Hello Fellow Steemians,

Welcome to yet another exciting season of the crypto academy. The academy has been an educative forum which I am grateful for being a part of it once again. This week I attended a lecture by professor @awesononso on the topic of The Bid-Ask Spread. Let's go through it together as I discuss the homework given by the professor.

Properly explain the Bid-Ask Spread.

Before we can go any further, let's first rewind to bid and ask price. This way, we shall not only know the background of Bid-Ask Spread but also what it is.

So, what is the bid and ask price?

Every transaction has a buyer and a seller. These two parties, in most cases, have different prices for a commodity or asset at a given period. The buyer's price is called the bid price. The seller's price is called the ask price.

Therefore, the bid price is the highest price a buyer chooses or is willing to buy an asset or commodity at a particular period. On the other hand, the ask price is the lowest price a seller is ready or willing to sell an asset at a given period. Whoever said time is money, I think this is what they meant because the bid and ask price are never constant for a given period. Hence, time is very crucial when we define these two terms.

In financial markets, Bid-Ask Spread is the difference between the bid and ask price. Under normal circumstances, a commodity with a tight bid-ask spread will command a high demand, while a commodity with a wider bid-ask spread may have a low demand.

So, to get the Bid-Ask Spread(s) from the ask(a) and bid(b) price, we can use the following expression: s = a - b

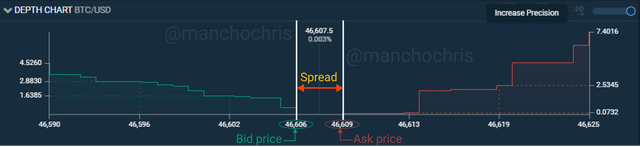

Below is a screenshot that shows an example of Bid-Ask Spread on a cryptocurrency pair of BTC/USD.

Fig 1: Bid-Ask Spread | Bitfinex.com

From the above chart, the bid price is $46,606 the asking price is $46,609. So, from the s = a - b expression stated above;

bid-ask spread = $46,609 - $46,606

bid-ask spread = $3

Why is the Bid-Ask Spread important in a market?

The bid-ask spread is important in the market because it can be considered as a measure of the supply and demand for a given commodity. Since the bid price is related to buyers we can say it represents the demand and the ask to represent the supply for an asset as it's related to sellers. When these two prices move further apart from each other the price action is said to have a change in supply and demand of that commodity.

The depth of the bid prices and ask prices can have a great impact on the bid-ask spread. The bid-ask spread may widen significantly if fewer traders place limit orders to buy an asset hence generating fewer bid prices or if fewer sellers place limit orders to sell.

If Crypto X has a bid price of $5 and an ask price of $5.20,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

Given:

The Bid Price = $5

The Ask Price = $5.20

a) Recall that:

Bid-Ask Spread = Ask price - Bid price

Hence,

Bid-Ask Spread = $5.20 - $5 = $0.20

Bid-Ask Spread = $0.20

Therefore, the Bid-ask spread of Crypto X is $0.20

b) Recall that:

Bid-ask spread percentage = (Spread/Ask Price) X 100

Where, Spread = $0.20 and Ask Price = $5.20

So, Bid-ask spread percentage = ($0.20/$5.20) X 100

%Spread = (0.03846) X 100

%Spread = 3.846

Therefore, the Bid-ask spread percentage of Crypto X is approximately 3.85%.

If Crypto Y has a bid price of $8.40 and an ask price of $8.80,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

Given:

Bid price of Crypto Y = $8.40

Ask price of Crypto Y = $8.80

a) Recall that:

Bid-ask spread = Ask price - Bid price

Hence,

Bid-ask spread = $8.80 - $8.40

Bid-ask spread= $0.40

Therefore, the Bid-ask spread of Crypto Y is $0.40 or 40 cents.

b) Recall that:

Bid-ask spread percentage = (Spread/Ask Price) X 100

Where, Spread = $0.40 and Ask Price = $8.80

So, Bid-ask spread percentage = ($0.40/$8.80) X 100

%Spread = (0.04545) X 100

%Spread = 4.545

Therefore, the Bid-ask spread percentage of Crypto Y is approximately 4.5%.

In one statement, which of the assets above has the higher liquidity and why?

Crypto X has higher liquidity than Crypto Y because of not only the smaller Bid-Ask spread but also its corresponding percentage spread which is less than that of Crypto Y. This, therefore, signals a higher trading volume for Crypto X than Crypto Y.

Explain Slippage.

Allow me to start with a rough basic example let's assume that I want to buy 10 apples and Josh has 10 apples at $1 each, Chris has another 10 apples at $2 each and finally Ken has 10 apples at $3 each.

Let's say I consider the $1 per apple price but by the time I get to Josh's stall he has already sold 5 apples so I buy the remaining 5 apples. I then go to the next cheapest seller which of course is Chris however he has already sold 7 apples and I've only found him with 3 apples left. To complete my order of 10 apples I move over to the final seller (Ken) where I spend $6 on 2 apples.

As you can see, I went in a trade thinking I was going to buy 10 apples at $1 apiece because that was the cheapest price but because of slippage in the market, I ended up buying 10 apples for a total of $17 which in this example would be a 70-slippage rate. Remember slippage doesn't just occur when you buy cryptocurrency it'll also occur when you come to sell too.

Explain Positive Slippage and Negative slippage with price illustrations for each.

Positive slippage:

Right away from the name, you can tell it favours the trader. In this case, the trader enjoys a more profitable transaction because the order gets executed at an advantageous position. Thus, when a trader places a sell order at any given price in the market the price of the placed order slip to a higher value, the trader benefits positively from the trade as the trader bags more profits compared to what they had planned to gain.

Alternatively, a positive slippage can apply to a buy order. In this scenario, the executed order of the trader happens at a lower price to the intended one thus, the commodity is bought at a much lower price, which increases the profits of the trader.

For example; Joshua places a buy order of $1 for any given assets on the markets. The executed order was placed rather than placed at $0.7. Hence, the positive slippage will be $0.3

On the other hand, when a sell order of $5 is placed for any given crypto asset and is executed at $3. The positive slippage will be $2.

Negative slippage:

This is when the executed orders are filled at a price point that is less favorable to the trader. In this case, the trader experiences smaller profits than what was expected. It is generally of huge disadvantage to traders, and can apply to both sell and buy orders.

For sell orders, this slippage happens when the final filled price of the trader on the market is lower than the desired price. For a buy order scenario, the executed order is filled at a price higher than the desired price point of the trader. Therefore, the purchase of the asset happens at a higher price.

For instance, let's say a trader places a buy order of $28 for crypto A on the market and the executed order was rather placed at $29. Hence, the negative slippage will be $1.

Meanwhile when another trader places a sell order of $30 for crypto B on the markets and the executed order was rather placed at $25. The negative slippage will be $5, per the calculation where the $25 is deducted from the $30 price point.

Conclusion

It is essential for a trader to be aware of Bid-Ask spread an asset (crypto) as exposure to liquidity is of greater advantages in trading coins easily. Thank you Prof. @awesononso for lecturing us about this interesting topic.

You have been curated by @yohan2on, a country representative (Uganda). We are curating using the steemcurator04 curator account to support steemians in Africa.

Keep creating good content on Steemit.

Always follow @ steemitblog for updates on steemit

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit