SWING TRADING

Swing trading is a trading style used by crypto traders to focus on profiting off the changing trends of the financial market over a period of days or weeks. This trading style is long term and therefore requires a lot of patience as the swing trader is expected to hold a single trade for as long as a minimum of two days to several weeks.

Swing trading is ideal for full time workers that are unable to always monitor the slight movements of price trends. The financial market does not move in a straight line towards its direction (bullish or bearish) but moves in a zig-zag manner due to retracements in the market thereby creating higher highs (HH) and higher lows (HL) in an uptrend (bullish) market and lower highs (LH) and lower lows (LL) in a downtrend (bearish) market, therefore a swing trader is expected to observe the charts and make trades on higher time frames like the daily (D1), four hour (H4) and even the one hour (H1) time frames as such trades could go against the trader on a lower time frame due to the fluctuation of price caused by retracements.

The image above shows an uptrend (bullish) market having higher highs (HH) and higher lows (HL).

The image above shows a downtrend (bearish) market having lower highs (LH) and lower lows (LL)

Relative strength index

The rative strength index serves as the indicator, when the rsi is over the 70 line, it shows it's time to leave the trading market ,but below 30, it is the right one to buy.

Trade management

The aspect of loss is an inevitable thing but, it can be reduced as a swing trader. It is very important to set up still loss below the closing price of the previous charts.

Due to the larger time frames used in swing trading, the trader is expected to have larger targets. This means that both the stop loss and the take profit is expected to be far from the entry point. The trades are also expected to be worth the time spent in terms of ratio risk to reward, having a minimum of 1 : 2 ( the ratio of reward should always be greater than that of the risk). For example, a trader willing to risk $1 per share in order to gain a minimum of $2 per share (1 : 2) is more profitable than a trader willing to risk $1 per share to gain $0.99 per share.

How To Swing Trade

To successfully swing trade, you must take the following steps:

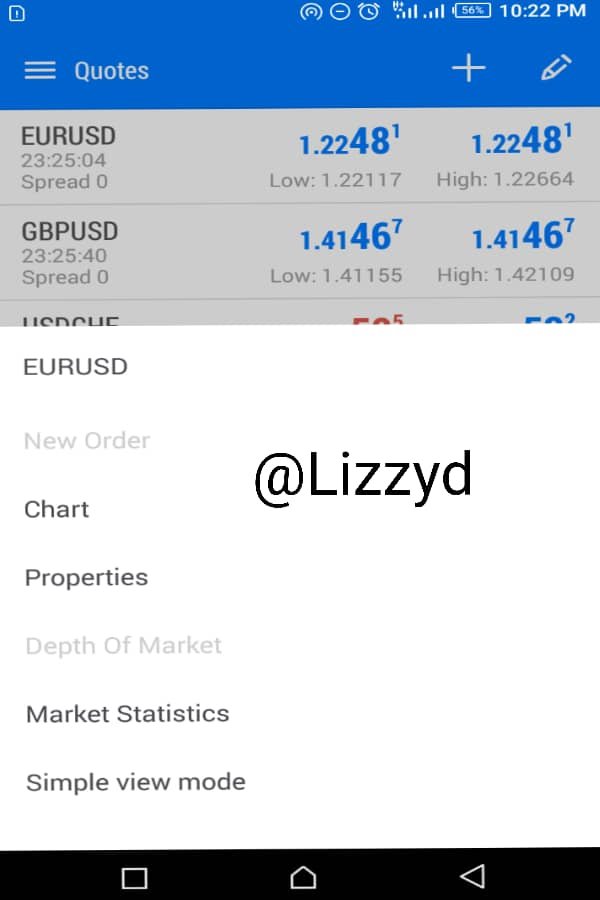

- Choose a trading pair.

In this case, I will be choosing the EUR/USD.

- Look for the overall market trend of the chosen pair using the daily (D1) time frame.

The overall trend in the image above indicates a bullish market on the daily time frame.

- Confirm the market trend of your chosen pair on the four hour (H4) time frame and draw either your support or resistance zone ( or both).

Multiple time frame analysis

This helps to understand the present state of the market. The technicalities of the market trends are understoo via the analysis. Here, we also know the situation of the market whether it is experiencing an uptrend or downtrend.

I will be considering the four hour and daily time frame analysis

The four hour time frame also indicates a bullish market where the previous red candle has been exhausted and the next candle is going bullish.

In the case of an uptrend such as this, the support zones are drawn.

- Locate the candle stick on (H1) that indicates entry and draw your support /resistance zone to further confirm your trade.

The green and red candlestick together shows a tweezer bottom to indicate that the next candle will be bullish.

Use a much lower time frame such as the 15 minutes (M15) to get precise entry and stop loss point for your trade.

Go to a higher time frame such as the H1or H4 to fix your take profit.

The daily time frame will look like the image above where the entry point is 1.22477, the stop loss is at 1.22330 (below) and the take profit is at 1.23044 (above) indicating a buy of ratio 1:4 risk to reward.

Advantages and Disadvantages of Swing Trading

Advantages Of Swing Trading

A swing trader would not need to spend hours monitoring the trades because the trade would last for a long term.

A swing trader enjoys the privilege of having a full time job while making massive profits trading.

A swing trader gains more from the long term trade than a scalper would from a short term trade.

A swing trader can risk very little to gain much.

Disadvantage Of Swing Trading

Due to the long term trades, a swing trader is unable to ride the trend as a scalper would.

A swing trader could suffer overnight risks due to unexpected reversals of the trend which could cause the trader to be kicked out of the trade prematurely and with a loss.

Sudden change can be an indicator of sudden loss.

It has the tendency to deal with small return or profits.

Cc: @yohan2on

Hi @lizzyd

Thanks for participating in the Steemit Crypto Academy

Feedback

In Swing trading, the minimum trading chart, a trader will look at is that of 1hour but you went further below 1hour by looking for entries in 15minutes time frame. That would apply to day trading and not Swing trading. Your trading plan was not clear. You lacked an in-depth technical analysis in explaining and demonstrating your understanding of Swing trading.

Homework task

4

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You've got a free upvote from witness fuli.

Peace & Love!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much @fuli. I appreciate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit