Hello Everyone, How are you all? I hope well. So today, I invite you all to read Home of Crypto Trading With Alligator Indicator, which the professor @kouba01.

The Alligator indicator is also known as the Williams Alligator indicator as Bill William made it. It is a technical indicator used to smooth moving averages of the market.

William made this indicator because as he thinks that the market works like an alligator, as when he is hungry is moves quickly, and after that, he rests, and when he gets hungry again, he starts looking for food again.

The William Alligator indicator is trend-based, as it shows the current trend of the market, whether it is going in an upward direction or downward.

While in the Alligator indicator, there are three lines of different colors, which are:

| Colour (Line) | Period (Moving Average) | Offset (Adjustment) |

|---|---|---|

| Blue (Jaw) | ||

| Red (Teeth) | ||

| Green (Lips) |

So as in this, you can see the Green (Lips) are always closer to the market candles, while the Red and Blue stay a little away from that. Alligator indicator is famous for spotting the trend.

Calculation of Alligator indicator:

Median Price = (High + Low) / 2

Alligator jaw = SMMA (Median price, 13, 8)

Alligator teeth = SMMA (Median price, 8, 5)

Alligator lips = SMMA (Median price, 5, 3)

Here,

High = is showing the highest Price

Low = is showing the lowest Price

SMMA = is showing the Smoothed Moving Average.

The Moving Average works on both the past and present data, and in the SMMA, we see the longer periods, as it has a low affect on small periods. The moving average was seen as a delayed trend indicator and not good enough. Still, in the Alligator Indicator, the moving average has to confirm that greatly, so it makes it more accurate.

So for this question, I will be using Tradingview.

Step 1: Firstly, we went into the Tradingview, clicked on charts, and then clicked on the [Indicator]

Step 2: There, we will type Alligator and choose the William Alligator.

Step 3: Now, the William Alligator Indicator has been added to the chart.

Step 4: Now, as we have to choose the configuration of the indicator and to make it reliable for trading, we will click on the [Setting] option, as after clicking on that, options will appear for us where we can configure the setting of the indicator according to our choice.

Step 5: The first option in the setting is off [Inputs] where we can set the Offset and the Lengthof Jaws, teeth, and lips of our choice. As here, the default setting is jaws (13), Teeth (8), and Lips (5). And we can now change that if we want according to our choice.

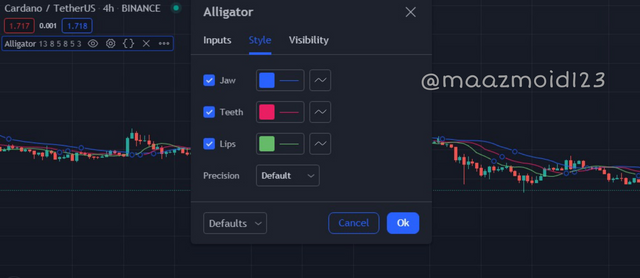

Step 6: The other option we can see here is of Style, as in this we can change the color of the lines, as of in default setting, the Jaws are of Blue line, teeth are of the red line, and Lips are of the green line. But we can also change them as we want.

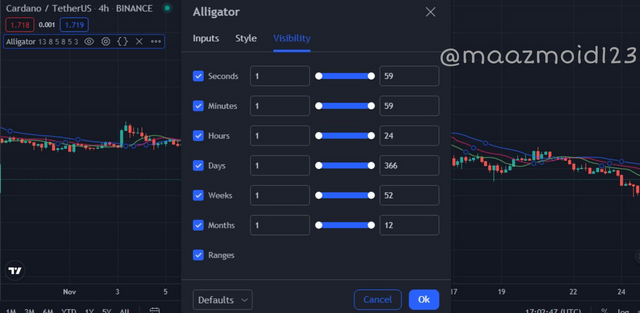

Step 7: We here can change the Visibility of the indicator, but we will make it on default.

I will not say that if it is advisable for someone to change the setting of the Alligator Indicator, as the default setting itself is set by the famous trader Bill William himself, but we can also say that no setting is ideal for everyone. And every trader goes according to their trading style.

But if we see that if we will increase the length of the Alligator indicator, so in the long run, while like any other indicator, traders use that setting in the short term trading as it gives signals more quickly. Still, in this, the risk of false signals also gets high.

So it is advisable to use the default setting to give the most precise signals.

So as we know that according to the Bill William, the market is usually in the 3 phases The Rest Phase, The Awakening Phase, and The Meal Phase. So now we will be going to see them one by one.

As we can see, the market is not moving, so it is a no trading zone or in the consolidation phase where it is not advisable to enter the market. In this, the Alligator's jaw, teeth, and lips came closer, and they didn't move much.

In this, it is said that the market remains 70% of the time in the sleeping phase. And we can guess the sleeping phase thanks to the crossing of the jaws, lips, and teeth lines. When these lines cross each other, it is expected that the market will go into the sleeping phase. So at that point, we usually stop our trading and then wait for the Alligator or the market to wake up in search of food.

And now we can see in the chart that the lines are separating and the green line has gone above the other line, which means it is a buying time as the market is going in the uptrend.

As we know, when the green line goes above, the market starts moving upward, as the animal is awakened and now is searching for food.

Here in the above chart of BTC/USDT, we can see that the market is in the meal phase as after awakening of the market, the prices are going up while the jaws, lips, and teeth are a little away from each other, making way for the meal to go to the belly.

So it is the right time to do the trading before the market gets full and again goes into its sleeping phase. We can also see the trend reversal when the blue line goes above the green line. Still, now in the chart, we can't see any disturbance related to that, so the market is going in the uptrend, but if the blue line goes above the green line, we can expect the downtrend in the market.

To predict whether the trend will be bullish or bearish, we can see the three lines of the Alligator indicator as we know that when the green line goes above the red and blue line, the market is going in the bullish trend, and when the blue line goes above the green and red line the market goes in the bearish.

So there is also a sleep phase in which when the three lines cross each other, the market goes into the sleep phase, and when the green or blue line goes above, the market shows a bullish and bearish trend.

So as we all can see in the above chart of ADA/USDT, both bearish and bullish trends of the market. And we can see that when the green line goes above, while the blue line goes bottom, the market shows the bullish trend.

When the blue line goes above the green line goes bottom, it shows the bearish trend. So while these lines are going up and down and showing the trend in those moments, these lines cross each other, there is a chance that the market will go into the sleep phase. We waited a little bit to see if the green or blue line went to the top or bottom then we made our trade according to the situation.

Another good observation we can see in this, that when the market goes in the bullish trend, the green line goes top, and these three lines are below the Price of candles. The market goes downtrend, the blue line goes top and green to the bottom, and the observation is that these three lines are above the price candles in the chart.

The main purpose for the traders who are using any indicator is to understand the sell/buy signals of the market. And Alligator indicator is also used to see the sell/buy signals and analyze the market's movements.

Buy Signal: The Alligator indicator shows the buy signals when the green line goes above the red and blue lines while the blue line goes bottom. But before making the buy in the market, we will wait for some time as when the lines cross each other, and the market/animal go to sleep, so we will wait for the green line to create a space between the other lines.

Sell Signal: The William Alligator Indicator shows the sell signal when the blue line goes above the red line and the green line goes bottom. Like in the buy signal, we will wait for the blue line to make a space with other lines to confirm the Signal and then make our sell of the asset.

In the above chart of ETH/USDT, we can see that the green line goes above the red and blue lines, so we waited for some time for the line to make some space, and then we made our buy as it was the buy signal.

Here we can also see that these three lines cross with each other, but it was to create some panic, and many people might have made their sell, but if we had waited a little longer to see the space between the line, we saw that the green line again goes above the red line and blue line and goes in the bullish trend again.

In the above chart of BTC/USDT, we can see that the blue line is above the red line and the green line, and there we waited when the three lines cross and waited for the line to create some space to confirm the buy signal.

So firstly, we know that scalping trading is when the traders use a short period for trading and make frequent and small profits. As we know, crypto is the most volatile market compared to forex and stock trading. So the scalping gives a good way for the traders to earn frequently.

Scalping is an intraday trading style in which the traders have to sit in front of the table full time. The traders take advantage of the volatility of the market. At the same time, the Alligator Indicator is also really effective for the traders in scalping style trading, as its default setting is set to get the most in the short term. And scalping trading is all about that.

So here, in the above chart of ADA/USDT of 45-minute time frame, we can see the volatility of the market and the many points where a trader can enter the market and exit the market with profit and less risk. And the scalping trading is all about that, while the Alligator indicator has shown multiple crosses showing the market trend or entry and exit points.

From the beginning of the first season of the Crypto academy, I have made much homework regarding the indicator. I have said that no indicator is reliable enough in every homework regarding the indicator. It is never advisable for us to use any indicator alone. While using the indicators alone, we can not differentiate between the false Signal and the right Signal.

Not every indicator is 100% correct, so even the most reliable indicator is not reliable enough to use alone. Often, these indicators show false signals and use more indicators that can filter out the false signals.

So as we can see in the above chart, we can see that at some point, the market is going up, and at some point, the market is going down, so the traders will move according to that.

And now we also have added the MACD indicator and the William Alligator indicator, and now we can see the false signals. Now we can eliminate or filter out these false signals.

| It has three moving averages, making it more accurate than the indicators with one moving average. | It can show false signals in short periods. |

| They are easy to use, so it is a good indicator even for the newbies who don't know much about the indicators. | It can generate false signals like any other indicator. |

| It works in all time frames and markets. | Slow signals because of 3 moving average. |

The William Alligator Indicator is very easy to use. It is much reliable than many trend indicators as it shows a bullish and bearish trend. We can also use this indicator with more indicators like RSI and MACD to minimize the false signals. And it uses three lines of moving average, making it more reliable in finding the trends.

So that was all from my homework. I hope you like it.

Regards,

@maazmoid123