Hello dear Steemians,

I am back again with a wonderful submission that was taken from Prof. @imagen's lesson about Bitcoin's Trajectory. Enjoy my article!!

Bitcoin Halving

The Bitcoin network presented the idea of decentralized money and blockchain innovation where monetary exchanges are conveyed in a shared arrangement. The Bitcoin network exchanges are confirmed through an interaction called mining, where a few incredible organization hubs (clients) called diggers, contend to approve every exchange utilizing modern PCs in tackling complex numerical calculations to discover the nonce worth of the square. Bitcoin Miners are compensated with new Bitcoins for checking and approving exchanges.

Bitcoin dividing is an interaction where this prize is divided into two, diminishing the number of new Bitcoins made to support the absolute number of Bitcoin available for use. This division is set to happen after 210,000 squares have been made inside the Bitcoin organization, which means about every four (4) years until the all-out supply is depleted.

The Bitcoin network has been split three (3) times, the subtleties are as per the following:

1-The primary Halving

The principal Bitcoin network dividing happened in 2012 when the digger's price was decreased from 50 BTC to 25 BTC per block mined.

2-The Second Halving

Following four years (4), the second dividing of the Bitcoin network happened in 2016 when the digger's price was decreased from 25 BTC to 12.5 BTC per block mined.

3-The Third Halving

Following four (4) years, the last splitting of the Bitcoin network happened on the eleventh of May 2020, where the excavator's price was diminished from 12.5 BTC to 6.25 BTC per block mined.

Next Bitcoin Halving

As recently clarified and noticed, the Bitcoin network is set to be divided each four (4) a long time until the 21,000,000 BTC all out supply is depleted. The following Bitcoin dividing will happen in the year 2024 where the current 6.25 BTC mining award will be decreased to 3.125 BTC per block mined.

Current Bitcoin Mine prize

With the eleventh of May 2020 splitting, the current digging award for Bitcoin is 6.25 BTC.

Two Halved Cryptocurrencies

1-Litecoin Halving

Like Bitcoin, a Litecoin excavator's prize is split after every 840,000 squares have been made, which means each four (4) is a long time. The light coin was presented in 2011 by Charlie Lee, and in August of 2015, the first splitting happened. Where the 50 LTC reward was split into 25 LTC. The following splitting will happen in August of 2023.

2-Bitcoin Cash Halving

Bitcoin cash is a hard fork from the Bitcoin network made in 2017, where the Bitcoin Cash network is split after every 210,000 squares which means each four (4) a long time. The current award for mining is 6.25 BCH. The following splitting is in 2023 where the digger's award will be decreased to 3.125 BCH.

Consensus Mechanisms

The term Consensus Mechanisms in blockchains allude to a for the most part acknowledged set guidelines or conventions embraced in conceding to the legitimacy of information (exchanges) or an organization state (blockchain state) by the hubs associated with the blockchain.

The blockchain agreement instruments came about because of the decentralized idea of blockchains where security, dependability, straightforwardness, honesty, and proficiency of the blockchain depend on a great many individual hubs running on the blockchain appropriated record programming.

The agreement instrument of a blockchain is utilized for different exercises on the blockchain some of which incorporate administration, mining, guidelines, and so on There are various sorts of agreement calculations, some incorporate verification of history (PoH), confirmation of work (PoW), evidence of-stake (PoS), designated verification of-stake (DPoS), evidence of-mind (PoB), and so on

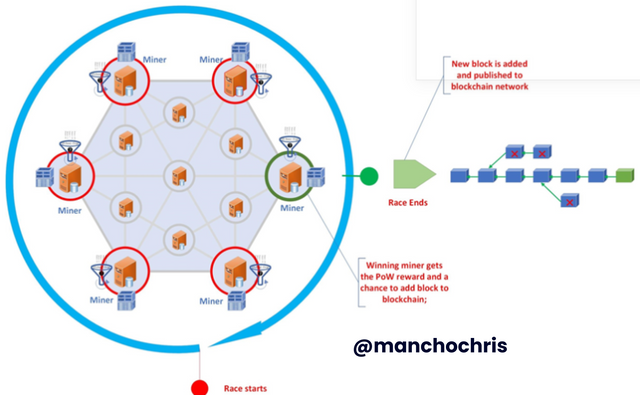

Verification of-Work (PoW)

The Proof-of-Work (PoW) is a sort of agreement calculation that requires a lot of work to be done on the blockchain by hubs (clients) to procure more privileges. The necessary work exertion remembers confirmation and approval for on-chain exchanges by hubs (excavators), where diggers utilize amazing PCs to settle complex numerical calculations to discover the nonce of an exchange block.

The proof-of-work agreement calculation is exceptionally financially savvy, due to its high power utilization, which results from the use of incredible PCs for mining in endeavors to get together with the blockchain's exercises where a large number of exchanges are lined on-chain for approval. Preferably, the proof-of-work agreement calculation requires around 10 minutes to approve an exchange, which is moderately lethargic in contrast with the normal Bitcoin network throughputs, which prompts clogs and bottlenecks.

Blockchains that utilization the confirmation of-work (PoW) agreement calculation are Bitcoin, Litecoin, Ethereum, and so forth

Confirmation of-Stake (PoS)

Proof-of-Stake (PoS) is a kind of agreement calculation that shares the blockchain's obligations dependent on the number of crypto resources held by the hubs (delegates), permitting more freedoms and commitments to the chosen hubs. This agreement calculation was made because of the issues related to the confirmation of-work agreement calculation which are the significant expense of activity and intense usage of energy.

In the proof-of-stake consensus calculation, network hubs (clients) vote (stake) the level of their resources for a chosen hub (delegate). The agents use the marked resources to take on doled out on-chain liabilities that for the most part sort for a better turn of events and usefulness of the blockchain like, approval of exchanges, new convention execution, administration, making society lines, and so forth

Blockchains that utilization the evidence of stake (PoS) agreement calculation are Cardano, EOSIO, Polkadot, and so forth.

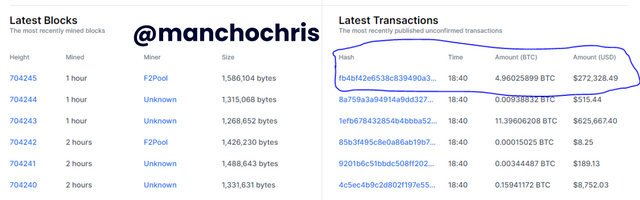

Enter the Bitcoin browser and enter the hash corresponding to the last transaction. Show Screenshot.

Bitcoin Explorer

For my demonstration, I chose Blockchain Bitcoin explorer.

To follow me, visit Blockchain explorer's official website to access the latest Bitcoin transaction.

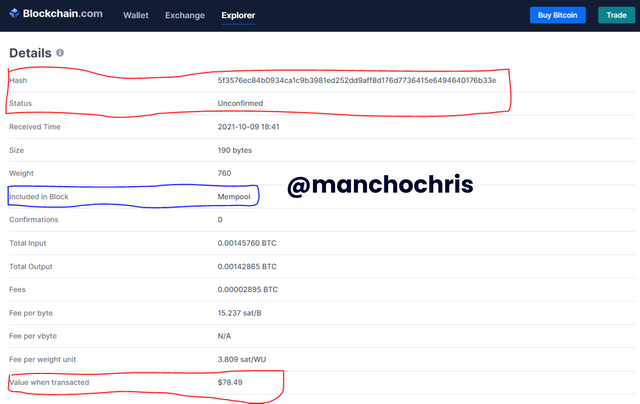

Now let us enter the hash of the latest transaction and the details are as follows:

The hash of the latest transaction is:

5f3576ec84b0934ca1c9b3981ed252dd9aff8d176d7736415e6494640176b33e

The Bitcoin transaction was added to block: Mempool and the transaction input is 0.00145760 BTC and the output is 0.00142865 BTC which is equivalent to $78.49. A transaction fee of 0.00002895 BTC was charged.

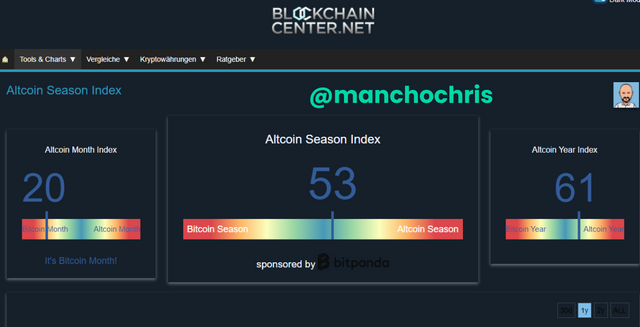

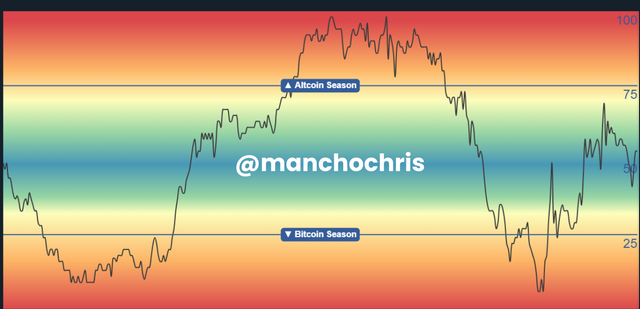

AltCoin Season

AltCoin Season alludes to a period inside the crypto environment in which crypto resources except for Bitcoin expansion in market value. This accumulation comes because of Bitcoin's 40-half strength of the whole crypto market. Preferably, during AltCoin seasons, bitcoin loses some level of its strength to better-performing coins. For example, on account of Ethereum which rose to more than 20% market strength while Bitcoin's predominance dropped to 40%.

Sometimes, experts allude to altcoin season as a wonder that happens when around 75% of other digital forms of money increment esteem more than Bitcoin inside the multi-month, 90 days, 1-year stretches.

Current Season

As indicated by the information delivered by Blockchain Focus' true site, the flow season is Bitcoin season. The AltCoin season record remained at 53 which implies that the Bitcoin season list is around 47, while the AltCoin year file remained at 61, which suggested that the year might potentially end as an AltCoin year.

Last AltCoin season

The last AltCoin season went from 25th of March 2021 to 21th of June 2021, Where the AltCoin file vacillated between 73 - 98%. The AltCoin season crested on the 18th of May 2021 with the altcoin list recording a record high of 98%.

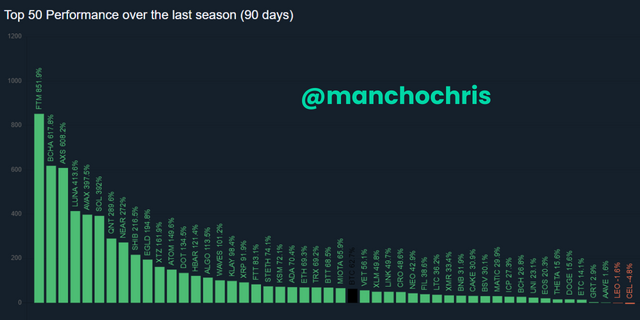

AltCoin growth

As per the information delivered by Blockchain Focus' true site, a portion of the top-performing altcoins in the last season filled in at enormous rates with the top AltCoin AXS which yielded around 982% in the last AltCoin season.

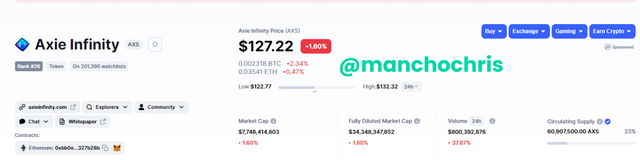

1-AXS Token

AXS is the local badge of the Blockchain-based game Axie Infinity, where in-game characters are purchased, reared, and offered to procure benefits. From the last AltCoin season, the AXS token has developed progressively. Before the AltCoin season, AXS token cost was around $3, however from the altcoin season to the new season, the AXS token arrived at a record-breaking high of $155.27 which addressed a 982 percent increase.

The AXS token has a unit price of $127.22, a market capitalization of 7,748,414,803, and a diluted market cap of $34,348,347,852. AXS traded volume in the last 24 hours is $800,392,876.

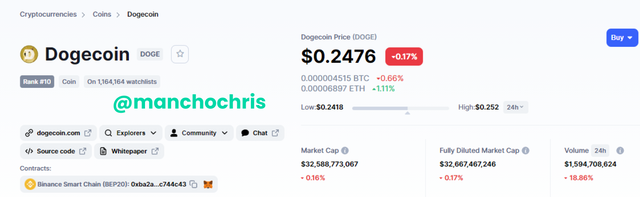

2-Dogecoin

Dogecoin (DOGE) is a shared, open-source digital currency. It is considered an altcoin and a practically wry image coin. Dispatched in December 2013, Dogecoin has the picture of a Shiba Inu canine as its logo.

While it was made apparently as a joke, Dogecoin's blockchain still has merit. Its hidden innovation comes from Litecoin. Prominent components of Dogecoin, which utilizes a content calculation, are its low cost and limitless stockpile.

The Dogecoin token has a unit price of $0.2476, a market capitalization of $32,588,773,067 and a diluted market cap of $32,667,467,246. Dogecoin traded volume in the last 24 hours is $1,594,708,624.

ADA Token/ Cardano

Cardano is a proof-of-stake blockchain stage: the first to be established on peer-looked into research and created through proof-based strategies. It joins spearheading innovations to give unmatched security and manageability to decentralized applications, frameworks, and social orders.

With a main group of specialists, Cardano exists to reallocate power from untouchable constructions to the edges – to people – and be an empowering power for positive change and progress

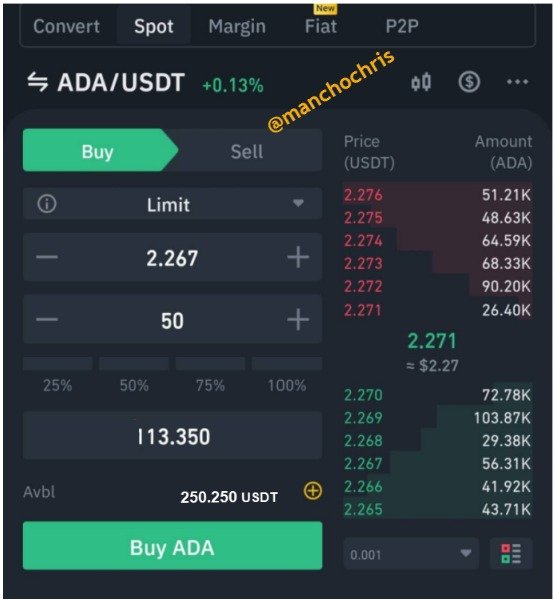

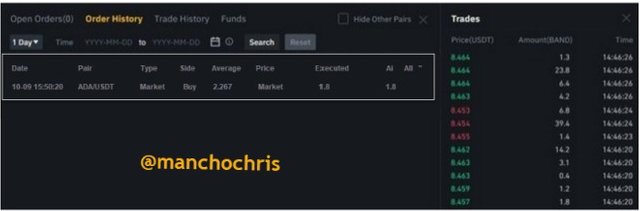

I will demonstrate my transaction through Binance transaction type is Buy, choose trade execution type as market, Enter the amount of ADA to be purchased in USDT from the available balance, then click on Buy ADA.

The investment transaction history is recorded on the exchange account.

Why Cardano Token

I chose Cardano because of its major benefits. Cardano is that eco-accommodating crypto. For a simple examination, here's how much energy Cardano is assessed to utilize each year:

Cardano: Six-gigawatt hours

Remember that one terawatt is equivalent to 1,000 gigawatts. Put another way, Bitcoin utilizes probably as much energy as Argentina, which has around 45 million individuals. Cardano utilizes probably upwards of 600 U.S. homes.

This is because Cardano utilizes an alternate framework, called a confirmation of stake, to check exchanges. Verification of stake restricts the number of gadgets checking exchanges at any one time, which keeps energy utilization sensible. Then again, Bitcoin and Ethereum utilize the evidence of the work model. Evidence of work doesn't confine the number of gadgets included, and that can prompt amazingly high energy use. Ethereum is currently changing to a proof of stake model thus.

It can deal with huge quantities of exchanges.

Adaptability has been an issue for the greatest digital forms of money. Bitcoin measures around five exchanges each second, and Ethereum measures around 15. That prompts more slow exchanges with higher expenses. Visa, then again, measures around 1,700 exchanges each second.

In tests, Cardano has handled 257 exchanges each second. What's more, it's likewise intending to add another layer, called Hydra, to its blockchain. With this innovation, it might handle 1 million exchanges each second.

- Cardano has a wide scope of employment.

Cardano is an aggressive undertaking, and there are numerous possible uses for its innovation across an assortment of enterprises.

For a current, genuine model, we have Cardano's organization with the Ethiopian Ministry of Education. Cardano's blockchain will store carefully designed records for 5,000,000 Ethiopian understudies. At the point when those understudies seek advanced education and occupations, they'll have their records and accomplishments accessible on the blockchain.

Here are other use cases for Cardano in various areas:

Medical care: Cardano's blockchain can confirm drug items to stay away from the danger of purchasing fake prescriptions.

Money: Cardano can be utilized in non-industrial nations as a record of individuals' characters and to exhibit their reliability.

Agribusiness: Blockchain innovation can give dependable store network following to ranchers, haulers, and traders.

It adopts an exploration first strategy.

An extraordinary aspect regarding Cardano is that its improvement cycle is peer audited. Architects and scholarly specialists spend significant time in blockchain innovation and cryptography are instrumental in building Cardano.

The companion audit measure implies that Cardano is the sort of digital money with gradual turns of events, not one that rolls out fast improvements. The upside of Cardano's methodology is that companion audit gets security gives that could some way or another lead to more significant issues later.

There's a predetermined number of Cardano accessible.

Cryptographic forms of money can either have a fixed or limitless inventory. Bitcoin is the most popular illustration of digital money with a decent stock, as there won't ever be more than 21 million Bitcoin.

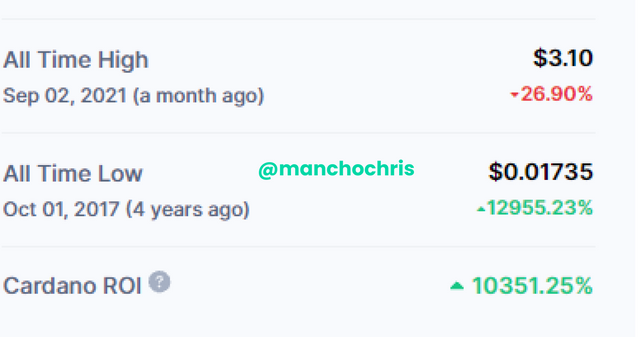

All-Time High

The success of Cardano and its Oracle project saw the valuation of the ADA token reach an all-time high of $3.10 in September 2021 just a month ago.

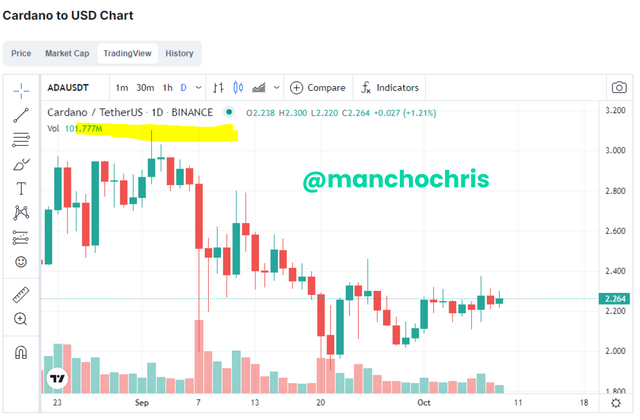

See also the chart representation below;

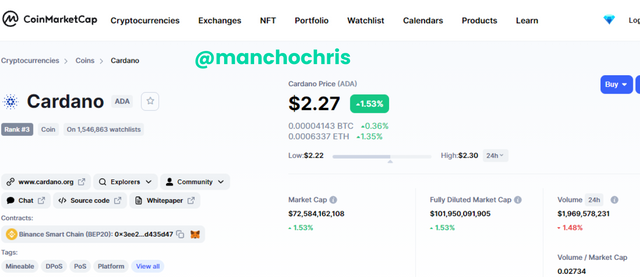

ADA Token Current Price

ADA token has a current value of $2.27 according to the most used cryptocurrency information website Coimmarketcap, ranked #3

ADA token has a market capitalization of $72,584,162,108 and a diluted market capitalization of $101,950,091,905. ADA Token traded volume in the last 24 hours is $1,969,578,231.

The Circulation supply of the ADA token is 32,040,000,000 ADA and a total supply of 33,117,618,880 ADA.

Conclusion.

Bitcoin splitting is a foundational measure set inside the product of Bitcoin to occasionally diminished the pace of new bitcoins made as remunerations acquired by diggers for approving exchanges. This action is put to support the absolute stockpile of Bitcoin for a practical time of years. Like Bitcoin, some other digital forms of money execute dividing some of which are Litecoin, Bitcoin Cash, and so forth

Agreement Mechanisms are a pleasing measure utilized inside a Blockchain to check the credibility of exchanges and different conventions inside the Blockchain. There are various sorts of agreement calculations with each meaning to develop the idea of past ones.

Band convention prophet administrations give key capacity administrations in decentralized money through the arrangement of irrefutable genuine information to on-chain, utilized by keen agreement engineers to additional upgrade its capacity.

Much thanks to you educator @imagen for this educative and adroit illustration.

Gracias por participar en la Cuarta Temporada de la Steemit Crypto Academy.

Continua esforzandote, espero seguir corrigiendo tus asignaciones.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have been curated by @yohan2on, a country representative (Uganda). We are curating using the steemcurator04 curator account to support steemians in Africa.

Keep creating good content on Steemit.

Always follow @ steemitblog for updates on steemit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit