Hello @kouba01 thank you for this wonderful lecture on Cryptocurrency Contracts For Difference . I have really learnt alot from your submission. I am also very happy to add my contribution to this assignment.

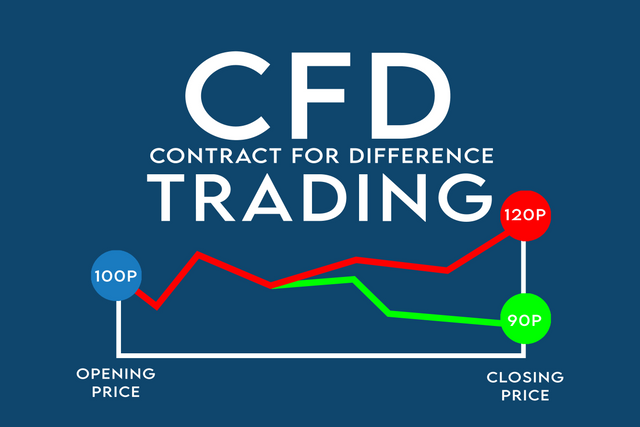

What is CFD?

CFD trading (Contract for Difference) is a form of trading and investing in an asset that allows individuals to exchange and invest in an asset by entering into a contract with a broker rather than opening a position directly on a market.

When the trader and the broker agree to replicate market conditions, they will resolve the difference when the place closes. CFD trading has a number of advantages that direct trading does not, including access to overseas markets, leveraged trading, short (SELL) positions for assets that do not usually have that option, and more.

How does CFD work?

A contract for differences (CFD) is an arrangement between an investor and a CFD broker to swap the difference in the value of a financial commodity (stocks or derivatives) between the opening and closing dates of the contract.

It is a sophisticated trading technique that can only be used by professional traders. A CFD investor never directly owns the underlying asset.; instead, the investor earns income based on the asset's price adjustment.

Also, if the trader expects the asset's value will fall, he or she will open a sell position. The trader must buy an offsetting trade to close the position.

Do all brokers offer cryptocurrency CFDs?

Cryptocurrency CFDs are available from any broker.

This is because brokers provide cryptocurrencies allowing them to be exchanged or purchased, which is the primary reason for their existence. For purpose of clarity i will like to list a few cryptocurrency CFDs brokers.

- Exness

- etoro

- AvaTrade and many more

Advantages of Cryptocurrency Contracts For Difference (CFDs)

There's no need to go through the trouble of purchasing cryptocurrencies or storing tokens in wallets;

You can swap the underlying CFDs on cryptocurrencies with your fiat currencies.

Possibility of winning in both bullish and bearish market conditions;

To exchange a greater volume, take advantage of leverage and margin trading.

Many methods and functions, such as the classic, trailing, or assured stop-loss, improve risk management.

Trade with a regulated broker who offers those guarantees in a secure setting.

Disadvantes of Cryptocurrency Contracts For Difference (CFDs)

It is possible to lose a lot of money if margin trading and the impact are not well regulated.

The total amount of financing fees charged while holding a position overnight can often surpass the amount of long-term profits;

If you have substantial losses and insufficient funds in your trading account, you will face a margin call or account liquidation.

How do I determine if cryptocurrency CFDs are suitable for my trading strategy?

Before one can know the suitable cryptocurrency CFD suitable for his or her trading strategy, he must do a little research or investigation. I will explain some steps to consider so one can determine if a cryptocurrency CFDs are suitable for his trading strategy.

First of all, a person must set a breakthrough strategy.

This simply entails determining a key price level for a particular security. You buy or sell when the price reaches your main amount, depending on the trend. When breakout trading, the most important thing to note is to stop any trades when the market isn't offering strong signals.

Give it a miss if you can't tell which direction the overall trend is going in. This is where a thorough technical review comes in handy. Use charts to find trends that will give you the best indication of where the trend is going.

Moreover, investors should have a short-term plan. You should not make it a long-term investment because you never know what will happen along the way, so it's best to stick to a short-term trading approach. Even though long term investments are good but for early profits one must use short term investment and CFD are particularly good for short term investment.

Also the investor needs to understand his total position size. The overall market visibility of your trade is your position size. You should weigh your available resources and the amount of risk you are willing to take when opening a new job.

Every CFD trader should include in their trading strategy how much capital they are willing to gamble on each trade – note, this is how much money you can afford to lose.

Lastly, Stops and limits will also help you manage your risk. Attaching stops and limits to a position is a popular form of risk management. These help protect your resources by pre-defining the exit levels for your trade. A stop-loss order tells your broker that you want to close your trade at a lower price than the current market price. Set your stop-loss based on your answer to the question, "How much money am I willing to lose before I close my trade?"

Are CFDs risky financial products?

CFDs, like any other product involving financial markets, are potentially risky. CFD trading is leveraged so while it can lead to greater returns on smaller investments, it is also possible to lose more than your deposit. Lets talk about some of the risks involved.

Gaps in the market and market uncertainty is one of the risk involved. Financial markets can experience rapid fluctuations, which will be reflected in the prices of our instruments. The probability of gapping occurs as a result of market uncertainty. When the prices of our instruments abruptly change from one level to another without going through the level in between, this is known as gapping.

Another risk involved is holding cost. You can incur holding costs depending on the positions you hold and how long you hold them. If you keep positions on such instruments overnight after 5 p.m. New York time, these keeping expenses are charged to your account on a regular basis. In certain situations, particularly if you hold positions for a long time, the total of these holding costs can outweigh any income or greatly increase losses. It's important to have enough money in your account to cover your keeping costs.

Lastly, leverages are among the risky factors of CFD. Through depositing only a fraction of the full value of the transaction you wish to position, leverage allows you to gain exposure to the markets. This means that while you could potentially benefit if the market moves in your favor, you could still lose a lot of money if the trade goes against you and you don't use proper risk management.

Do all brokers offer cryptocurrency CFDs?

NO is the answer to this inquiry. Since cryptocurrency CDFs are not available from all brokers. It is also not required that an agent be present while a transaction takes place. Furthermore, transfers can be completed without the need to pay fees to a centralized exchange system so in this sense not all brokers offer cryptocurrency CFDs.

A list of brokers that offer cryptocurrency CFDs include

XTB

IronFX

IC Markets

TMGM

GO Markets

FP Markets

BDSwiss

Etoro

Explain how you can trade with cryptocurrency CFDs on one of the brokers (Using a demo account)

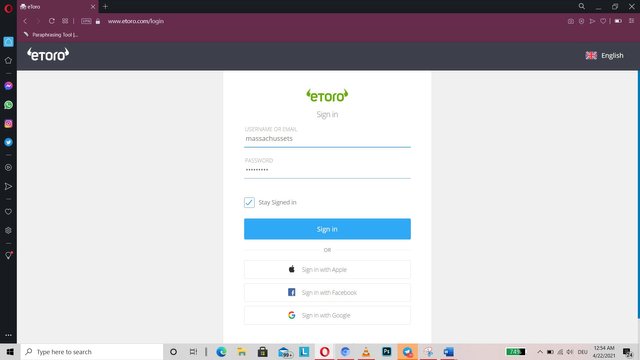

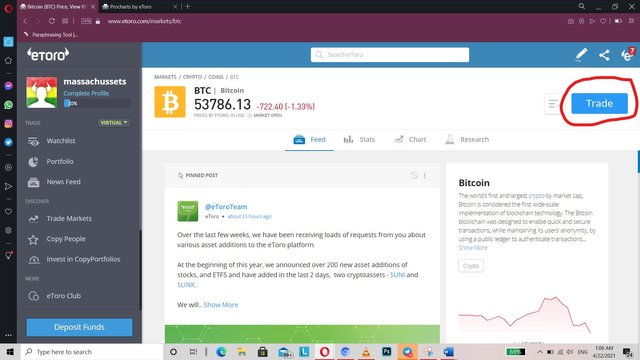

First of all i logged onto the official website of etoro on https://www.etoro.com/

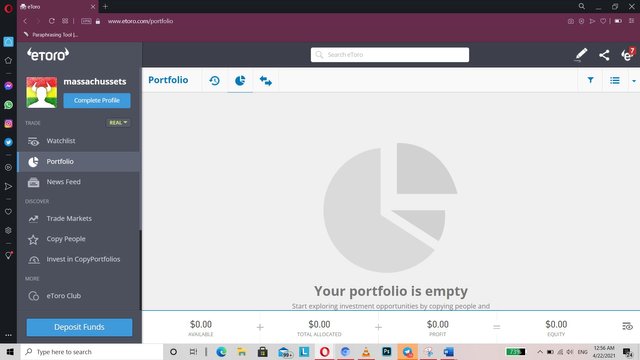

I created an account first before proceeding to switch from real portfolio to virtual portfolio

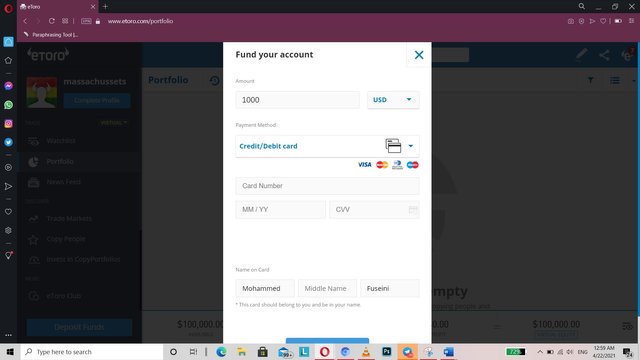

I deposited some funds by clicking on the deposit funds button below the left bottom corner

Before i could proceed i had to input the details of my credit (VISA CARD) .

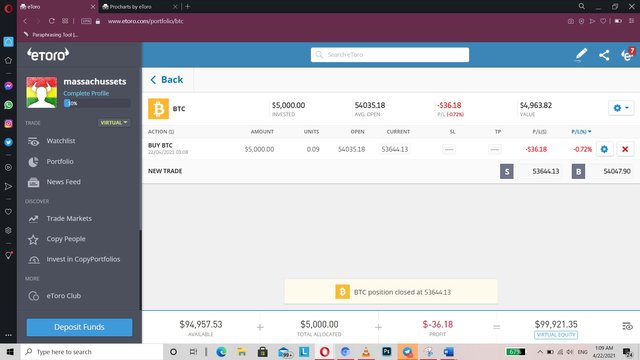

I checked my virtual portfolio to see if the transaction was successful which it had gone through successfully.

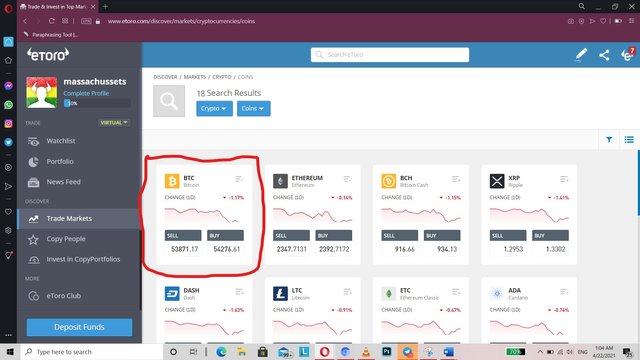

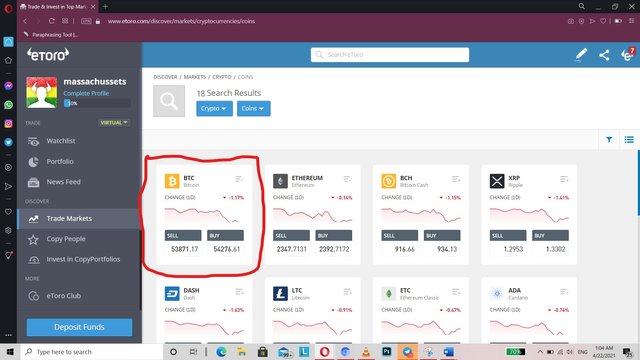

Click on Trade markets

Select a cryptocurrency, i select BTC

Click on Trade

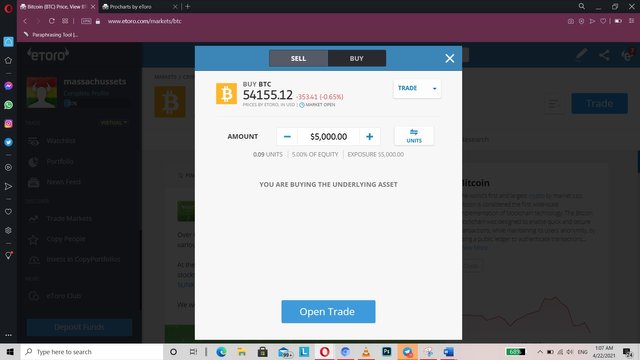

Enter the desired amount and click on Open Trade

Conclusion

I really enjoyed this lecture on Cryptocurrency Contracts For Difference (CFDs) by prof. @kouba01.CFD trading is a worthwhile investment. It does, however, come with its own set of risks, and it is something that you should take the time to think about. CFDs, like Forex, can be extremely lucrative if you know what you're doing. You will be good if you take the time to learn it. Hoping to learn more from you prof.

Hello @massachussets,

Thank you for participating in the 2nd Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 4/10 rating, according to the following scale:

My review :

I did not understand your opinion on the fourth question, you answered it twice in two different ways, and the rest of the answers did not have a specific methodology, only a group of information that you presented without filtering it so that the answer is clear.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://steemit.com/hive-108451/@farhmade/crypto-academy-season-two-week-2-homework-post-for-kuoba01

Please professor @kuoba01 my work has been skipped.

Thank you 🙏

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your work will be checked by Sir yohan soon!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Alright professor @kuoba01 Thank you very much

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit