ELLIOT WAVE THEORY

The Elliot wave theory is a method of technical analysis that involves treating the market trends as a wave that follows a repeated pattern and so the behavior can be predictable when it conforms to the template that is laid out by the Elliott wave theory.

This theory was arrived at by Ralph Nelson Elliott after analysing trade data of 75 years and by 1938 he published a book which detailed his theory.

WHAT IS THE APPLICATION OF ELLIOTS WAVE THEORY

The Elliott theory can be used to spot bullish and bearish trends in the cryptocurrency market by first observing the trends and comparing it to Elliots model .

The Elliot wave theory makes it easy for a trader to know when to enter into a market( purchase coins) and when to exit the market( sell his coins) so as to make profit and avoid unnecessary losses.

What is Elliott's model?

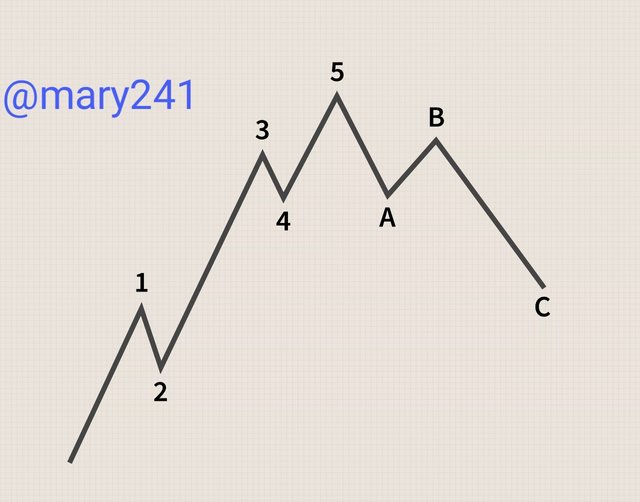

From the wave chart above ; a wave for a bullish trend, it can be seen that once an Elliot wave is spotted to have the above features.

The Elliott theory classified the waves and gave then numbers ranging from 1 to 5 and also another group of waves that he represented using the alphabets a , b and c.

The Elliott theory classifies those trends that go with the trend( uptrend) , that is, the first five waves , as impulse ways and the last three waves , the ones that go against the uptrend as corrective waves.

On being more specific, of the first five waves in a bullish trend, Only wave 1 and 3 and 5 are actually impulse waves and the two waves in between are known as correction waves albeit to a small degree.Wave 2 corrects wave 1 and wave 4 corects wave 3.

After wave 5 the next corrective wave tends to fall below the previous corrective waves( wave 2 and wave 4) and that is because it is not just correcting wave 5 but it is correcting the whole of the first five waves.

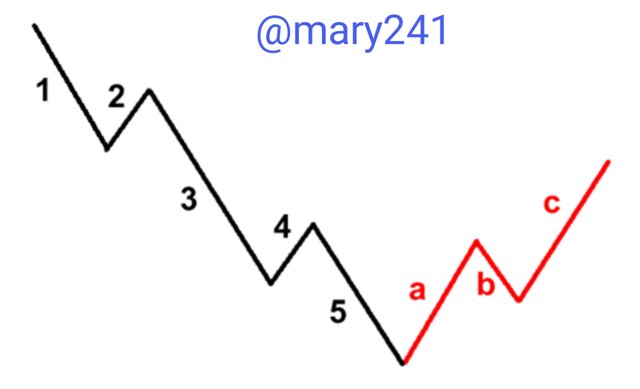

So after the first wave, there is a price reduction( probably due to investors selling their coins ) and then some other traders jump in the wagon and a price increase follows at wave 3 ; which is longer than the previous price increase, after which there is a price reduction , and a short lived price increase at wave 5 and that is followed by a long price fall and the second phase of the Elliott cycle begins and this is a bearish trend and also in this phase, any wave that follows the downtrend is an impulse wave and any trent that goes up or distorts this impulse wave is a correction wave and both phases make a cycle .

IMPULSE AND CORRECTIVE WAVES

Impulse waves : These are waves that follow the trend, be it a bullish or bearish trend, and this waves vary in degree and they are brought about by the mood, psychology and confidence of traders in a particular coin or asset.

For instance in the bullish trend diagram shown above ,wave 1 , 2 and wave 3 are impulse waves because they follow uptrend and of course they very in degree.

Corrective waves :

These waves are the waves that do not follow the trend, that is, they break the trend. These waves are called corrective waves because they tend to regulate the price of a coin.

Corrective waves from the above diagrams are wave 2 and wave 4. Corrective waves occur when the demand of that particular asset plemmets, and this is caused by investors selling their coins and the loss of confidence in the coin.

#/HOW TO EASILY SPOT THE DIFFERENCE BETWEEN IMPULSE AND CORRECTIVE WAVES

To spot this wave you need to understand the fundamental difference between impulse and corrective waves.

Impulse waves always follow the trend , if the trend is bullish these waves rise and if the trend is bearish, these waves go down.

Corrective waves never follow the trend, and they always break an impulse wave.

From a careful observation of the bearish trend in the above figure, the waves that follow the downtrend are the impulse waves while the waves in between two impulse waves are the corrective waves.

The corrective waves are the waves that did not follow the downward trend.So it is good to buy at the base of a correctionn and observe the model to know when the next correction wave is like to occur and the wave that comes after and also how high the price is likely to rise, and not panic sell when there is a correction wave later as the second impulse wave is usually longer and the price goes high again.

MY THOUGHTS ON THE ELLIOTT WAVE THEORY

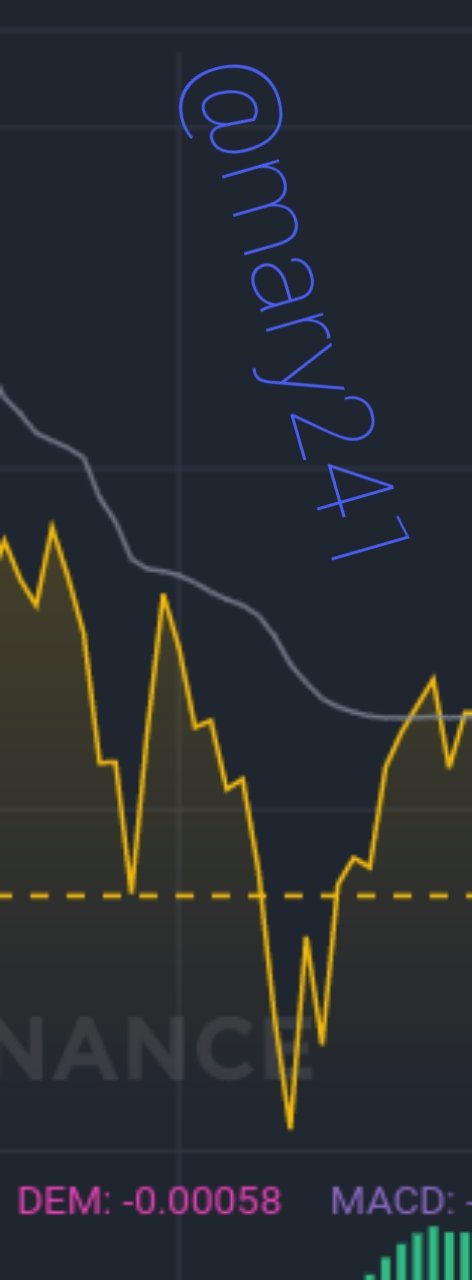

The Elliot Wave theory is a great tool in the fundamental analysis of a coin or other assets. This theory is very efficient although it is very hard to spot those trends.

So the main issue with the Elliot Wave theory is that a lot of effort and time is taken to spot trends or models .This theory can be even more efficient when combined with appropriate fundamental analysis, since the Elliot wave theory only focuses on the historical repetition which according to Elliotts theory is perpertual .

A good knowledge of this theory makes it easy for a trader to know when to buy a coin to make profit and when best to sell in order to avoid losses ( at least to a considerable degree ).

WHY I AM A FAN OF THE ELLIOTT WAVE THEORY

I like the Elliot wave theory because it brings a high gmfehree of certainty into the highly fluctuating and volatile market like Cryptocurrency trading. The Elliott wave theory has a success rate of over 80%. So all that is needed is just practice, and more practice and one will be able to make good profit in cryptocurrency trading.

Thank you for being part of my lecture and completing the task!

My comments:

Explanations were a bit messy and not clear at all.

Also, you didn't identify the pattern that was asked.

Overall score:

2/10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit