.png)

The Leased Proof of Stake consensus mechanism is described as a more advanced variation of the Proof of Stake consensus process. This is the Waves platform's consensus method for confirming and adding new blocks to the network. Holders of the Waves currency can lease their coins to a contractor or full node using this system, and the contractor or full node will be able to pay the user leasing his money agreed-upon benefits. Users can choose between leasing and staking their coins while using the leased Proof of Stake protocol.

The leaser must lock up the quantity of token he or she wishes to bet in order for the lease to take place. The token stays in the leaser's wallet, but the user will not be able to use it until the lease is ended. The leaser also creates a lease contract that includes the following information.

• The recipient's address

• The total number of Tokens leased

As a result, full nodes and nodes operators may employ not only their own mining power but also the mining power of other users to create new blocks and collect rewards. The prize is then split, with a portion going to the leaser. The greater the number of tokens, the greater the payout.

What is the difference between Leased Proof of Stake and Proof of Stake consensus mechanism

Leased Proof of Stake

• Leased Proof of Stake is a more advanced variant of Proof of Stake that allows users to rent out their tokens to other users for mining.

• In an LPOS, every crypto currency holder, regardless of their token's amount, can participate in the mining process. To be a complete node, for example, users must own at least 1000Waves tokens. Users with less resources can lease them to full nodes to profit from the mining process.

• LPOS rewards are split between the leaser and the node operators.

Proof of Stake

• Proof of Stake is a consensus process that allows crypto currency holders to stake their coins in order for their coins to be used to verify and produce new blocks.

• On the other hand, not everyone can use the Proof of Stake consensus technique to create a new block. To be able to Stake and become a validator, you must have a certain amount of tokens.

• Mining rewards aren't shared because leasing isn't an option.

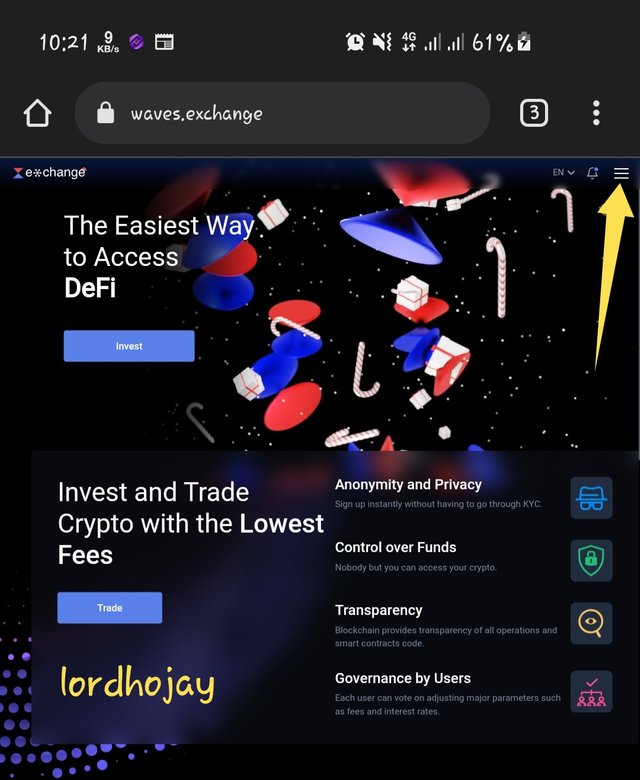

First of all, let's discuss a little about the Waves.Exchange platform. Waves.Exchange is actually a decentralized exchange platform that is used to exchange a number of crypto assets that are available in the exchange. It allows the users to store WAVES tokens and other crypto-assets as well. Besides decentralization, It is also a very secure crypto exchange where the users can store and trade the assets efficiently.

Signing Up in Waves.Exchange

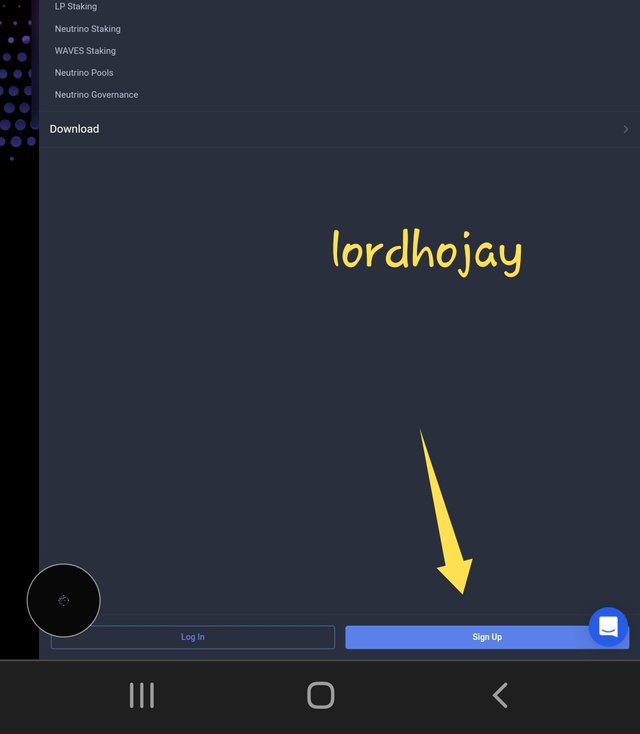

• To begin, go to Waves.official Exchange's website and select tab in the upper right corner.

• Click on sign up to open a new account.

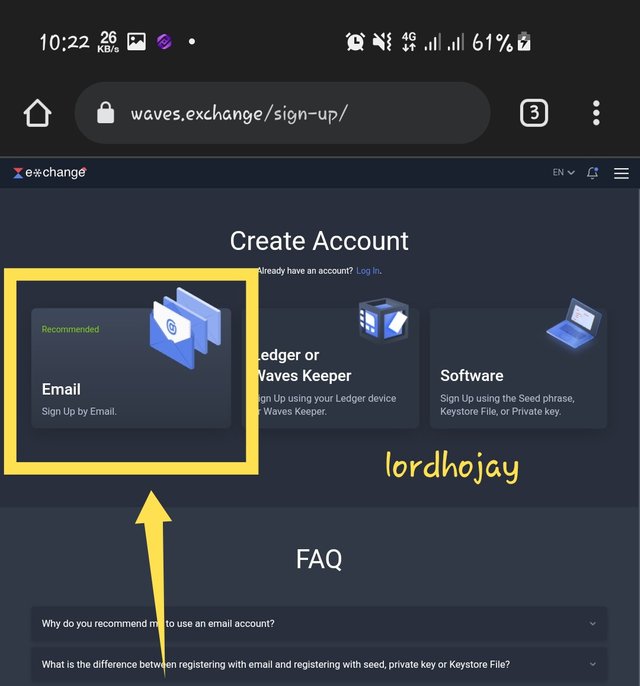

• Now you'll notice a lot of alternatives for signing up, but I'm going to go with Email.

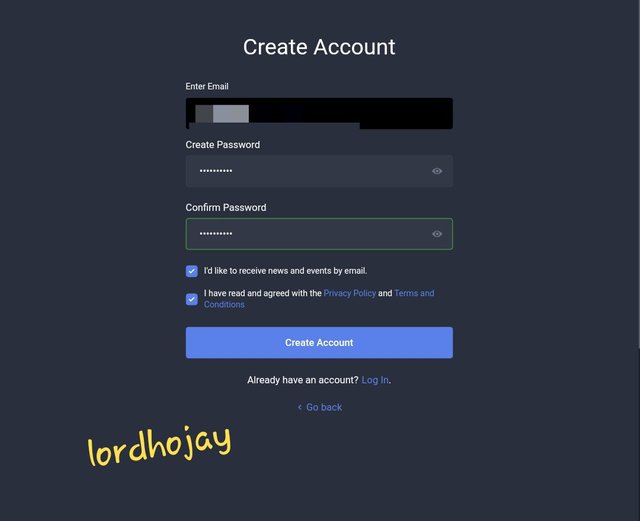

• Set a password and enter your e-mail address. Click the Create Account option after you've confirmed your password.

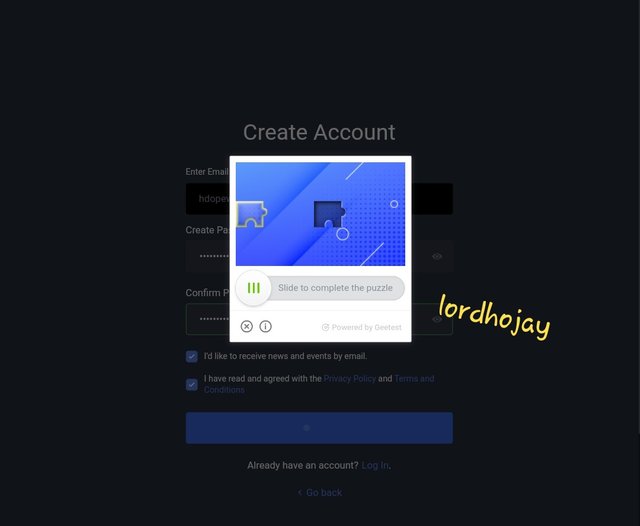

• Perform the robot verification by dragging the shape.

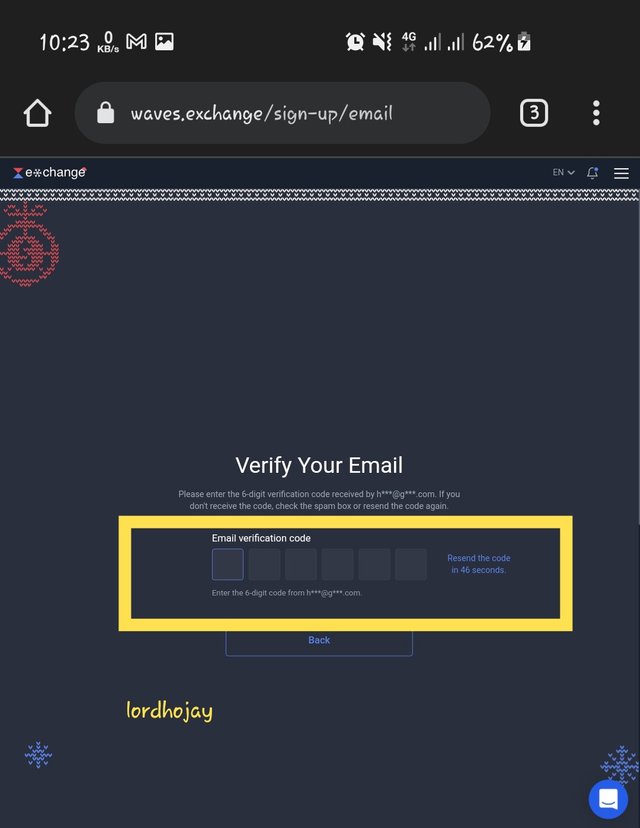

• After, a code will be provided to your email address after the Robot verification has been verified. Enter the code that was emailed to you.

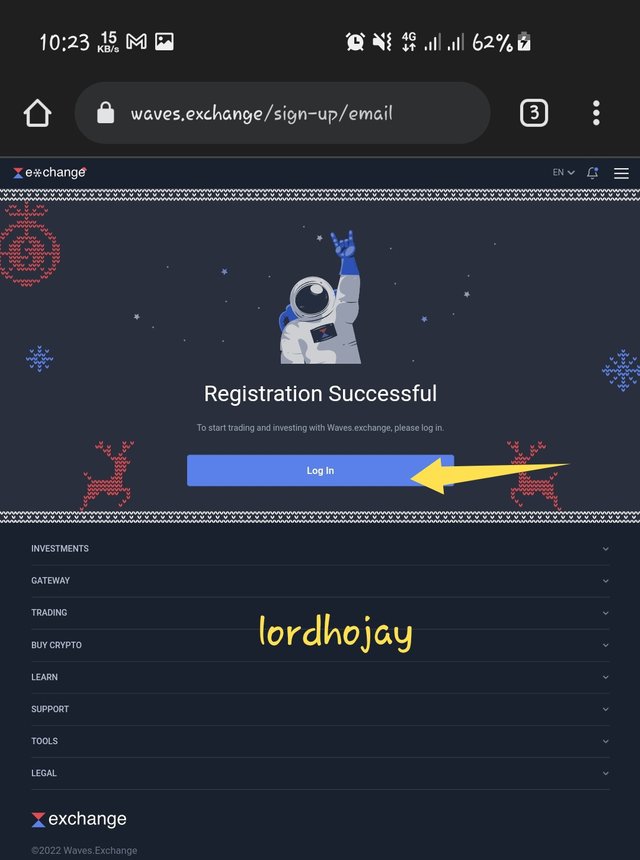

• The account will be created successfully. Now select Login from the drop-down menu.

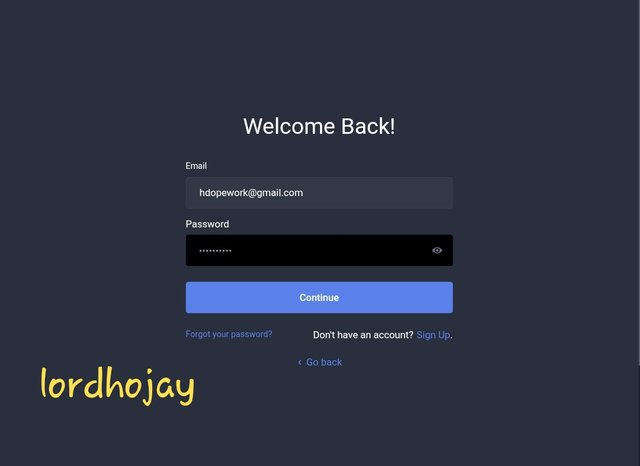

• After that, select the Continue option and input your account's email and password.

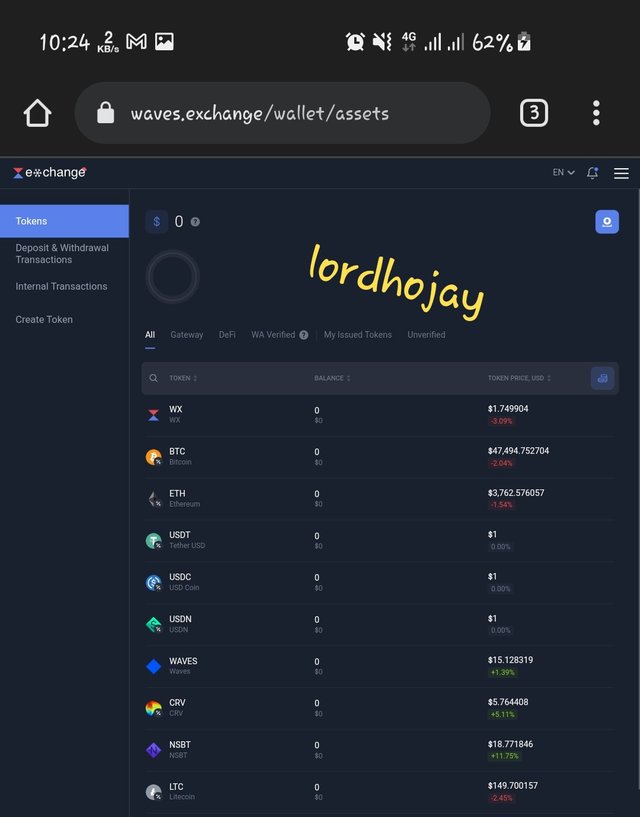

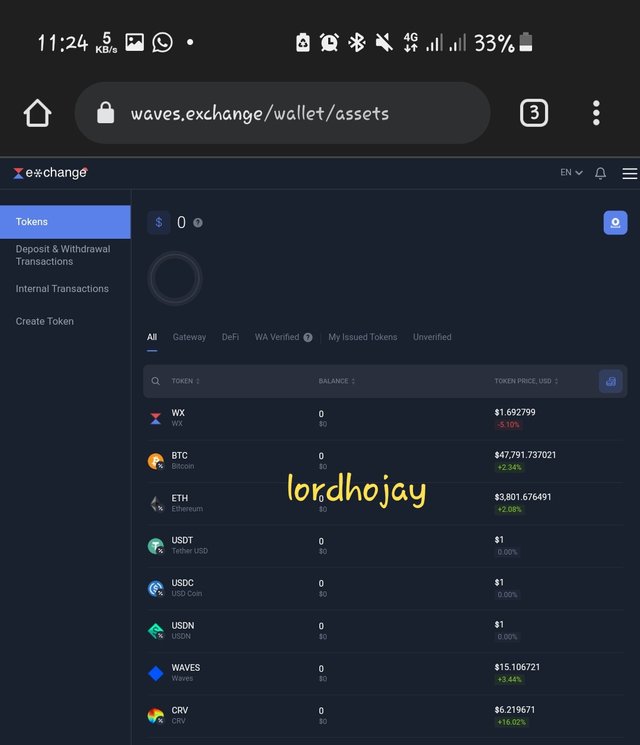

• The account will be logged in successfully. In the screenshot below, you can see my logged-in account.

Features and Options in Waves.Exchange

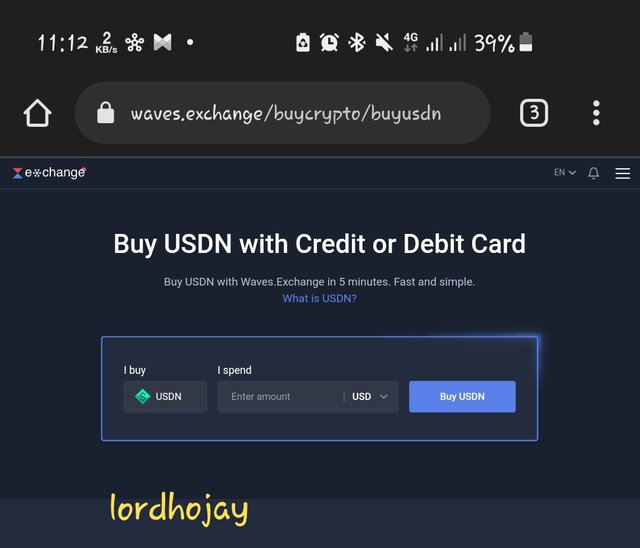

Buy Crypto: The platform's initial feature is the Buy Crypto option. This feature enables users to purchase various crypto assets (stablecoins) using various payment methods such as a bank account or other crypto assets. Users may use this tool to quickly and securely acquire a variety of currencies accessible on the exchange.

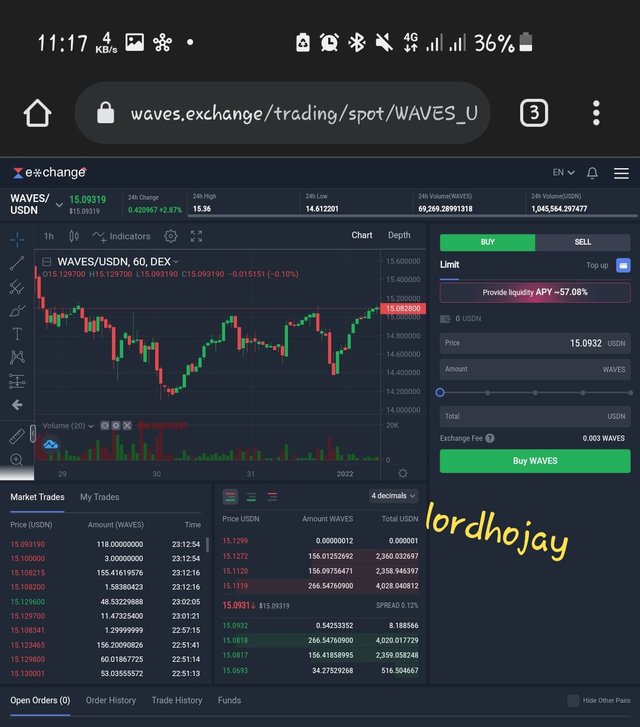

Trading: Users of the exchange can trade different tokens accessible on the site using the Trading function. Spot Trading, Swap, and Swap (WAVES/USDN) are the three methods in which users can exchange these tokens. This feature also allows us to see the price charts of several crypto pairings and add technical analysis tools like as indicators to the price charts.

Wallet: This feature allows users to see how much money they have in their exchange wallet. The exchange allows users to view the tokens they hold. They may use Waves.Exchange to deposit and withdraw various tokens to various exchanges. This function also allows users to look up their deposit and withdrawal history.

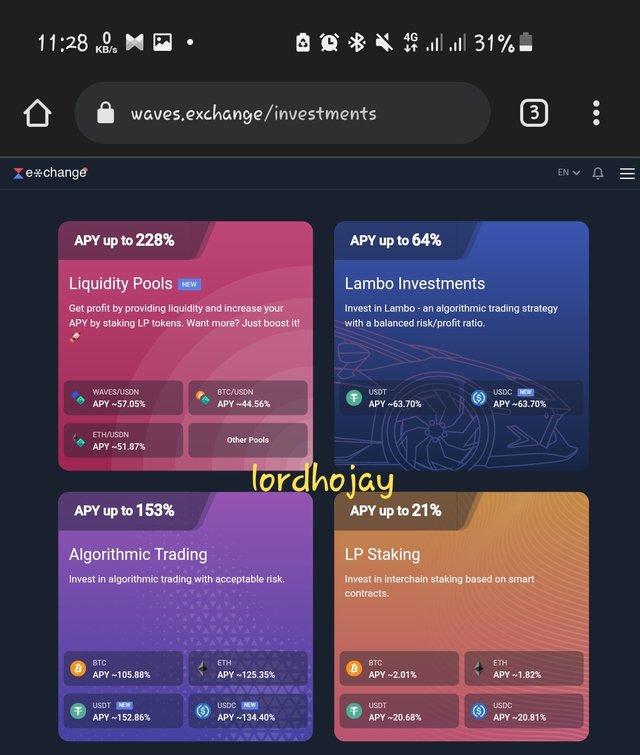

Investment Modalities

Waves.Exchange members have access to a variety of investment alternatives. By utilizing these investing alternatives, consumers might generate significant income. These are depicted in the screenshots below.

Waves.Exchange members have access to a variety of investment alternatives.

• They can put their tokens in the Liquidity Pools and earn money by supplying liquidity.

• They can also earn from their investments in Lambo Trading.

• They may also invest their money in Algorithm Trading and profit handsomely.

• Users may also stake their tokens in the LP Staking and benefit handsomely.

• Waves Staking entails staking WAVES tokens and leasing them to nodes in exchange for a percentage payment.

• Users can also invest in Neutrino Governance to take part in the platform's decision-making process.

• Users can also receive daily prizes by investing stable coins in the Neutrino Pools.

• Firstly I clicked on the search icon

• Secondly I type in chz and click on the wave/usdt pair

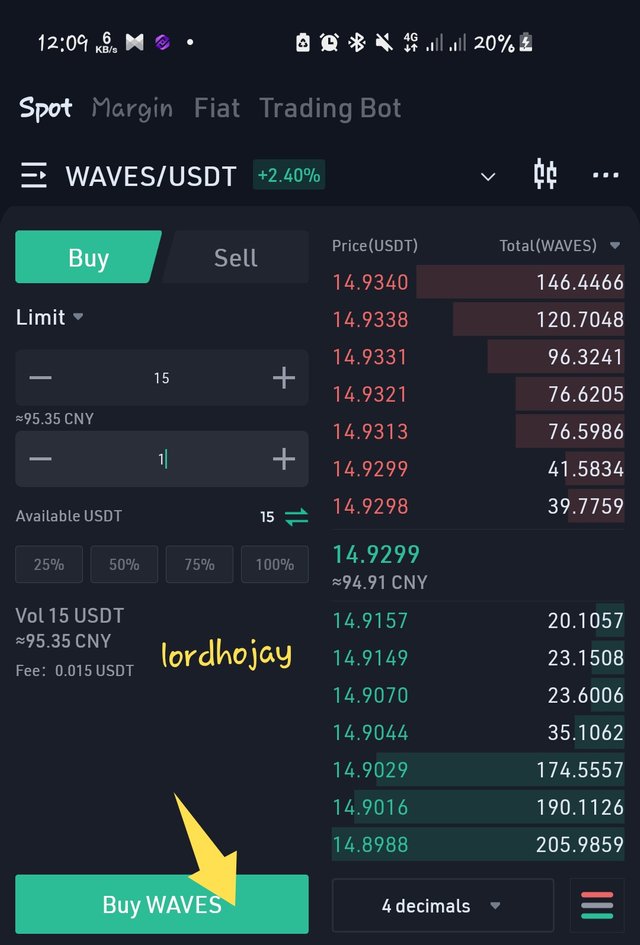

• From my Binance account, I purchased 15 USD worth of Wave. While I was purchasing this, the price of CHZ was 14.29 USDT. I was able to buy 1 CHZ

What is WX token

The native currency of the waves.exchange platform is the WX token. As previously said, waves.exchange is a decentralized trading platform based on the Wave Blockchain ecosystem, which was founded in 2017.

The WX token can be used for a variety of purposes. A couple of them are listed below.

To transact on the Waves.exchange platform: It is the platform's native currency, and it is the primary medium of exchange for most of the platform's transactions.

Staking: Holders can also invest using the WX token. Staking allows users to lock up their money for mining in exchange for WX benefits.

Fee for each transaction: The WX token is also used to pay the platform's transaction fees.

Investment: The WX token may also be used to invest in the platform's many investment options, such as Lambo Investment, Algorithm Trading, and so on.

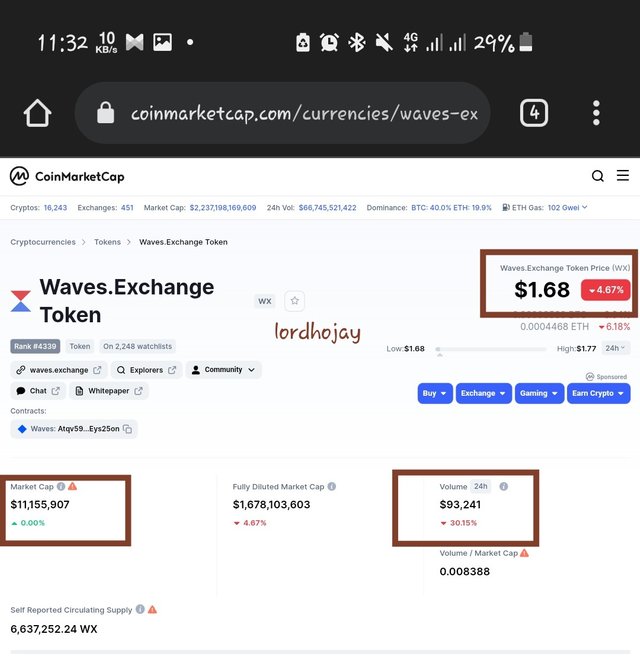

What is your value and Market Capitalization at the time of writing your post?

At the time of writing this post, the following information could be gotten about the WX token.

Price: $1.68

Market capitalisation: $11,155,907

24hrs trading volume: $93,241

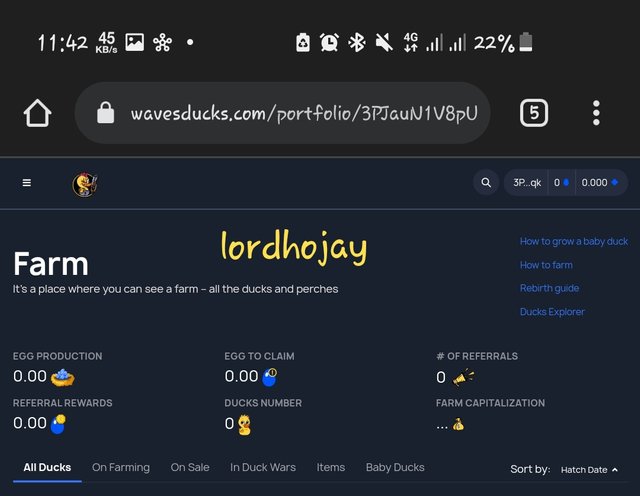

Wave Ducks is a digital gamification staking platform with collectibles. Users must discover and acquire NFT pictures in the shape of Ducks as part of a play-to-earn incentive system. Users may farm EGG tokens, breed the ducks they've obtained, and sell them on the market whenever they want on this initiative.

The EGG token is the Wave ducks' in-game money, and it is swappable on the platform for the aim of hatching genesis ducks, who users may then breed to get a rare Duck NFT.

Wave Ducks is now rated in the top 20 marketplaces.

To use Wave Ducks, you must first create an account on the official Wave Ducks website. Wave ducks users who have a waves.exchange account can use their login credentials to log in.

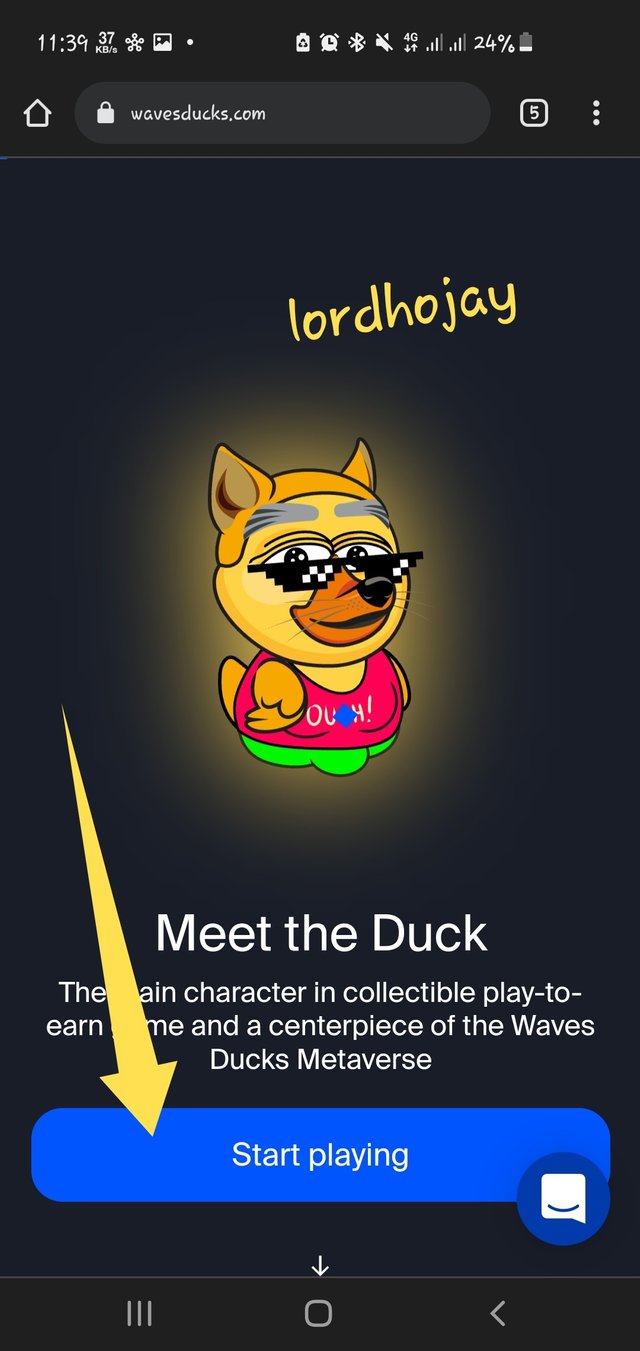

How to access waves ducks

• To begin, go to wavesducks.com and click on the start playing button on the first interface to be taken to the login page.

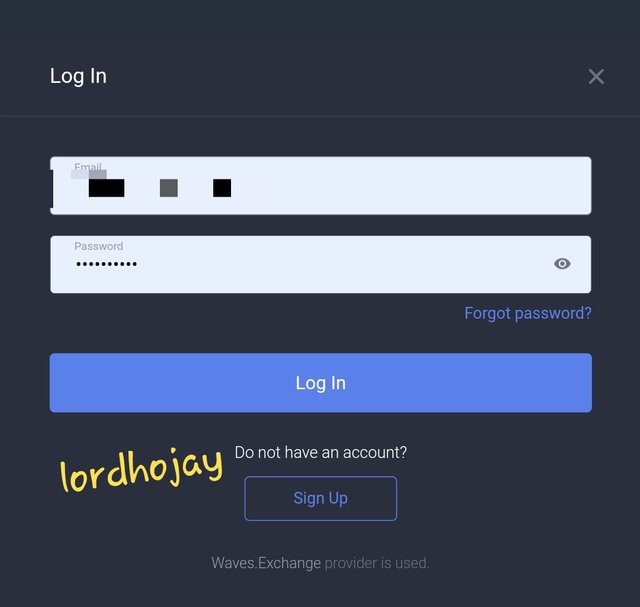

• After that, go to sign up and fill out the needed data, such as email and password, before clicking create account. Since already have wave accounts so i can login with it by inputing my email and password.

After that, you've successfully created a Waves Ducks account, which can also be used to log into Waves Exchange.

We also learned about the WX governance token and how to transfer the WAVES token from an exchange. The Waves platform and the various investment services that it offers us, ranging from pool, staking, and algorithmic trading, each service has a different percentage of earnings depending on the investment method and token used, so we also learned about the WX governance token and how to transfer the WAVES token from an exchange.

Thank you professor @imagen for this class.