Hello everyone, how are you all doing? I hope fine. So today, I invite you all to read my other homework, which is on Dark Pools in Cryptocurrency and given by one of the main and best professors of the #SteemitCryptoAcademy @fredquantum.

So let us get started.

Dark Pool

So as we know that in Cryptocurrency, there is transparency, security, scalability, and reliability. But nowadays, people want some privacy too, with more scalability, and some want a place where they can buy and sell their assets without interfering in the market price. So that time, the Mimblwimble Protocol came into being, which had solved the privacy and scalability issue.

Along with that, the Dark Pools came to solve the issue of buying and selling without being affected by the slippage. Dark pools was there in the market for a very long time as it was founded in 1980 for the Stock trading purpose. And then, in 2016, the Kraken exchange platfrom was launched.

The dark pools are the private exchanges for the traders to do their trading without being affected by the slippage and causing any chaos or market volatility.

How Dark Pool Works

Dark pools were made for the large investors who did not want to impact the market with their large orders or buy/sell the asset. So to see that how the Dark Pool works, we will be the market orders and Limit orders as in cryptocurrencies. These two types of orders are used.

If we see about the Market Order, it is used in like every Exchange, as in that whenever we buy or sell anything, there is a slippage cost involved in it. For example, we buy an asset for $10, and when the transactions are initiated, we get $9.8, and in that $0.2 was a slippage cost which we had to bear.

While in the Limit Order, there is no Slippage cost involved. We can buy or sell assets at a predetermined price. So in this, no slippage is involved in it, and the market's volatility is not affecting our trade. So in the Dark Pools, most exchanges use the Limit Orders.

So in the Dark Pool, nobody can see your order. And the order book of the market is not visible to the others, and it allows the traders to do trading anonymously. And the orders in the Dark pool will only be matched with the other Dark pool order, who wanted the same predetermined price.

Kraken Dark Pool

So we know that the first Dark Pool in Crypto was launched in 2016, the Kraken exchange. And after that, many Dark pool exchanges have been launched, but we will see the Kraken Dark Pool.

The Kraken Dark pool was launched for traders who wanted to trade big amounts without being affected by the market's slippage and volatility as it offers the Dark pool on their platform.

So the Kraken Drak Pool works on the limit order as I have elaborated above. In the Limit order, one does not know about the market orders, and the trader puts his predetermined price on which he wants to buy/sell the asset. And that order is invisible to the orders as the market order is eliminated in that, and only the one matched with that price by the system will be able to see it.

Supported assets on Kraken Dark Pool

So the supported assets on the Kraken dark pool are:

In the Kraken Dark Pool it only available for Ethereum (ETH) and Bitcoin (BTC), with the fiat curruncies which are:

Bitcoin Pairs:

- BTC/CAD

- BTC/EUR

- BTC/GBP

- BTC/JPY

- BTC/USD

Ethereum pairs:

- ETH/CAD

- ETH/EUR

- ETH/GBP

- ETH/JPY

- ETH/USD

Bitcoin and Ethereum pair:

- BTC/ETH

Requirements For Getting Involved In Kraken Dark Pool

So the requirements for getting involved in the Kraken dark pool are:

- In the Kraken Dark Pool, only the Limit Orders are supported.

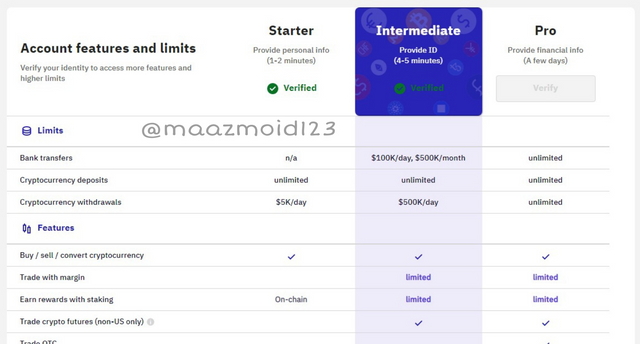

- Only people who are Pro Verified can trade in Kraken Dark Pool.

- The minimun order for the Etherum (ETH) is 50k USD in Kraken Dark Pool.

- The minimun order for the Bitcoin (BTC) is 100k USD in Kraken Dark Pool.

Fee Attracted on Kraken Dark Pool

In Kraken Dark Pool, the fees normally depend on your last 30-day trading volume. The more the volume will be, the less the fees will be.

But normally it the fees start from 0.20% to 0.36%, which is extra from a normal limit order.

The steps to perform block trading on the Kraken Dark Pool platform are:

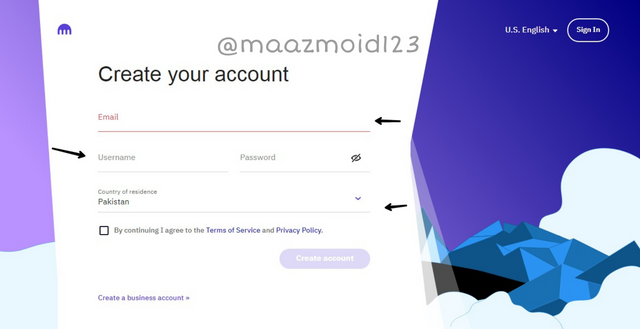

- So firstly, we will go to the Kraken.

- There, we will create an account.

- After creating an account, we will verify ourselves. There are three steps in that Starter, in which we will have to give our name and home address. Then there comes Intermediate: We have to show our ID and a bank statement. And as you can see in the Fig. 2, I am an Intermediate verifies, and then there is Pro Verified, for that we need to Fund our account to apply for Pro Verified.

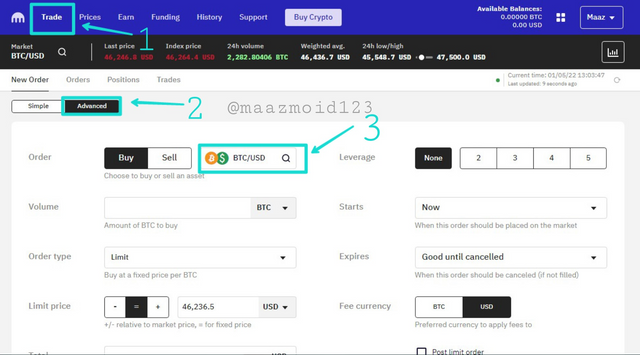

- After that, we will click on trade, then on the Advanced option, and finally click on the assets search option to go to Dark Pool trade (as shown in fig. 3). But as we know, to go for Dark Pool, we need to be a Pro Verified.

Decentralized Dark Pool

When the word decentralizedcame up, we knew that there was no authority and no third party involved in that. So the Kraken Dark Pool, which we have seen above, is the Exchange Dark Pool, and now we will see the Decentralized Dark Pool.

So the Decentralized Dark Pool block trading takes place in the decentralized Exchange, which eliminates the presence of the third party from the transactions. The Decentralized Dark Pool is more secure than the centralized Dark Pool. As in the Decentralized Exchange, it maintains anonymity. It does not have the KYC verification like the centralized exchanges, and it also distributes the blocks in the different parts when the order is placed, and then different nodes perform the job. And the integrity of that transaction is verified by the Zero-Knowledge Proofsfor a higher level of authentication.

Zero-Knowledge Proofs

zk-SNARK ("zero-knowledge succinct non-interactive argument of knowledge"), also known as the Zero-Knowledge Proofs, was developed in 1980. And the parties who have done the transactions or the information will verify that they know, but they do not tell what the information is all about.

These two parties act like the Verifier and the Prover, in that Prover shows that they have the information while the Verifier verifies that.

REN Decentralized Dark Pool

REN, which was previously known as Republic Protocol, was founded in2017 by CEO Taiyang Zhang but then it was renamed the Ren Protocol in 2019.

Ren is a Decentralized Exchange that has a decentralized Dark pool as well. So that means there is no third party involved in it. The Ren Decentralized Exchange has solved many issues like the Atomic Swaps or the cross-chain trading in free movement, which implements the peer-to-peer Exchange of the crypto from one blockchain to blockchain using the smart contracts.

So the Ren allows the Decentralize Finance (Defi) users to swap the token with any two blockchains in a free movement in a single user transaction.

| Centralized Dark Pool Exchange | Decentralized Dark Pool Exchange |

|---|---|

| It requires the KYC verification to start trading | It does not require any KYC verification involved. |

| There is a third party involved in it | There is no third party involved in it |

| It does not have any smart contract involved in it | It only has the smart contracts |

| The orders are made seeing the market orders | Orders are made when the address is confirmed |

| There are slippage fees involved in it | There is no Slippage fee in it, and only you have to pay bridge fees. |

So the recent huge sale of Bitcoin in the crypto ecosystem we saw just a month ago, when on December 5th, 2021 $1 billion worth of Bitcoin was liquidated, and because of that, the whole crypto market was plundered. The price of the Bitcoin fell from $55 k to $41 k, which was a huge blow-off to the market.

So if we say that the liquidation which was happened on December 5th of 2021, because of which the market plundered badly, have been made on the Dark Pool, then the change in the price of the asset would not have been happened, as this trade would have happened anonymously with no market order to show. So there would not have a chance of the price going down.

Firstly, if we see the normal Exchange that works on the law of economics, which is when the Supply is greater than the demand, then the price of the asset will decrease, and when the demand is greater than the supply, the price of the asset will increase. So in the normal market, there is a market order. When traders see a high buying in the market orders, they also start buying the assets, increasing the asset price. When they see a high selling in the market orders, the traders also start selling their assets to save themselves from the loss, making the market price fall.

But when the people use the Dark Pool, it only shows the limit orders and not the market orders. The buy/sell of the asset happened anonymously, which does not affect the asset's market price. And there will be no change in the market.

In the Dark Pools, the minimum order requirements are high, but even that does not affect the market price because of the anonymity of the transactions. And because of that anonymity, the asset's price does not change because the demand and the supply of the asset are not changed.

| Advantages of Dark pool | Disadvantages of Dark pool |

|---|---|

| There is no slippage cost involved in that as the orders are placed at limit orders | No identity, so it can also use in corruption |

| It does not affect the market after the big whales sell/ buy | It has a lack of transparency |

| It has an extra level of security involved in it. | There are many risks involved in it. |

| Eliminate the sentiments involved in trading and the fear of missing out | To make the Prediction of the price will be hard because of the anonymity of the transactions. |

Conclusion

Day by day, many new advancements and the technological boom are growing, and the solutions for the problems are also there. The Dark Pools are made for the big whales whose buy/sell will not affect the price of the asset because of anonymity in the platform.

Regards

@maazmoid123