Hello guys, I will like to thank professor yohan2on for this wonderful lectures on risk management.

Question 1

Define the following Trading terminologies:

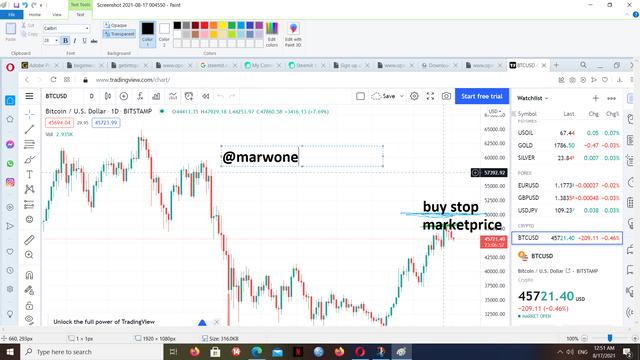

Buy stop

Sell stop

Buy limit

Sell limit

Trailing stop loss

Margin call

(I will also expect an illustration for each of the first 4 terminologies listed above in addition to your explanation)Buy Stop

This occurs when orders are executed when the price of an asset increases more than it current price. We put the buy stop order above the current prices. When the price rise above the current price you have set the order you made will be activated but if the price does not rise to the buy stop the order wont be activated it will remain pending until it reaches the buy stop.

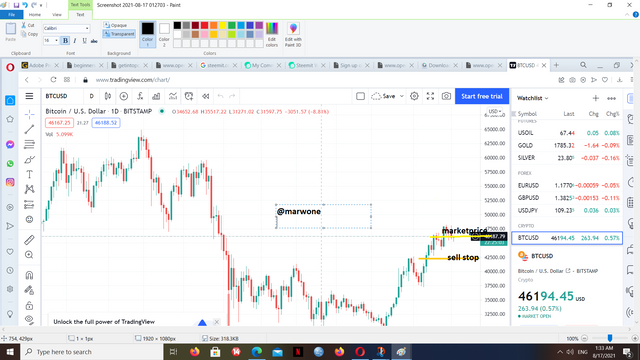

*Sell stop

Sell stop is the opposite of stop order. With sell stop orders executed are activated when the price of an asset is below the current price. This is usually done when the price of an asset is falling or when the price is expected to fall.

Traders place their orders below the current market price so they could avoid further lose. Orders will only be executed when the price reaches the sell stop. Others remains pending until it reaches the sell stop.

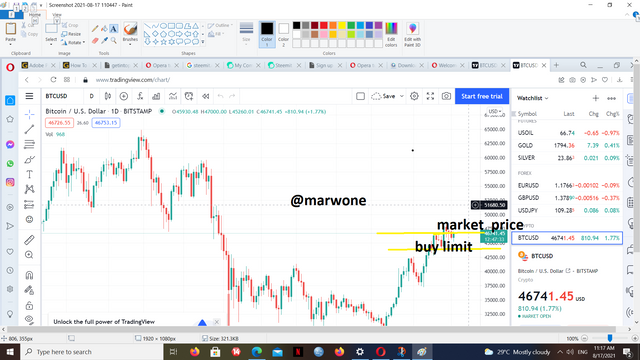

*Buy limit

Buy limit order helps traders to buy their assets at below the current market prices. It helps to determine the amount of money they want to pay for the asset they want buy. Buy limit will only be activated or executed when the price of the asset reaches the price you set or below the price. Buy limit is usually done when traders expects the price of an asset will fall so they could buy the asset bellow it current market price.

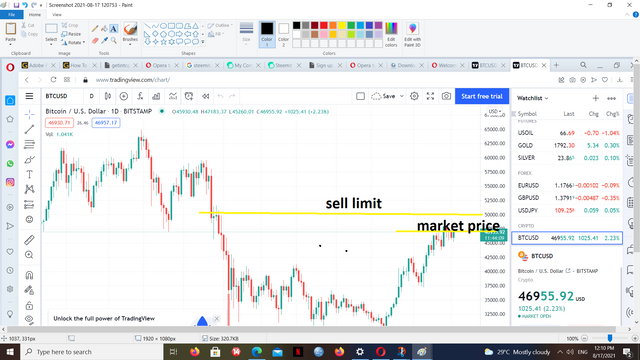

* Sell Limit

Sell limit helps traders to sell their assets above the current market price so they the can maximize profit. When you set a sell limit it is activated or executed when the price of the asset reaches where you set your sell limit or higher than your sell limit. Sell limit helps traders determine the amount they want to sell their assets.

* Trailing stop loss

Trailing stop loss is use control or manage risks in the market. Traders who do not want to lose more in the market usually uses the trailing stop loss to prevent further loses by closing their trade if the price of their assets falls bellow the current market price. Trailing stop loss is set buy traders at a price that is below the current market price of the asset. The assets will only be sold when the price of the assets falls to bellow the current market price to where you set your trailing stop lose but when the assets rises above the current market price the asset will not be sold it will remain as pending order.

* Margin call

Margin call happens when an individual or trader's margin account is lower than the amount required by the broker. When margin call happens you only have two ways to solve it.

These are ;

- By selling some of the assets you have in your account

- And also by depositing extra money in your account.

Practically demonstrate your understanding of risk management in trading.

As an investor on should always know that there is risk involve in investing cryptocurrency. One can say risks is the possibility of something bad happening.

In crypto trading there are four main risk involve which every investor should know before entering in crypto trading.

These risks are;

- Credit risk

- Legal risk

- Liquidity risk

- Market risk

RISK MANAGEMENT STRATEGIES.

- Stop Loss + Take profit

Stop loss is an order that is use to close trade when the price of an asset falls to a certain level.

And also take profit helps investors to sell their assets when it increases to a particular level. take profit helps investor to exit the market before the market goes against them.

I used BTC/STM for my transaction since bitcoin and steem are trading pairs.

From the image above the yellow line with the indication ( buy )is the current market price, so when the price increases to where the white in is my asset would be sold since that where I have set my take profit and also when the price of the asset falls to where the red line (stop lost) is my asset would be sold to prevent further lost .

- Risk/Reward Ratio

Risk/Reward is used by investors to compare the risk and potential returns on his or her investment. The risk/reward ratio also helps investors the right time to start investing in an asset.

Below is how risk/reward is calculated;

R=(target price - entry price)/(entry price- stop loss).

let assume that I have $20,000 which I want use it to buy bitcoin and my target is to make $22,000 and stop loss at $21,000. My risk/reward ratio will be,

R = (22,000-20,000)/(20,000-19,000) = 2

therefor my risk ratio will be 1: 2 which is good ratio for a trader.

Risk management is one of the major thing every investor must know or else may run at lost. And also before you start investing in cryptocurrencies you have to know the major risks which are involve in investing in cryptocurrencies.

And also new investor should also be ready to accept failures since there are risk involve in investing in cryptocurrencies which can not be prevented. And also new investor should make sure that they invest money that they are ready to lose since one can easily lose all your tokens within a short period of time.

Hi @marwone

Thanks for participating in the Steemit Crypto Academy

Feedback

This is under-average content. Kindly take time to research and understand the concepts so that you can confidently explain them in a clear way.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit