and also reveals when a trend is getting weak. Another indicator I will love to mention which I will be using to answer this question is the RSI. Relative strenght index. As we all know that indicators are used along with patterns just to further confirm signals. RSI also fits into this aspect as it complements the line chart so well. You can make the best use of this indicators by taking note of the points such as noticing when your RSI level reaches 30 or below it means the asset has been over sold and the trend is likely to change or reverse soon. On the other hand,when price reach 70 and above,it shows asset has gotten to an overbought region which means there is going to be reversal or. change in trend.

Prove your Understanding of Bullish and Bearish Trading opportunities using Line charts. (Demonstrate with screenshots)

Identifying opportunities on a line chart is not difficult at all when you understand the technique to be used. Using the ascending and descending triangle trading pattern can help you spot opportunities very easily.

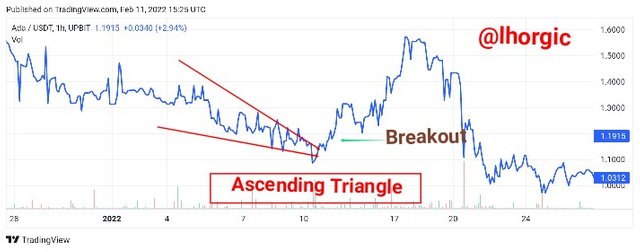

Ascending Triangle

In ascending triangle trading pattern,what we anticipate is a bullish movement which we would love to take advantage of. You connect your line to form your triangle by identifying you lower highs and lower lows in such a way that it brings out that triangular shape as seen in my screenshot. The points where the line connects is the points where there's likely to be a breakout upwards and it a opportunity to take a long position.

Descending triangle pattern.

In descending triangle pattern,what we look out for is a bearish movement or opportunity to take a short position. Here you connect your lines to form your triangle by identifying your higher highs and higher low points. The point where they intercept is the point where there's likely to be a breakout that will bring about a downward movement which in turn gives you the opportunity to take a short position

Investigate the Advantages and Disadvantages of Line charts according to your Knowledge.

There is a common saying which is also applicable to the lesson that whatever comes with advantage has it disadvantages too. I would like us to explore the pros and cons of line chart.

Advantages

- Line chart are very easy to read and interprete.

- Line chart eliminates noice and distraction in the market.

- it's very efficient and effective when used on a higher timeframe

- it is less complicated when compared to candlesticks

- Its very suitable for those starting out in crypto trading because of it simple nature.

Disadvantages

- It doesn't supply enough informations for proper analysis

- It only work well with higher timeframe which has in a way limits it efficiency.

- It only take into consideration the closing price which is just a fraction of the information that should be supplied for wise trading decision.

- Having to draw too many lines on the chart for the sake of analysis can actually make the chart messy and complicate if adequate care is not taken.

Conclusion

I learnt a whole lot from this lesson,it my first time of exploring the line chart and I must say,I found it really interesting. It now clear to me that line chart is simpler and less complicated when compared to the traditional candlestick that trader use for their trading activities. Learning to use the line chart with other relevant indicators such as RSI and Moving average is key as no patter can stand alone without the need of an indicator.

Thanks so much @dilchamo for this awesome lecture which I've taken my time to explore before writing attempting this homework. I just hope my entry meets your expectations.

Regards

@lhrogic♥️