What is Forecasting

It simply means a positive guess of future occurrence.

Forecasting refers to the practice of predicting what will happen in the future by taking into consideration events in the past and present. Basically, it is a decision-making tool that helps businesses cope with the impact of the future’s uncertainty by examining previous data and trends. It is a planning tool that enables businesses to plan their next moves and create budgets that will hopefully cover whatever uncertainties may occur. While Price forecasting is predicting a commodity/product/service price by evaluating various factors like its characteristics, demand, seasonal trends, other commodities’ prices (i.e. fuel), offers from numerous suppliers, etc.

What is a Forecast?

A sales forecast is an important tool for any business, because it predicts future events. While a sales forecast can show you the level of sales you should expect to achieve month-to-month or even year-to-year, it can also provide a wealth of additional review - such as show you potential for growth in particular segments over time, reveal new market opportunities, and shed light on the chances for growth of the market if certain features and functions of existing products are improved. Because of this, most businesses draw up a sales forecast once a year.

Why is price Forecasting needed?

A forecast can play a major role in driving company success or failure. At the base level, an accurate forecast keeps prices low by optimizing a business operation - cash flow, production, staff, and financial management.

It helps reduce uncertainty and anticipate change in the market as well as improves internal communication, as well as communication between a business and their customers.

It also helps increase knowledge of the market for businesses. Moreover, a promising forecast is compelling to investors who might be interested in putting money into a business.

There are three general methods:

Qualitative

Quantitative

Causal models

Qualitative approaches are generally used when data is not readily available –in instances when a business, product or service is new. Typically this technique uses expert opinions and informed judgements that are logical, systematic, and unbiased in their estimations, which are then quantified. As the name implies, they are not as rigorous generally as quantitative methods.

Quantitative methods rely on historical or “time-series” data, so it is more often used when the product or service has been stable and available for some time. New businesses or businesses with new products might not be able to use this method. The forecast is extrapolated by recognizing patterns, trends, and changes in the data using this mathematical technique.

Causal modeling, the most sophisticated of the three forecasting tools, identifies the relevant causal relationships. This process takes into account everything that influences sales, even employing some time series analysis, and limits the number of assumptions in the forecast. If assumptions are made, they are monitored throughout the modeling to insure that they are valid, and the model is continually refined when more information about the business is available.

what method is best for predictions and forecasting.

These analysis are popular with all traders in the market. Before you take any trades, you must have a solid reason as to why you want to take that trade.

Every trader has a tactuc he/she trades every time he/she gets to the market. In other words, to make that final decision to enter a trade, you have to do analysis on the market first.

3 COMMON TYPES OF ANALYSIS.

Technical analysis

Fundamental analysis

Sentimental analysis

TECHNICAL ANALYSIS

Technical forex analysis is the study of historical price action to identify patterns and determine probabilities of future price movements in the market.Technical analysis connotes that, a market has a memory lane. Therefore, future changes will be influenced by the patterns of its behavior in the past.

This means that there are higher chances of past occurrences repeating itself in the future.Technical analysts predict price movements and future market movement by taking smoke time to study what happened in the past using charts.

They are only concerned with price movements not the reasons of occurrence.

They identify patterns of market behavior that were recognized in the past as important and has every tendency to repeat itself in the future.

FUNDAMENTAL ANALYSIS

Fundamental analysis is the study of what actually causes market price changes .Under normal circumstances, price is determined by forces of demand and supply. And demand and supply is highly influenced by;Economic factors like inflation, employment,consumer behavior and price index.

Political crisis like elections, change of government, wars and instabilities

Financial policies like the monetary policy, fiscal policy and macroeconomic policies.Environmental factors, like landslides, tsunami, drought, pandemic diseases

SENTIMENTAL ANALYSIS

Sentimental analysis is quite different from the 2 types of analysis above,It’s all about the market feelings and emotions.You must now know that the market is composed of buyers and sellers of different sizes. That is, the market makers who are the big influence of the market, the retailers and you and me the speculators.

Sentimental analysis shows how different traders in the market choose to whether follow the trend by buying when the market is going long or go against it.But the truth is, no matter how strong your feelings are, you have got to control them.When the market is up you buy and when it is down you sell. Your single decision as a trader cannot make any change on the market as small as you are.

When the market is going higher, it shows you a signal that more traders will buy because of the rise of price or appreciating of the currency.

As a trader you need to first confirm the buying and selling mood of the market participants so that you are able to respond positively.

Technical and Fundamental analysis are the two methods that are used . They are very important and these are necessary when trading.

Personally, Technical Analysis is way standard than any other analysis . it seen as very valid and is used for a very long time for trading. Fundamental analysis necessary whenever any of such situations occur other wise technical analysis is best for day to day trading.

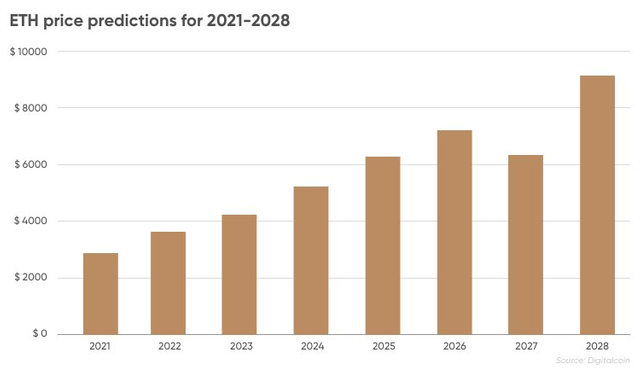

PRICE FORECASTING ON ETHEREUM

Image source

Front the graph above, it is evident that that is surely a rise in the the price of ethereum which will continue to increase.

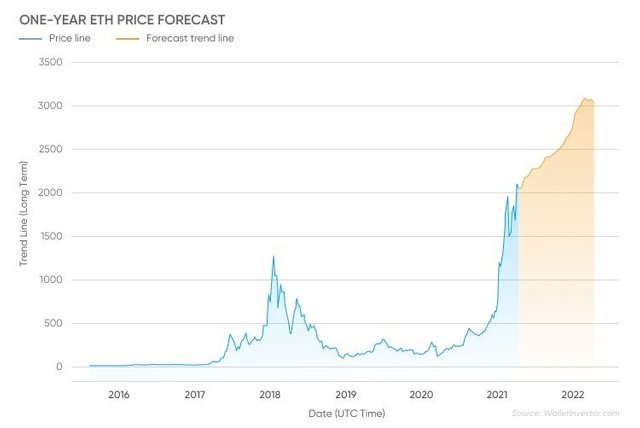

Image source

The value of ETHEREUM rose and fell in 2019, but there is every indication of a rise in 2021. It is advisable to invest in the ETHEREUM crypto trading.

In conclusion,both analysis are crucial and are widely used by the traders to analyze the market. On the basis of these analysis, market price forecasting is carried out when the traders emerge the market. These methods are very useful and crucial in the whole trading process.

Hi @lizzyd

Thank you for joining The Steemit Crypto Academy Courses and participated in the Week 10 Homework Task.

Your Week 10 Homework Task verification has been done by @Stream4u, hope you have enjoyed and learned something new.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit