Hello fellow steemians, it's been another wonderful week and a great pleasure to attend this week's lecture. All thanks goes to the Almighty and also a big thanks goes to Professor @wahyunahrul who took his time and make sure to digest this lecture to our understanding. This lecture was really helpful.

My homework submission for the questions asked is below.

Personally, I will say YES, IDO should be done on cryptocurrency.

The full meaning of IDO is INITIAL DECENTRALIZED OFFERING. The IDO program is generally a very amazing event. Tokens are generally launched on this IDO programs on decentralized platforms or Decentralized Exchange(DEX).

Each token launched on this program always comes with it's own initial price by it's protocol in order to get the attention of more investors on their project.

The IDO program is a fundraising event. A lot of money is generated when running the IDO program.

One important thing to note is that, tokens that are run on IDO are usually new to the crypto world and they have never been listed on the DEX platforms. Their attention from traders and investors are very low because they are new to the system.

But with the IDO event that is still new on the decentralized exchange, the tokens will definitely become well known to investors and it will be well-listed on the DEX platforms. The price value of these tokens will rise sharply as investors are getting to know them.

There are a lot of impact the IDO event have on the successfulness of a token. These impacts on the tokens cannot be underestimated. Some of them are;

i) The IDO event create awareness and bring the attention of investors to the project and the token. This event also helps to enlighten investors more about the token and also clear doubt about it's eligibility.

ii) The IDO event is generally a fundraising program which helps to generate millions of dollars for the project. The money raised helps in the development of the project and also helps in furthering research on the project.

iii) Prices of tokens increases sharply under IDO program. All tokens have their initial price when launched. This prices are usually low because they are not well known to investors and traders. As time goes on, the prices of these tokens rises because investing are now beginning to invest in those projects.

Yes, the IDO program has a lot of positive impact on the world of cryptocurrencies. Some of these impacts are describe briefly below:

- Open fundraising for the project: Mostly in the token offering method, it is usually observed that as soon as the sale of the token goes public, investors buy the tokens in large numbers for lesser price. After buying this tokens in lesser price, the investors will sell it again to the general public gaining a very huge profit.

Companies precisely startups do not need permission to kickoff the fundraising event, also with the IDO fundraising approach, companies do not need the centralized exchange.

One unique thing about the IDO event is that, anyone can organize and start his own IDO as well as participate in any IDO event, not just the private investors or traders.

- Fast trading of tokens: One of the benefits of the IDO event is that, a token under the IDO program can be traded immediately and faster. Because of this, when investors realized that a token has the potential to trade fast, they quickly buy these tokens when it is launched.

The investors will later resell them at an appreciative price during the IDO. For example, when the UMA protocol fundraising was ongoing, the initial token price of 1UMA was $0.26, but it later jumped to around $2 per UMA.

This shows a positive impact of an IDO events towards the successfulness of the token or project.

- Immediate liquidity: One may ask, What is the meaning of liquidity? Well, liquidity simple has to do with the ability to buy or sell easily and conveniently on the market. Or in a very simple term, how fast you can get your hands on your cash.

In the IDO event, the project tokens can easily get instant liquidity, which in turn can benefit the price of the token.

- Increased prices: Tokens that find themselves in the IDO mostly have a positive impact on it's prices. After the IDO event, there is usually an increment in the prices of the token as many private investors and traders are experienced in the project.

I gave an example of how the UMA token price rises after a successful IDO. This is an increment in the prices of tokens, showing that, IDO really has a lot of significant impact on the cryptocurrency world.

What are rug pulls? Rug pulls are a recent aspect of exit scam, in which scammers impersonating as crypto developers abandon a project and then escapes with investor funds by removing buy support or decentralized exchange (DEX) liquidity pools from the market.

One token that had IDO but rug pull was the TRUAMPL(TMPL). This token was created on the 15th August, 2020.

The TMPL token mimics the Ampleforth(AMPL) token.

This token was planned for a public sale on the Ethereum platform. The TMPL is an ERC20 token which was created on the Ethereum chain.

Public sales are generally promoted through marketing channels in advance to attract potential investors to increase the value of the tokens, which helps the development of tokens.

The Ethereum contract address of the owner of the token was:

0x5d64a2b59328c1e387806ebefaebcf57a45a298e

The owner wickedly withdrew the whole liquidity containing 154 ETH and 2,926,099 TMPL tokens. This activity happened just 40 minutes into the public sale of TMPL token.

Many traders and investors traded their valuable ETH for TMPL token at the market rate. They did that because they feared missing out on the benefits when the price increases in the future.

Over time, this resulted in the liquidity pool being filled with more ETH tokens, once the goal was reached, prompting criminals to withdraw.

Although all of the buyer's TMPL tokens were almost useless after the rug, the scammer escaped with about 154 ETH, worth around $ 90,000.

The TMPL exit scam discussed above is one of a series of rug scams that occurred on the decentralized exchange platform.

Another project that rug pull was the Meerkat Finance.

The meerkat finance was a DeFi project that sold out with $31 million in crypto assets. On their official Telegram channel, their team claimed that their smart contract vault was breached.

The two tokens I will be making my analysis on are the Terablock token and the Don-key token.

TeraBlock can be defined as a computerized crypto trading exchange that personalizes the users trading knowledge through machine learning.

This technology simplifies the way people enter the crypto ecosystem, and at the same time promotes the use of DeFi services instead of traditional finance.

To this end, TeraBlock allows customers to use bank cards to purchase cryptocurrencies or gain exposure without significant market risk.

Recently, TeraBlock finished $2.4 million in financing before commencing its TBC token, a utility token that helps minimize exchange fees. Accordingly, more information on the roadmap will be published.

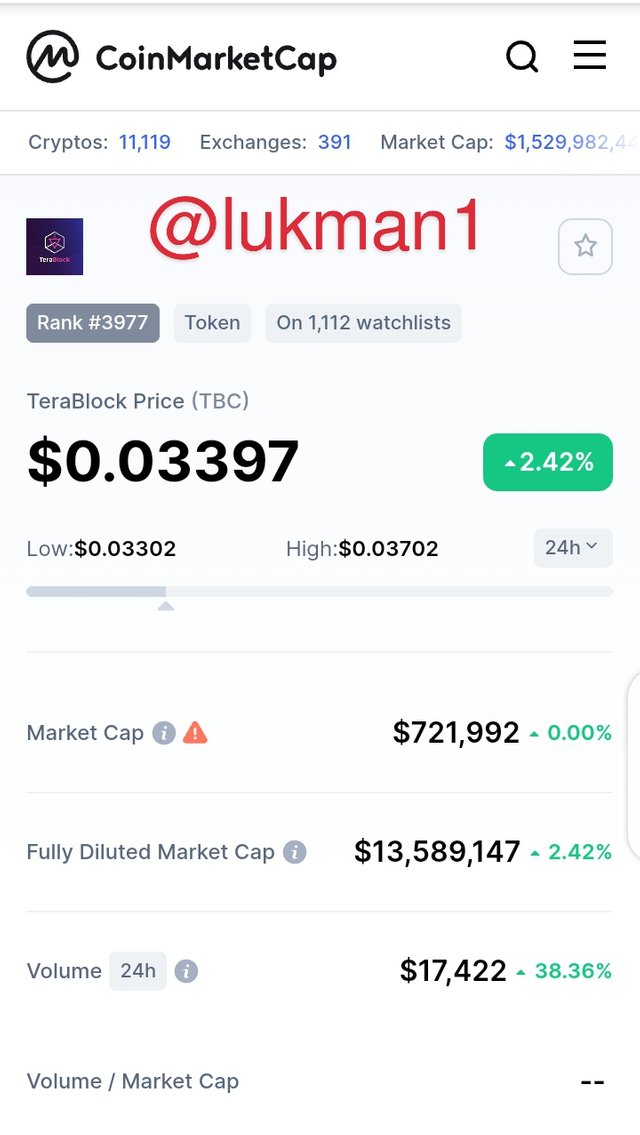

According to the coinmarketcap.com, TeraBlock token rank #3977, it's current market price is $0.03397 with 24hr trading volume of $17,422.

The TeraBlock token is on 1,112 watchlist with it's low price being $0.03302 and high price of $0.03702 within the last 24hrs. The token has a market cap of $721,992.

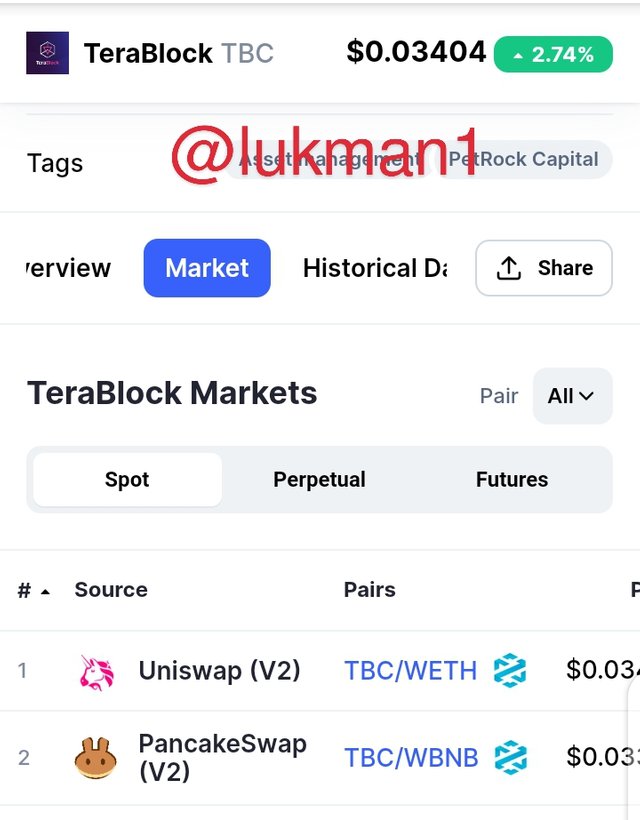

The decentralized exchange platforms we can find this tokens are the UNISWAP and the PancakeSwap.

In the UNISWAP, it has a pair of TBC/WETH and on the Pancake, it has a pair of TBC/WBNB

Don-key Finance is a high-performance farming social network for the retail and institutional markets.

DonKey recently raised $2.2 million from macro investors. They aim to become the eToro of yield farming by lowering the entry barriers for yield producers and liquidity providers.

The Don-key automated protocol computes the best risk-reward probabilities from various crypto markets to give users with the greatest possible return.

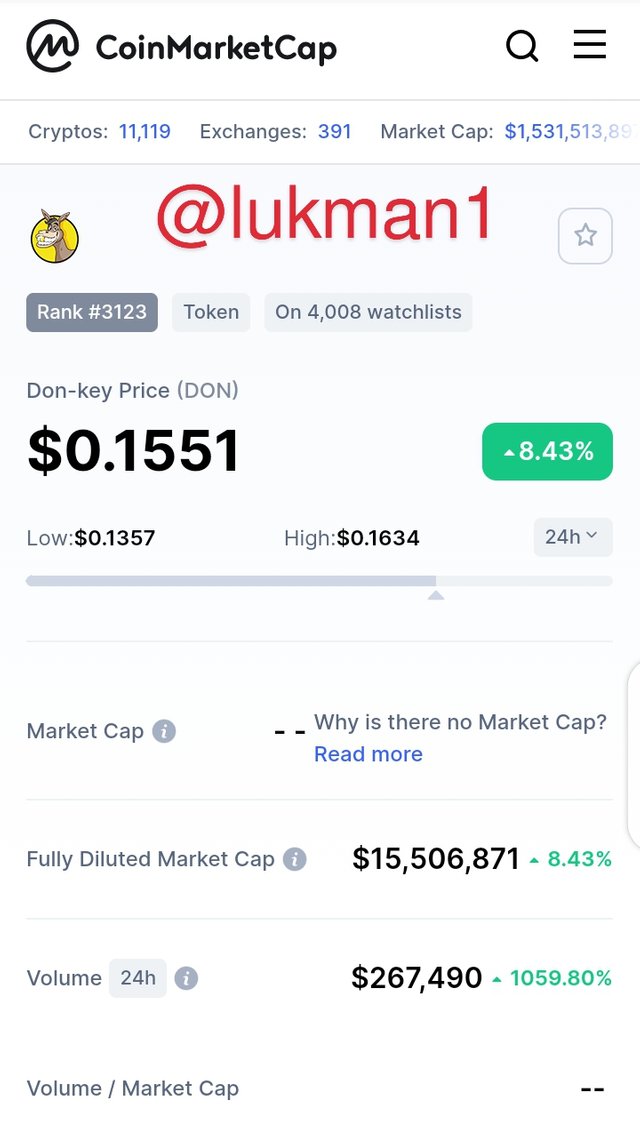

According to the coinmarketcap.com, Don-key token rank #3123, it's current market price is $0.1551 with 24hr trading volume of $267,490.

The Don-key token is on 4,008 watchlist with it's low price being $0.1357 and high price of $0.1634 within the last 24hrs. The market cap of the token is not currently available on the platform.

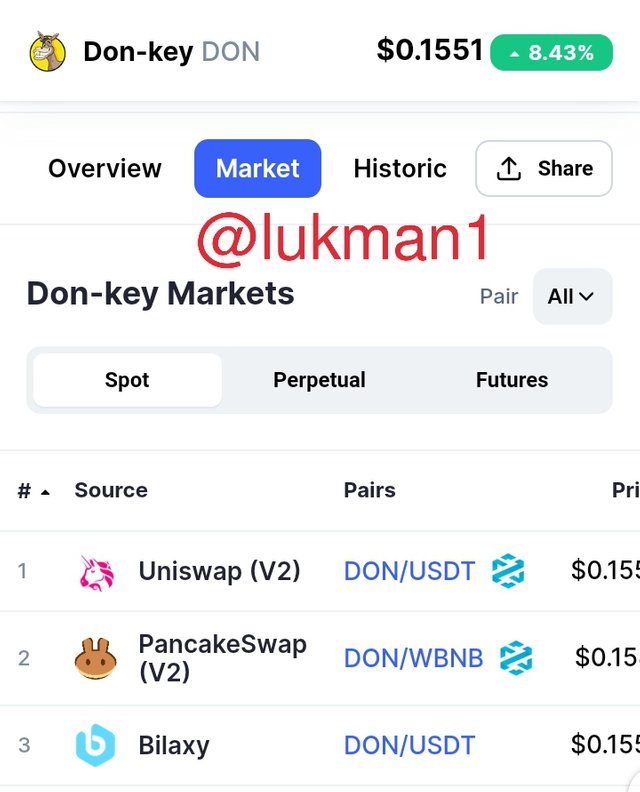

The decentralized exchange platforms we can find this tokens are the UNISWAP, PancakeSwap and Bilaxy.

In the UNISWAP, it has a pair of DON/USDT, on the PancakeSwap it has a pair of DON/BNB and on the Bilaxy, it has a pair of DON/USDT.

Considering the exchanges both tokens find themselves, as well as their pairs, they are all good and I think they are advantageous over other tokens.

Personally, I admire the Don-key finance because of the pairs it have and it's current market price. It's pair with the USDT and BNB makes me to like it more.

Those two pairs are well known and accepted by many investors in the cryptocurrency world. Also the Don-key with it's market price being $0.1551 is encouraging. In all, they are both good tokens.

The token I will be considering which is currently IDO is the cardence.oi. The IDO for cardstarter tokens commenced at 3 pm UTC on July 28, 2021.

At a normal circumstances, before you can partake in a project like IDO, you need to meet the criteria the organizers of that project spelled out.

This is not different from the cardstarter IDO.

Before I explain the steps you need to follow to participate in the IDO, I think it will be of help to share the link with you for those who wish to partake in the cardstarter IDO.

The resource link for the cardstarter IDO is: cardstarter.io

Now let's continue with our discussion, in order to be eligible to participate in the cardstarter IDO, there are five basic steps to follow. This steps are the KYC, Tier system, Staking, IDO registration and IDO event.

I'm now going to explain briefly the steps I listed above.

Indicates that users who are interested in participating in IDO must use fractals to complete the KYC project. This KYC process should be initiated as soon as possible.

After the registration window is closed, each participant has a 24-hour grace period to complete the KYC process.

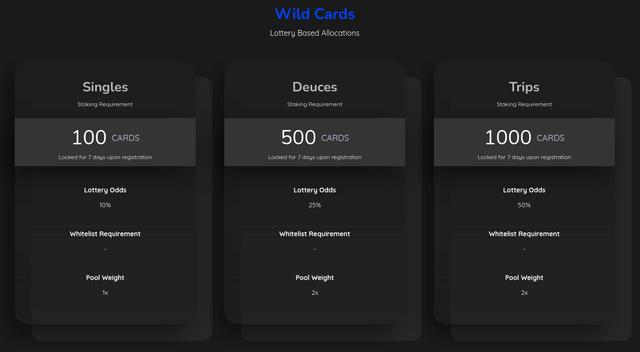

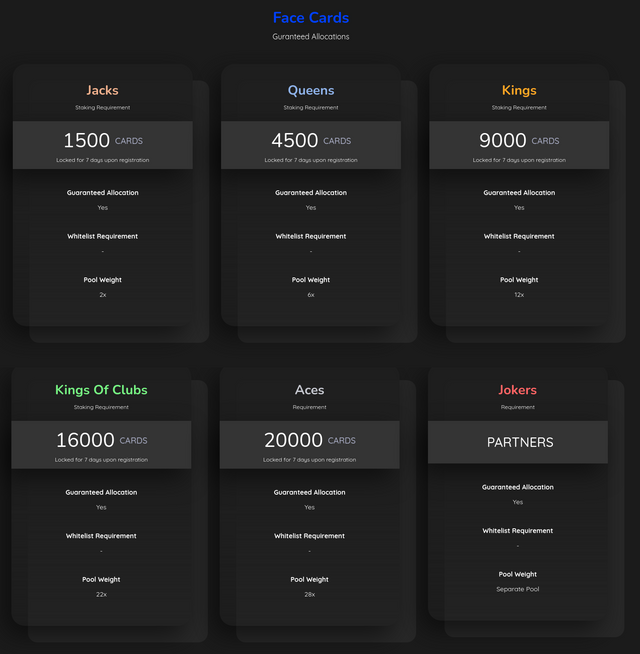

In the cardstarter IDO, there are currently two types of tier system they require to use. These two tier systems are the:

Wildcard Tiers

Face Card Tiers

Wild card tiers are all based on lottery tickets, with different pool weights. You only need to use 100 card tokens to participate in the wild card tier.This tier system falls between 100 to 1000$ CARDS.

This type of tier was introduced to acknowledge and reward Cardstarter early supporters who had trust and believe in the long-term vision and the economic health of the project.

This tier system falls between 1,500 to 21,000$ CARDS.

Each Participant is required to bet their CARDS tokens via https://app.cardstarter.io/ before starting to register for IDO.

The minimum bet amount a participant can use to stake is $100 CARDS. Cards below the prescribed quantity will be rejected.

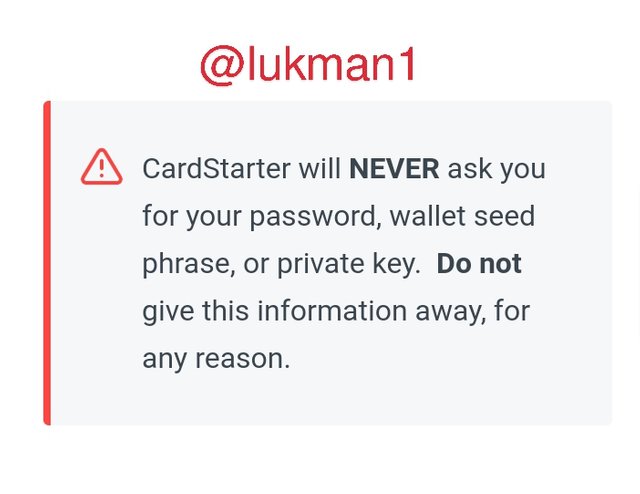

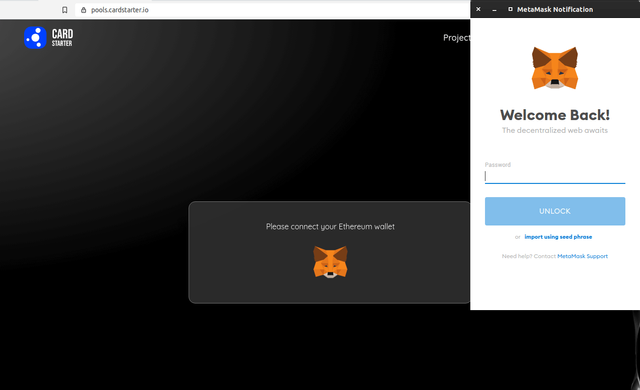

Everyone who is interested in becoming an IDO event participant must register. Participants must navigate https://pools.cardstarter.io/. And continue to register. You have to bear in mind that under no circumstance, you should not release your private key to anyone or personal particulars to anyone.

Every participant needs to connect to their Ethereum wallet where the tokens will be deposited.

Cardstarter IDO includes two main events. These events are

Whitelist Sale

First Come First Serve Sale

In the event, participants must be rest assured that allocations will be funded with ETHEREUM (ETH). Participants must also know that every allocation at the whitelist sale are secured and guaranteed and also the whitelist sale will be open for 24 hours time period.

The introduction of IDO has a lot of significant impact in the world of cryptocurrency. The IDO helps to market and create awareness of a token which plans to be launched. This marketing allows investors and traders to purchase this tokens thereby increasing its value. The IDO also helps to raise a huge sum of money for the project as it is a fundraising event.

But as we all know, a project cannot be introduced without facing some challenges. Many IDO tokens has rug pull and most of them are as a result of scammers who impersonate themselves as private investors. So I will entreat you that, before you participate in an IDO event, make sure you do your necessary checks to ascertain whether it's legit or fraud and please do not release your password, seed wallet address or your private key to any third party.