JUSTLEND AND TRONLINK

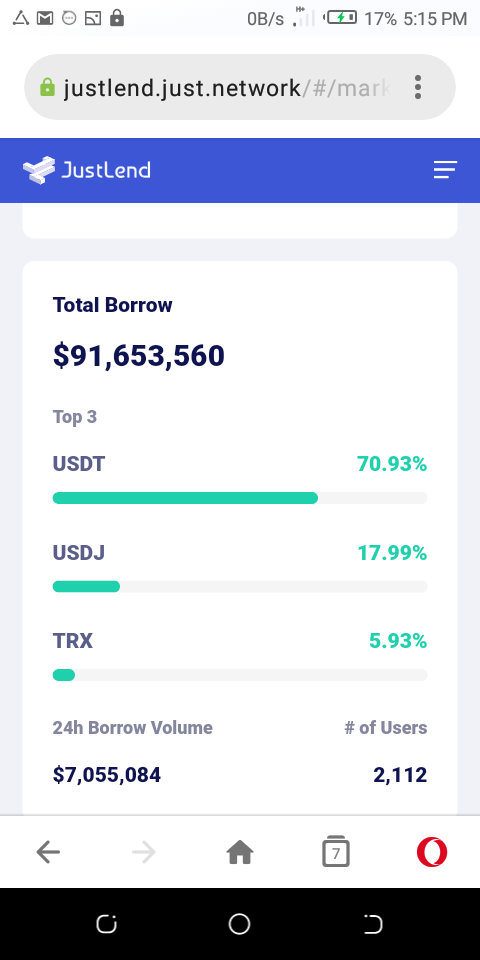

Justlend is a decentralized exchange (DeX) that brings together borrower and lenders together in a very dynamic blockchain which uses some complex algorithms to constantly change the APY of tokens depending on the overall flow of jTokens in the pool. Like all decentralized exchanges it uses the blockchain technology meaning it does not store trade information in a central server ; it does not even save user password ,

TRUSTLEND

is a very secure platform for performing crypto currency trades .TrustLend exchanges use a special wallet ,

TronLink

TronLink, . What is Tronlink? TronLink is a decentralized wallet that is powered by the Tron(TRX) token.

JustLend offers access to a considerable number of coins or tokens like

Tron(TRX) ,

Tether USD( USDT) ,

Bitcoin(BTC) ,

Ethereum( ETH) ,

SUN(SUN) ,

JUST(JST) ,

JUST Stablecoin( USDJ) ,

Wink( WIN),

Wrapped BTT( WBTT) .

The market that offers the highest annual percentage yield(APY) is "wink( WIN) " ;it has an APY of 17.74% ,and the market or tokens with the lowest APY is the "JUST Stablecoin(USDJ)" , with a APY value of 0.75% (all SPY values are values as at when writting this report) .

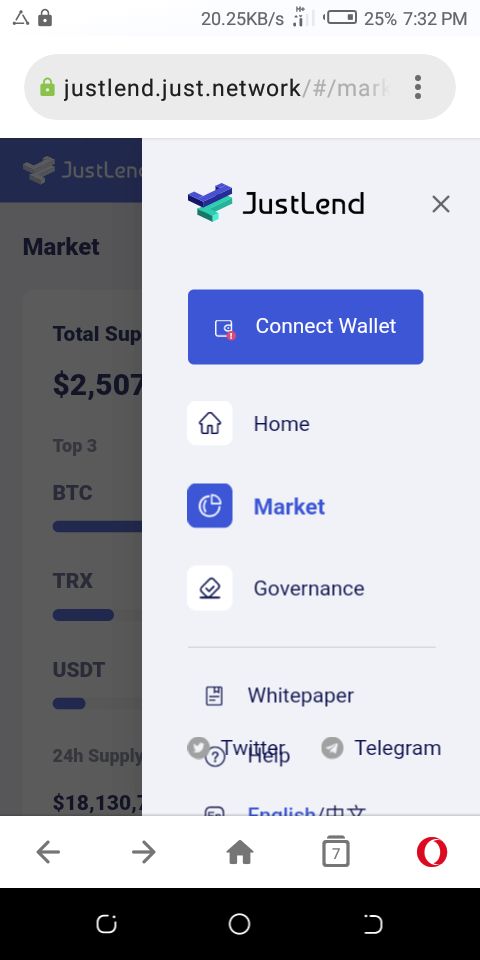

HOW CAN ONE CONNECT TRONLINK WALLET TO JUSTLEND EXCHANGE?

The Tronlink wallet is the only wallet compatible with the JustLend exchange .Bellow is a step by step guide on setting the above connection.

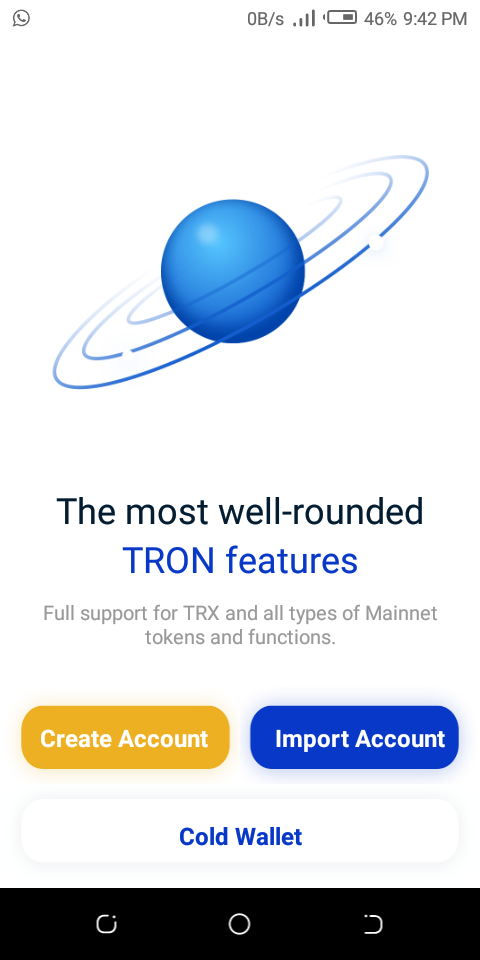

Step 1:Download the" Tronlink " App on your App store.

Step 2: Open the app and click on Creat account.

Step 3: Some keywords will be provided which you will need to provide in the next page.

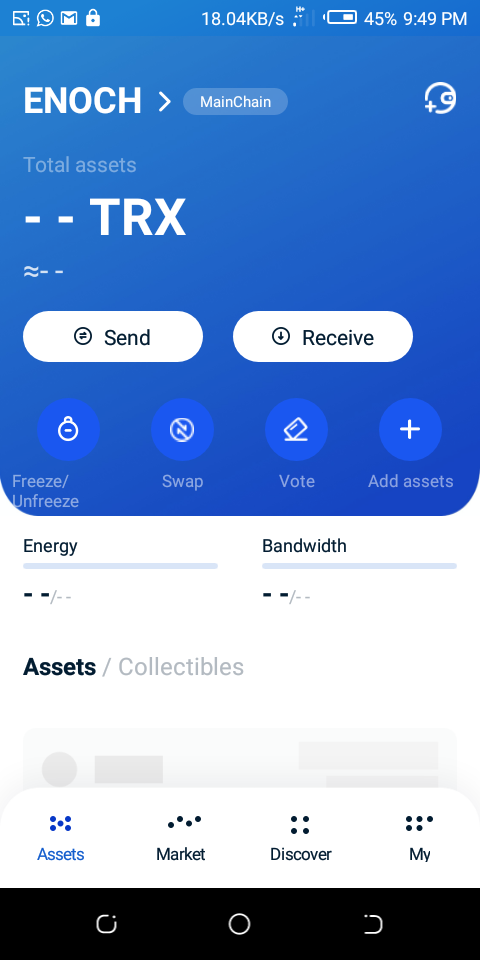

Step 4: You will be taken to your dashboard.

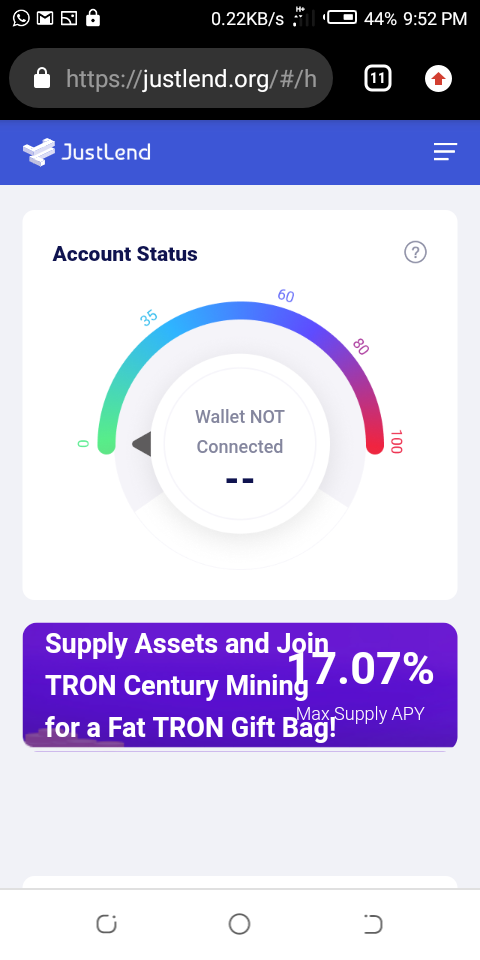

Step 5: Visit the official website of the JustLend exchange ( JustLend.org) .

Step 6: Click on the menu bar at the top right hand corner of your home screen.

Step 7: click on connect wallet and your connection is complete

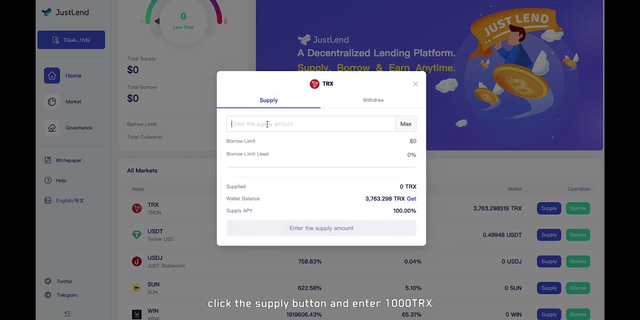

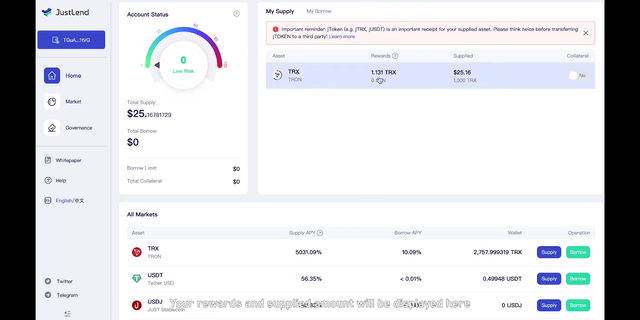

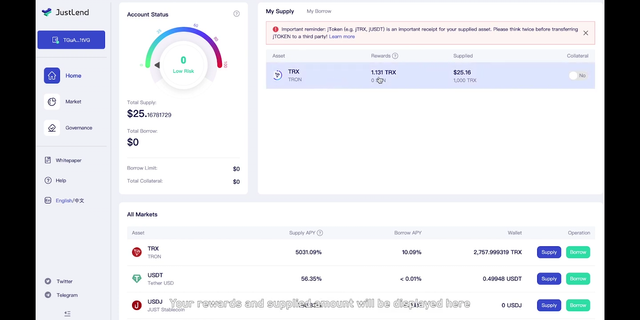

How can I acquire jTokens ?

jTokens are like a certificate or" receipts" that one gets after supplying any token in the JustLend. So for instance if I supply 1BTC , I get a certain number of jBTC which basically is what is used as a standard of interaction within the JustLend Blochchain. So jTokens- smart contracts , are the media through which transactions are understood by the blockchain protocol.

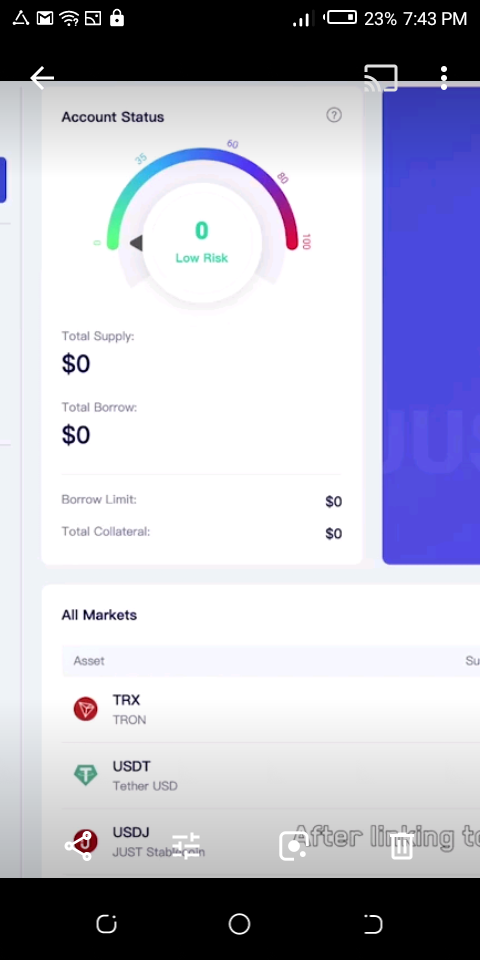

How can I collateralize my jTokens ?

To borrow tokens you need to have jTokens. jTokens are what you get when you supply a token to the blockchain pool, so to collateralize your jTokens just go to the wallet part of your Justlend dashboard and click on the "collateral" icon at the top right hand corner .

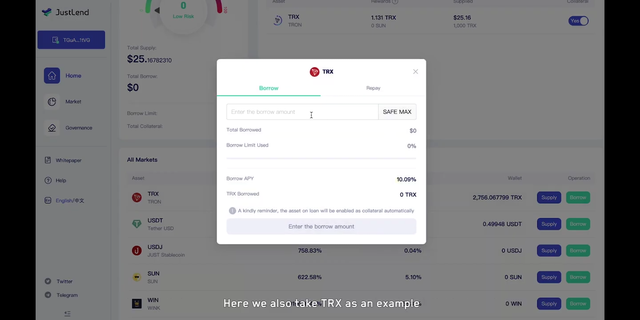

Steps to borrowing a token

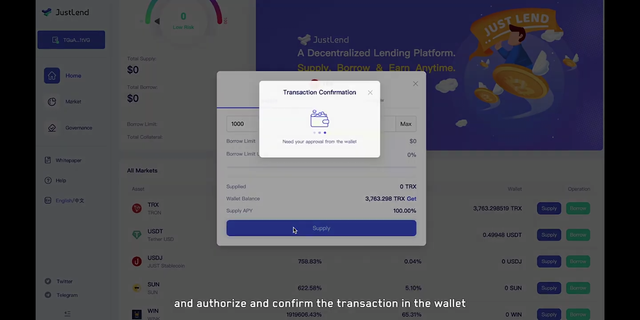

Step 1 : You click on the "home " icon and then collaterize your jToken ; as demonstrated above ,and then you select any of the tokens you want to borrow on the home screen.

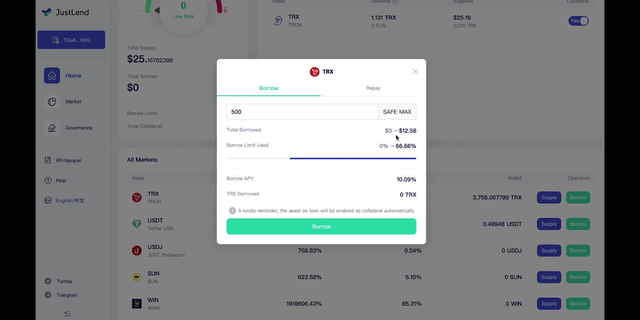

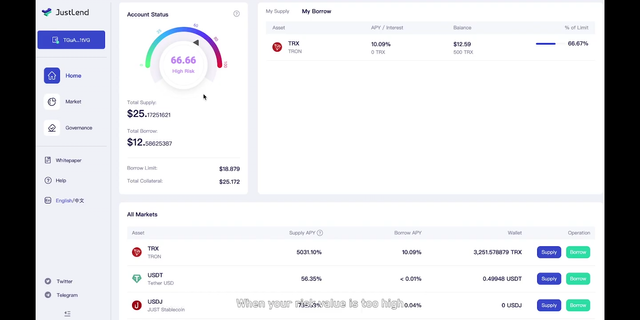

Step 2: Now you can enter the amount of token you intend to borrow ; you should know that the higher the borrow amount, the higher the risk value , and confirm it in your wallet.

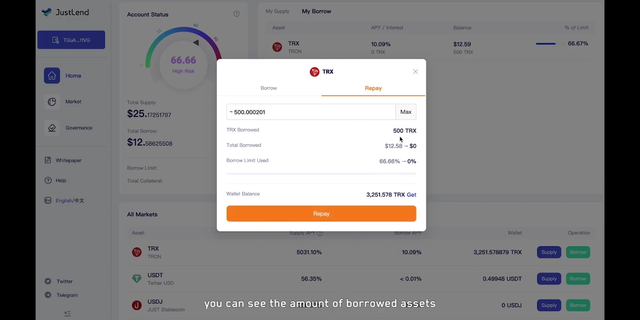

I borrowed 500TRX but ended up paying 500.000201 which means I paid an interest of 0.000201 TRX .

Net APY

Net APY is the quantity that tells if you made profit during the supply and borrowing cycle . A positive net APY means that the cycle generated profit but a negative net APY means the cycle resulted in a loss .

Net APY is calculated using this formula : [summation(value of supplied tokens × supply APY) -( Value of borrowed token × Borrow APY)] ÷ value of total supply . So in my case the the net APY = [(12.59×5031.09) - ( 12.5864×10.09)] ÷ 25.1725 , inputing this into a calculator gives Net APY = 4,269.18%.

During trade , the risk value was 66.67% .A risk value of 100% triggers immediate liquidation of the collateral , that is , you loose your funds .

To avoid loosing your precious funds , the best thing to do is to increase the supply , that is, supply more tokens or pay back all or some of the funds you borrowed and hope the market gets favourable soon to begin toake profits again.

HOW DO I REPAY AND UNLOCK MY COLLATERALIZED ASSETS?

To unlock collaterilized assets, one needs to pay back all the tokens borrowed and its interests too, this can be done by following the following steps :

Step 1: Go to the homepage of the Justlend platform and click on "my borrow " icon which is at the top right hand corner and click on the "repay" icon .

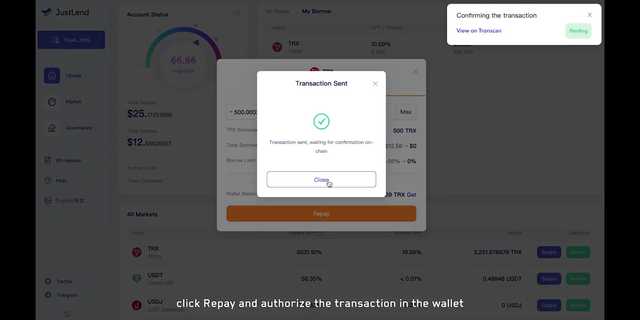

Step 2 : The total amount to be repayed to unlock the assets will be shown to you , then you click on on repay and then you confirm the transaction on your wallet ,and you can access your funds once again.

Hi @mary241,

Thank you for attending the lecture in Steemit-Crypto-Academy- Season 2 & doing the homework task-3.

As I can see, you have used a Wallet other than Steem integrated Tron wallet.

Can you please provide the Tron Wallet Address which you have used for this Task?

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello professor

This is it below

TKRAhYZKxPSvZukcv1kTmYPsbu7ErttSUE

@sapwood

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Unfortunately, the address(TKRAhYZKxPSvZukcv1kTmYPsbu7ErttSUE) does not match with the screenshot demonstrated by you as a real example in this task.

As per this screenshot, a wallet ending with "VG" is used in this Task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit