Hi. prof. @fredquantum thanks for this wonderful lecture on Zethyr Finance. Below is my submission.

What is Zethyr Finance?

The Tron Ecosystem has been one of the best in providing a superb environment for developers and third-parties to be able to build DApps on the ecosystem, which has brought about its growth in recent times in the blockchain space.

Among the DApps that has gained the attention of users on the Tron Ecosystem is the Zethyr Finance which is presumably a DApp. Despite the fact that there are many lending DApps on the ecosystem, Zethyr Finance stands out because it has embedded DEX on its platform, which uniquely identifies it from its peers and stands tall among its peers, and enables Tron users to exchange tokens on the platform. What is Zethyr Finance?

Zethyr Finance is DApp on the Tron ecosystem which offers users the ability to lend their assets in return for massive earnings through a specified APY through a process called *Supply, in that they are able to use these assets lent as a collateral to borrow on the platform with a specified interest on repayment through a process called *Borrow.

What are the features of Zethyr Finance? Discuss them. What's your understanding about DEX Aggregator?

Zethyr Finance has so many features to offer and they include the following;

- Lending and Borrowing

- Zethyr Exchange

- Stable Swap

- Ztoken

- Markets

Let’s throw more lights on each of the above-mentioned features.

Lending and Borrowing

Lending

.png)

As the platform’s primary goal is to lend and borrow, lending and borrowing cannot not be left out as one of its features.

Users are able to lend out their Tron assets through Supply and earn passive income by providing users with an agreed APY on each token they lend out.

Borrowing

.png)

And on the other hand, just as a bank will need a collateral before borrowing you funds, users are as well able to borrow funds using their locked -up tokens as collateral for any motives which also attracts an interest for any amount taken with a specified APY.

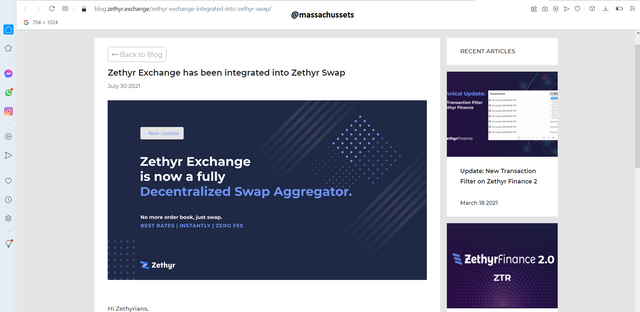

Zethyr Exchange

.png)

With the integration of this feature on the platform, users are able to exchange their tokens for other tokens on the platform through the help of DEX aggregator which basically compares prices to other DEX for a moderate pricing which basically no lending DApps offers such feature. And this feature is transaction free, meaning there is no any transaction fee attached to it. For example, I can swap my TRX token for USDT without any platform transaction fees.

Stable Swap

.png)

Just as its name implies, we are talking about fixed tokens. This feature gives users the opportunity to directly swap stable coins with a consensus that is different from another stable coin with a different consensus. The platform currently supports two cross-chain swaps: * Tron (TRC20) and ERC20, both of which are purged against **USDT. To understand this, let’s say I own *50 USDT which runs on the Tron consensus (TRC20) and I want it in (ERC20) which runs on the Ethereum consensus, which I can swap it for in ERC20. But mind you, this comes with a transaction fee.

Ztoken

Zethyr is no exception. Most platforms have their own native tokens running on their platforms for transaction purposes and accessibility purposes, and zethyr is no exception.

Ztoken is a native token of the zethyr finance platform which basically serves as a reward medium for users who supply assets to the protocol and are represented in units on the platform. Also, this gives users accessibility to collaterals on the platform to borrow funds.

Markets

.png)

This feature gives an indication of the total supply on the platform as well as the total borrowing in a ranking. As at the time of writing this, there was a total of $640,607.91 supply and a total of $24,501.34 borrowed, with the various tokens arranged in order of supply and borrow.

DEX Aggregator

DEX aggregator simply helps in gathering up all information about exchanges and swaps and they sort them out to bring out the best from it that will be in the right interest of the users. With the old system of order book which showed users a list of different offers from both buyers and sellers, the integration of DEX aggregator has made it easier and faster for users to swap their tokens at a better rate without having to choose. This integration of the DEX aggregator has increase the liquidity of users. As at the time of writing the recent aggregated application on Zethyr DEX Aggregator were Justswap, Uswap and Sun.io which they said was coming soon.

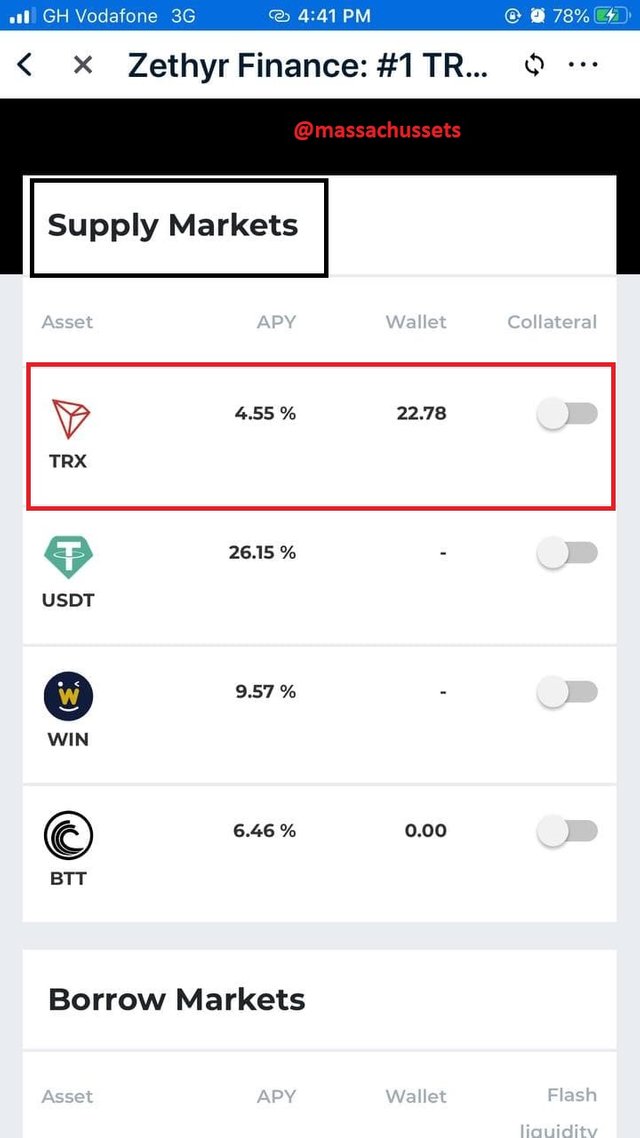

Explore the Zethyr Finance Markets and show your observations in terms of profitability of Supply and Borrow (Hint: Best Supply/Borrow APY). Screenshots required.

In respect to this, we have to visit the zethyr official site to be able to have a proper assessment of this. https://zethyr.finance/

When visited, at the top of the dashboard we can find the markets, then click on it for more in-depth detail.

.png)

We can see that, we have a total supply of assets being $631,335.80 with the various assets arranged based on their percentage wise. TRX token being ranked first with a percentage of 86.35%, USDT being 1.08%, WIN token 2.08% and BTT 10.49%.

.png)

On the other hand, a total of $24,107.20 was borrowed, with the respective volume of tokens being arranged in an orderly manner.

As part of the observation, 99.74% represents TRX tokens borrowed, followed by USDT 0.16%, BTT representing 0.10% and WIN 0% to imply that WIN was not borrowed as at the time of writing this.

When you scroll down, you will have a clear summary of all the markets. Below is a screenshot of the entire market.

.png)

As seen above, in the supply index, USDT has the highest APY with 26.15% at the time of writing this, meaning that it will be more profitable when one supplies USDT on the zethyr finance platform because it has got the best APY.

On the other hand, the borrow index, the USDT has an 8.00% APY, which is the lowest APY on the borrow index, which further signifies that, users who borrow will pay much less as compared to the other tokens.

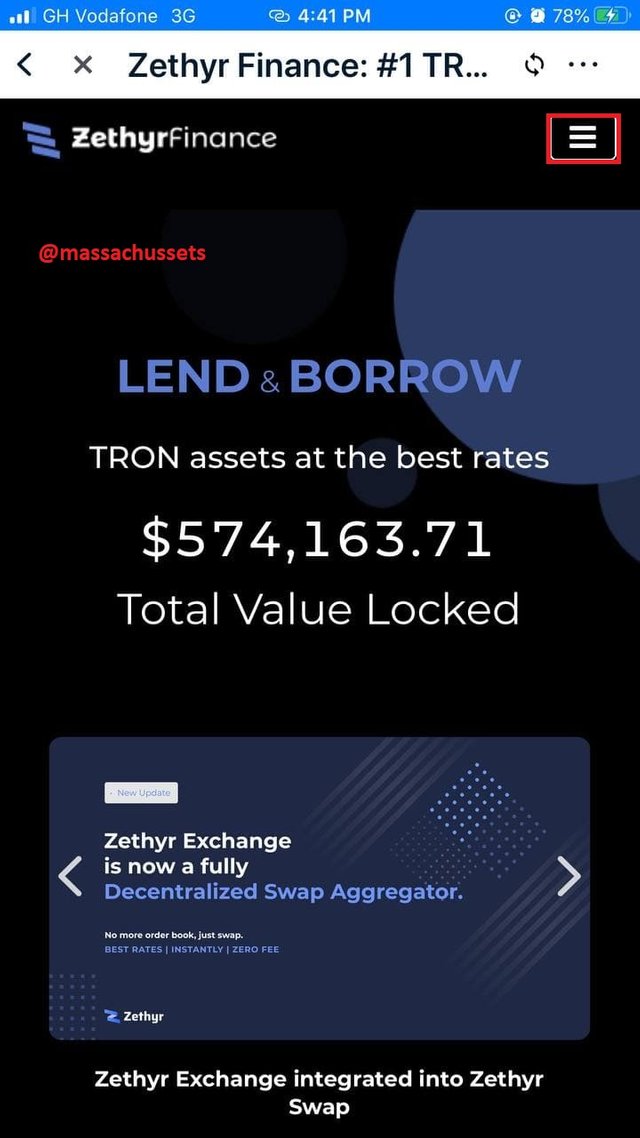

Show the steps involved in connecting the TronLink Wallet to Zethyr Finance. (Screenshots required).

To be able to do this, we first have to visit https://zethyr.finance. In my case, I am using the website to execute this.

- Ensure that your Tronwallet is logged in.

.png)

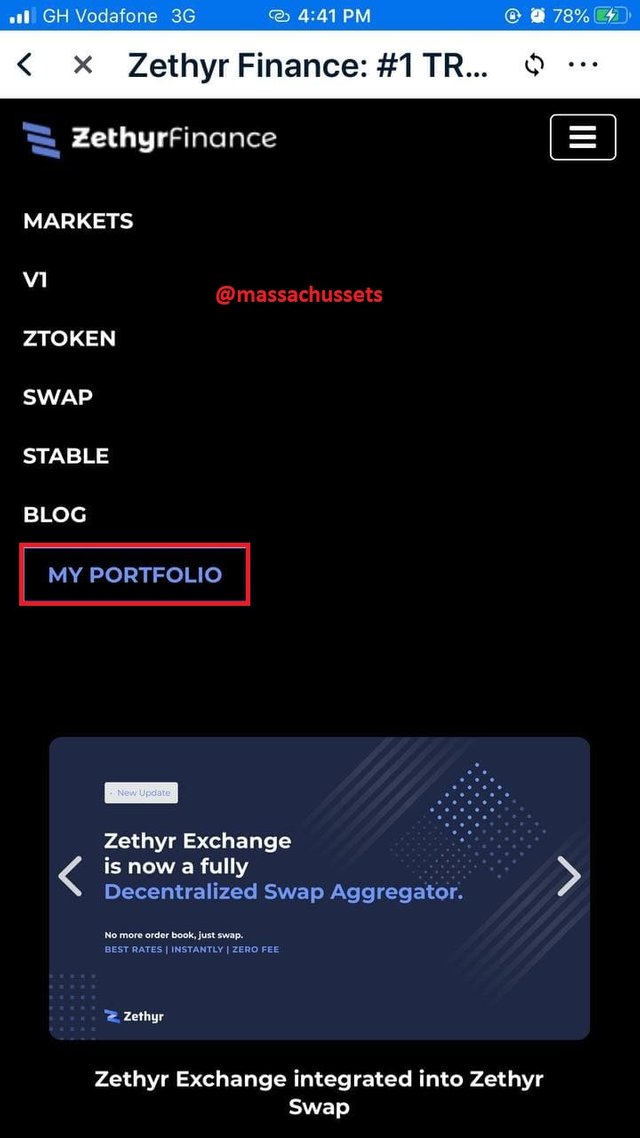

- At the top right corner of the browser locate and click on MY PORTFOLIO

.png)

- A request would be sent to your Tronwallet asking for permission to connect, click on Connect, for zethyr finance to connect to your Tronwallet.

.png)

- At this point, we have successfully connected Tronwallet to the Zethyr finance platform.

Give a detailed understanding of ztoken and research a token of another project that serves the same purpose as it.

Ztoken

The Ztoken is a native token that is rewarded to suppliers who supply their assets on the exchange. For example lets say a supplier supplies USDT on the exchange he will receive zUSDT, same goes with TRX, WIN and BTT. The Ztokens are also pegged in the ratio 1:1. Also this Ztoken can be used as a collateral in borrowing an asset on the exchange. When a user has this Ztokens he also has the liberty to perform all actions the other assets on the exchange does. Anytime a supplier supplies to the exchange, he receives an equivalent interest which is sent directly to his wallet.

Alternative Project to Zethyr Finance

As earlier stated, it is not only Zethyr Finance that offers the lending and borrowing services, but others too. As it stands now, Zethyr Finance offers the services ever. Another alternative to zethyr finance is Mantra Dao, which is also based on the Defi protocol and offers lending and borrowing to its users. As it stands now, the developers are working so hard to join the pokaldot blockchain but then run Riochain.

Mantra Dao also have a native token on its platform called the OM Token, this token can be used to acquire loan facility on the platform and as well gives users the power to vote for the better governance of the ecosystem and also be used for staking for better and attractive returns.

According to coingecko, as at the time of writing this, the OM token has the following statistics;

| Price | $0.226059 |

|---|---|

| Market Cap | $84,272,492 |

| Trading Volume | $7,000,963 |

| Ranking | #502 |

| ATH | $0.860573 |

.png)

OM Token has been listed of several exchange markets which simply means that it has future as its being listed by the major exchange markets.

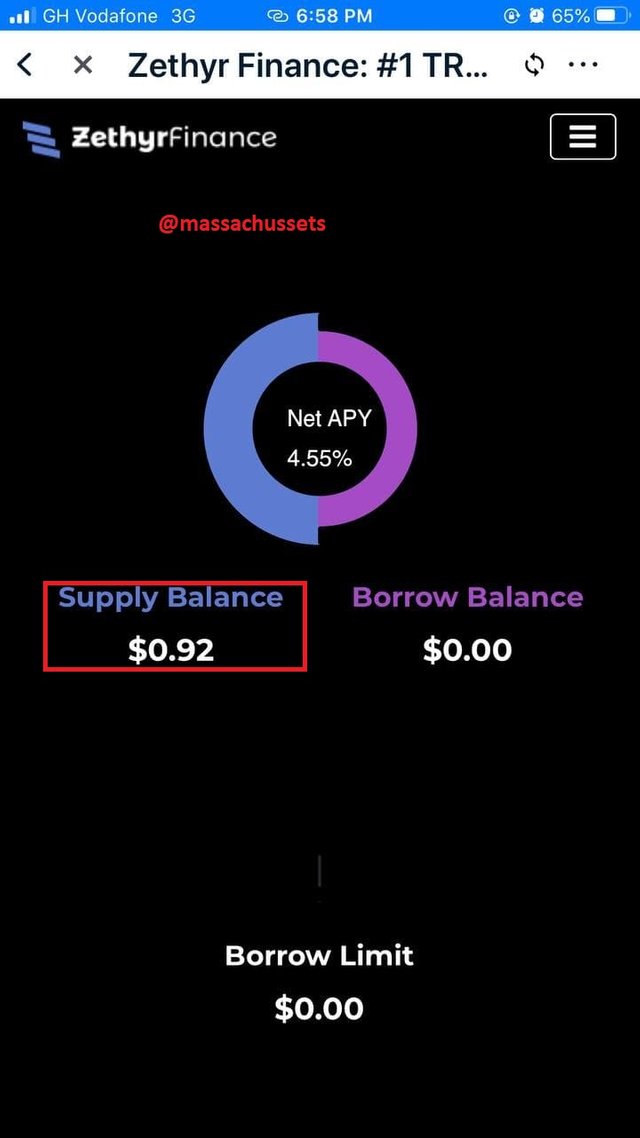

Perform a real Supply transaction on Zethyr Finance using a preferable market. Show it step by step (Screenshots required). Show the fees incurred.

Before one can perform a real transaction on the Zethyr Finance, he must follow these steps

- On the Zethyr finance homepage, go to the three parallel line that is located at the top right corner of the window.

- Next Click on my portfolio and click on the supply option

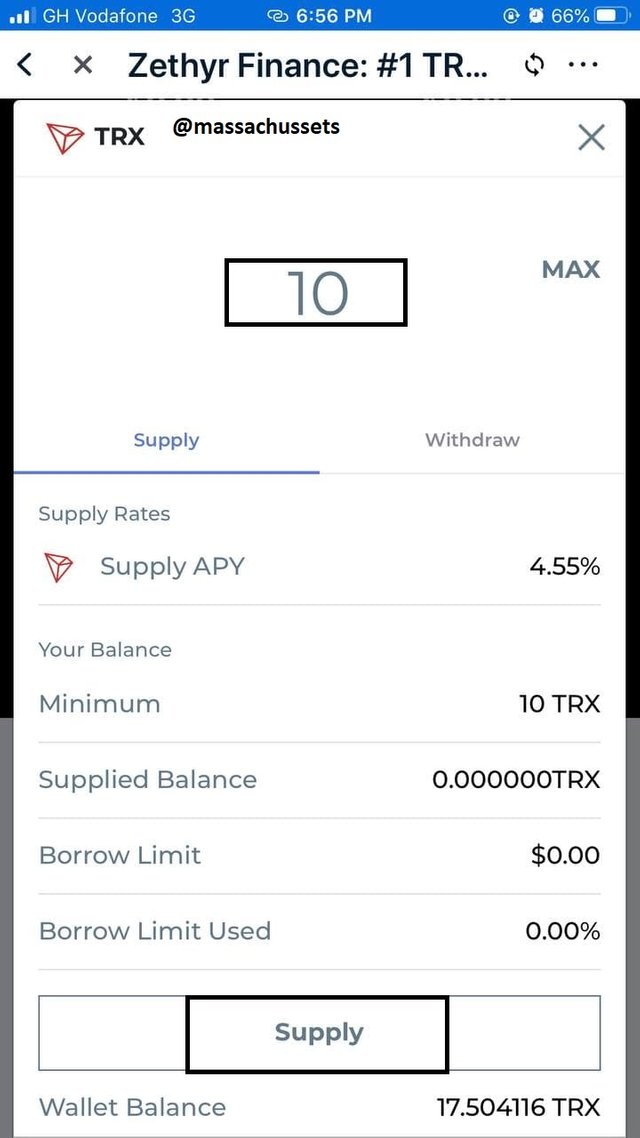

- For the purpose of this, I will be using the TRX token so i clicked on the TRX asset.

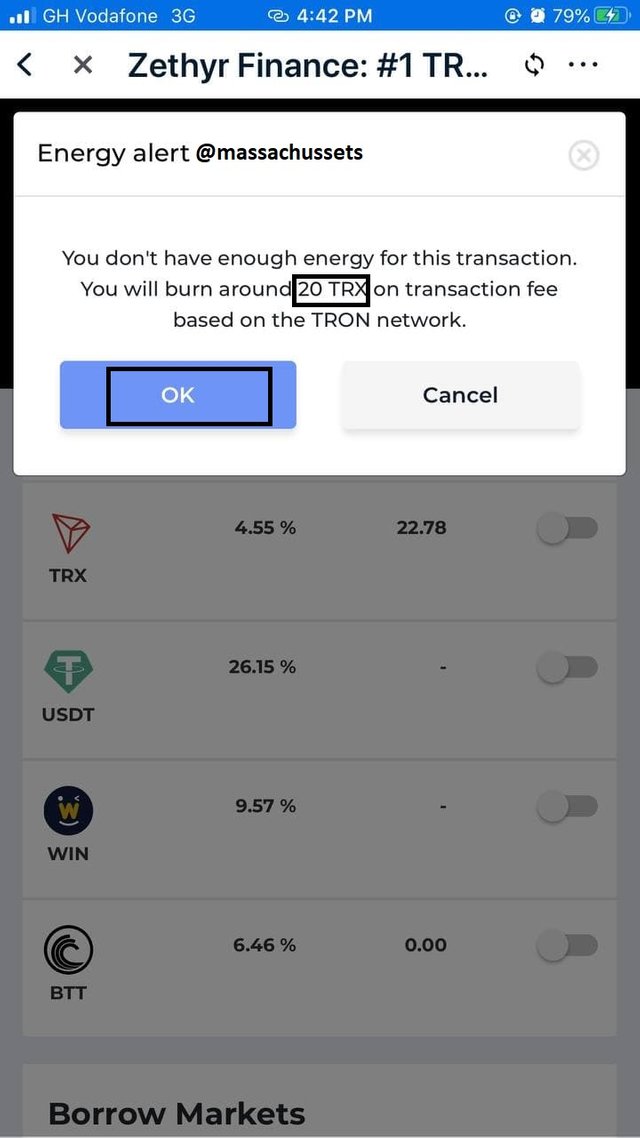

- Check the supply option and now click on Enable

.jpg)

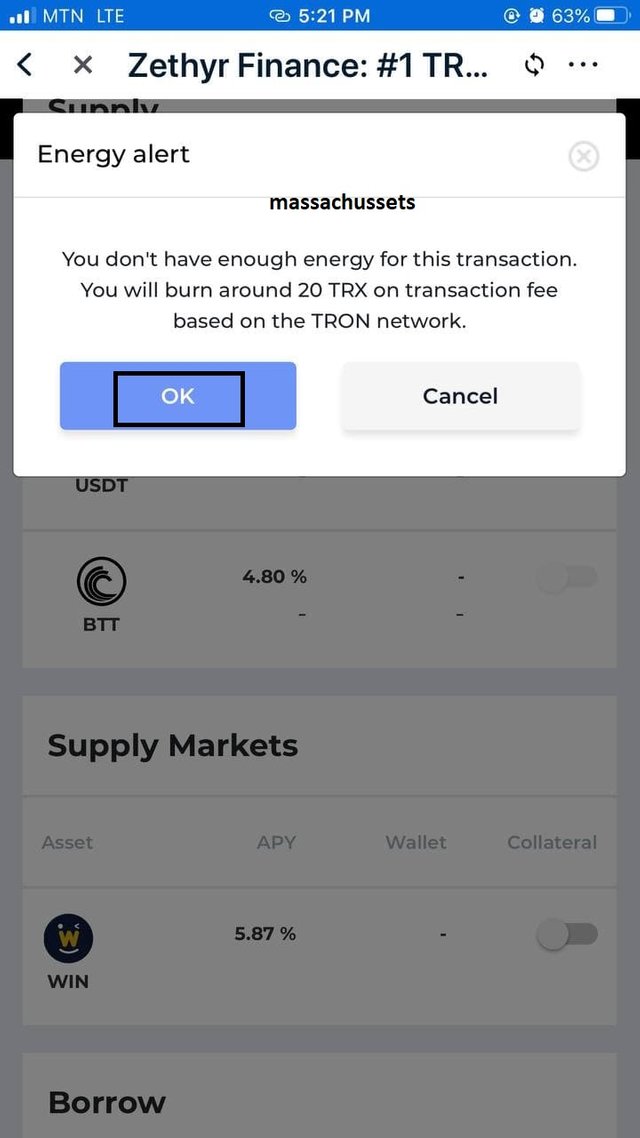

- A pop up window appears telling me the amount of TRX i will be burning. I will be burning 20TRX.

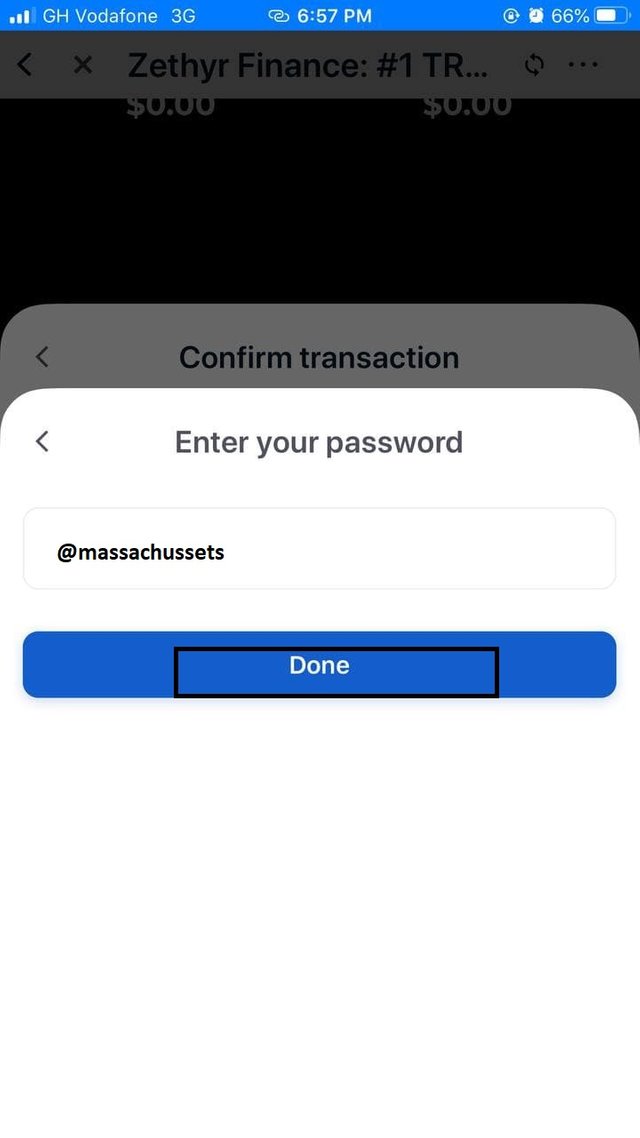

Now a new window appears asking for you to enter the amount of TRX to be supplied. Click on supply if done. For me I chose to supply 10 TRX.

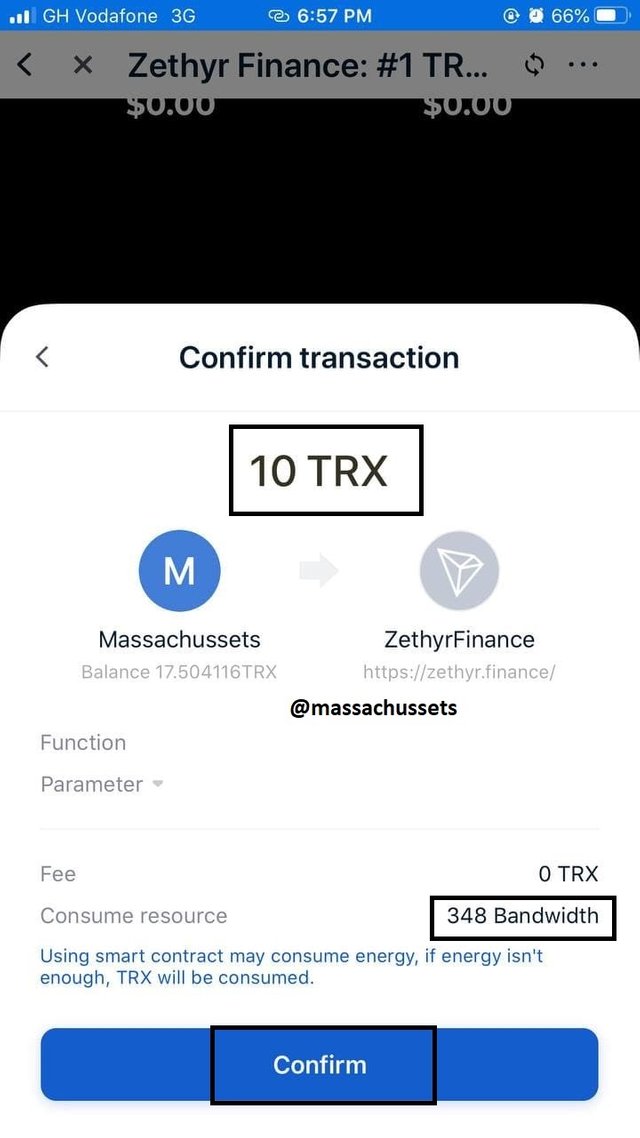

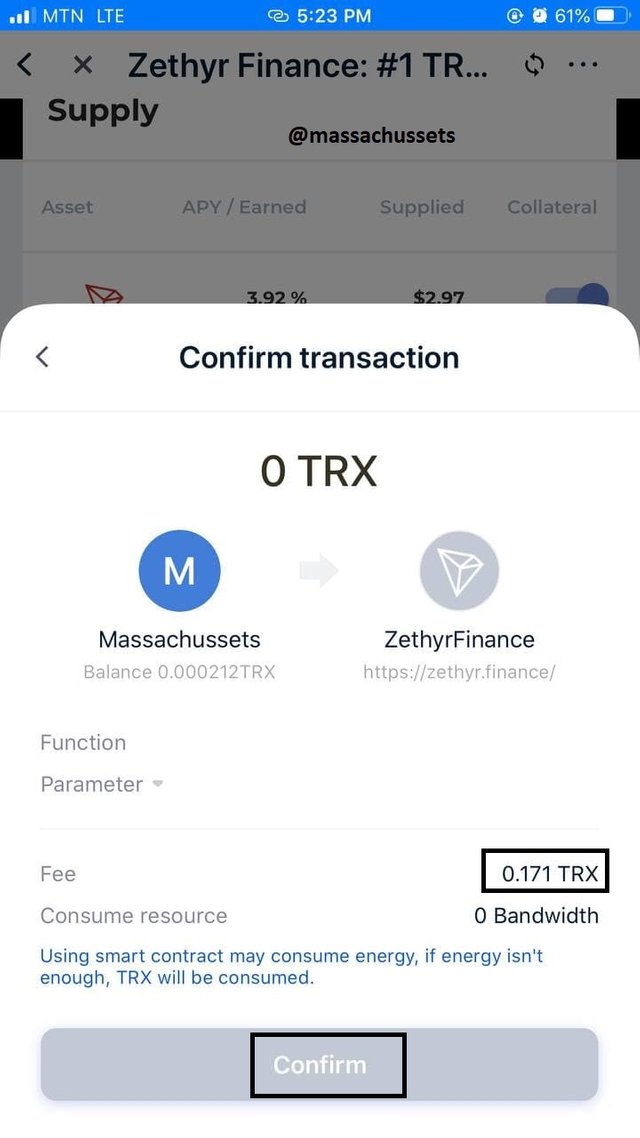

click on confirm.

Enter your password to sign transaction.

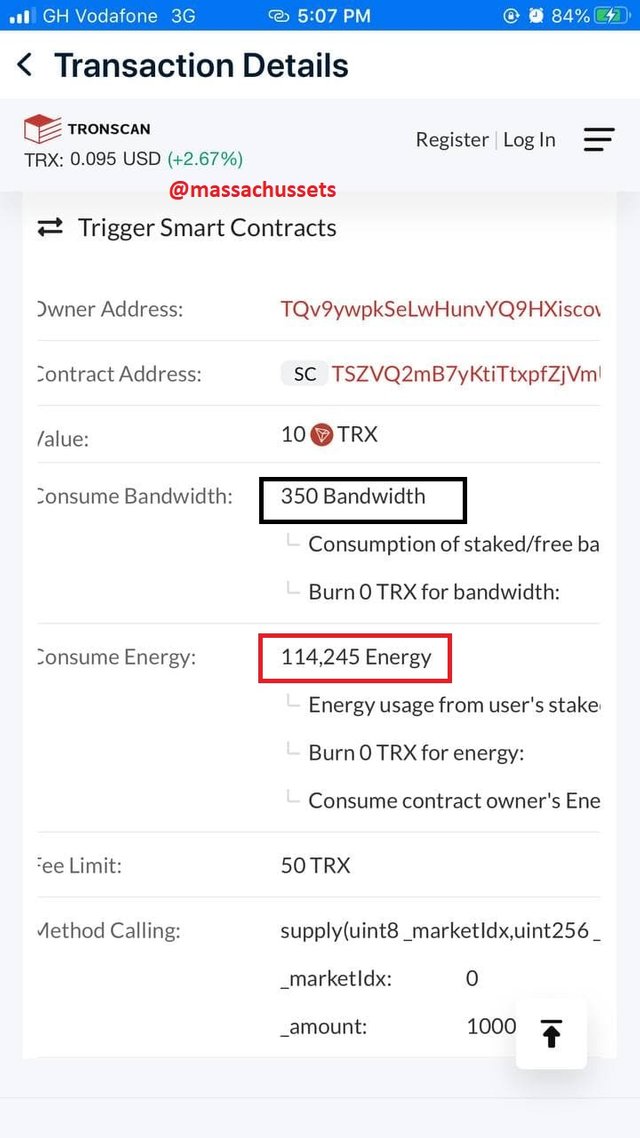

This is the transaction hash and the link

cbee6884c3e32da28c9edbc78ac816bb7a8235d94ba4df443ea7b06a5b6f862c

https://tronscan.io/#/transaction/cbee6884c3e32da28c9edbc78ac816bb7a8235d94ba4df443ea7b06a5b6f862c?lang=en

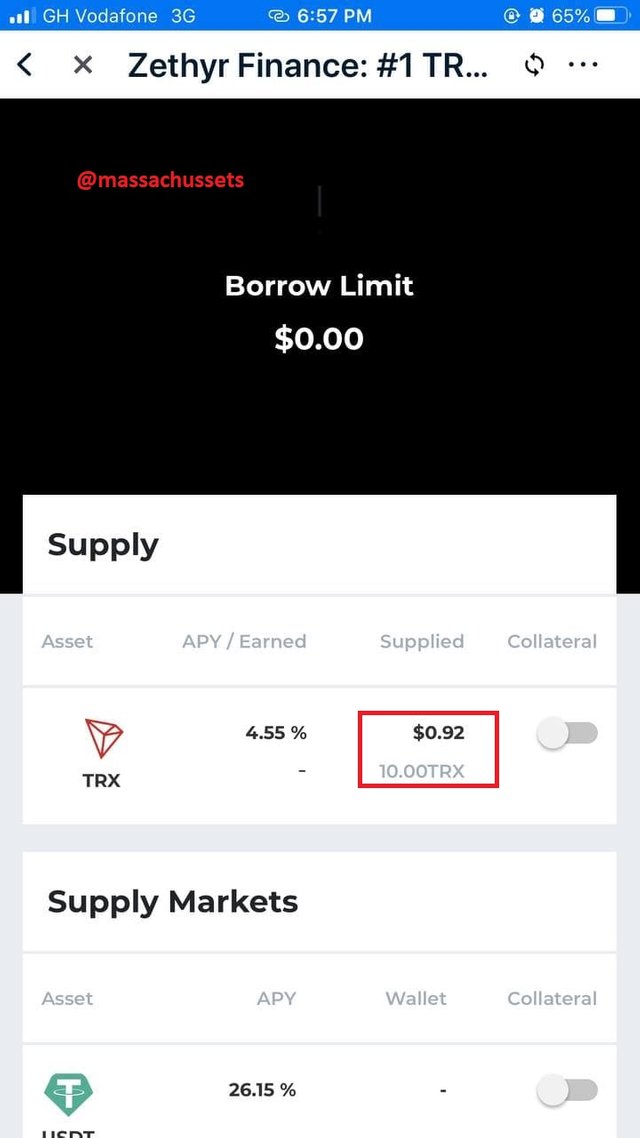

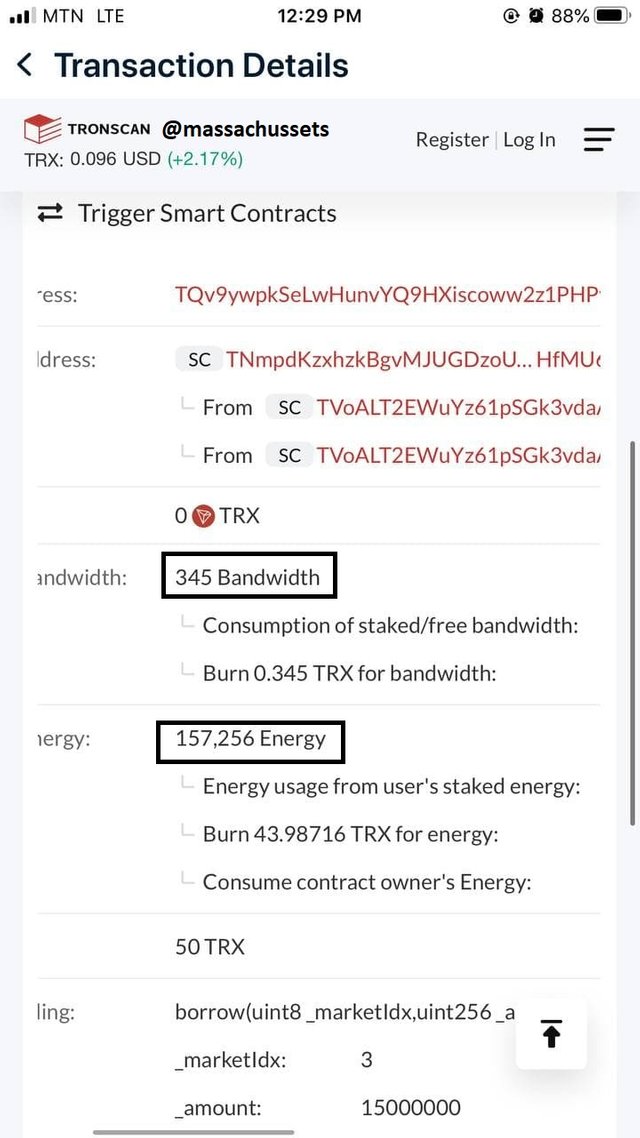

From the screenshot below from tronscan we can see that the transaction consumed a total of 114,245 Energy and also a bandwidth of 350 but incurred a fee of 0TRX.

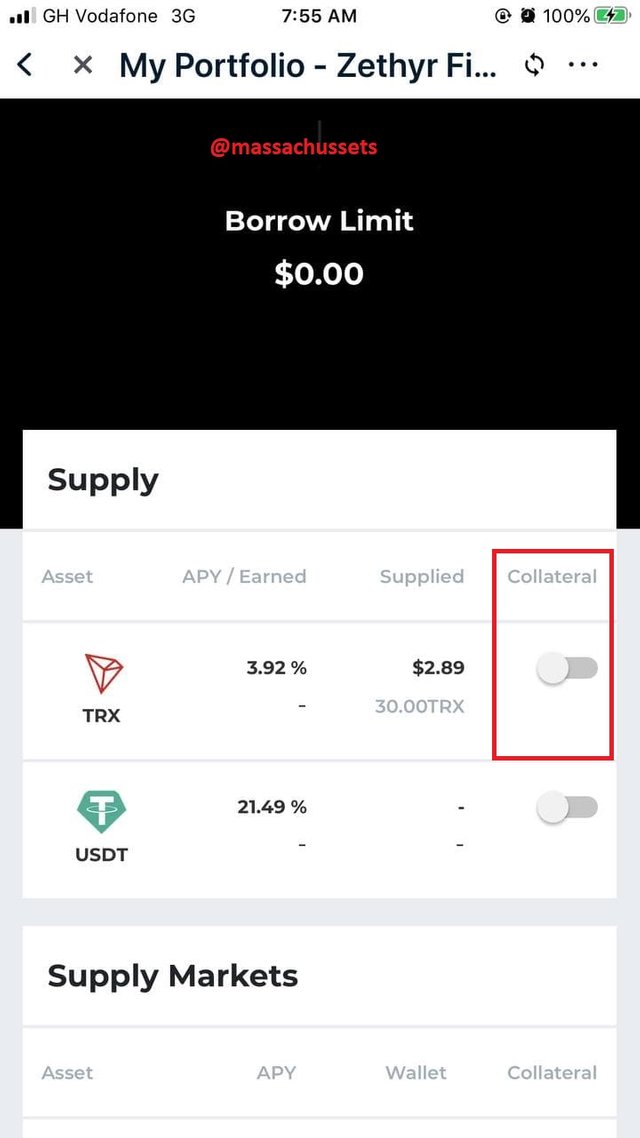

7- Collateralize your asset to Borrow on Zethyr Finance, repay the borrowed asset and withdraw your supply. Show the steps involved and your observations (like the fees incurred). (Screenshots required).

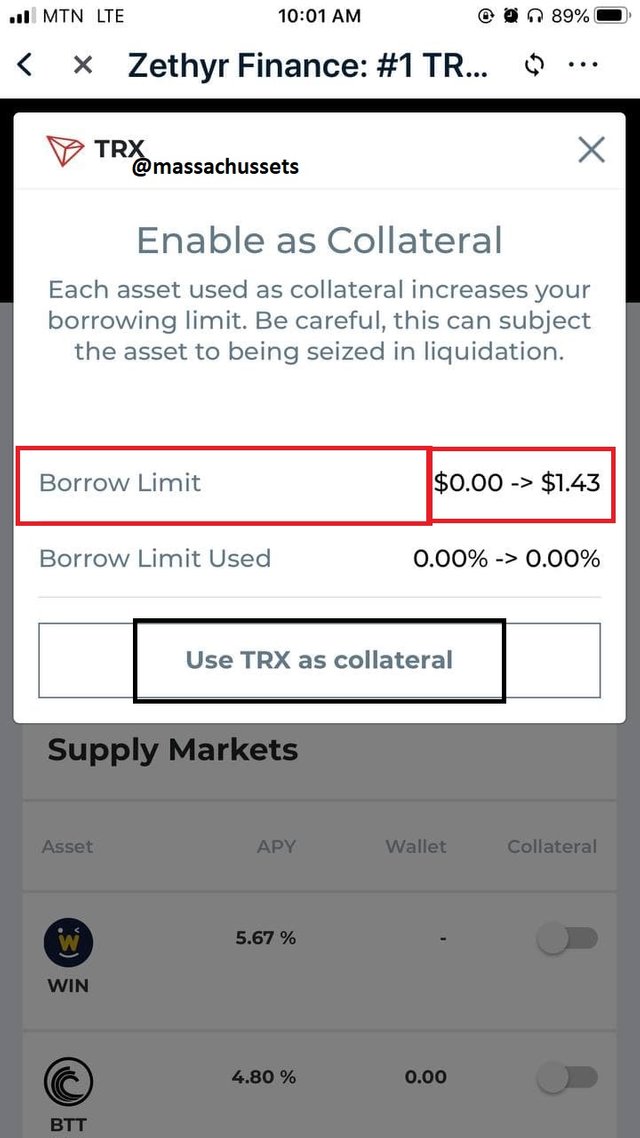

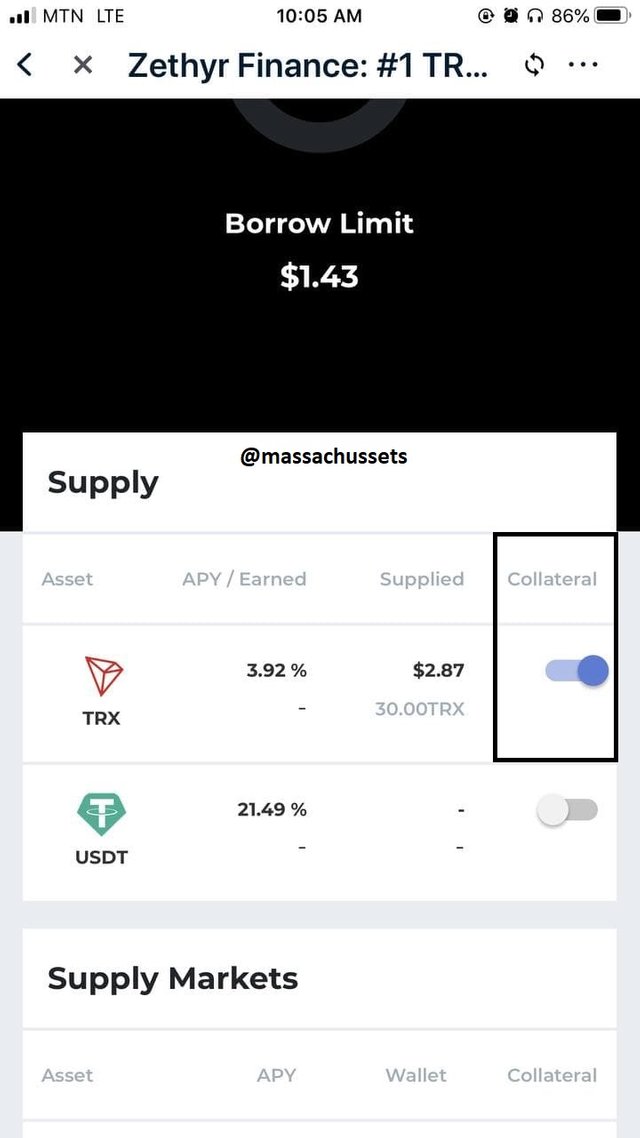

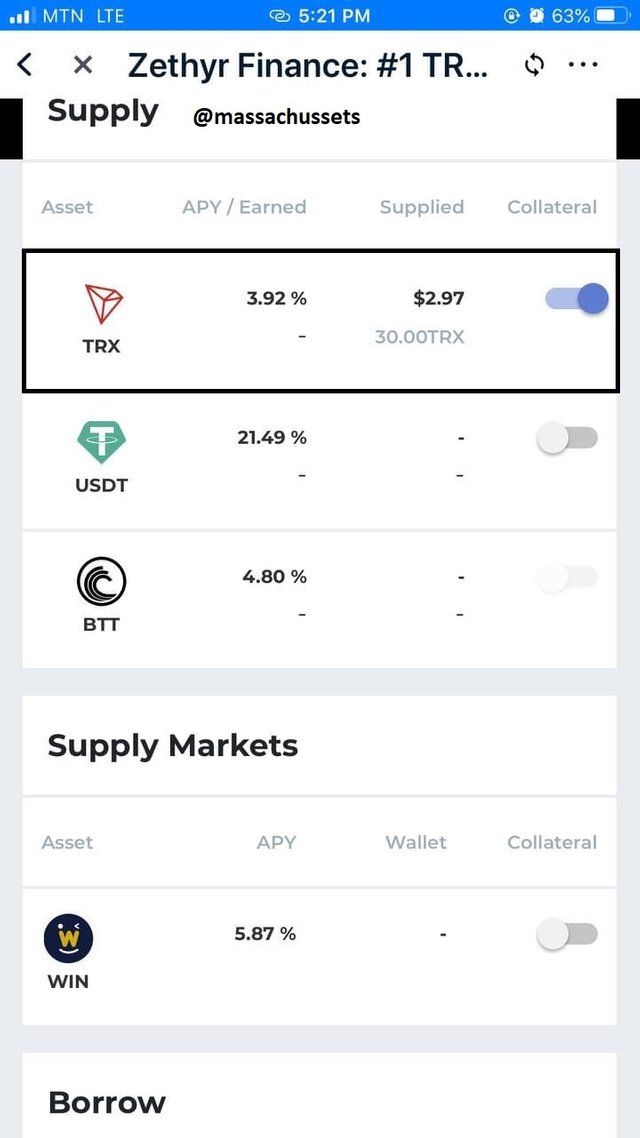

- With reference to my post above, we can select the collateral button under the tron asset.

- A pop up will show asking for a confirmation to use as a collateral.

- click on use TRX as collateral from the pop up.

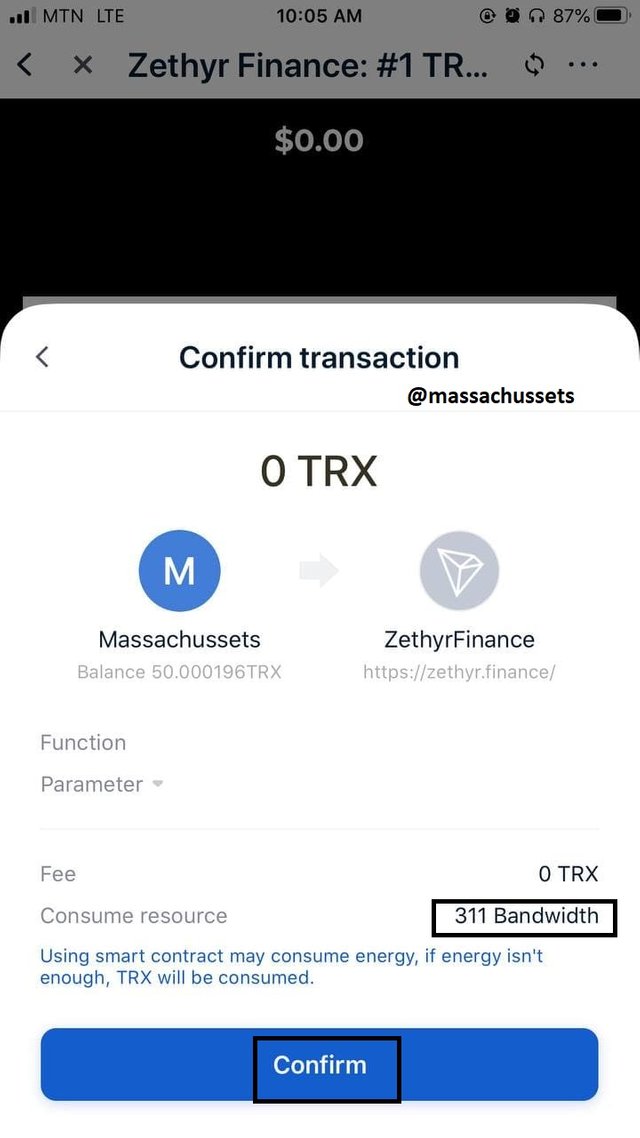

- click on ok to confirm the energy warning.

- Now input your password to process it.

.jpg)

.jpg)

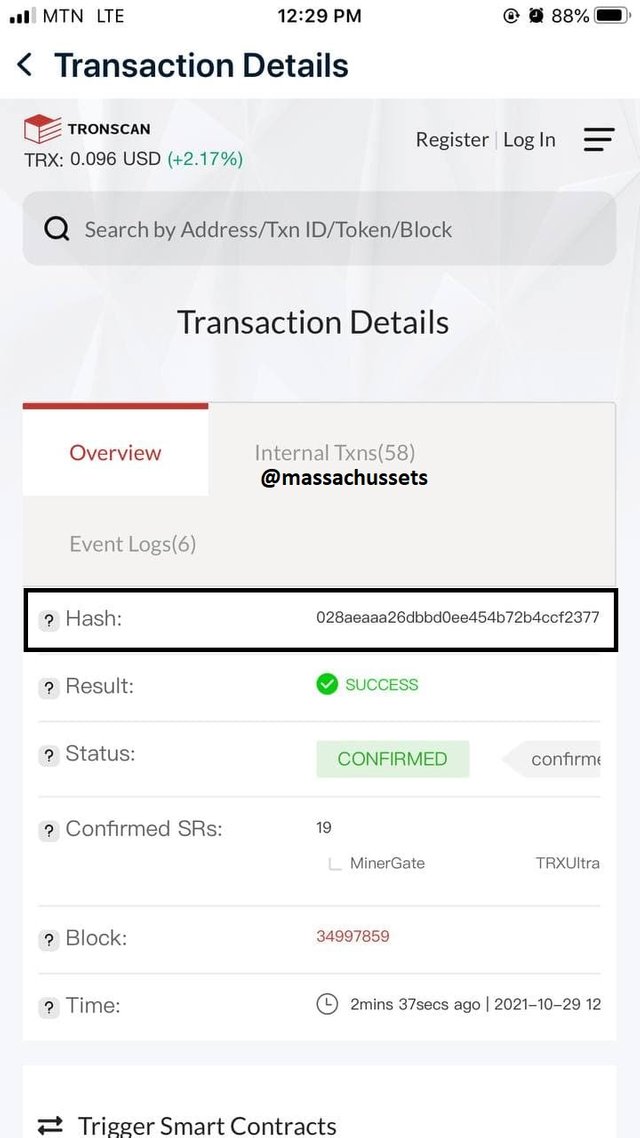

This is the transaction hash and the link

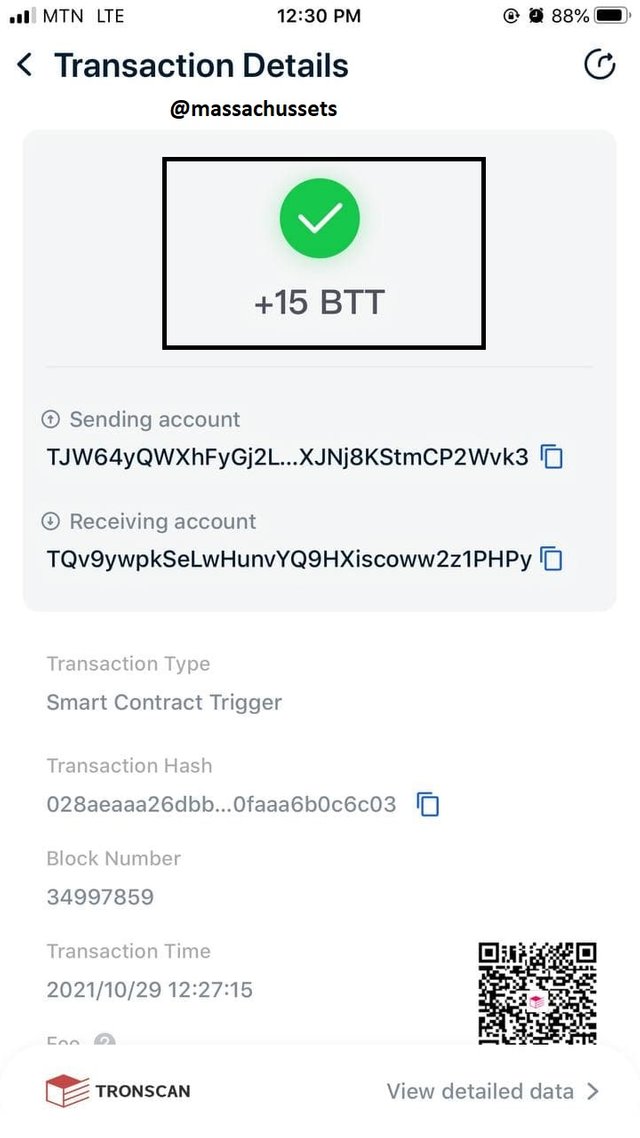

028aeaaa26dbbd0ee454b72b4ccf237739abc3852891dd331d60faaa6b0c6c03

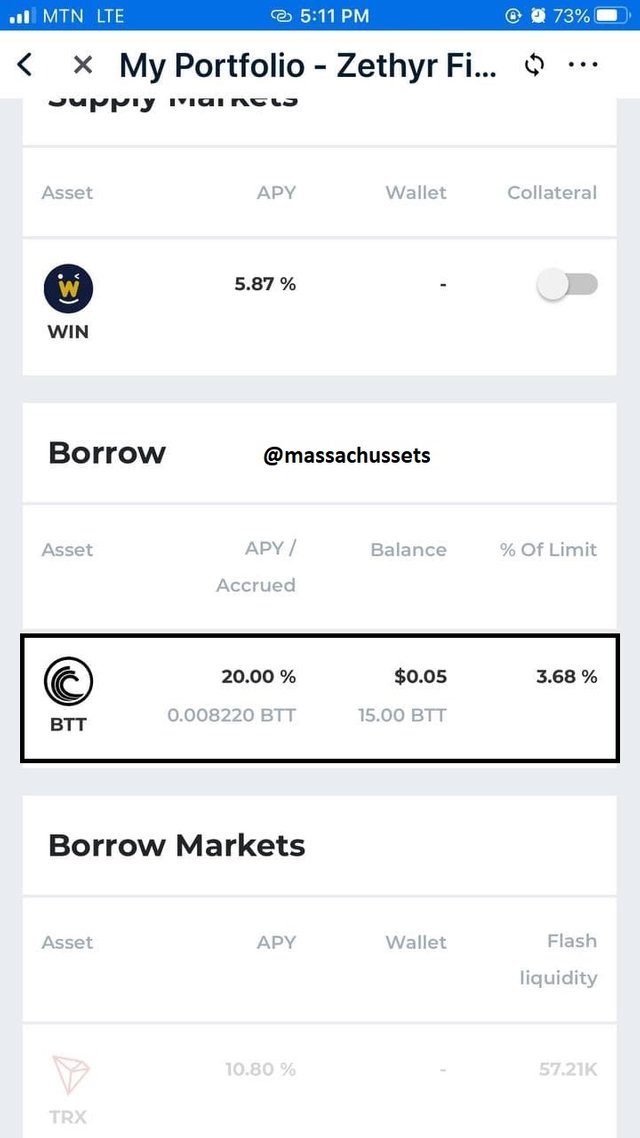

After all this is done, you have now set to use TRX as collateral. We are now good to borrow.

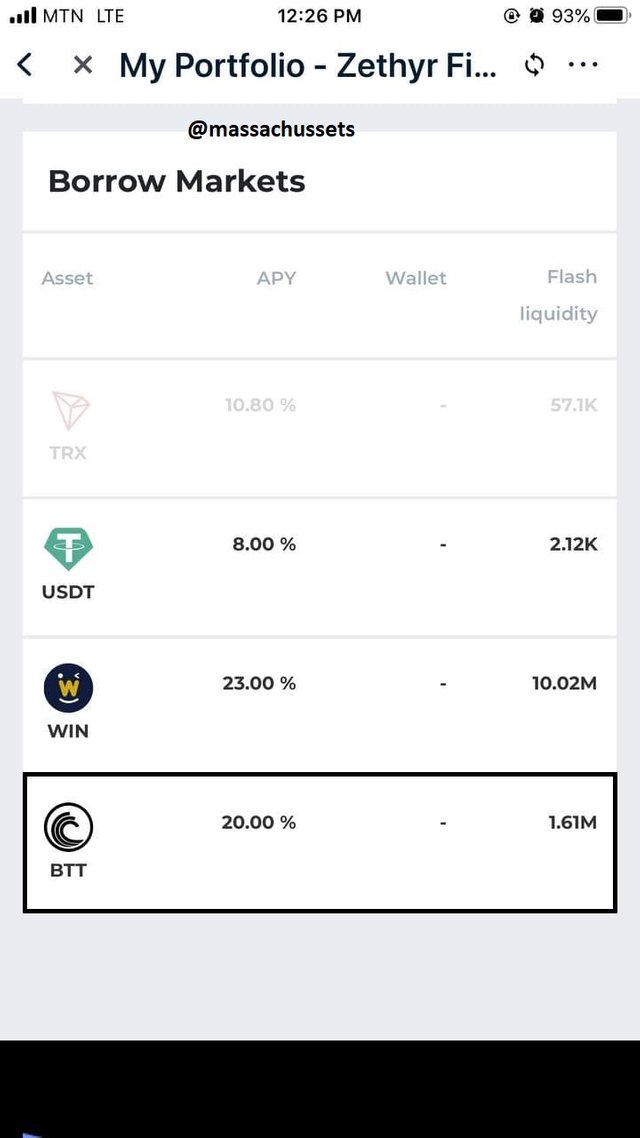

- Firs of all, I will select the market in which i want to perform the borrow on. In my case i will be using USDT.

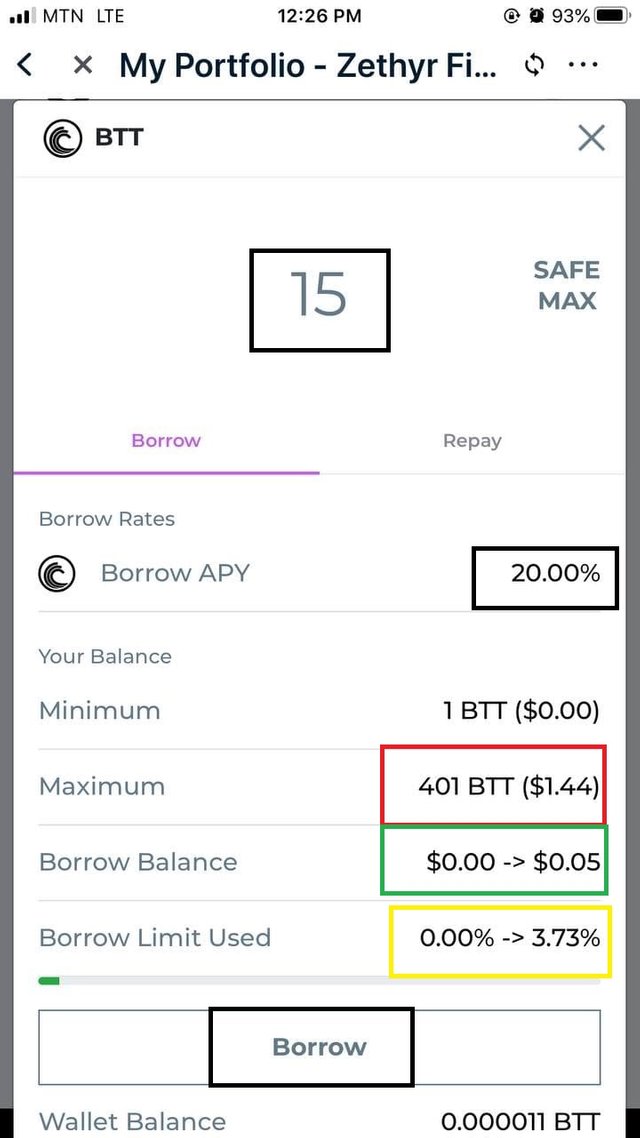

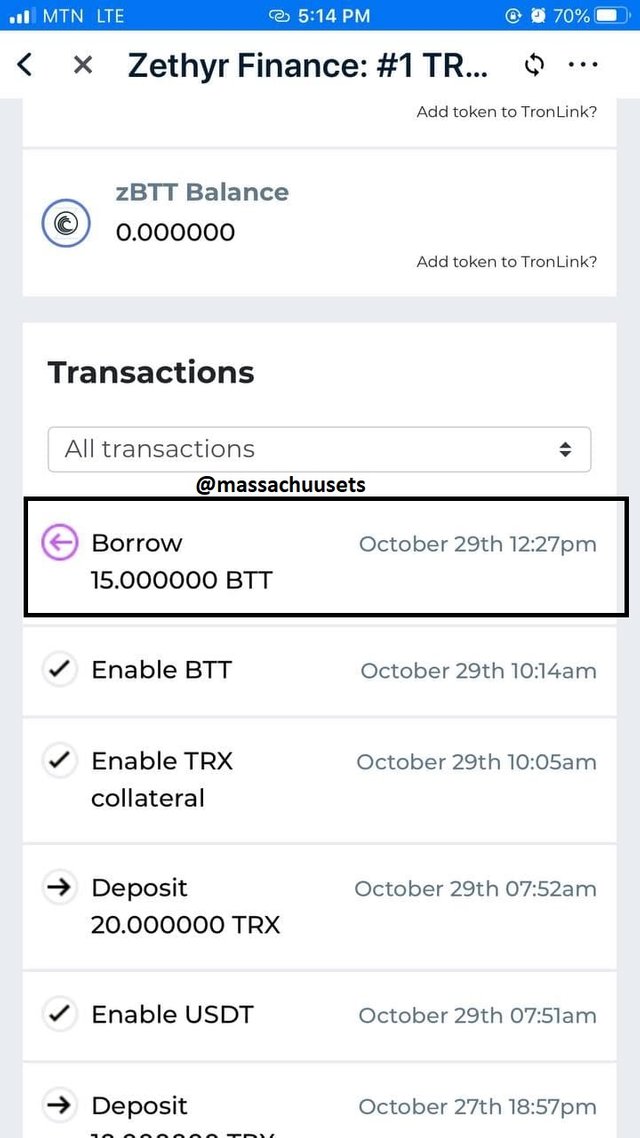

- Click on the BTT asset.

- Click on Enable

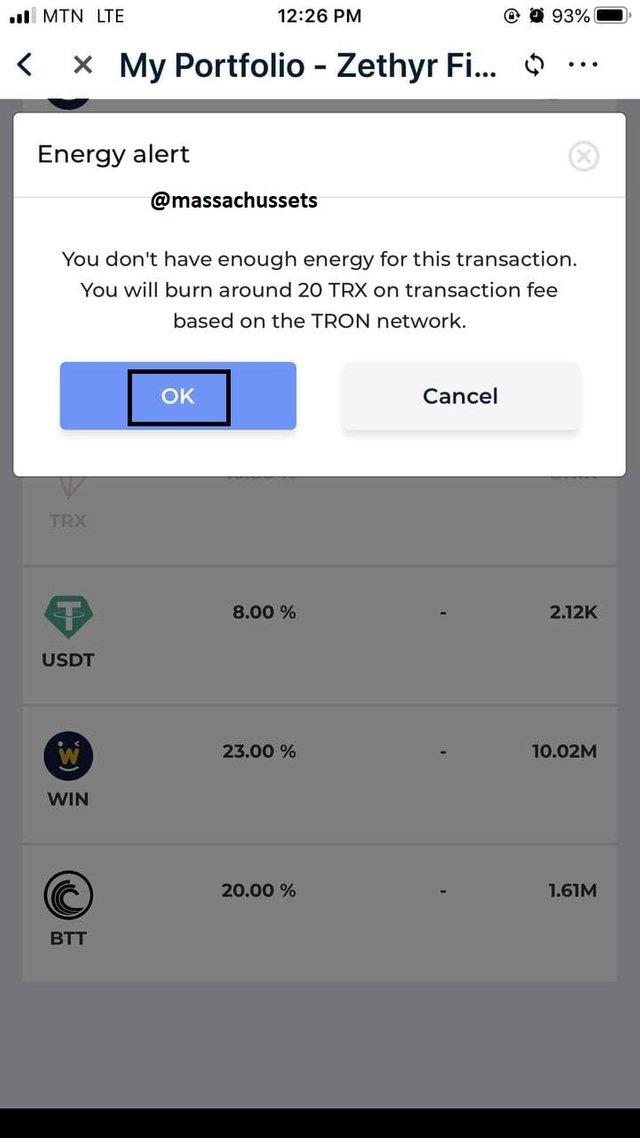

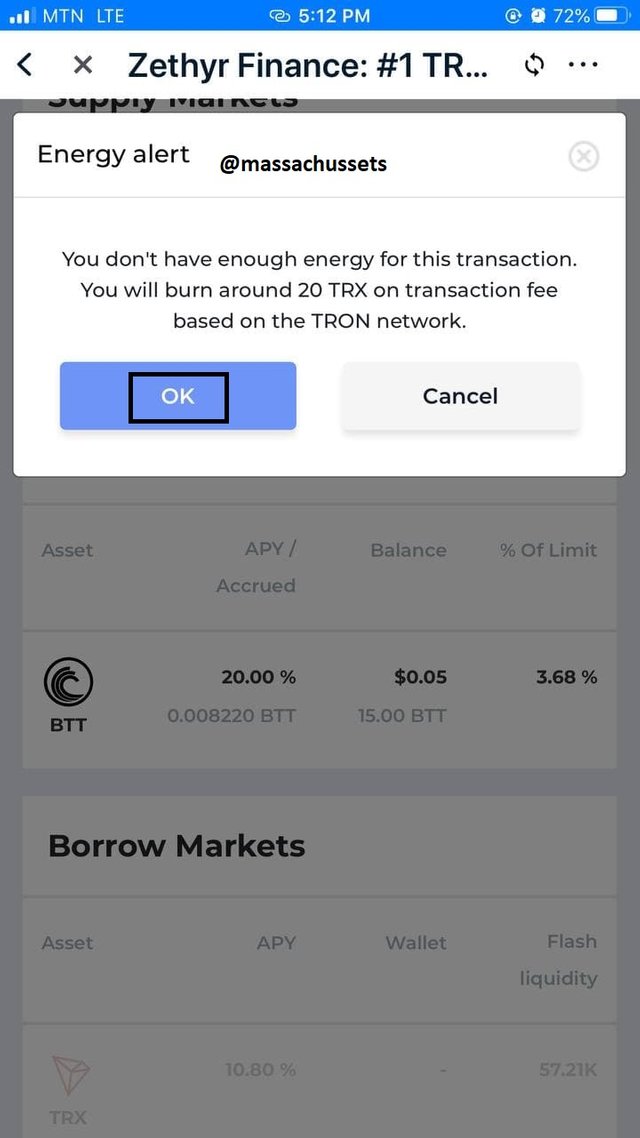

- click on Ok from the pop up that tells you the amount of trx to be burnt. Here 20TRX

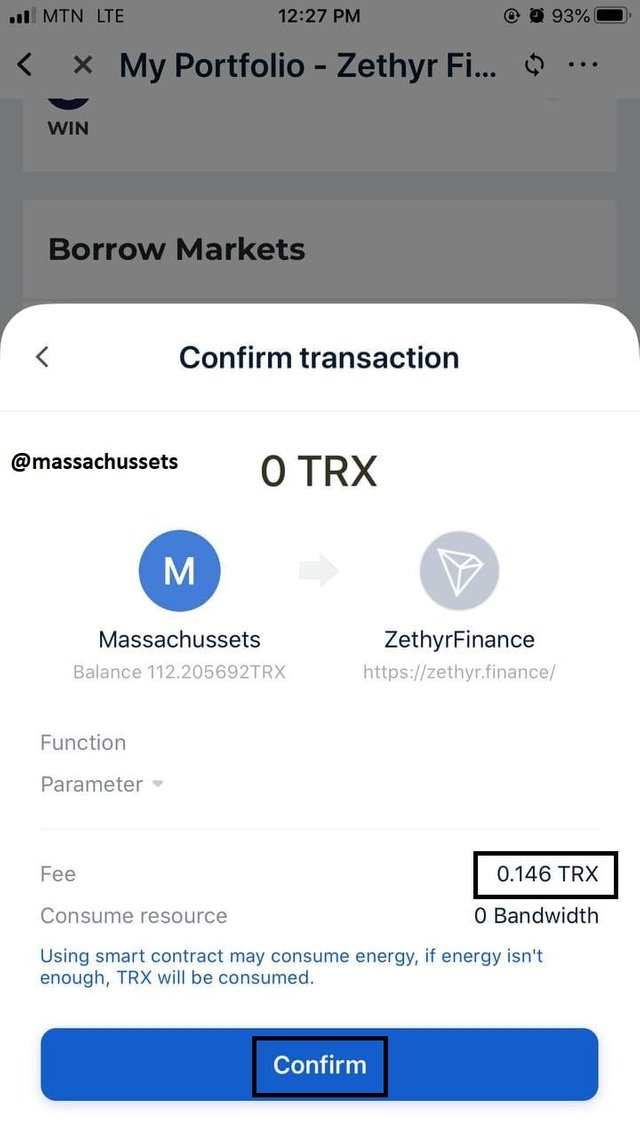

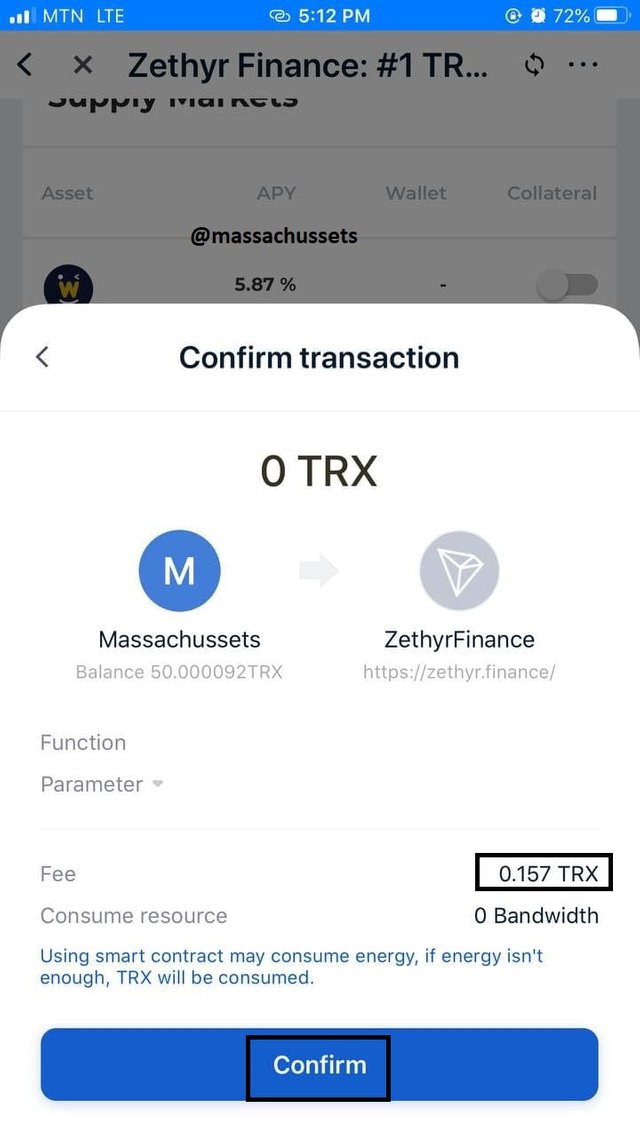

- Confirm transaction

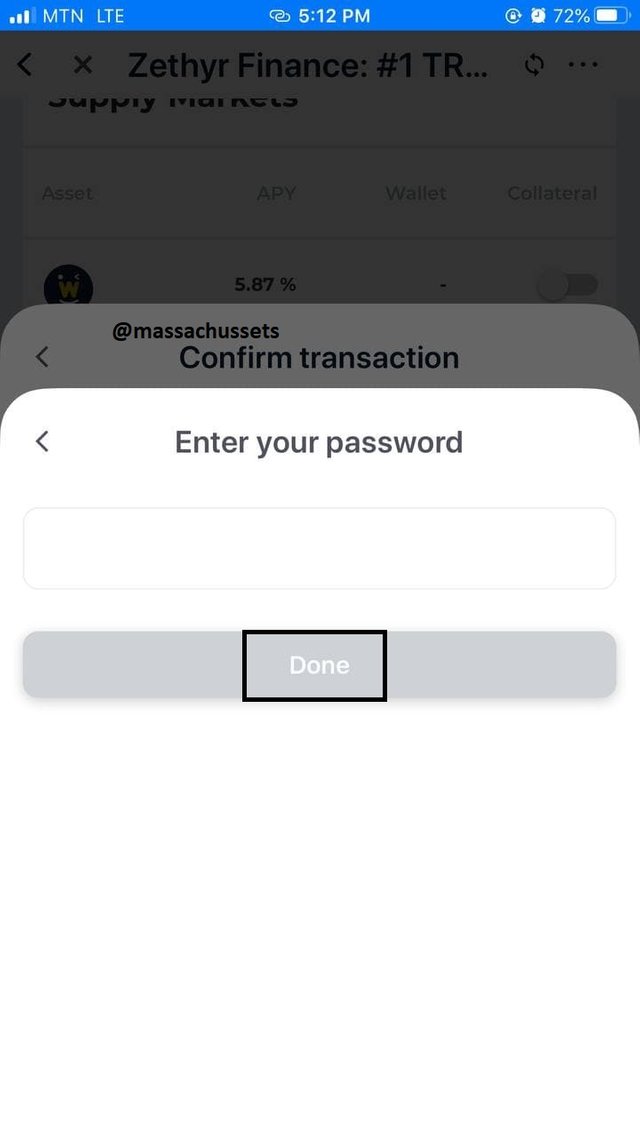

- Enter the password to sign the transaction

- click on the BTT.

- Enter the amount you wish to borrow. Here i entered 15

- Now click on Borrow

- A pop up menu appears showing the energy required which is always 20TRX

- Click Confirm

- Enter your password

.jpg)

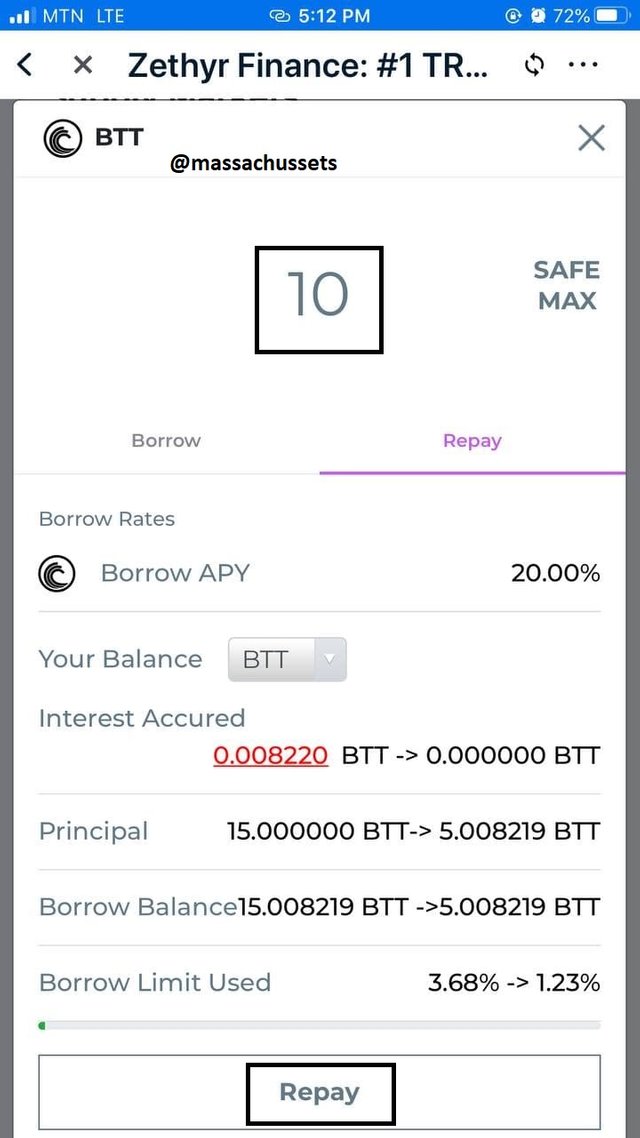

Now lets look at how to repay Borrowed asset

- First of all you must click on the borrowed asset.

- Tap on to the REPAY option

- Enter the value

- Click on the** REPAY** button

- Click on confirm.

- Enter your password.

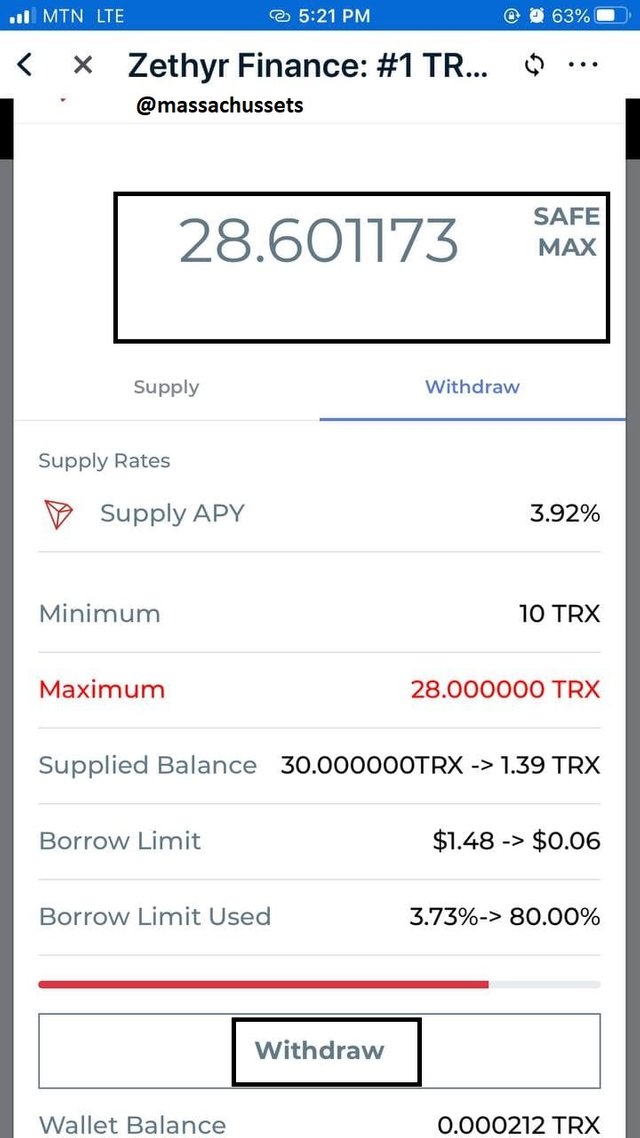

Lets talk about how withdrawing the asset from the Supply Pool

- First of all, Go back to the supply asset option.

- Click on the asset that was already supplied

- Tap on the withdraw option

- Enter the amount or just click on SAFE MAX and then click on withdraw

- Click on confirm

- Enter your password

I had few problems while trying to repay and withdraw. I have used almost 200TRX but the results are still the same. But i have really understood the steps. I cant proceed again because i have lost so much trx in the process of burning which never reflected.

8- What do you think of Zethyr Finance? Is it great or not? State your reasons.

The Zethyr finance is a decentralized finance that is operated on the tron blockchain. For me yes it is a great thing. Below are my reasons.

The Zethyr finance protocol is less expensive for everyone as compared to other exchanges. In fact the fees charged are 0.1%.

It is a DeFi that provides suppliers the avenue to earn much profits from their funds.

It also provides suppliers a platform for them to lend out their funds which in return maximizes profits for the.

It also give suppliers the chance to exchange TRC-20 USDT for ERC-20 USDT.

Since the Zethyr finance protocol uses the DEX aggregator which basically allows suppliers to choose from a variety tool available in a single page suppliers do not need to worry about order books all you need to do is just swap and you good to go.

Conclusion

It was such a wonderful lecture once again by prof. @fredquantum on Zethyr Finance. Through the assignment i really explored so much. The Zethyr Finance is one unique decentralized exchange that is known for lending and borrowing that is built on the tron blockchain. It offers its suppliers so much profits from their funds. It also has a relatively low fee charged per transaction. Suppliers can also exchange TRC20 USDT tokens for ERC20 tokens. Thank you.

.png)

#club5050 😀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit