ORDER BOOK

The order book is a list that contains all the purchase and sell requests , this run down has every one of the open order that can ne got to on an exchange. the open request is only a purchaser or a dealer proclaiming that there are prepared to purchase or sell any asset.

The Order book will contain the purchase and offer orders of clients to either buy or sell a coin. The Order book can be compared to a market , I .e where purchasing and selling happens however for this situation it is the purchasing and selling of crypto resources.

The Order book isn't confined, anybody could make an open request on the Order book, there request will be on the open request until it is dropped by either the individual who applied for the offer or the individual who acknowledges the offer.

Say, an individual applied for an open request on a specific trade to purchase Doge for 2800 USD, someone else should acknowledge selling their wave at that equivalent season of 2800 USD. This doesn't mean that when an individual submits a request, he will consistently see somebody who needs to sell at that cost.

BENEFITS OF ORDER BOOK

The order book offers the clients the chance of settling on excellent choices, it gives the clients a comprehension of the market patterns.

DIFFERENCE BETWEEN A NORMAL MARKET AND ORDER BOOK

From our meaning of what an order book is, we could as of now answer this inquiry. To me there is next to zero contrast between the request book and a traditional market. The significant distinction is that in the order book, exchanges are very much recorded, however in an ordinary market the exchanges are a large portion of the occasions not archived.

Both the order book and the ordinary market all perform purchasing and selling exchanges, in the two cases there is somebody who will purchase and there should be somebody who is likewise able to sell.

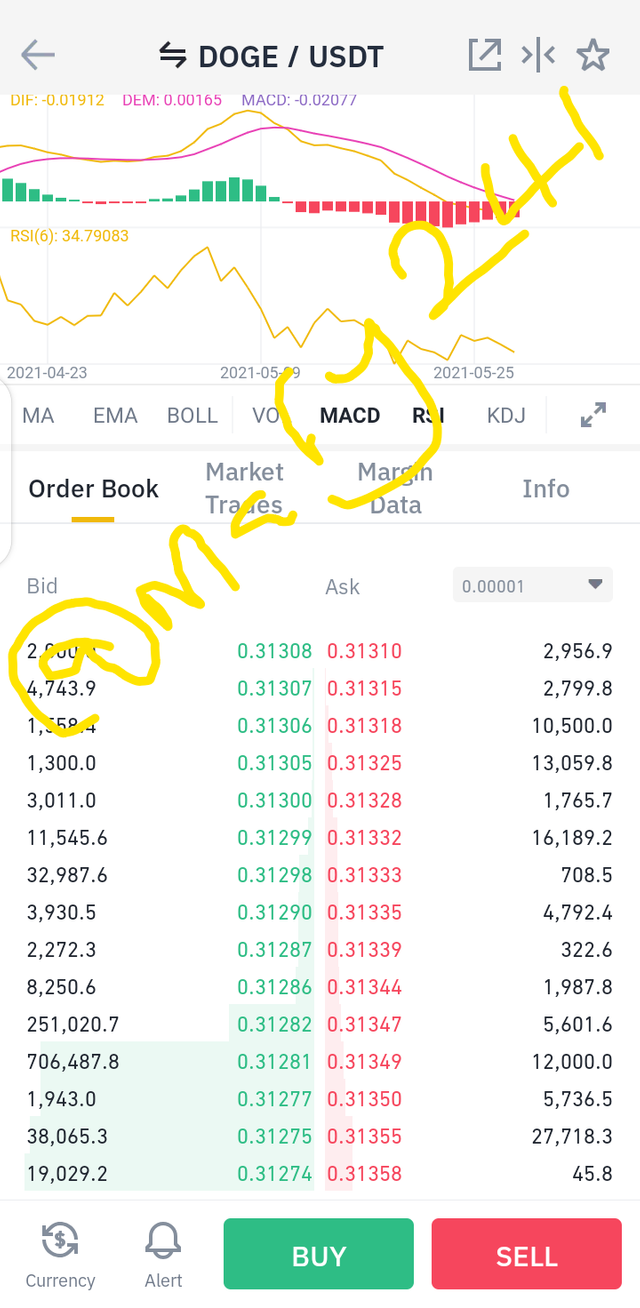

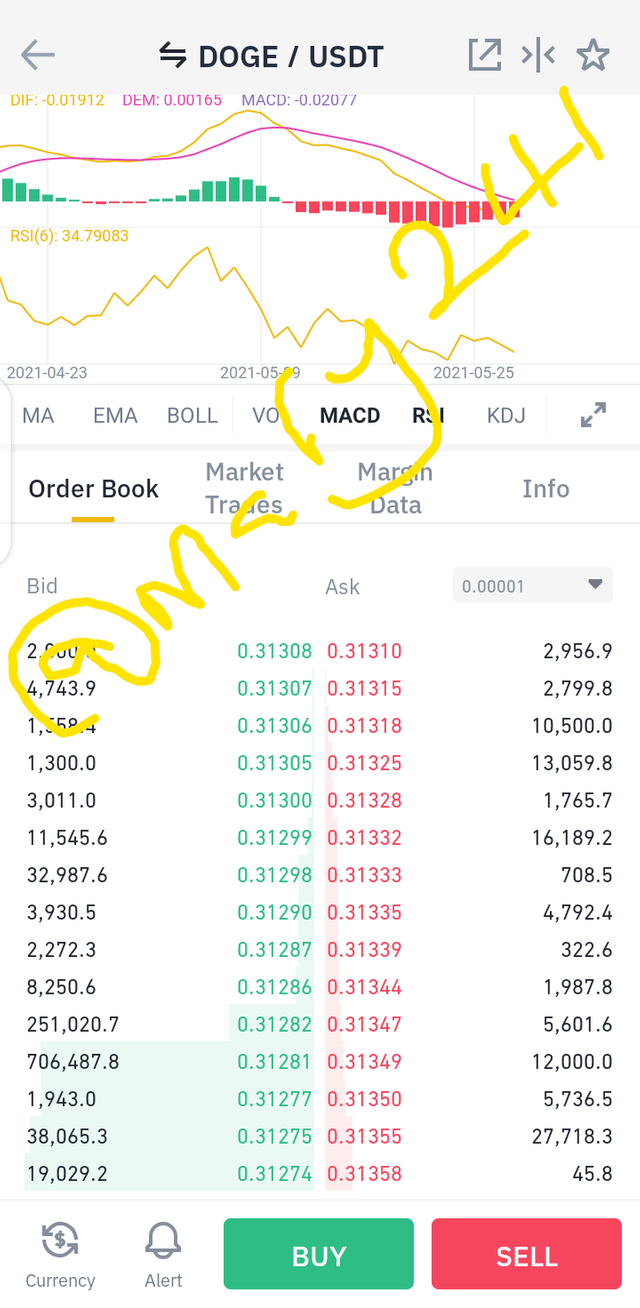

STEP BY STEP INSTRUCTIONS TO SPOT ORDER BOOK ON AN EXCHANGE

You might be pondering where you can discover the order book, you may have been utilizing the trade application without observing the order book, now I will show you where you will see the request book on your trade stage.

For this representation I will utilize the binance trade application

Stage 1: First is to download the trade application or login to the trade site.

Stage 2: subsequent to opening the application or a fruitful login it will show an interface with different coins. ( for this situation I need to check for the order book of DOGE/USD.

Stage 3: enter the coin you need to check for its order book

Stage 4: it will open up the outline for BNB/USD or the coin you chose, under the graph you will see the request book.

Pair: gives you the opportunity to compare the costs of two currencies. Not all exchanges makes it possible to pair cryptocurrency and fiat currency like the U.S dollar, except for exceptions like Gemini, Binance, kraken and coinbase who offer fiat trading pairs. The Pairs makes it possible to illustrate the worth of the coins in relation to each other.

Suport and resistance:

the support refers to a level of price in which a downtrend can be able to be on hold due to high demand and the interest to buy. When there is a drop in price of and asset, the interest to buy shares will be on the increase, this results in the formation of the support line.

The support help alludes to a degree of cost where a downtrend can have the option to be waiting because of popularity and the interest to purchase. When there is a drop in cost of and resource, the interest to purchase offers will be on the increment, this results in the arrangement of the help line.

While the resistance emerges because of the interest to sell when there is an increase in cost.

Market Order: the market order is a order to buy or sell a resource at its best cost per time, the market request ensures the request is completed however that doesn't go to say that it will guarantee a specific cost.

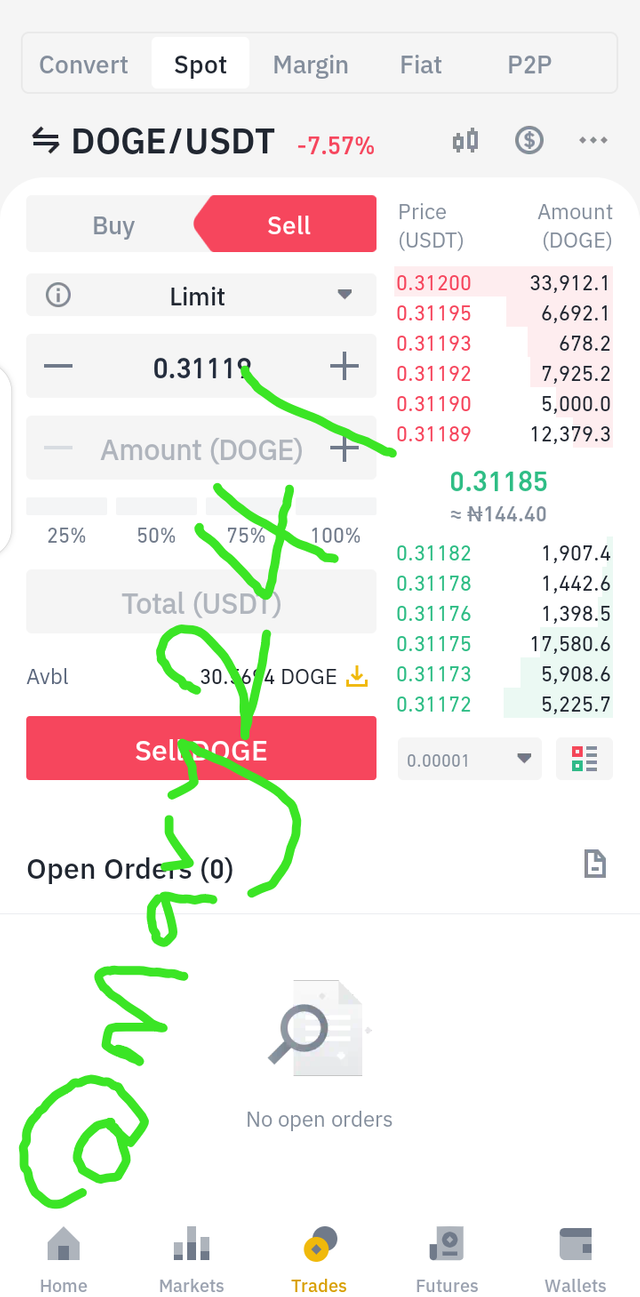

Limit Order:- this a request to buy or sell a resource where there will be limitation to the amount you are to pay for a resource and the amount you can get for the offer of a resource. Albeit the limitation is set, it doesn't promise it being followed.

IMPORTANT FEATURES OF THE ORDER BOOK

The highlights or parts of a request book is as per the following

1.The buyer and the sellers side

The Bid and ask highlight

Price highlight

Visual demonstration highlight

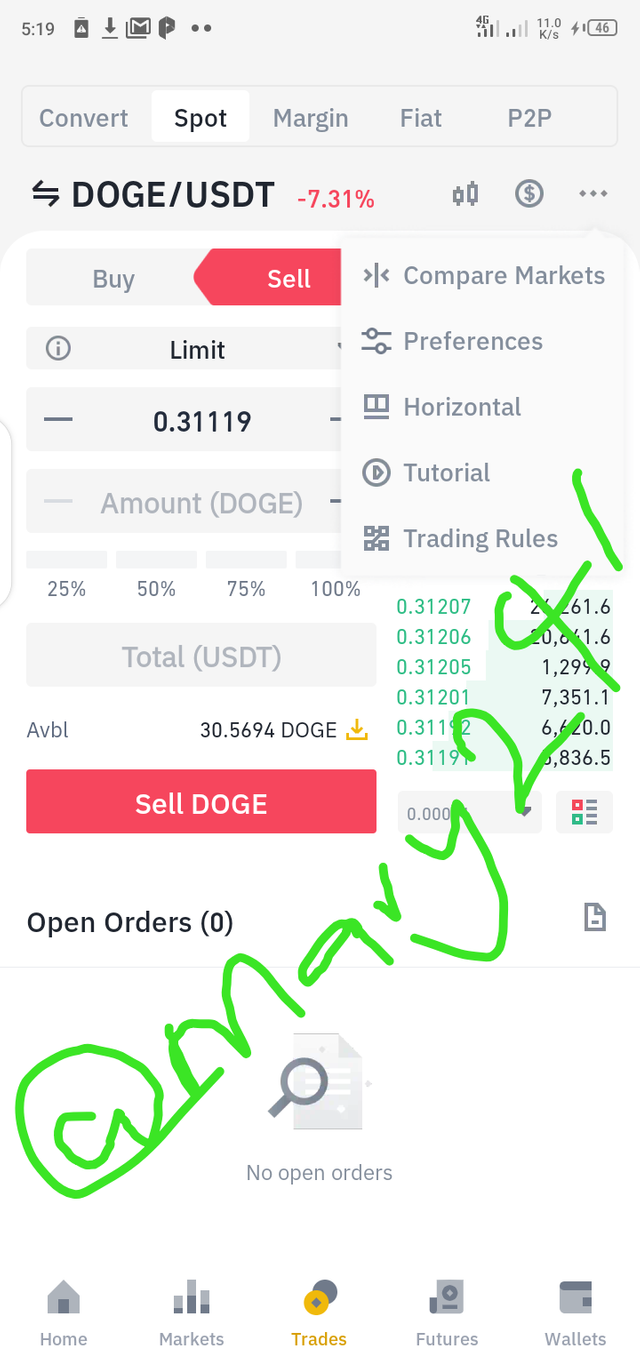

PROCEDURES FOR PLACING BUY & SELL ORDERS IN STOP LIMIT TRADE

Now we will be going through the step by step procedures on how to place buy and sell orders and we will be using the stopnlimit order..

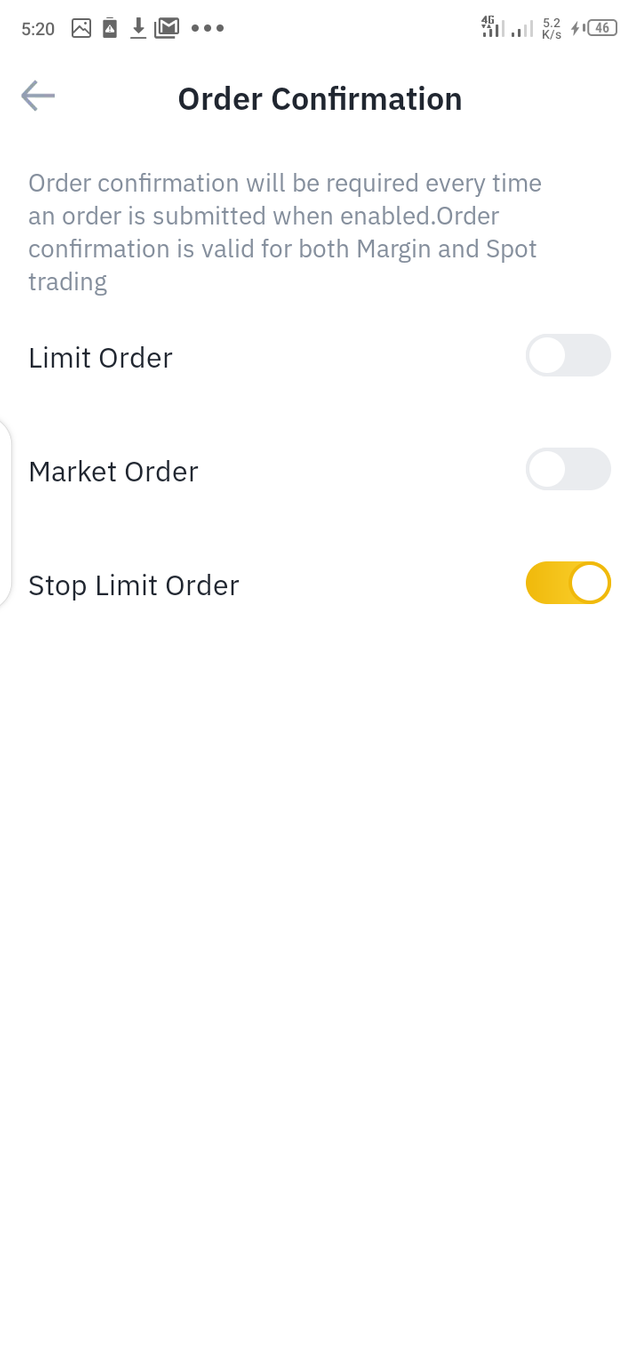

The First thing to do as always is to open the exchange app to access the platform. For this demonstration we will be making use of the BNB exchange platform, once you have entered the platform you will see trade on the lower part of your screen, when you click on trade, you will notice three horizontal dots that is at the top corner if your screen next to the dollar sign, click on it.

After the above is done, you will see preferences, click on it

Now Select the order type you want

HOW DOES ORDER BOOK MAKE US HAVE PROFIT AND MINIMISE LOSS

If you followed this article carefully, you should be able to answer the above question conviniently. The order book gives you a thought of how the market pattern is going, it assists you with acquiring benefit as it assists you with effectively distinguishing when the costs are modest to purchase, this also assists with managing misfortune

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

Thank you very much for participating in this class. I hope you have benefited from this class.

Grade : 3.5

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit