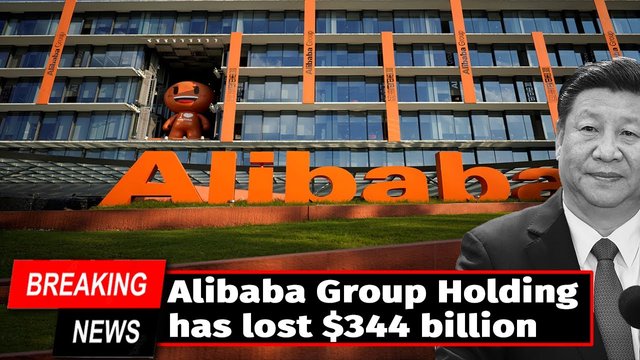

World Biggest Wipeout

Ali Baba group holding has lost $344000000000 in world's biggest wipeout. Few people could have predicted the downward spiral for Ali Baba group holding when founder Jack ma delivered a blunt criticism of China's financial system last October. Yet one year on the technology Titan has lost a whopping $344000000000 in market capitalization the biggest wipeout of shareholder value globally according to data compiled by Bloomberg. Shortly after the now infamous speech Beijing suspended the listing of its fintech arm and group and has since followed up with a widespread crackdown on the country's most vibrant sectors causing Chinese stocks to tank. Ali Baba shares sank from an all time high that month to a record low 3 weeks ago in Hong Kong as Beijing stepped up its scrutiny of the company's practices and urge to restructure of its fintech business. Despite a 30 percent recovery from October 5 the stock is still 43 percent lower than its 10/20/20 peak. Bloomberg intelligence expects fiscal second quarter active users of the E. commerce giant to have beaten consensus projections as a result of China's 0 covert policy. Ali Baba is set to report earnings on November 5. Beijing kicked off sweeping reforms of the private sector a year ago by pulling the plug on a planned initial public offering by and group co and Ali Baba Philly it also founded by mom. That was followed by an antitrust probe of the e-commerce giant Ali Baba for alleged abuses of its market power. Month typically kept a prominent profile largely disappeared from public view in the months that followed. The communist party's campaign moved on to other targets including delivery giant made one in private tutoring companies. Ali Baba paid a record 2.$8000000000 anti trust fine and promised to reform its practices.