Name at least 2 Blockchains that use the Wrapped BTC, excluding Ethereum, and show screenshots. Explain.

Wrapped tokens in cryptocurrency refers to pegged tokens of a coin intended to foster interoperability on blockchains. Different blockchains follow different set of operative standards for tokens to run. So tokens of one blockchain can't work on other blockchain . So to soolve this problem, wrapped tokens are created and pegged with underlying asset in the ratio of 1:1. We can say that, wrapped tokens act like bridges between two blockchains. Example, wBTC is a wrapped token of BTC . Pegging ratio of 1;1 means that wBTC price is same as that of BTC. The pegged BTC is kept in custodian like multisig wallet , a smart contract, DAO etc. We will go into details of wrapped tokens later. For now, let's talk of two blockchains and they are BINANCE SMART CHAIN and SOLANA blockchain.

Wrapped BTC on Binance Smart Chain (BSC) .

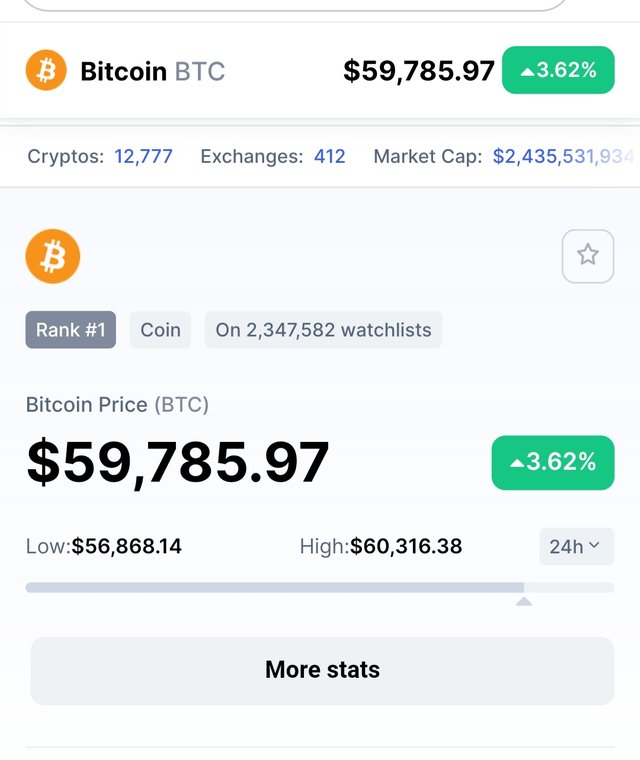

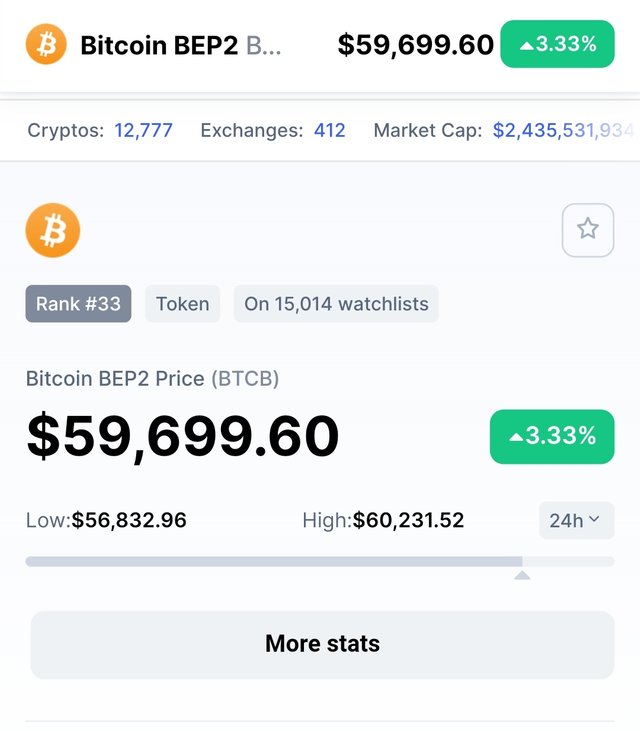

BTC on BSC is wrapped and transferred via Binance bridge to allow bitcooin holders interact with DeFi ecosystem. Wrapped BTC on BSC is symbolised as BTCB. BTCB is a BEP2/BEP20 asset wrapped token of BTC on Binance Chain/Binance Smart Chain with a 1:1 peg ratio to BTC locked on the Bitcoin blockchain.

In the screensshot above taken from CMC, although there is some difference in price but in reality, we can exchange BTCB for BTC im the ratio of 1:1 .

Source

Working of Binamce Bridge

Wrapping of BTC to BTCB actually increases the ue-case of BTC in DeFi ecosystem. Some of the worth mentioning applications of BTCB are in lending, yield farming, liquidity mining to maximize the profits without selling BTC for interacting with DeFi.

Wrapped BTC on Tron

Tron ecosystem is a very tough competitor of Etherium network as for DeFi interaction of later is concerned. Simce Tron network is rich in Dapps and BTC can not directly interact with any of these Dapps unless it is a wrapped. BitGo in conjunction with Kyber Network and Republic Protocol produced wBTC initially for Tron ecosystem to increase use case of BTC in Tron DeFi network like JustSwap, JutLend etc . wBTC therefore provide token holders opportunity to interact with DeFi world to maximise their profits without need to sell BTC for some other token.

As i mentioned in the introductory part of this task that there must be guardian of pegged token. In Tron that job is done by locked address of BitGo company for the token unless unwrapping is carried out and wBTC is burnt to maintain stable token dynamics. On top of all above, wBTC has lowered gas fee for its interactions with Tron DeFi.

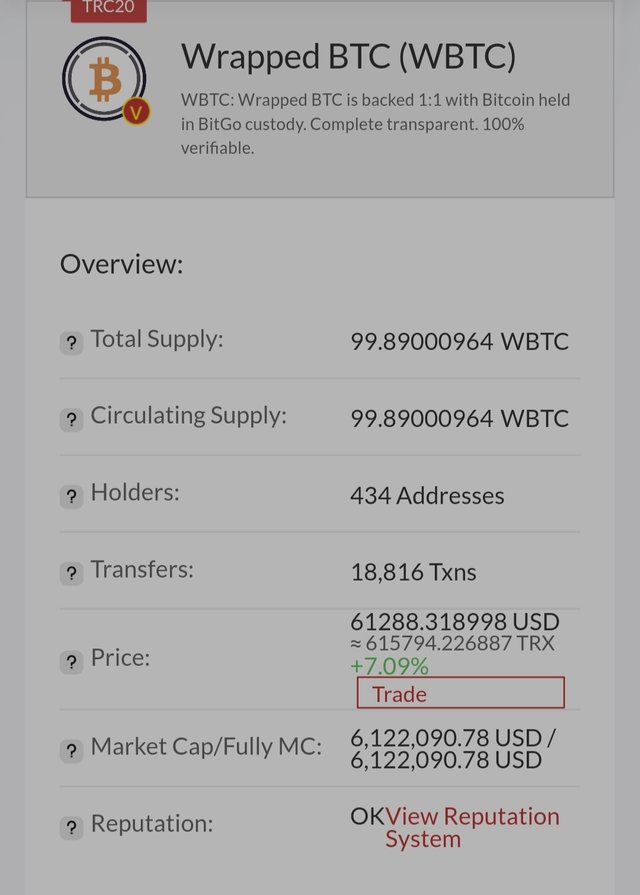

Tronscan statistics

Total Supply:

99.89000964WBTC

Circulating Supply:

99.89000964WBTC

Holders:

434 Addresses

Transfers:

18,816 Txns

Price:

61288.318998 USD

≈ 615794.226887 TRX

What is the difference between the wETH of the Ethereum platform and the wETH of the TRON platform? Explain.

It is thought provoking that if the wrapped tokens were created to promote interoperability between different blockchains then what was the need of creating wrapped token of the same coin on different blockchains. Do they really differ or are the same? Let's take the example of wrapped token of Ethereum on the Ethereum blockchain and Tron blockchain to help understand the differences.

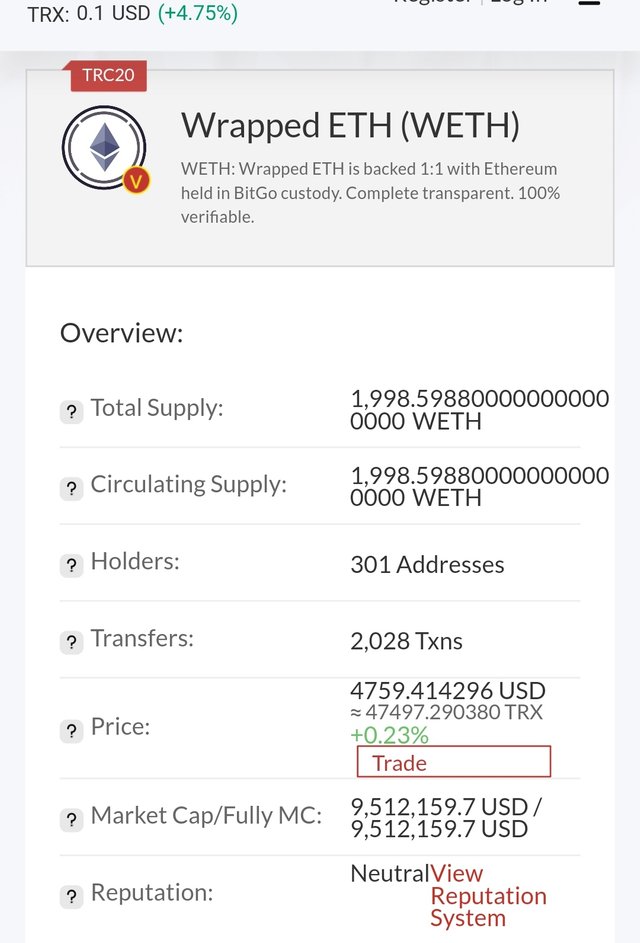

wETH on ETH blockchain follow ERC-20 standards where as wETH on TRON follow TRC- 20 standards.

Creation of wETH on Ethereum blockchain does not involve any third party but are facilitated through smart contracts. Therefore unwrapping of wETH to ETH does not involve burning of wETH thereafter. On the other hand, wrapping of Ethereum to wETH on Tron blockchain involves BitGo which acts as a third party for Tron network . Therefore after unwrapping of wETH , the wETH tokens are burned to maintain the supply demand dynamics.

wETH on Ethereum blockchian are more decentralised as no third party is involved where as on Tron Network BitGo is involved.

Make an investment of at least $ 5 of a Wrapped token. Explain the process with screenshots. You can use the JustSwap platform.

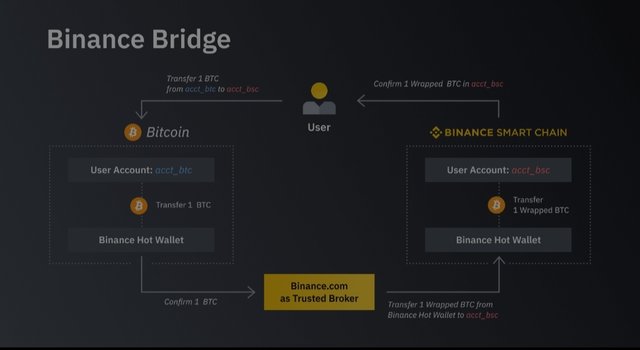

To perform this investment, I'll swap TRX with wBTT.

Open TronLink App and from the bottom panel of the main page of the app, click on "Discover".

On the next page, click on JustSwap and it will take you directly to justSwap main page

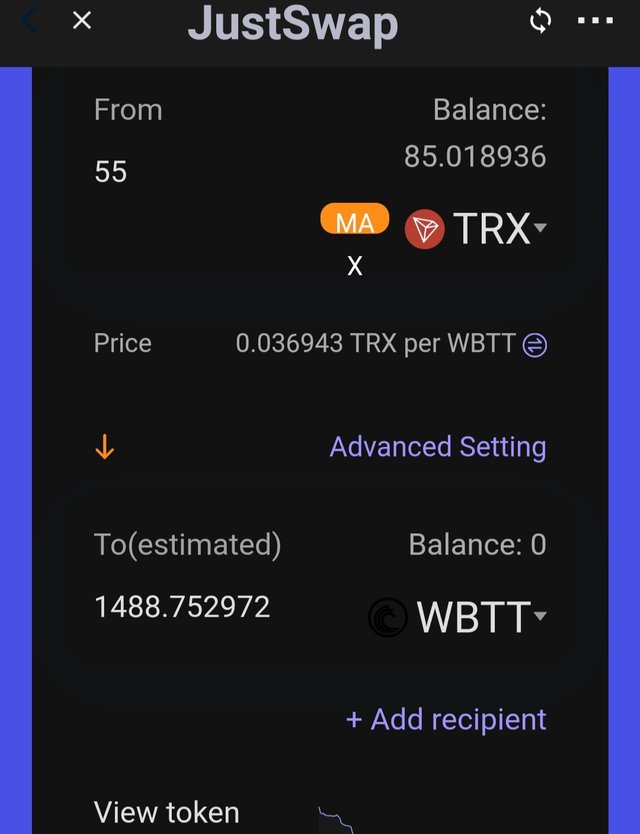

On the main page of app , we need to select the token to which we want TRX token be converted.

Than select the amount of either TRX or WBTT.

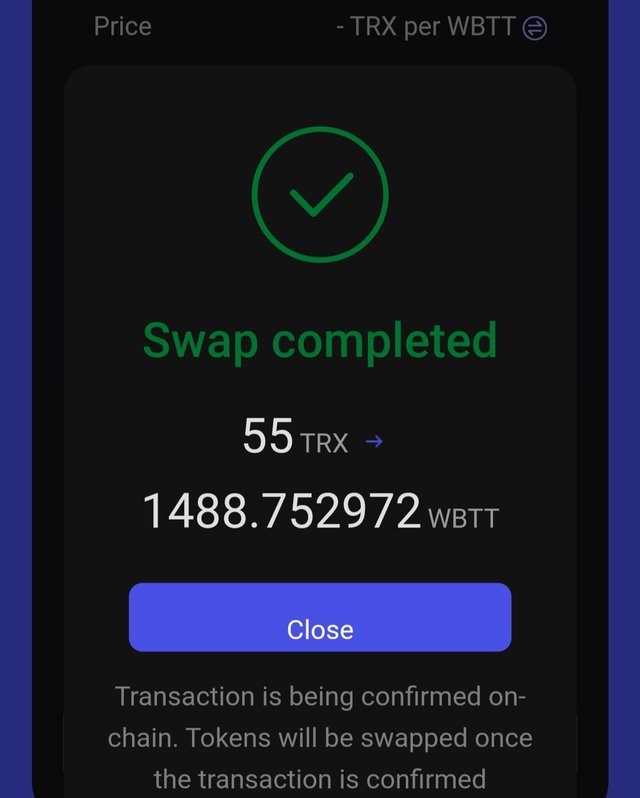

I choose 55 TRX. For 55 TRX we will get 1488.775 WBTT . Click on swap.

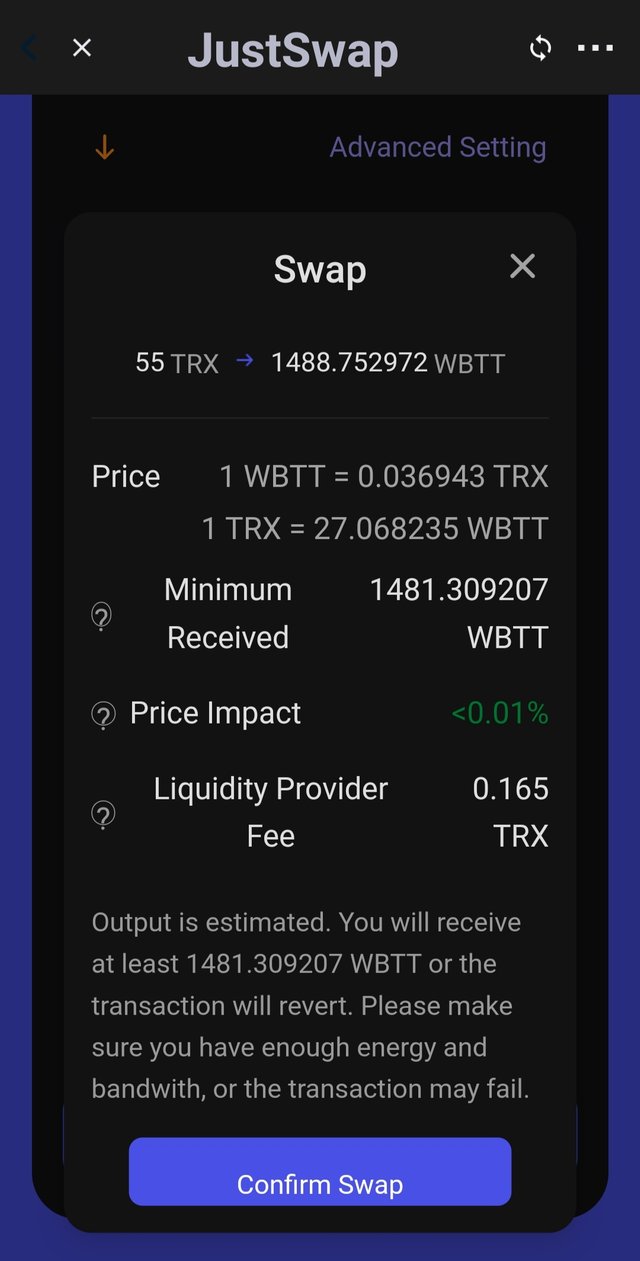

Next, confirm the swap by clicking on confirm swap. A transaction fee of 0.165 TRX (0.3% of total TRX) was charged as liquidity provider fee.

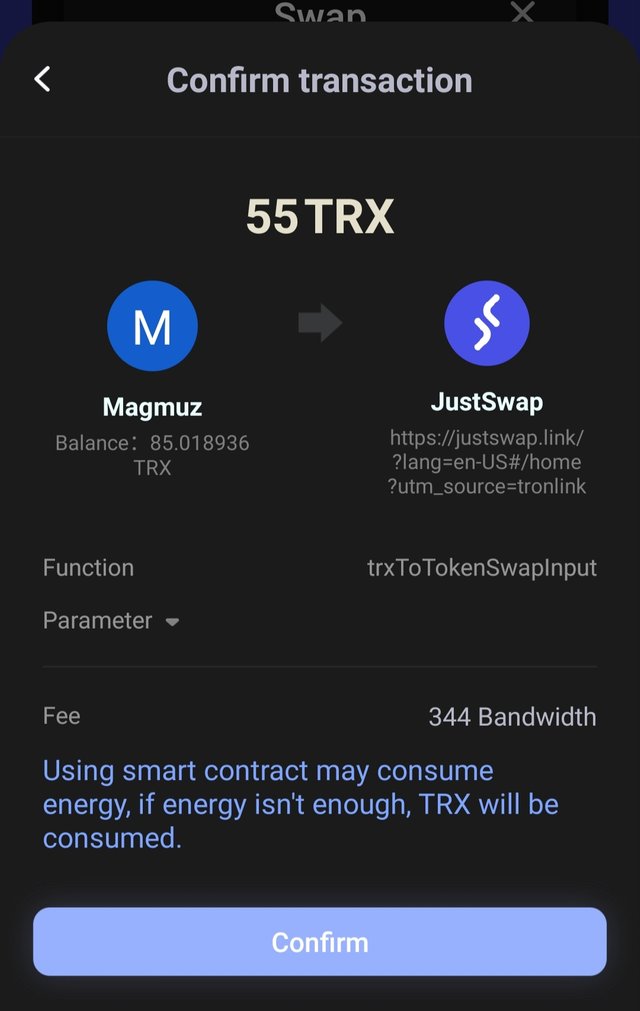

Next we need to sign the swap transaction. Click on sign transaction.

We need to enter TronLink password to finalise the transaction.

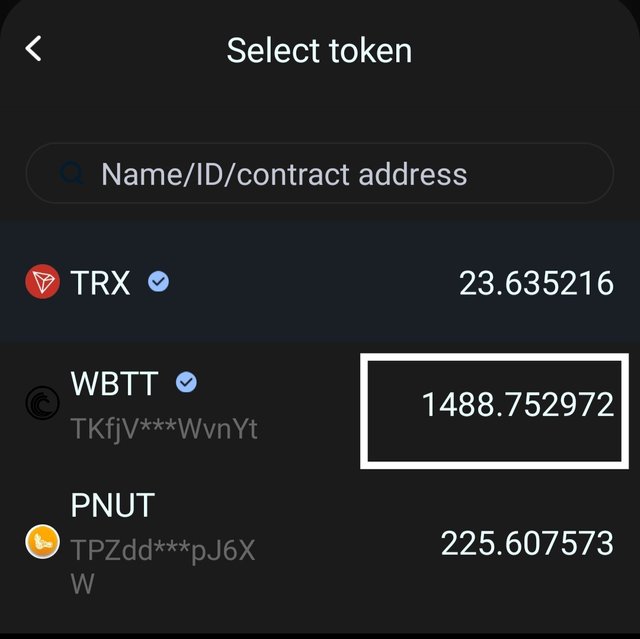

Next the success notification will appear and WBTT will be credited to TronLink.

Explain in detail the Wrapped token of the TRON Blockchain. Show screenshot.

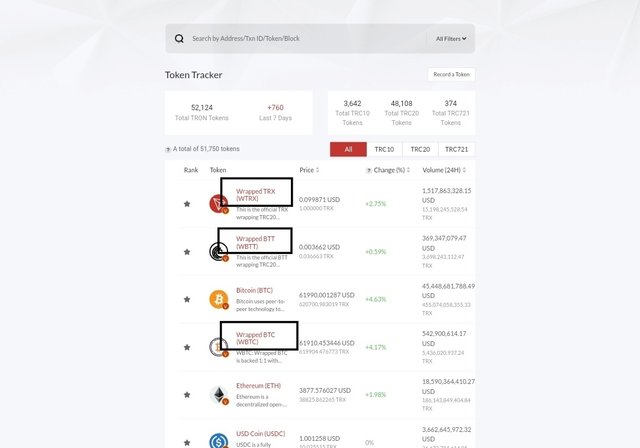

Tron blockchain has succeeded in operation of certain wrapped tokens like wBTC, wTRX, wETH, wBTT

[Source(https://tronscan.org/#/tokens/list)

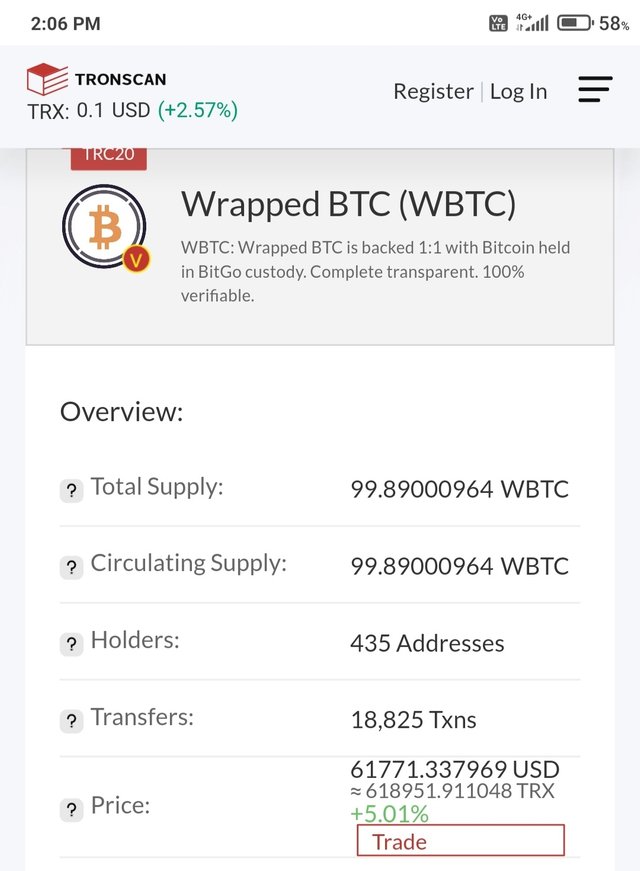

wBTC on Tron

wBTC on Tron is pegged to BTC in the ratio of 1:1 and BTC is locked on BitGo address unless wrapped BTC is returned back to BitGo and wBTC is burnt to prevent inflationary devaluation.

Total Supply:

99.89000964WBTC

Circulating Supply:

99.89000964WBTC

Holders:

435 Addresses

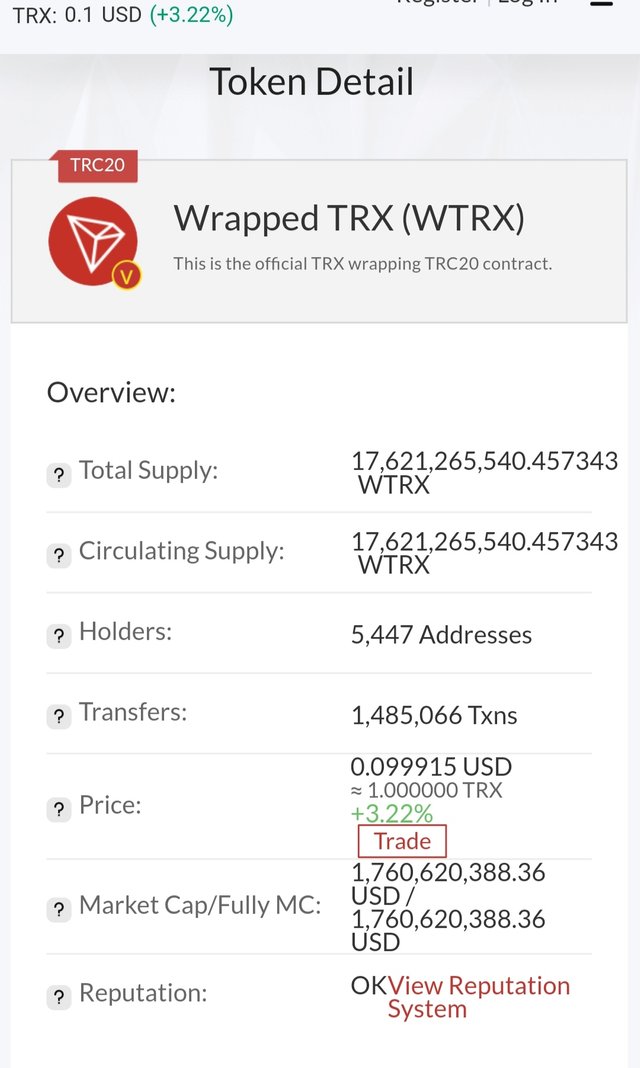

wTRX on Teon

wTRX is Tron network wrapped Tron token.it matches TRC 20 standards like TRX. But it is confusing to understand the need of wTRX on Tron blockchian when TRX can perform job of wTRX. However, use case of wTRX has increased for its interaction with Dapps and Interoperablity among other blockchains .

Total Supply:

17,621,248,938.803729WTRX

Circulating Supply:

17,621,248,938.803729WTRX

Holders:

5,447 Addresses

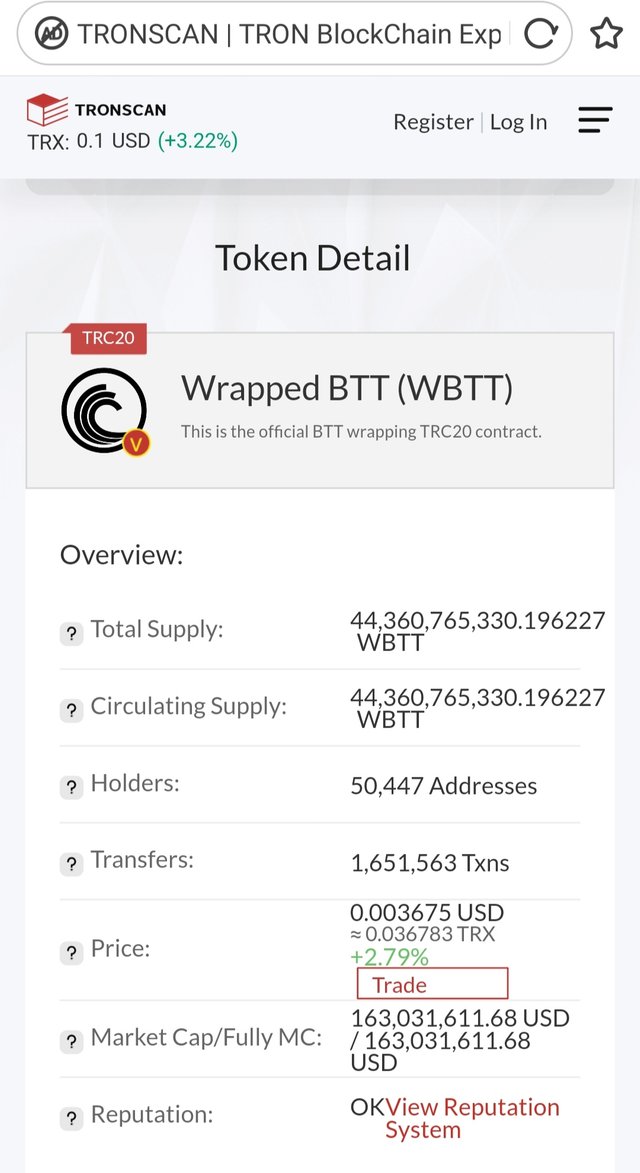

wBTT on Tron

WBTT is wrapped token of BTT. However, it differs in minting process as there is no BitGo custodian. wBTT differs from BTT in standards of operation as former works on TRC 10 standards where as later works on TRC 20 standards.

Total Supply:

44,360,615,490.196227WBTT

Circulating Supply:

44,360,615,490.196227WBTT

wETH on Tron

wETH on TRON has been discussed in relation to wETH on Ethereum above.

What is to mint a Wrapped token? What is burning a Wrapped token? What is your function? Create an example explaining the process.

Mint a wrapped token.

Minting is synonymous with mining and does exactly the same job as done by mining process. Minting is therefore a process of generation of wrapped tokens. Mining of unwrapped tokems is careied out by miners by following different consensus mechanism. The process of generation of wrapped token is different. To generate wrapped token, the unwrapped tokens are sent to custodian or smart contract that converts it to the wrapped token and send it back to the address from which it was sent. For example, to mint wETH on Tron blockchian, a user cannot do it directly on Tron blockchain but a user has to send ETH to BitGo address and they mint wETH and send to the user. At the same time, ETH is locked in the address till the time unwrapping takes place. At the time of unwrapping, ETH is send back to user after receiving wETH and the received wETH is burnt to maintain the value of ETH .

Burning a wrapped token.

We know that wrapped tokens are pegged to unwrapped token in the ratio of 1;1 . It means that for every unwrapped token sent to the custodian, one new wrapped token is generated and an unwrapped token is locked in the address. So total supply of the token is increased. From the law of supply and demand, we know that when the supply of an asset or security increases, the value of that security or asset decreases . On the contrary, when the demand of the asset or security increases or supply decreases, the value of that security increases.

Applying the same law to the wrapped and umwrpped tokens, if burning is not carried out then that will lead to the devaluation of the token under consideration because of inflation. So mechanism of burning is in place which involves burning of the wrapped tokens after release of the unwrapped tokens to the owner of the token. As explained above, BitGo burn wETH after release of ETH to the owner.

Conclusion

Blockchain has revolutionised the world of finance and is now expanding its use case in different fileds of life. Transfer of tokens across different blockchains is not possible unless tokens are wrapped. So wrapped tokens are there to foster interoperability between different blockchains. Also wrapped tokens inceease use case of tokems in Dapps.

You have been upvoted by @sapwood, a Country Representative from INDIA. We are voting with the Steemit Community Curator @steemcurator07 account to support the newcomers coming into Steemit.

Engagement is essential to foster a sense of community. Therefore we would request our members to visit each other's post and make insightful comments.

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit