Hello friends,

I like to thank you @awesononso for providing us the valuable resources to know about the order books. This is so helpful as we always trade in the cryptocurrency market and the order book plays a vital role in the trading.

1. Define the Order Book and explain its components with Screenshots from Binance.

The order book is a digital list of orders (includes buy and sell) for the financial asset and This will be organized by the pricing value of the orders. And the main important thing about this order book is that it was updated in real-time and this was the great benefit of the digital order book. It will show dynamic results throughout the day. After that, this order book also helps to know at what price buying order is placed and at what price a sell order is placed. This helps traders to place an order.

It was shown on the right side of the Binance advance chart. In the Binance platform order book is nicely represented and as you see in the below screenshot you will easily identify the buy and sell order as Buy orders are shown in the green color and sell orders are shown in the red.

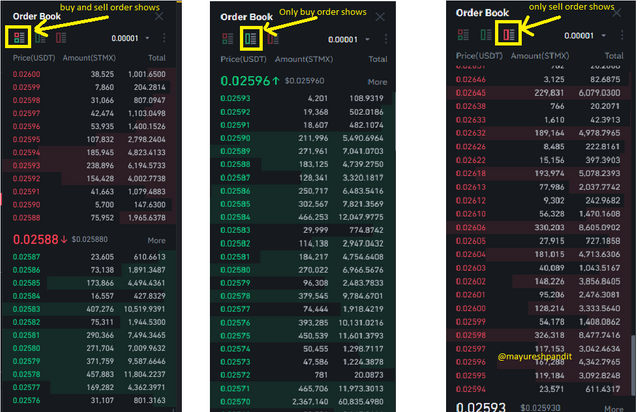

In the Binance they offer three views of order book as in the default view shows buying and selling order both will be shown and they also offer only buy orders view and only sell order view.

As you see there is a filter to show and hide the buy or sell orders. As I select the filter 0.01 USDT its only shows the orders above that price level as you see in the below screenshot.

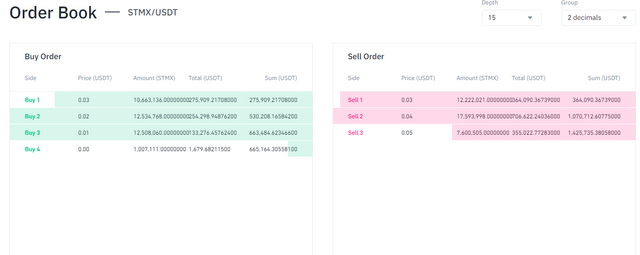

If you click on the more option from the order book then it will land you on the below page where they show buying and selling orders in more detail and in that you get two dropdowns to select the depth and decimals and according to that orders will be shown.

Order books are most helpful to see the liquidity of the particular assets and it helps also to check the support and resistance level of particular financial assets. Also helps the investors/traders to know the highest buying bid placed for that particular asset and the lowest ask value for that particular asset. When their prices are matched it placed an order and that particular trade enters into the trade book and also updates in the current order book. As it was a digital order book all the things are happening in real-time and that was so helpful for the traders and investors.

2. Who are Market Makers and Market Takers?

As we make a trade on the platforms like Binance, Wazir,x, and many others, It is very important to know are you a market maker or a taker. As trading charges for market makers are low compared to the market takers. Market maker fess are compared to lower as it promotes the liquidity to order book and it helps to build the market place and Market taker are those who take away the liquidity from the order books and Makers or takers fees will be charged after the trade are completely executed. Let's see in the details:-

Market Maker

Market makers are like assets for the order books as Market makers are placing the limit order that will buy or sell orders as per their need. But these orders are not immediately executed and it helps to build a marketplace of the platform so they will be rewarded as low trading charges. Generally, this type of order is placed by the big traders and institutions as they have the patience to wait until the order is placed. Sometimes small traders like me also preferred to place the limit orders.

Market taker

Market takers generally the traders who take away the liquidity of the order book as they placed immediately order either buy or sell. They placed the order with existing prices from the order book of the asset to execute the order. As they accept the price from the order book and takes away the liquidity from the order book they need to bear higher trading charges. As they placed always market orders.

