Hello fellow cryptonians, Much thanks to this community for the support and upvotes and lessons given to us all. I am also happy to take in professor @stream4u weekly lecture.

After digesting this weeks lecture note, it is with much conviction that i can be able to participate in Week-7 homework.

source

Money is something that most of us spend a majority of our lives trying to obtain, and most of us have very little idea of what it even is. Money is a medium of exchange that allows people to get the services they need in order to live. Since it is an economical commodity it has to be managed very well so as not to be misused.

WHAT IS MONEY MANAGEMENT

Money management isnt just as simple as we see it to be, it involves saving, budgeting, investing and spending.

Money management may be a strategic technique employed to form money yield the very best interest-yielding value for any amount spent.

Spending money to satisfy cravings (regardless of whether or not they will justifiably be included during a budget) could also be a natural human phenomenon.

The idea of cash management techniques has been developed to scale back the quantity that individuals, firms and institutions spend on items which add no significant value to their living standards, long-term portfolios and assets.

As we dealing with crypto, Money management may be a financial strategy which determines how a trader goes to take a position his money in several cryptocurrency assets. Trading is not like gambling. In gambling, losers are advised to spend more to regain whatever has been lost; however, in cryptocurrency trading, the other is true.

WAYS TO MANAGEMENT MONEY IN YOUR CRYPTO TRADING

RISK TOLERANCE

Risk tolerance is that the amount of cash that you simply are able to spare from your account without affecting your future trades. As a trader, you ought to only put out what you're prepared to lose. Putting an excessive amount of at stake are often devastating just in case of a nasty trade.

In the finance arena, risk tolerance is described because the degree of variability in returns of an investment that an investor is prepared to face up to .

Factors affecting Risk tolerance

These are the factors you ought to pay keen attention when setting a risk tolerance level.

Time horizon; investments are often short term or future . Remember, short time-frame investments carry a better risk than future frame investments.

Stick to and Follow your Trading Plans

This is a crucial strategy. A majority of latest traders will toss their plan within the ashcan when the hell breaks loose, and that they lose a few of trades.

The panic related to making mistakes in trades is always closely followed by a group of revenge trades where a trader seeks to regain all that he or she has lost by carrying uncoordinated trades. The result is often more losses.

Therefore, it's essential to stay to your plan. You are advised to write down down your strategy on paper and stick with it. The written note shouldn't be changed and will be adhered to religiously.

Your written note should include clear exit points. In case you lose, don't alter the stop loss point within the hope of recovery, unless it's provided in your strategy.

Secondly, you ought to highlight all the amount at which you propose to enter new contracts, and therefore the volume desired, just in case of a positive outcome.

This money management strategy is one of the most difficult for all traders. The moment everything goes red, panic kicks in. Not many can withstand the thought of losing money and ultimately concede to pressure. If you'll master this strategy, combined with the op

My future plan on my money management will always be based on the above assumptions. I will see to it that that no matter how little I will be earning at the end of every year or month, I will allocate some amount of my capital to investing into the crypto world. This is because the world today is being ruled by crypto. I will make sure I buy some assets, one at a time.

Let’s say if I buy one ETH coin, I will monitor to see if it’s going to move in a downward direction or it’s going to rise using my portfolio. This will make it easy and help me carefully know the next coin I will be investing. By so doing, I will be able to manage my money very effectively.

source

PORTFOLIO MANAGEMENT

Portfolio management simply deals with taking benefits and profits from investment made.

With this type of management style, the strengths and weaknesses and how streaks rise and fall are compared and opportunities checked and also falls in an investment. Portfolio management is in two phases, thats, active and the passive portfolio management.

The active type just deals with the buying and selling of goods and other assets in other to beat the larger market. With the passive type it seeks to compare the returns of the market by imitating the makeup of a particular index.

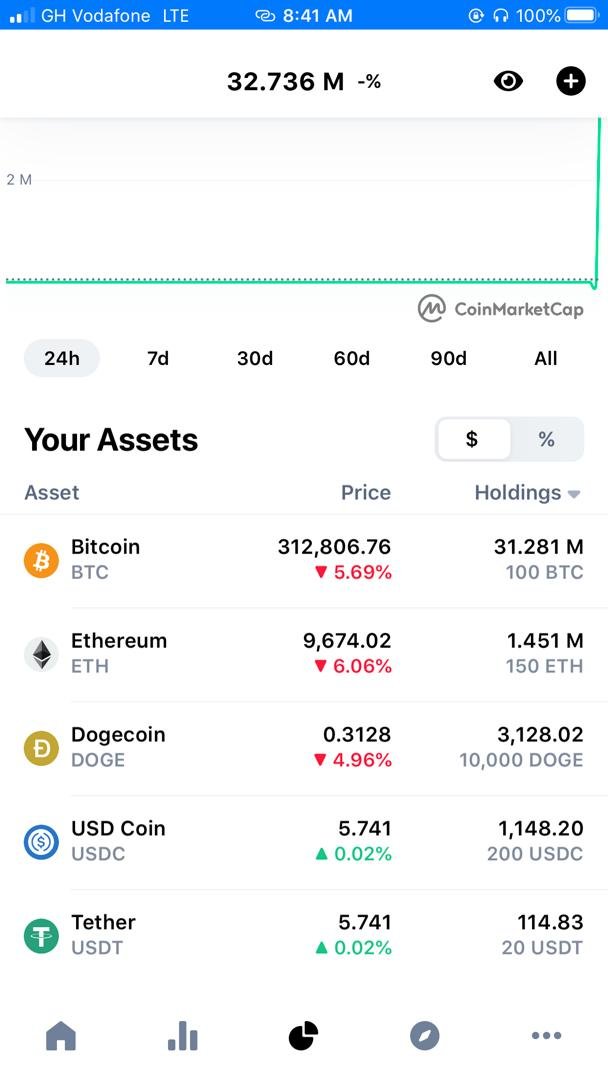

Personally, I have a few investment going even though am still new in the crypto trading and thats exactly why i have taken this crypto course so serious so i can be able to manage my assets and also e a pro one day. I have a portfolio I am monitoring at the moment and hoping to invest more. I bought Bitcoin in the early stages of this year but sold it quite early because i was afraid in going down and also i didnt use money i could afford to lose. Below is a screenshot.

With my ambition to invest in some of the coins, i have selected a few i am monitoring and also reading more about them and also listen to experts predictions on them. Below is a screenshot of ethereum coin which i would love to invest in the near future because with critical consideration and observations ive realised it has a potention of reaching the peak and even give a good challenge to BTC. Also i have dogecoin,USD coin, and tether. Below is a creenshot of its streaks.

this is for ETH

.jpeg)

USD COIN

.jpeg)

DOGECOIN

TETHER

In conclusion, Developing a money management strategy in crypto trading is straightforward and straightforward . However, the hardest thing is self-discipline. Get your head in line, and you'll wade into the pool of profitable traders.

i would also like to thank professor @stream4u and hope that my solutions provided for this week’s homework on money and portfolio management will be considered and taken into consideration and also get some upvotes. I am also very eager to learning more in the coming weeks.

Hi @massachussets

Thank you for joining Steemit Crypto Academy and participated in the Homework Task 7.

Your Homework task 7 verification has been done by @Stream4u, hope you have enjoyed and learned something new in the 7th course.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks prof. @stream4u. I’m much grateful

prof @stream4u pls my last week’s homework task was scored 5/10 but it hasn’t been curated yet and the days is almost done for payout. Below is the link to my post. I will be very glad if you helped me to get curated. Thank you

https://steemit.com/hive-108451/@massachussets/crypto-academy-week-6-homework-post-for-stream4u

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit