Introduction

Hello to all amazing steemians in the crypto-academy. I thank the crypto professor, @reddileep for giving such an explicit explanation of this lecture on, Heikin-Ashi Trading Strategy.

Question 1: Define Heikin-Ashi Technique in your own words.

In the 1700's, a Japanese named Manehisa Gonna developed a technique called the Heikin-Ashi technique. This technique became widely used by both investors and Traders to help identify both Trend direction and strength when trading. Market volatility usually causes noise during Trading which distracts the trader in correctly identifying the trend strength and trend direction.

Heikin-Ashi translated to English means "average bar" in the Japanese language. This method also uses candlesticks as the traditional candlesticks but the only difference is that it uses "average prices". The use of average prices goes a long way to eliminate the noise caused by market volatility in the traditional Japanese candlestick.

The wicks of the Heikin-Ashi candle stick reveals the strength of a trend. The markets are either bullish or bearish. The bearish market is indicated when a string of candlestick in a downtrend has no upper wicks, and the bullish market indicated when the string of candlestick in an uptrend has no lower wicks.

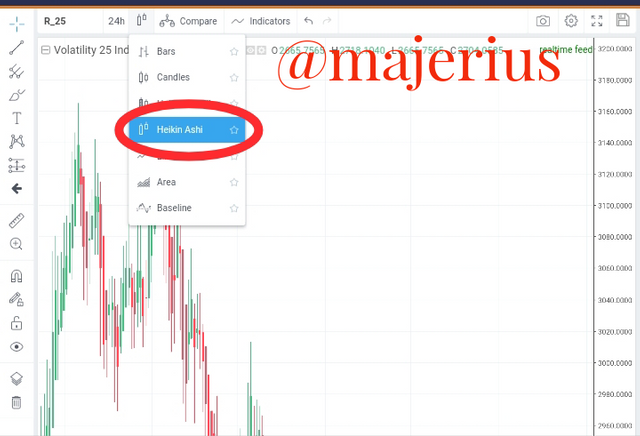

That's an experimented a little on it. I inputed the Heikin-Ashi chart by clicking on an icon which look like candlesticks and selected Heikin-Ashi. As shown in the screenshot below.

Question 2: Make your own research and differentiate between the traditional candlestick chart and the Heikin-Ashi chart. (Screenshots required from both chart patterns)

The Heikin-Ashi and traditional candlesticks though similar, have critical differences which I am going to show you using two charts on the BTCUSD Market. The time frames will remain the same while the candlesticks will differ.

The charts above show a clear difference between the 2 techniques which are detailed in the table below:

| Heikin-Ashi Candlestick | Traditional Japanese candlestick |

|---|---|

| Colors of candlesticks are consecutively and smoothly displayed. Making trend movement better to be interpreted by traders. | Colors of candlesticks change frequently giving no distinct pattern to follow. Making it difficult to interpret the movement trend. |

| because of the average taken, the candlestick price may not correspond to the current price. | Market price matches with the candlestick at any point. |

| Candlesticks open at the midpoints of the previous candlestick. | Here, one candlestick opens after the closure of the previous candlestick. |

| Noise in the market is reduced, thereby causing the candlestick to flow smoothly and and color follows the trend movement. This enables the trend to be efficiently analyzed. | Color disparity is as a result of the technique reacting to all price actions even when on the strong trend. |

Question 3: Explain the Heikin-Ashi Formula. (In addition to simply stating the formula, you should provide a clear explanation about the calculation)

The Heikin-Ashi technique uses formulas when creating their candle sticks. Meanwhile the traditional candlesticks are made up of four components; high, low, open and close. They all have their formulas as shown below:

- High of Candlestick

these values obtained from the maximum high price of the current scandal. This can be the open, high, or close price of the candle.

High = Maximum (High, open, close) of current candle

- Low of candlestick

this is obtained from the minimum low price of the current candle which can be the low, open or close price of the candle.

Low = Minimum (low, open, close) of current candle

- Open of candlestick

This is calculated by adding up the opening price and closing price of the previous candlestick and dividing by two. This is actually the average as the name Heikin-Ashi implies. The result gotten is the price at which the next candle opens, and is usually the midpoints of the previous candle.

Open = 1/2 (open of previous candle + close of previous candle)

- Close of Candlestick

this is obtained by adding up the high, low, open and close price of the current candlestick and dividing the results by 4. This makes the closing of the Heikin-Ashi candlestick to be termed the average price of the candlestick.

Close = 1/4 (open + high + low + close)

Question 4: Graphically explain trends and buying opportunities through Heikin-Ashi Candles. (Screenshots required)

Trends

Identification of trends on the Heikin-Ashi candlestick are quite easy. The flow of the candlesticks are smooth, and they reduce market noise and also, the colors of the candlestick move in line with the trend. All this, thanks to the fact that the Heikin-Ashi creates its candlestick by calculating the average.

The trend strength is shown via wicks. For a down trend, the candles have no upper wicks to indicate the bearish movement while for the uptrend has no lower wick to indicate the bullish movement. The explanation of this statement is graphically shown below.

Furthermore, the Heikin-Ashi can be used to determine buying and selling opportunities in the market. This can be done by analyzing the indecisive candles.

Buying and selling opportunities

The characteristics of a market is known when the trader finds a good opportunity to either buy at a favourable price, or sell to gain profit. This makes the Heikin-Ashi trading technique look even more interesting.

If after the indecisive candlestick we notice a strong bullish candle, we can interpret that as a buy Signal. On the other hand if after the indecisive candlestick will notice a strong bearish candlestick we can interpret that as a sell signal. Do this method is widely used, it is not 100% efficient because of the random way the market can go.

Question 5: Is it possible to transact only with signals received using the Heikin-Ashi Technique? Explain the reasons for your answer.

My answer to this question is Yes, it is very possible to trade with signals received using the Heikin-Ashi technique, but it is not 100% sure that the signal will be accurate. That is why the Heikin-Ashi strategy has to be combined with another indicator, to increase the accuracy of trading signals received.

For example, pairing the Heikin-Ashi to indicators like the Exponential Moving Averages known also as (EMA-21 and EMA-55), improves the signals received by Heikin-Ashi and helps the trader to distinctly select out false signals.

Question 6: By using a Demo account, perform both Buy and Sell orders using Heikin-Ashi+ 55 EMA+21 EMA.

Buy

Using the STEEM/USDT, i first checked the indecision candle. Once i spotted it, i waited for the bullish candlestick to appear. Once that candle appeared i checked the EMA-55 and EMA-21 levels.

Seeing my graph, the slope was depreciating so i placed my order and bought.

Sell order with BTCUSD

Still using the demo account, i engaged a sell order when I noticed a bearish candle came after an indecisive one. The Heikin-Ashi technique was accurate.

Conclusion

Coming to an end of this class i learnt that the Heikin-ashi technique reduces noise in the market because it uses the average price. Also, that traders use it as alternative for the traditional candlestick for the interpretation of trend direction and trend strength.

Despite the fact that it is more accurate than the traditional candlesticks, without other indicators like EMAs it can't give out accurate signals. Using this technique doesn't guarantee at 100% the success of a trade since the crypto market is very volatile.

To this effect, the trader needs to gain a lot of experience in the trade of crypto using this technique to ensure a great success, because once a trade has been completed, you can't recover your lost assets.

Thank you so much prof @reddileep for this lecture! I am very grateful though i faced some difficulties in the practicals, i will continue working harder on that to increase my experience.

CC: @reddileep

Written by : @majerius