Hello Everyone, so today I invite you all to read my today homework which I am going to make on Chaikin Money Flow Indicator subject which is given by Professor @kouba01.

So let us continue with our homework.

The one who made Chaikin Money Flow (CMF) was Marc Chaikin, and it was made to see and also helps to identify the market trends and market strengths as it is a technical indicator.

As we know that there are many Oscillating Indicators, as we have studied about them in Steemit Crypto Academy like Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI) and there are also some which we have not studied but are used by many traders like Commodity Channel Index (CCI), Awesome Oscillator (AO) and many more. Chaikin Money Flow (CMF) is also an Oscillating Indicators.

In the Oscillating Indicators, there are two lines Up and down, which indicates the market movement. The Chaikin Money Flow (CMF) measures the buying and selling pressures and sees if the market is going up or down during a specified time.

Chaikin Money Flow (CMF) Oscillatory line moves in a certain period, as the Marc Chaikin suggested period is 21, while it also works on the default setting which is 20. Chaikin Money Flow (CMF) Oscillatory line moves around Zero(0) line between 1 and -1.

So in this, if the market price got close above Zero means that market is

Chaikin Money Flow (CMF) is a trend-identifying indicator, so it is not advised to use it alone.

The formula to calculate the Chaikin Money Flow (CMF) is divided into three parts:

- Calculating the Money flow multiplier:

Cash Flow Multiplier = [(Close price - Low price) - (High price - Close price)] / (High price - Low price)

- Calculation of the volume of cash flows:

Cash flow volume = cash flow multiplier x volume for the period

- Calculation of Chaikin Money Flow:

Chaikin Money Flow = sum of 20 or 21 periods of cash flow volume/sum of 20 or 21 periods of volume

So here lets' take some hypothetical values, and then put them in the above formulas:

High : $1000

Low : $600

Close : $950

21 Period Sum of Volume : $400

Volume for the Period : $200

- Calculating the Money flow multiplier:

Cash Flow Multiplier = [(950 - 600) - (1000 - 950)] / (1000 - 600)

Cash Flow Multiplier = 300/400

Cash Flow Multiplier = 0.75

- Calculation of the volume of cash flows:

Cash flow volume = 0.75 x 200

Cash flow volume = 150

- Calculation of Chaikin Money Flow:

Chaikin Money Flow = 150/400

Chaikin Money Flow = 0.37

So from the above, we can see that from that asset price and volume, we calculated Chaikin Money Flow and we get the value of Chaikin Money Flow which is 0.37.

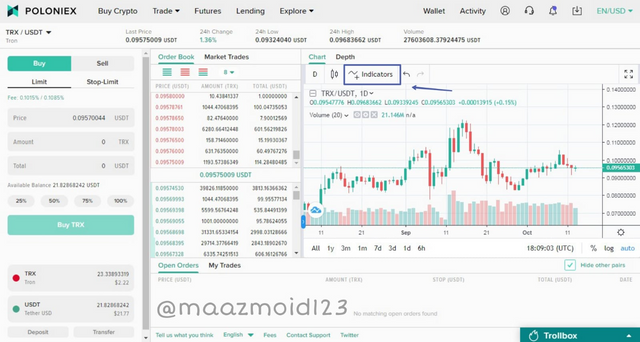

To add the Chaikin Money Flow in Charts I will be using Poloniex.

- Firstly we will go to the main page of Poloniex.

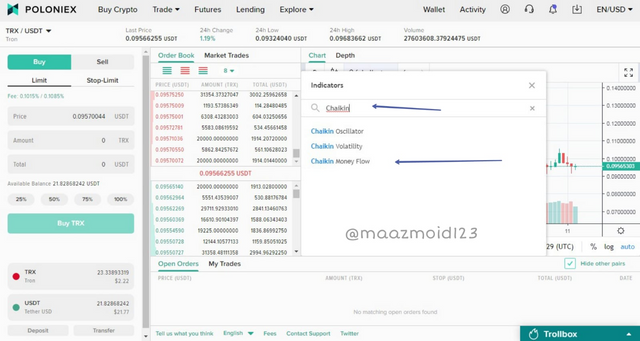

- After clicking on Spot trade, the chart will appear where we will click on the Indicator option.

- I will then search for Chaikin Money Flow Indicator, then will [select] the indicator.

- The Indicator is now added to the chart.

- Firstly we will click on [Setting].

- There in [Styles] we can select the color of the Chaikin Money Flow oscillatory line and also of the Zero line.

- Then in Input, we can set the length/periods, as on default it is on 20.

As we know that the default setting on Chaikin Money Flow Indicator is 20, while the suggested setting from Marc Chaikin is 21. But it also depends on the traders as if they are analyzing a short time frame so they usually decrease the period from 21, as it gives response faster if we go below the 21, the indicator will have high volatility, and sometimes it also gives wrong signals, so it is usually used by the short term traders. While if we increase the period from 21, the response will be a little slow, so we will get fewer trading signals, but the indicator will be less volatile, it is mostly used by the long-term traders.

In Chaikin Money Flow Indicator confirming the direction of the trend is easy, as we also talked about it above as when the oscillator line goes above the Zero line that means that the market is in the bullish trend and if the oscillator line goes below the Zero line that means that the market is in the bearish trend.

Entry Point:

In this when the Chaikin Money Flow indicators oscillatory line goes above the zero line, that means that market is started moving upward, so that is mostly the entry point for the traders and they make a buy at that point.

Exit Point:

In this when the Chaikin Money Flow indicators oscillatory line goes below the zero line that means that the market is started moving downward, so that is mostly the exit point for the traders and they do a sell at that point.

The above image is the perfect example for the Buy and sells points or the entry and exit points. In this, we can see that when the Chaikin Money Flow indicators oscillatory line starts moving upwards, the price in the chart also starts moving upward and when it crosses the 0 lines we make a BUY. That means there was buying pressure in the market.

And then we also can see that when the Chaikin Money Flow indicators oscillatory line starts going downward, the price of the asset also starts moving downward and when it crosses the 0 lines we made a *SELL. That means there was selling pressure.

Crossover signal between the CMF is as such when the oscillatory line of the CMF is going above and below the zero line after every or some candles, because of which the traders usually get confused and ended up in a loss, the example of the Crossover signal between the CMF, is shown below: as in this we can see that the Chaikin Money Flow (CMF) line is going above and below the 0 line multiple times.

As many people get panicked or confused in this situation and end up at a loss. So this tackle this situation we trade with a crossover signal between the CMF and wider lines such as +/- 0.1 or we also can take +/- 0.15, +/- 0.20, or above.

We can see in the above image, that when it goes above the 0 lines we wait, and see when the line goes above + 0.1, and at that moment we will have a BUY ENTRY.

And, similarly, when the line goes below the 0 lines we will wait for it to cross - 0.1 level and then we will do a SELL ENTRY.

Now in the above image, I have tried to example it a little more, as I have taken the wider lines such as +/- 0.1, and here I have marked the point in which we can see that the CMF is going above or below the +/- 0.1 line, and at that points, we have made a Buy and sell or entry and exit levels.

As we know that the divergence occurs when the Chaikin Money Flow Indicator goes in the other direction than the price movement.

When the Chaikin Money Flow Indicator line starts going down the price in charts starts going upwards but after that moment the price start declining.

And when the Chaikin Money Flow Indicator line starts going upwards the price in charts starts going downwards but after that moment, the price in charts also goes in the uptrend.

Bullish Divergence:

In the bullish divergence, the Chaikin Money Flow Indicator shows the Bullish movement, while in the charts the price movement goes downwards. So that shows that the downtrend is about to end, so after that, the price goes in the Bullish trend as you can see in the above image.

As we can see in the above image that the Chaikin Money Flow Indicator line Is going Upward while the price in the chart is moving downward, but just after that, the price starts moving upward.

Bearish Divergence:

In the bearish divergence, the Chaikin Money Flow Indicator shows the bearish movement, while in the charts the price movement goes upward. So this shows that the uptrend is about to end, so after that, the price goes in the bearish trend as you can see in the above image.

As we can see in the above image that the Chaikin Money Flow Indicator line Is going down while the price in the chart is moving upward, but just after that, the price starts moving downward.

No indicator gives 100% accurate signals or shows trends, sometimes or usually it gets correct but there are also times when traders have been at a loss because of false signals.

Chaikin Money Flow Indicator can also show false signals, so it is not advisable to use Chaikin Money Flow Indicator as standalone.

One should use 1 or more indicators with the Chaikin Money Flow Indicator to get the correct signal, as when we use more indicators the signals can be more accurate as if one indicator will be showing a false signal the other will correct. So it is advisable to use other technical indicators with Chaikin Money Flow Indicator as well.

Now we know that Chaikin Money Flow Indicator is a really good indicator for the traders as it helps the traders in seeing the market trends and market strengths as well.

Reading the Chaikin Money Flow Indicator is easy to use, as when the oscillatory line of the CMF goes above the 0 lines that will mean that the market is in a bullish trend, and if the oscillatory line of the CMF goes below the 0 lines the market will go in the bearish trend.

As for the periods, the default setting of the Chaikin Money Flow Indicator is 20, but the advisable setting according to the founder of this indicator Marc Chaikin is 21.

And it is not advisable to use this indicator as a standalone indicator as there is a risk of getting false signals, so we should use more indicators with it to filter out the false signals.

now that was all from my side.

Regards,

@maazmoid123

Hi @maazmoid123

Thanks for participating in the Steemit Crypto Academy

Feedback

Total| 7/10

This is good content. Thanks for demonstrating your understanding of Trading using the Chaikin Money Flow Indicator.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit