Hello Steemians

I am @mabubakar966. I hope you all are well and in good spirits. This is my second post in the Steemcryptoacademy I had created a post to participate in the contest "Bitcoin Halving" of week 1 of season 15, which turned out to be invalid because I had not joined any clubs. But now, let me tell you that I have powered up all my rewards on Steemit and have not withdrawn any rewards. And now, I am creating a post to participate in the "Stock to Flow" contest. I hope that my entry will be valid this time, and I will win the contest.

Question no. 1

Explain in your own words the Stock to Flow Model, what is its function?

Stock to Flow Model

The term "stock to flow" refers to the relationship between the existing supply of a specific asset or commodity and the new production of that commodity within a particular period. This is essentially used to predict future value. It is divided into two parts, first, "stock," which represents the current supply of a commodity, and second, "flow," which signifies the new production of that commodity. It helps determine the connection between the existing supply and the newly produced items over a certain period, usually several years. This concept is often applied to more valuable assets, such as Gold or Bitcoin. The Stock-to-Flow model was created by an analyst named PlanB. This model is designed to indicate the scarcity and price trends of Bitcoin. We use the Stock-to-Flow model to understand the Stock-to-Flow ratio. The logarithm of the Stock-to-Flow ratio has a direct relationship with the logarithm of the price. The Stock-to-Flow ratio indicates whether the price will be lower or higher. When calculating the ratio for a commodity, a method is applied that divides the current supply of the commodity by the newly mined commodity, resulting in a ratio.

Method to calculate

Stock-to-Flow = Current supply of commodity / Newly mined commodity

Increasing Stock-to-Flow Ratio:

The Stock-to-Flow ratio has a direct correlation with the price. If the ratio is higher, it increases scarcity. We know that when scarcity is higher, demand also tends to increase, leading to an automatic increase in price.

Decreasing Stock-to-Flow Ratio:

The Stock-to-Flow ratio has a direct relationship with the price. If the Stock-to-Flow ratio decreases, scarcity also decreases. This will inevitably lead to an increase in supply, and with demand remaining constant, the price will decrease.

S2F model for BTC

Taking Bitcoin as an example, it calculates the ratio between the existing Bitcoin supply and the annual production of new bitcoins. The foundation of this model lies in the principle that scarcity enhances value. Assets that achieve a higher ratio in the stock-to-flow model tend to have higher values, providing the potential for increased value over time. In essence, the model suggests that assets with a higher stock-to-flow ratio are perceived as more scarce, and this scarcity contributes to an increased likelihood of their value rising.

In 2019, the total number of bitcoins in existence was 17.5 million, while the annual production of new bitcoins at that time was 0.7 million. As we know, the Stock-to-Flow ratio is calculated by dividing the total current supply of the coin by the yearly production. So, based on this calculation, the Stock-to-Flow ratio is 25. This means that, according to this ratio, it would take approximately 25 years to produce an amount of new bitcoins equivalent to the current existing supply.

Stock-to-Flow Ratio = Annual Production/Current Supply

Stock-to-Flow Ratio= 17.5million/0.7million = 25

For today in my reviews, Now, the total number of bitcoins is 19.61 million, and the number of bitcoins to be produced this year is 328,500. Similarly, we will divide the total bitcoins by the yearly production of bitcoins, and the resulting answer will be the Stock-to-Flow ratio.

Stock-to-Flow Ratio= 19608518/328500 = 59.63

The Bitcoin halving is an event that creates scarcity. The halving event occurs every four years, resulting in a gradual reduction in Bitcoin production. As production slows down, the supply decreases. We know that as the supply decreases and demand remains high, the price tends to increase. Therefore, we have observed that as the supply decreases, the Stock-to-Flow ratio increases. When the ratio is higher, the price is also higher, and this trend is expected to continue in the future. With the upcoming Bitcoin halving, production will slow down even further, and now there is a high probability that the price of BTC will increase in the future. As BTC becomes scarcer, the price is expected to rise accordingly.

Functions of Stock-to-Flow model

Price Forecast:

Using the Stock-to-Flow model, we can make predictions about whether the price will decrease or increase. The Stock-to-Flow model emphasizes scarcity, informing us whether the price will decrease or increase.Market Attitude Indicator:

The Stock-to-Flow model can be used to assess market conditions. When the ratio is analyzed, it provides insights into scarcity, allowing us to understand whether the price will decrease or increase. This analysis can also provide a global perspective on changes occurring in the market.Scarcity Evaluation:

With the Stock-to-Flow model, we estimate scarcity by dividing the soon-to-be-created coins by the total existing coins within a certain time frame. If the ratio is higher, it indicates greater scarcity.

Question no. 2

What would be the advantages and disadvantages of the Stock to Flow Model?

.png)

Advantages of Stock to Flow Model

1. Predictive Source:

The Stock-to-Flow model is a significant tool for many investors, enabling them to forecast future market prices and potentially earn profits. Investors often find it particularly beneficial when they are involved in specific events and use the Stock-to-Flow model effectively. The model tends to be most advantageous when applied accurately to market situations, helping investors make informed decisions and optimize their potential for profit.

2. Historical Connection:

The Stock-to-Flow model brings about significant changes in market history, influencing movements in prices. This reflects a kind of historical correlation between them.

3. Comparative Analysis:

Through this, investors conduct comparative analysis, examining the supply of different commodities to observe and understand the corresponding price movements.

4. Bitcoin Analysis:

Through this approach, investors thoroughly observe the main cryptocurrency, Bitcoin, and, while examining its value, they also analyze alternative cryptocurrencies (altcoins). During events such as Bitcoin halving, they leverage the Stock-to-Flow model to potentially gain significant profits.

5. Investment Decision:

The Stock-to-Flow model informs investors whether they should invest money or not, indicating whether the value is likely to decrease or increase, enabling them to make investment decisions accordingly.

6. Scarcity Assessment:

Using the Stock-to-Flow model, we can easily gauge scarcity by examining the total supply and then dividing it by the yearly mined bitcoins. This helps us understand the level of scarcity, providing insights into the market's value and price trends.

Disadvantages of Stock to Flow Model

1. Unpredictable future projection:

The Stock-to-Flow model doesn't always provide accurate predictions; there can be biases in it, and future accuracy is not 100%. The market changes, and it doesn't allow for consistently accurate predictions in the future.

2. Not applicable to all assets:

This model allows us to observe predictions for only a few commodities, and it is not universally applicable to all assets. We know that each asset is different from others, making it challenging for the model to be universally accurate. If applied to other assets, accurate results may not be obtained.

3. Restricted forecast duration

This model can only predict to a certain extent, with limited accuracy, and its predictions are generally short-term. The rapid changes in the market can restrict the model's ability for long-term forecasts.

4. Digital currency market instability

This model is predominantly used in the cryptocurrency market, which is known for its high volatility. Unpredictable price movements in the crypto market can significantly impact and alter the outcomes predicted by this model.

5. Presumption of logical market behavior

This model presupposes rational market behavior, and it is not always true. Emotional responses, sudden events, or unforeseen circumstances can disrupt the rational market, impacting the model's predictions.

6. Market sentiment neglected:

The Stock-to-Flow model overlooks market sentiment, while investor sentiment, news, and events can have a significant impact on the market. Stock-to-Flow alone may not capture the influence of these factors.

Question no. 3

Make an analysis of the Stock To Flow graph?

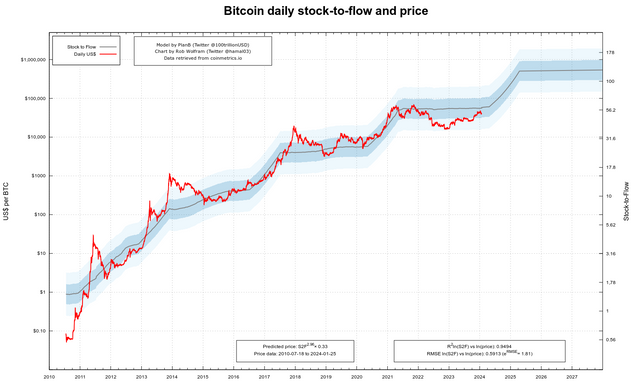

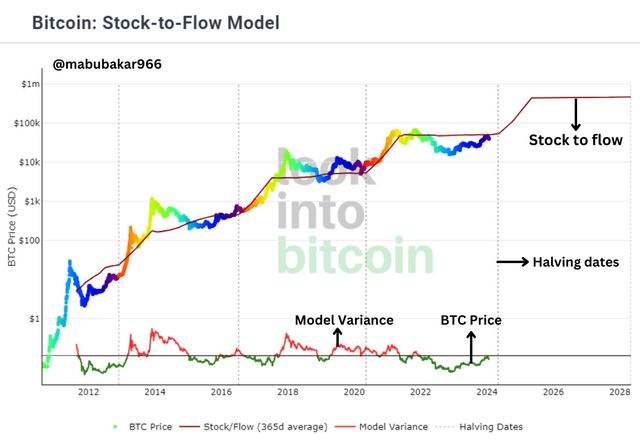

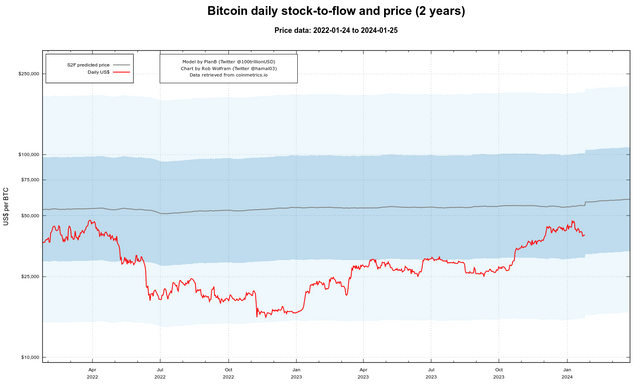

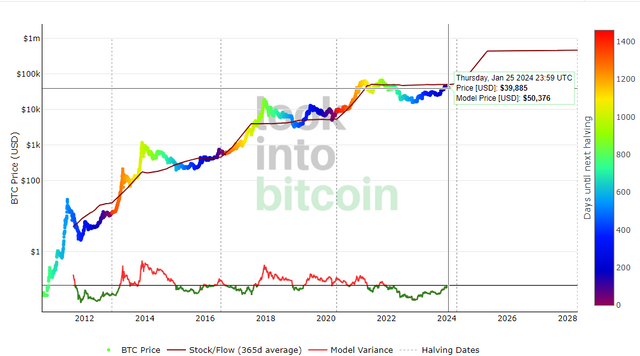

Look, this is a graph where you can see a deep correlation between the logarithm of BTC price and the logarithm of the Stock-to-Flow model. The y-axis of the chart shows the BTC price, ranging from $0.10 to $1,000,000, and the x-axis represents years from 2012 to 2028, covering all the prices of BTC during these years. It shows when the prices were low or high.

The BTC prices are displayed in green, while the Stock-to-Flow line is shown in dark red, making predictions from 2012 to 2028. The model variance is indicated in light red below, and the dotted lines on the y-axis are showing Halving dates.

Previous 2 year chart

If we look at the correlation graph for BTC and Stock-to-Flow over the past two years, it might appear somewhat like this. In this, you can observe that the relationship between BTC's actual price and the Stock-to-Flow model's predicted price is such that the predicted price is higher, but the actual price is lower. The Stock-to-Flow model's expectations were not fully realized, but the actual prices remained in close proximity to the model's predictions.

Analysis for today

.png)

If we talk about the current scenario, the price of BTC is $39,885, while according to the model, it should have been $50,376. In this way, the model is showing a slight deviation in the price. The price is lower, but it is anticipated to rise after the halving event because demand will increase and supply will decrease, causing the price to go up. When halving occurs, the price is typically higher. Despite the current difference, historically, whenever predictions have been made, the price tends to gradually increase. According to the model, the price is expected to reach up to $800k by 2028.

"Current date: 2024-01-26

Current price: $39917.66

Predicted price: $56013.92

Predicted × 1SE: $101181.7

Predicted ÷ 1SE: $31009.16

Predicted × 2SE: $202363.4

Predicted ÷ 2SE: $15504.58"

data from

The Stock-to-Flow (S2F) model doesn't always provide accurate predictions; there is typically some degree of fluctuation. However, it does offer useful insights, and we can obtain predictions from it on a daily basis. In the S2F model, certain factors need to be considered to understand when the rate of a particular currency might decrease or experience a change. It's essential to keep certain variables in mind, as the rate doesn't change dramatically every time; there are certain consistent factors at play.

Question no. 4

Can this model be applied to STEEM? Give reasons why this Stock to Flow graph model can or cannot be applied.

No, this model is not applied to STEEM.

Steem is indeed an altcoin, and its production is not as extensive. This coin is generated through the efforts of content creators on the Steemit platform. When individuals create and curate content, they receive Steem coins as rewards, contributing to the circulation and production of Steem. However, this process is relatively slow, as not everyone is actively engaged in content creation or curation to generate rewards. The supply of Steem remains limited due to these factors, making the model less robust for Steem.

Another factor influencing the dynamics of Steem is the ecosystem of the Steemit platform, which is built around rewards. The Steemit ecosystem plays a significant role in shaping the production and circulation of Steem coins.

In many cases, the value of altcoins, including Steem, tends to follow Bitcoin's value. For instance, if we apply a model like the one used on Steem but Bitcoin's value decreases, market sentiment may decline, investor interest may wane, and the value of Steem might also decrease. It's possible that an optimistic application of the model, assuming a higher price, might not materialize due to external factors like a decrease in Bitcoin's value, affecting the overall market sentiment and, consequently, the value of Steem.

Ending thoughts

"I hope that my entry will be accepted because I have transferred all my rewards to vesting. Winning this challenge is a dream of mine, and I always strive to succeed even when faced with challenges. This time, I am confident that there will be a noticeable difference. Participating in challenges not only enhances my knowledge but also brings many learning experiences. The benefits extend beyond just winning."

I would like to invite:

@thaizmaita @azwar82 @bela90 @bossj23 @abdul-rakib @shahid2030 @mohammadfaisal @zisha-hafiz @shanza1 @khursheedanwar @casv @arinaz08 @sahar78

My 1st achievement post:

Unfortunately @mabubakar966, by checking your post on the GPT-2 Output Detector gave us a 99% chance that the first paragraph was generated by ChatGPT.

Do not use this tool to generate answers to our questions as it is considered plagiarism. Warning: Don't return to this practice again so as not to mute your participation in our competitions.

Cc- @steemcurator01

@pelon53

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sir, I haven't used Copy ChatGPT for this paragraph. I write my post first in my native language(Urdu) and then use ChatGPT to transfer it into English.

I have proof of this, and I can show you a screenshot.

And here is the link of my chatgpt chat.

https://chat.openai.com/share/bee74936-d0ce-4995-87a5-c09260815694

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@kouba01

Sir, I request you to kindly take a look and review my post. I have written everything myself, and I conducted research using ChatGPT. Then, using ChatGPT, I translated my content into English.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@kouba01

Hlo sir plzz check it

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@mabubakar966

What is the current number or what is the next number or if we talk about it, we can recognize it from its color, we can recognize it from its colors, where its price will go now, it will go up, it will go down if we talk about it. So really the points were explained to us in a great way and it was really necessary to understand these points. Disadvantages are that people can directly find out which side it is going now and advantages are that people get profit here. Good luck

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings friend,

The "stock to flow" is about the relationship between the current supply and new production of an asset. It helps predict its future value. The model calculates the ratio by dividing the current supply by the newly produced items. This ratio indicates whether the price will be higher or lower.

Therefore, this is a very important model for those looking to invest in not only in the cryptocurrency space but also in the financial market.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Kudos brother you've a well recommendable knowledge about this concept.

The presentation is perfect and understandable,

Just from you I've been able to know the concept meaning, understand well the formula involves and possibly how I can apply it properly while making analysis.

The advantages and disadvantages provided is pretty understanding and manageable.

It amazes me on the analysis you just made. This prompt me to calling you a guru here.

Well done I'll love to read more 🙏

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well my dear friend you have talk about in much detail and you have right as so good but I don't know why they are saying about chat GPT but don't this hurted next time inshallah you will be great and best of luck for this participation as well

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Really deep and intense explanation from you my good friend I must say you have once again proving to be a very special content Creator on this platform especially when it comes to creating crypto related content that would educate their ecosystem on crypto analysis technical models and even indicators once again thank you for sharing such quality article please and engage on my entry https://steemit.com/hive-108451/@starrchris/eng-esp-steemit-crypto-academy-contest-s15w2-stock-to-flow-model-or-or-modelo-stock-to-flow

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

La escasez es el factor gobernante en el modelo S2F, por lo que hace también fundamental la existencia del halving como ha sido programado. Es como la pieza clave del rompecabeza en que se ha convertido el pronóstico a través del modelo S2F, los resultados son sorprendentes como lo visualizamos en el gráfico.

No puede ser perfecto pero me da confianza lo que ha ocurrido hasta ahora, solo debemos cuidarnos las espaldas aplicando otras herramientas analíticas que nos ayuden a resolver este rompecabezas.

Saludos y éxitos.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Stock ka matlab vote tokens hai jinko humne save Kiya hua hai aur Market mein available hai iske alava agar flow ki baat Karen to vah new aane wale aur new create hone wale tokens Hain aapane bilkul acchi Tarah explain kiya hai aur main aapki mehnat per aapko appreciate Karti hun lekin chat GPT ko use karna ek positive chij Nahin hai isliye main aapko advice Karti hun ki aap Is Tarah ki chijon se dur Rahe aur original rah kar content produce Karen Taki aapko bhi aapki journey mein Koi difficulty na ho.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit