Dearest of all, Steemians, Oh, and it's another adventure at the crypto academy, too! I really enjoyed the lecture from professor SAPWOOD and will be working on the related tasks for the rest of the semester.

Let's see: Question 1: What are the various "markets"markets""X" supply and demand will have to say regarding X lendings" options, as well as what is the lowest ""supply deposit"" rate""X""?"

(Screenshot needed)

JustListed available markets that provide both a supply and a way to borrow will be mentioned below:

appeared to disappear in an instant (TRX)

as well as numerous other cryptocurrencies and blockchains (ETH)

expanded polythene dots (SUN) Expanded tetraphosphonate phosphonium (TETP) (SUN)

We take collateral just in the Tether coin (tUSD) (WIN)

only still images that don't use the .JST suffix

A network of superstitious individuals' assumption

In other words, the markets, with the highest yield are found in the top spot on the SUN Loan Profile Tables and the market that offers the lowest cost is on the 0.73% Lender Payments Sun Tables (USDJ). Please give a look at the following screenshot to see proof of this claim. Currently, SUN supply is quite close to that of both WIN phoenix and WIN employee matching, however, with time, the supply of WIN phoenix is more plentiful than of the employee matching.

Question 2:

What's system will you use to connect your TRONLink Wallet to JustLend, and what kind of token (token. e. TRX, SUN, etc) will you use to provide revenue? furthering research to support/discovering additional evidence

Getting the TronLink wallet linked to JustLend

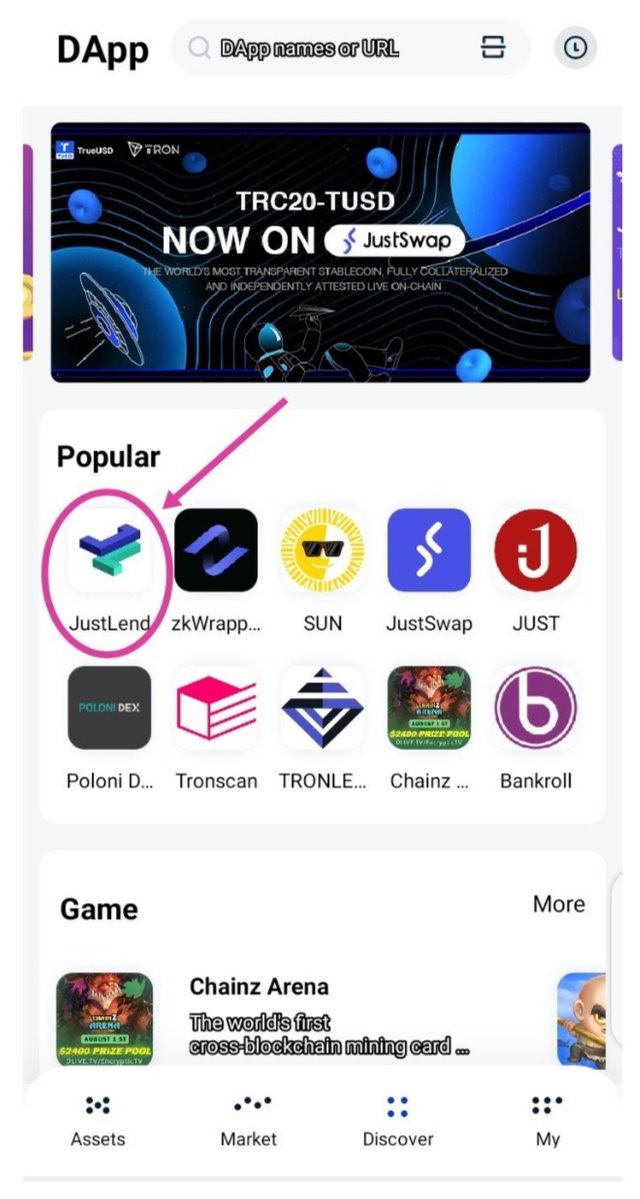

Use the Tronlink application.

Look under the “Find new and recently installed apps” on the application window' on the bottom of the screen.

If you would like to find out more about just lendit, click on the Popular button on the home page.

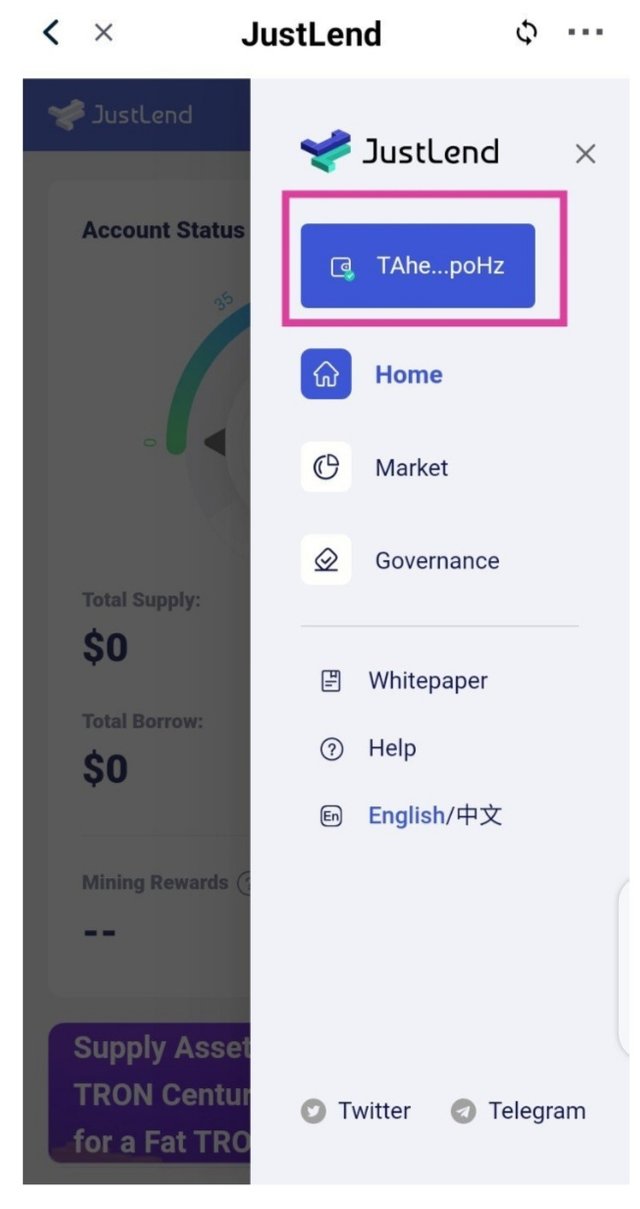

In that case, the wallet will be connected and is visible as a single card that automatically expands.

If a market is required, how do you meet the demand for just-in-time growth?

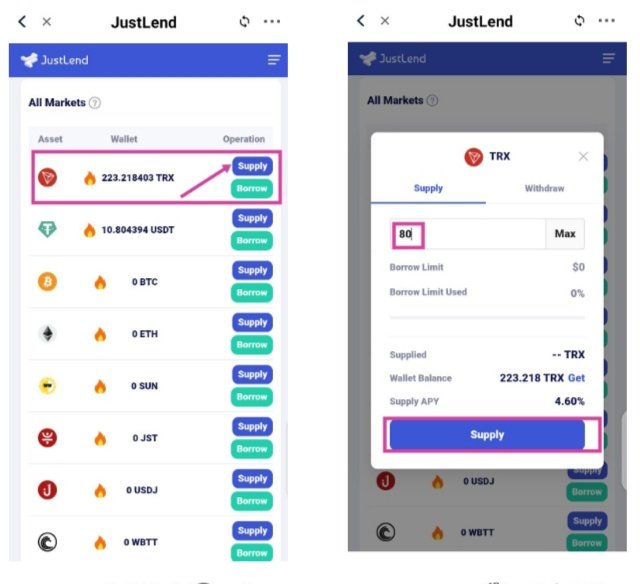

Go in any market for that you are selling in to, whether you're currently focusing on or on different products (In my own situation, I will supply TRX).

Then choose to expand your exploration of the TRX supply.

put the amount (80 TRX, at 4.60% APY) in my situation, and enter my TronLink password.

The supply contract was completed with flying colours, or nearly so.

Question 3:

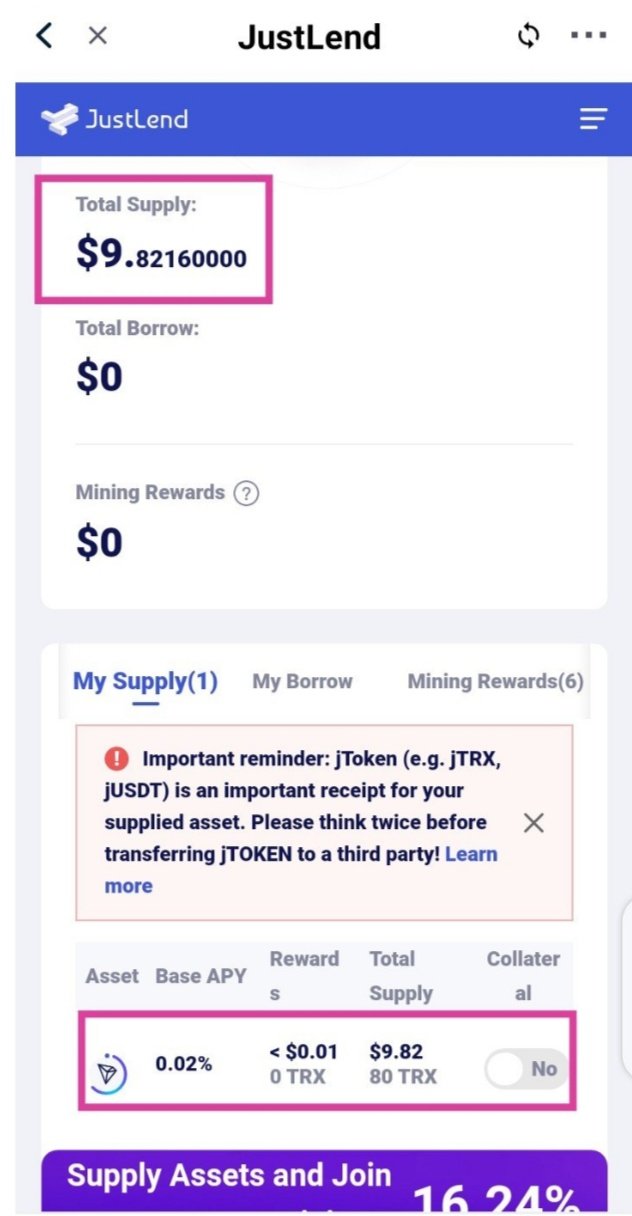

Once a specific token has been supplied, the second step is to check your TronLink to see how many tokens have been acquired. One can give evidence from screenshots.

Your JustLend token supply will correspond to a certain JustLend amount of money you will be sent to the market, no matter what the rate you supply to it.

To put it simply, if you purchase TRX, you will receive TRX, and if you purchase BTC, you will be rewarded with BTC.

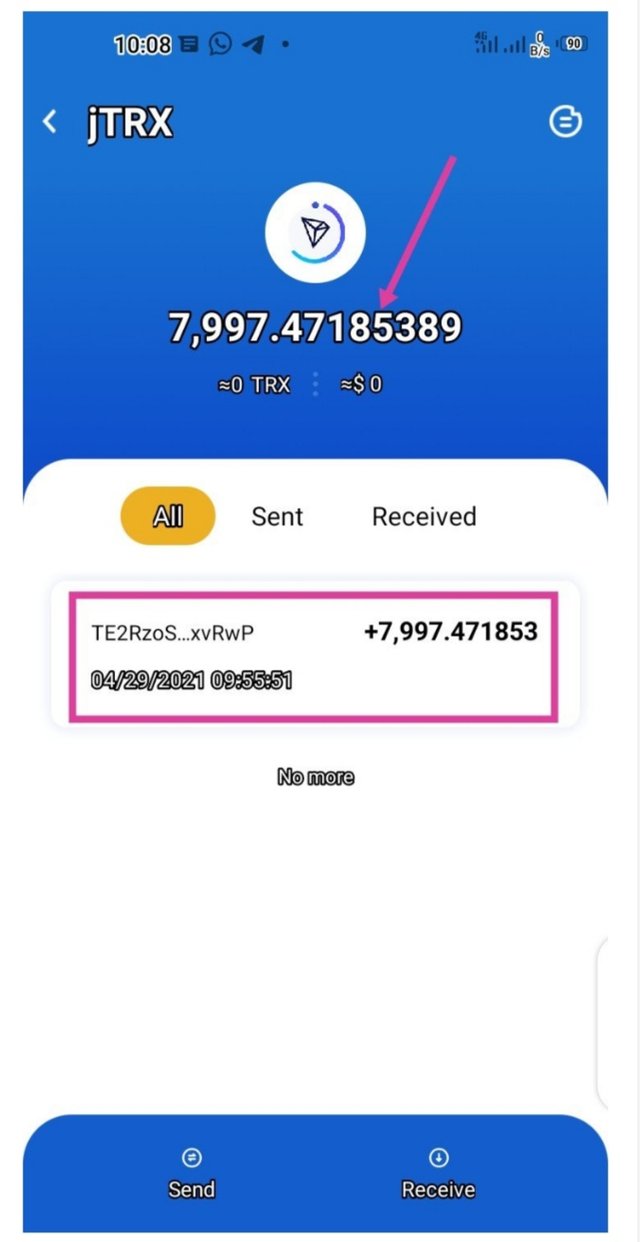

The value in my TronLink wallet is now 7,997.389 jTRX has been doubled after providing TRON on JustLend.

Question 4:

How can you add a new asset to the number of borrowed tokens? Are you able to borrow 1USDT and expand it to 1 step by step to see the entire borrowing process, or did you need to annotate a higher USDT copy of the screenshots?

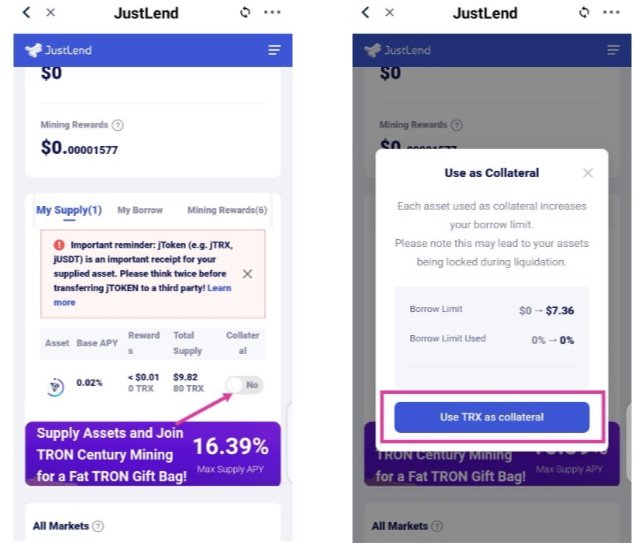

To make the portfolio position I took in jTRX expand, I will activate the collateral features, which were previously deactivated.

The new page is being loaded in. When the page has finished loading, select Trx for Collateral.

Perform the transaction as usual, but additionally log in using the password.

The transaction was successfully completed.

I will pick a collateral from the collateralized jTRX button, which will allow me to use a different market and allow me to use a different market

a USDTollar 1.82 as much as a dollar in the LESS Reserve Base Rate Fund, as compared to the base fund and that means that I am utilising about 13.58% of the money I can borrow from it.

You just put the price to continue and a single unit of USDT is successfully raised.

Question 5:

When did you make the purchase, how much interest did you pay, and what would cause the liquidation of the item to be due? The answer to your question, what is the expected APY (Annual Percentage Yield)? How would you estimate the level of danger/uncertainty in your case? Until then, use Expand

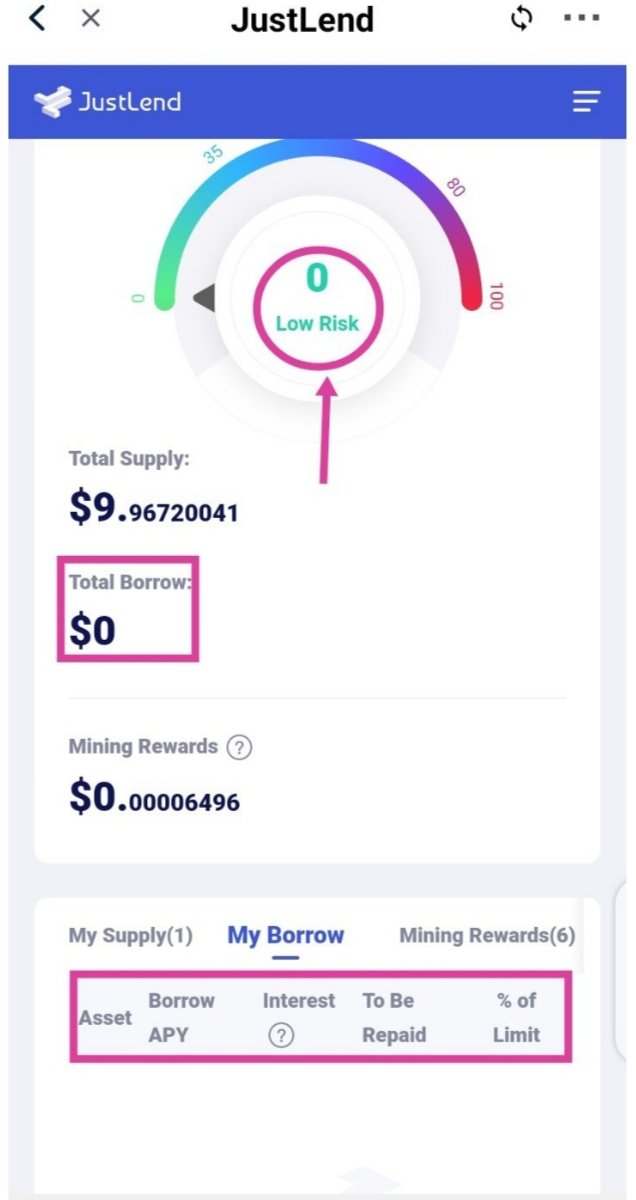

as revealed in the number of <1 USDT used as shown from the screenshot of my bank's previous financial account, the volume of my transaction was much lower than usual, the interest was approximately 0.01 USDT (less than 0.01 USDT).

I received 80 TRX, and now have my account-to-exposed-risk (default) credit TRX held as collateral, resulting in a net exposure of 13.58 percent and a net interest (after repayment) of 4.42 percent The stock market capitalization of my JustLend investment would be cut in half if the risk level reaches 100% Below you will find screenshots of my APY and account balance:

Question 6:

To expand on this idea, how do you return and unlock your asset with JustLend? Watch out, because there's another X

The asset that was borrowed can only be repaid using USDT, so I have to choose the USDT-dollars option and click on it."

The cursor should be moved to the next paragraph in the document.

[Selecting the amount of USDT] and then pay it back by] paying back the maximum amount selected

A customer must put in a PIN and then click "Pay" to complete the transaction.

Conclusion

JustLend is definitely a great platform on which buyers can trust because they know that sellers are giving and being paid. There are also other markets for which customers can borrow and supply if they so, once they have their products delivered, the buyer can easily become a lender, provided. This lecture gave me a new insights into JustLend and for allowing me to participate in the free crypto offering.

Sorry, dear.

The minimum reputation to participate in this Task is 50.

We would encourage you to join Newcomer's Community and try to complete the Achievement Tasks, that way you will earn and also grow in reputation.

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit