Hello, My Dear Steemians!

It is one more superb week in the academy. Again this week, I have gone to an interesting lesson introduced by Prof. @allbert on an incredible theme "Exchanging with Accumulation/Distribution (A/D) Indicator." in the moderate class. He has expressly clarified the ideas of the said subject. In this post, I will be responding to the tasks posted in the homework area. Cheerful learning!

A/D marker implies a gathering/dispersion pointer. It is a marker that is utilized to decide the gathering and conveyance period of a resource. A/D Indicator was created by a man known as Mark Chaikin. It is a pointer that contains a solitary line which wavers here and there.

To comprehend this marker well indeed, there's a need to know what gathering and dispersion are. The word amassing is utilized in finance exchanging when a resource is being obtained by numerous brokers and holds the resource with the sense of the cost of a resource. At whatever point there's amassing, it means that individuals are "siphoning" cash to secure a specific resource and that after the aggregation stage, the cost of a resource will shoot up.

Then again, circulation happens when the cost of a resource has been overrated, that is the point at which it is overbought. At this stage, merchants who have purchased the resource in the collection stage start to leave the market since they realize that the cost will encounter a fall.

In this way, what A/D Indicator does is that it shows the period of aggregation and circulation of a resource on the graph. A/D Indicator does this by utilizing cost and volume. A/D marker decides how cash flows dynamically into or out of a resource by the utilization of its cost and volume. Henceforth, A/D Indicator is alluded to as a volume-based pointer.

A/D Indicator is generally added to the diagram and when the market is rising and the cost of a resource is in an upswing, it shows that merchants are holding and purchasing the resource and when the pointer is declining and the cost is likewise falling, the dealers are appropriating the resource. This pointer is valuable as it tends to be utilized to anticipate the adjustment of the pattern. It has what is known as disparity which merchants use for the most part.

At the point when uniqueness happens, it shows the fatigue in the latest thing. To be all the more clear, when the cost of a resource is in an upswing showing series of higher highs and the marker heads the other way, then, at that point, the purchasers are being depleted and the upturn might be concluding. Also, when the cost of a resource is a downtrend, showing series of lower lows and the marker heads the other way, the downtrend might be concluding.

Presently, it is relevant to say how this indicator identifies with volume. Recollect that I said before that it is a volume-based pointer. At the aggregation stage, individuals will continue to purchase the resource. This stage is regularly known as a rebate on the lookout when the cost of a resource is exceptionally low. Brokers accordingly need to procure the resource as the cost is reasonable, thus as numerous dealers continue to purchase, the volume of the cost will be rising.

Thus, basically, at the convenience stage, there's expanded or high volume since numerous brokers hold the resource, and the AD indicator is seen as bullish. Then again, there will be a stage when the cost of a resource has incredibly expanded. It is a phase when the cost is overbought. It is generally expected to be called premium cost. Also, merchants sell at this cost. Then, at that point, dealers at this stage can presently don't hold the resource. Consequently, they start to disperse it. When they start circulating, the volume starts to diminish. Accordingly, at the dispersion stage, there is decreased or low volume, and the AD Indicator is seen as negative.

Relationship Between A/D indicator and the Volume

Both of these specialized markers use cost and volume, yet fairly in an unexpected way. The on-balance volume (OBV) checks out whether the current shutting cost is higher or lower than the earlier closing. On the off chance that the nearby is higher, the period's volume is added. Assuming the nearby is lower, the period's volume is deducted.

The A/D marker doesn't factor in the earlier close and uses a multiplier dependent on where the cost shut inside the period's reach. Along these lines, the markers utilize various estimations and may give distinctive data.

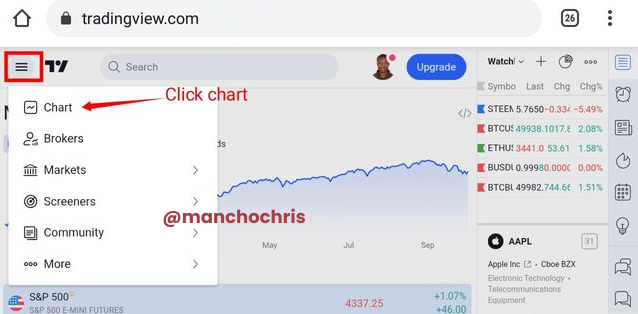

For this inquiry, I will utilize Tradingview to add the A/D pointer to the graph. •To do this, go to Tradingview.com

• Then the landing page will show up for you, from the landing page, click the three even lines at the upper left corner of the page as displayed in the image underneath by a red box.

• Then a snapshot "diagram" as demonstrated by a red bolt in the screen capture underneath.

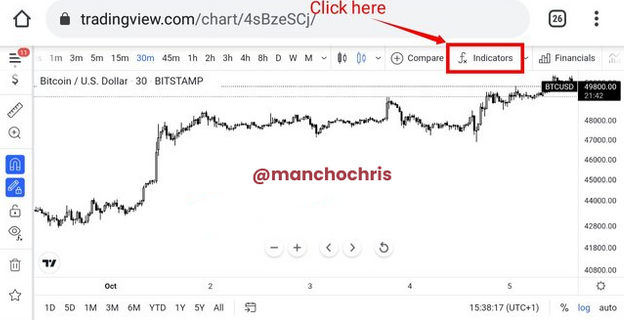

• Then the outline page will show up for you as shown underneath.

• Then from here, click the indicator as demonstrated by a red box in the screen capture underneath to add the A/D pointer to the outline.

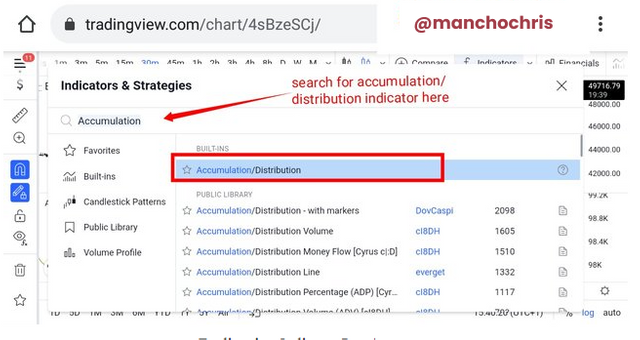

• Then the marker page will show up for you. In the pursuit bar, type aggregation is demonstrated by a red bolt in the screen capture underneath. Then, at that point, click amassing/dissemination from the query output as demonstrated by a red box in the screen capture beneath.

• Then the gathering/conveyance pointer will show up in the graph as shown by a red bolt in the screen capture beneath.

• With this, we have effectively added an A/D marker to a graph.

In this piece of the inquiry, I will clarify the recipe for the A/D pointer with a model.

Presently, to ascertain AD, the equation has three boundaries.

Cash stream multiplier

Cash stream volume

Past Accumulation/Distribution line.

The primary thing to discover is past Accumulation and dissemination. After that, you search for the cash stream multiplier and cash stream volume. Then, at that point, the result of the cash stream multiplier and cash stream volume is then added to the past collection and dissemination.

Subsequently,

Promotion = P (AD) + MFM × MFV

Where AD = Accumulation/Distribution

P(AD) = Previous Accumulation/Distribution

MFM = Money Flow multiplier

MFV = Money Flow volume.

Presently, to work out a Money stream multiplier (MFM):

MFM = [(C - L) - (H-C)]/(H-L)

Where C = shutting cost

L= Low the cost

H = High the cost

To work out the Money stream volume (MFV):

Cash stream volume is the result of the cash stream multiplier and volume of the period.

MFV = MFM × VP

VP = Volume of the period

Presently, we should compute this with a model.

I will utilize the graph of DOGEUSD to take boundaries for the computation.

.png)

Presently, from the screen capture, we will take the information of the day-by-day flame that was framed. We will take the nearby, high and low of the candle.

Shutting cost = 0.23824

High of the cost = 0.24590

Low the cost = 0.21181

Likewise, we need the incentive for the past AD line and the volume of the period. How about we take it from a similar graph.

From the screenshot:

the value of the volume of the period = 43624

previous AD line = 297895

Now, let's use the parameters for the calculation of AD.

Remember that:

AD = P (AD) + MFM × MFV

Now, let's calculate the money flow multiplier MFM first.

MFM = [(C - L) - (H- C)] / (H- L)

Closing price (C) = $0.23824

High of the price (H) = $0.24590

Low of the price (L) = $0.21181

MFM = [(0.23824 – 0.21181) – (0.24590 – 0.23824)] / (0.24590 – 0.21181)

MFM = [ 0.02643 – 0.00766] / 0.03409

MFM = 0.01877 / 0.03409

MFM = 0.55060

Therefore, Money flow multiplier (MFM) = 0.55060

Now, let's calculate money flow volume (MFV)

MFV = MFM × VP

VP = volume of the period = 43624 (data taken from the chart)

MFV = 0.55060 × 43624

MFV = 24019.433

Hence, Money flow volume = 24019.433

Now, the next thing is to substitute the value of MFM, MFV P(AD) into the formula.

Remember:

AD = P (AD) + MFM × MFV

P(AD) = previous accumulation and distribution = 297895

MFM = Money flow multiplier = 0.55060

MFV = Money flow volume = 24019.433

AD = 297895 + 0.55060 × 24019.433

AD = 297895 + 13225.0999

AD = 311120.0999

Therefore, AD = 311, 120.0999

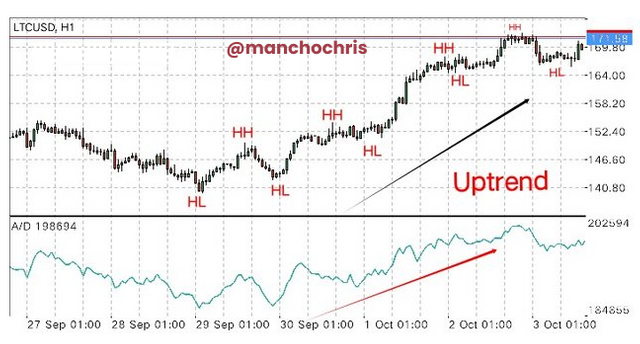

In this piece of inquiry, I will tell you the best way to recognize and affirm the pattern through the A/D marker. We will be seeing how to know when the cost of a resource is in an upswing and when it is in a downtrend. We should start with an upswing.

For Uptrend

To decide or recognize if a pattern is bullish with the A/D marker, the cost should be seen climbing up, that climbing. Then, at that point, when the cost is showing a progression of higher highs and higher lows, the marker, A/D pointer should likewise be beheading a similar way. Then, at that point, that pattern is supposed to be in an Uptrend. We should see the screen capture beneath to get what I'm discussing quite well.

You can find in the screen capture above that the cost is climbing, showing higher highs and higher lows. Additionally, if you take a gander at the A/D pointer, you will see it's likewise following a similar heading. It is going up with a series of higher highs and higher lows.

For Downtrend

A/D marker can likewise be utilized to distinguish if a resource is in a downtrend. For this situation, the cost of a resource will be moving lower with a series of lower lows and the A/D marker will likewise be declining. When the course of the cost and that of the A/D pointer is towards the drawback, then, at that point, the resource is supposed to be in a downtrend or negative.

As it is found in the screen capture above, the cost was declining and Al the indicator was additionally declining. This shows that the pattern at that specific timeframe is negative.

In the above situation, this is an ordinary A/D Indicator incongruity with the market pattern (Downtrend Movement). Critical conveyance exercises are progressing at this period whereby there are more Selling exercises than purchasing exercises and subsequently a decrease in resource cost.

This bear development ended at the help level at 0.00001119 before making an upswing inversion. A section exchange request was entered at 0.00001123 when there was an apparent and substantial upturn.

Stop-misfortune was set a little below the breakpoint to an award hazard proportion of 1:1 while having the Stop misfortune taken at 0.00001161.

No marker is 100% precise. The Accumulation/Distribution marker is the same. There are occasions where it can deliver bogus signs. Additionally, it neglects to feature specific states of the market because of the components it joins in its calculation cycle. Henceforth, there is the need to consolidate the use of the A/D pointer with other specialized markers to acquire an alternate gander at a resource's market advancement and check for conversion between the two structures.

.png)

The Stochastic Indicator is an expansion of the Accumulation/Distribution specialized pointer. I select the Stochastic Indicator since it imparts extraordinary conditions that the A/D pointer can't represent. The Stochastic marker can flag oversold resources when the price falls between the 0 and 20 edges. This demonstrates the selling strain will lessen at last, and purchasing tension will develop on the lookout.

Contrarily, when the purchasing strain of a resource inside a period arrives at its pinnacle, the Stochastic perusing falls somewhere in the range of 80 and 100. This specific reach is known as the Overbought level. It is trailed by a negative inversion as brokers offer the resources at excessive costs to secure benefits. The Stochastic marker has a higher affectability than the Accumulation/Distribution marker.

.png)

The ETHUSDT outline was chosen. The Stochastic and A/D markers were added in like manner. The difference between the value course and the Accumulation/Distribution marker was recognized. As the cost of the resource encountered a vertical development, the A/D marker showed a descending development. This implies that a negative inversion was approaching because there are very few purchasers during that period to keep up with the bullish value bearing. Similarly, the Stochastic pointer showed that the resource was in the Overbought zone. This affirmed that a negative inversion was close.

I opened a Sell Limit request after a negative light was shown. The Stop Loss of the request was set somewhat over the most noteworthy pinnacle of the graph, and the Take Profit edge was arranged to a proportionate level as the Stop Loss edge. The TPSL proportion was 1:1. A paper benefit of $2.81 is seen at the hour of the screen capture.

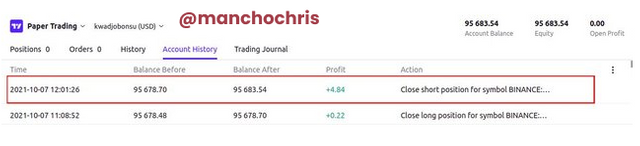

The order request was shut at a benefit of $4.84 as featured in the screen capture above.

Conclusion

It is unbelievable how they relate the collection with the dispersion in a solitary indicator, we can see that it isn't just with regards to how much cost increments, yet that the volume of activities is vital when completing Trading tasks since this will have a major effect. We can say that when there is an excessive cost in a crypto resource, and the volume that enters isn't sufficiently able to support the value, it will go down since there isn't sufficient volume in its entrance exchanges (there is no gathering). The market is capricious, and we should ensure ourselves admirably when directing our tasks.