What is your understanding of the Liquidity Level. Give Examples (Clear Charts Needed)

In the crypto/trading space, there are certain groups know as the Whales can be a group of bodies, a single entity, or just a single man influence controlling market movement these whales can manipulate how market trends moves using their large capital to buy-in or sell out particular market asset/coin.

In contrast retail traders who place their market orders above/below such coins could experience loss where their limit gets hit due to these big moves therefore in such situations the price of such coin tends to move beyond such trader market limit on a trade which results to a term known as market liquidity in trading

Liquidity in trading is also when a trader's opened/pending market order gets triggered due to the rapid movement of the market trends which have been influenced by high-profile institutions or market news.

Above is a BNB/BUSD pair of 1-hour time frame it can be observed from the chart there was a market downtrend in price where sellers were dominating the market from A on reaching B a quick spike in price was seen that made the price of BNB to uptrend and from C there was another change in a market trending these movements can result to Liquidity of open orders

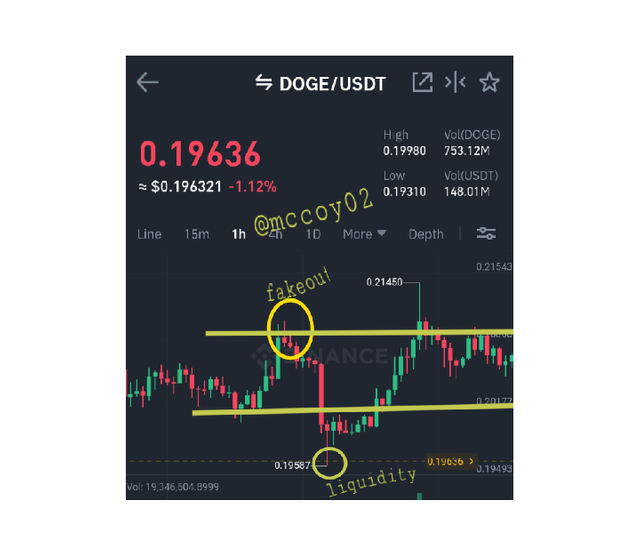

Explain the reasons why traders got trapped in Fakeouts. Provide at least 2 charts showing clear fakeout.

A fakeout in trading happens when traders expected a pair to trend in either uptrend or a downtrend but turns out to go against their expectations this leaves the trader to be trapped in the wrong trend move which can result in loss of capital in this situation traders in most case close their open position in loss, here are some reason why traders get trapped in a fakeout.

Inappropriate market entry and exit strategy; in trading an important rule to observe while trading is setting out our trading terms and conditions which will be used to guide traders when trading having a proper trading strategy will help minimize loss of funds in trade a trader who understands how technical analysis using trading indicators will easily understand when there is a fakeout in a trend having a prior understanding of how to use trading indicators will improve our trading strategy which will guide traders on when and how to enter a market trend.

Market psychology; trading without understanding the effect and principles of applying proper market psychology while trading can make traders be trapped in a fakeout an example if a trader made a profit on a particular trade entry greed can make such trader not close his profit and expectations there will be more profit which can lead to market reversal making such trader be trapped. also fear of losing capital can make a trader not close his trader which can lead to further losses.

Risk Management; here when a trader decided to use all his trading capital to open a position expecting a positive outcome which turns out to be the opposite when trapped in such situations there will be a high loss trading with at least 10% can minimize the risk of assets loss also Improper stop loss and take profit order can lead to making traders getting trapped in a fakeout market

The above chart is a 1,-hour timeframe of ADA/USDT it can observe a clear bullish trend was moving where buyers were dominating the market before a quick make reversal came up to change the trend direction trapping buyers unaware.

The same scenario was seen with BNB/BUSD pair leaving buyers trapped in a bull rally that reversed.

How you can trade the Liquidity Levels the right way? Write the trade criteria for Liquidity Levels Trading (Clear Charts Needed)

Using market structure to trade liquidity

Using MSB can be a great tool for trading market liquidity here a trader will equip himself to understand how the market trends and pattern moves which are in up or downswing generally understanding this uptrend and downtrend will make a trader figure out market reversal in any trend pattern.

With a prior understanding of how market swings move in either up or downtrend, a trader can trade liquidity levels in the market.

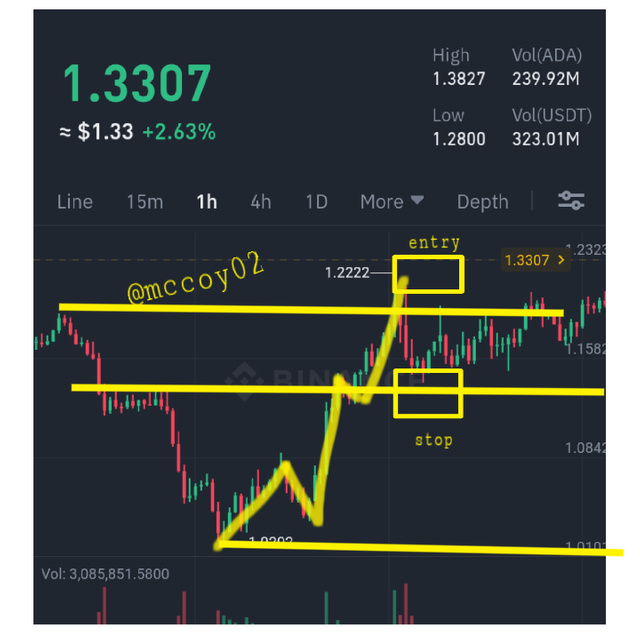

The above chart is a 1-hour timeframe of ADA/USDT following an MSB market uptrend swing pattern it can be observed there was a price reversal as ADA made a high swing in price.

Using a downtrend swing pattern it can also be seen ADA make a downtrend and made a reversal

Using MSB trading pattern strategy can help a trader understand simple market swing patterns which he can use as leverage to trade market liquidity movement in traders.

Criteria traders need to watch out for when using the MSB trading strategy are the movement of high and low trends movement formed either at the bottom or top of the trend.

Taking proper note of the trend support and resistance level and wait for a clear breakout or market reversal of trends will help in trading trends market liquidity.

Draw Liquidity levels trade setups on 4 Crypto Assets (Clear Charts Needed)

Here I will be using different charts to illustrate the liquidity level of different trading pairs.

- Doge/Usdt pair

- Shib/Usdt

- Trx/Usdt

- Dot/Usdt

The trading setup for the above pairs involves trading diligently observing the market for the market trend pattern movement and watching out for appropriate market reversal in any trending movement.

Conclusion

Market liquidity could be used by traders to take advantage of market trend movement and make a considerable profit understanding important key points when trading or catching up with the right market reversal trend can help traders make good profit market liquidity could also be used to liquidate a traders trading capital using a proper stop loss on any trade can help maximize such loss.

Fakeout can also be leveraged by traders to catch up with an appropriate market reversal traders should use technical trading indicators which can help them determine some important market movement of the trend.