3. What is a Market Order and a Limit order?

Market Order

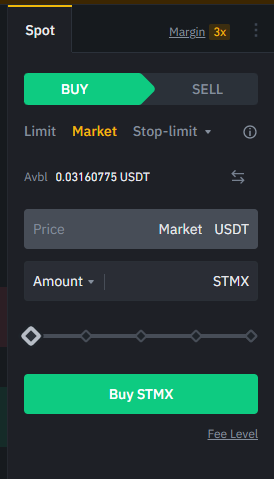

Market orders are the orders which are placed to execute immediately and accept the current bid or ask price. If you place the buy orders with market order type then it will be executed with the lowest ask from the order book and if it sells order then execute with the highest bid and to place this order using Binance you only have to choose the number of tokens and you're not allowed to select the price for the tokens.

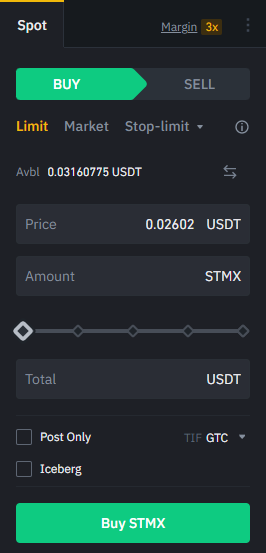

Limit Order

In the limit order traders/investors place, the orders with price different from the market price as results this orders take time to execute. It's like you simply guide the Binance platform on this price you have to place buy or sell orders.

4. Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

As I am earlier explain Market makers are that trader/investor who places the limit orders and this helps to give liquidity to order book and build the market place. As they help exchanges to build a marketplace they are rewarded with low trading charges.

Market Takers are referred to as the traders/investor who always placed a market order and they and as they place a market order it will be executed immediately and takes away the liquidity from the market.

5. Place an order of at least 1 SBD for Steem on the Steemit Market place by

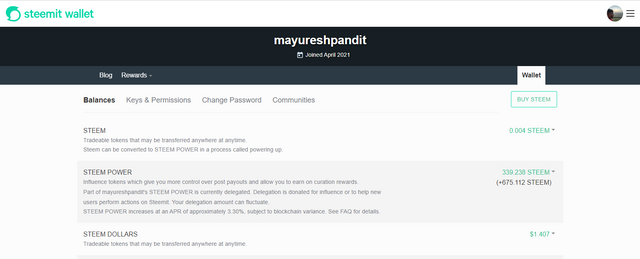

Firstly I log into Steemitwallet to perform this task.

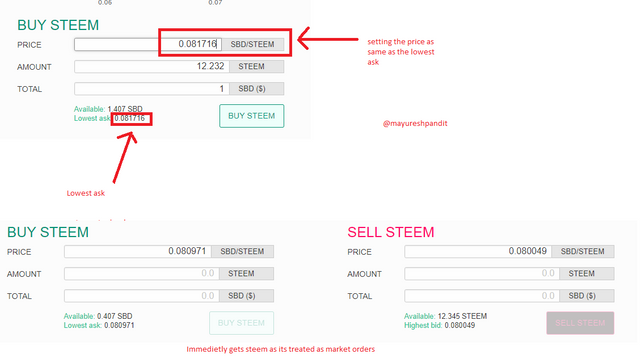

a) accepting the Lowest ask. Was it instant? Why?

As you saw in the below image I set the price of the Steem as the same as the lowest ask and it was immediately executed as it's treated as market orders. This is happening because there is a seller who demands the value of 0.081716 SBD/STEEM and I am placing a buy order with the same value then there is matched found by the Steemitwallet platform and executed our orders.

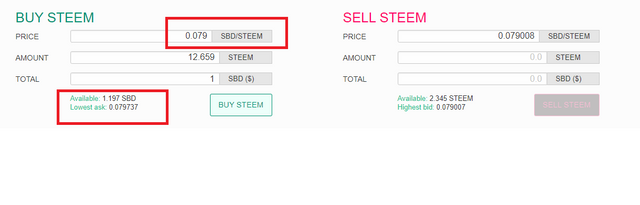

b) changing the lowest ask. Explain what happens.

To perform this order I sold some steam and buy an SBD as I don't have enough SBD in my wallet as I am already power up my last earnings.

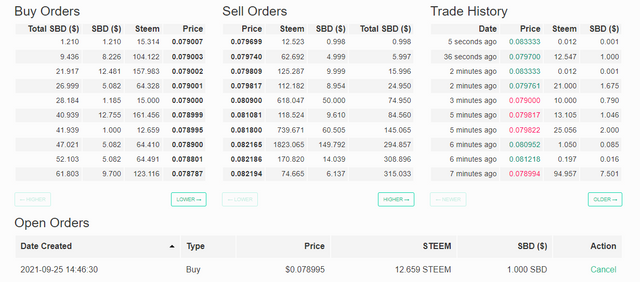

As you saw in the below order I changed the lowest ask and placed the order.

After that, it was goes into the order book and also shows me in the open order section. As it will execute when the seller agrees on my bid price and It will take time to execute.

6. Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

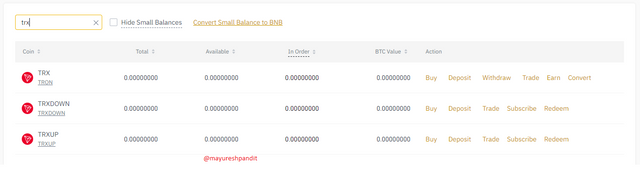

As you see all before placing the order I don't have any holding for the TRX token.

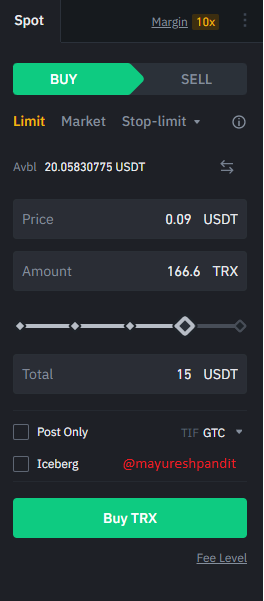

As I placed the limit order when price of TRX/USDT was 0.09146 that time I place the order with 0.09 TRX/USDT.

After placing the order It will show into the order book and in the Binance it will show with a yellow dot in the order book as I placed the order in that price level.

As it was the limit order it will take time to execute when the seller agrees to sell their TRX on that price level it will be executed.

7.Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

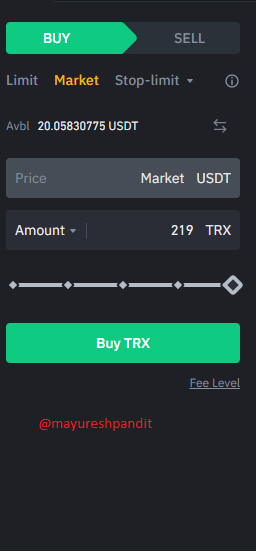

As I placed the market order of TRX/USDT with 219 TRX tokens it was immediately executed unlike the limit order and it was immediately shown in the trade book.

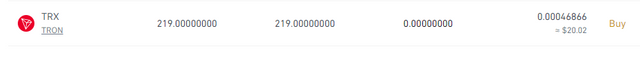

And all the TRX token shows into my wallet.

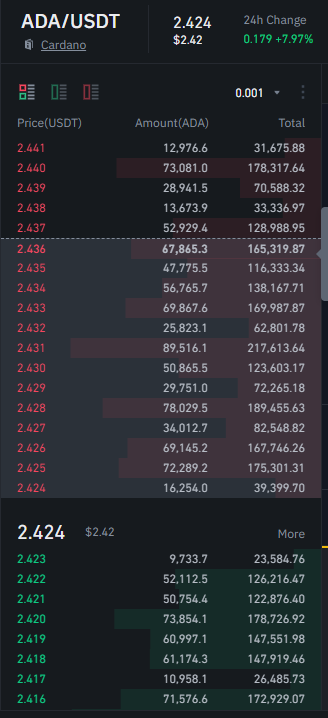

Q.8 Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices:

Below is the screenshot of the ADA/USDT pair at the time of this post written.

a) Calculate the Bid-Ask.

As you see in the above screenshot. We will get the

Highest Bid =2.423

Lowest Ask = 2.424

Bid-Ask= Ask price - Bid price

Bid-Ask = 2.424- 2.423= 0.001 USDT

a) Calculate the Mid-Market Price

Mid-Market Price formula is (Bid Price + Ask Price)/2

So we get

Bid price = 2.423 USDT

Ask price = 2.424 USDT

Mid-Market Price = (2.423 + 2.424)/2 = 4.847/2 = 2.4235 USDT

Conclusion

The order book is a very important tool for traders/investors and it includes many components and order types we just came to know in this post. It was a very important lesson in practical life and I like to thank @awesononso for providing us excellent resources for learning.

Hello @mayureshpandit,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

You did not complete the order in question 7 as requested.

You did not state the impacts of the orders in 6 and 7.

I noticed some parts that were paraphrased from other sources as well. Always be as original as possible.

The arrangement is good though. Keep it up.

Thanks again as we anticipate your participation in the next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit