Hi steemians glad to be here and participate in another interesting engagement challenge an interesting topic have been given for us to digress and share our idea about token unlock as always the crypto space is filled with different types of terminologies and understands these terminologies requires one to diligently conduct research and read to increase their knowledge.

Vesting in crypto Introduction

Token Unlock can't be understood without first knowing what a vest is or in another word token lock, vesting in crypto is a specific timeframe set aside by either a project team of developers to lock up a token for a specific time before unlocking or releasing those token into the market in most case vesting occurs after there have been pre sale of such token or in some cases when there have been airdrop were certain percentage of these token have been distributed among members or investors a vesting will be introduced which is locking up those token to avoid market dilution or excessive token circulation and to maintain price stability of such token, two key words in vesting are there should be the token and the next key word is timeframe for the vesting period.

1. Use your own words to define what an unlock token is? And in your opinion, why do some projects choose to lock a quantity of these tokens?

What is an unlock token?

From my introduction I've highlighted what vesting is which is token lock up, with that been explained let's delve to understand what unlocking a token is all about as we can see they are two different words one is lock and the other is unlock it's simply straightforward to understand.

Token unlock refers to the release or unlocking of a previously locked portion of a cryptocurrency token which mean for any unlock to happen there must be some sort of previous vesting of such token. Some projects distribute tokens through various mechanisms, often including vesting schedules or lock up periods this is to prevent immediate selling or trading by early investors, team members, or advisors. After these token are unlocked, it means that investors and holders are allowed to trade or transfer their tokens freely and sell or continue holding in other exchange, for most crypto project unlocking a token can be done base on certain percentage while some project all all locked token to be distributed one the unlocking period has elapsed.

In simple terms unlock token means releasing a token that has been lock this is mostly done by crypto project looking to avoid token price manipulation by early investors.

Why do some projects choose to lock a quantity of these tokens?

Unlocking a token can have various impact on the token market dynamics and price, these impact mostly lead to increased circulation supply of such token which potential affects it price value. These are other reasons why most project choose to lock a portion of their token.

To control distribution of token; when all token supply sold during pre sale are allowed to flow in market there will be excess token circulation to prevent this from happening most project will decide to lock some quantitative amounts of such token to avoid excess price drop and manipulation by high holders.

To control token circulation; when a project choose to lock a portion of it token there also controlling it circulation in market.

Reduce manipulation and speculation; locking up token can reduce excessive speculation from traders looking to dump or sell there token holding.

2. Clearly explain the method(s) by which these tokens are locked and then how they are released.

Clearly explain the method(s) by which these tokens are locked

There are different types of methods which crypto project or teams choose to lock their token here are some methods used.

Using smart contract; these method of locking up token is seen as the most decentralized and reliable ways of locking token in this method smart contract which are intermediary method of communicating with blockchain technology are used to define or determine what timeframe will be used to lock up such token for example a project team can choose to customize their smart contract to lock up a token for one year once that period has elapse it will automatically release such token to its holders without any dispute.

Using vesting schedules; these method allow a project team to lock up token and gradually allow that token to be distributed base on a specific timeframe the project team decides on.

Using community governance or DOA; decentralized autonomous organisation method of locking up token allow the project to use either a voting mechanism to determine or decide how a certain portion of the project token will be locked.

Uing multi-sig wallet; multi-sig wallet are considered one of the safest means of storing crypto token it requires the permission of two or three individuals to sign transactions in this method a project can choose to lock up their token in a multi sig wallet and can only be released when these different individuals come in agreement to unlock such token

3. What is the impact of an unlock token on the price of a crypto and how is it monitored? Give an example.

We all know every crypto project always want the best for its project especially when there is good utility, provided by such project they always want to see their coin being among top list on market capitalization, there are various implication of unlocking a token especially it mostly affect such project token price value, one of the impact of token unlock leads to fear uncertainty and doubt (FUD) which apparently lead to panic sell off from investors token unlock increase token supply to the market and therefore increase sell pressure among holders which potentially lead to decrease in such token price.

Base on my view a good way to monitor token unlock is by having good track record of market sales and buy, by knowing how investors will respond when a particular token is unlock will determine how such project will choose to unlock their token to the market also the project team should have sufficient funds to buyback token incase there is high panic and also introduce burn mechanism to reduce supply of the token.

Given example

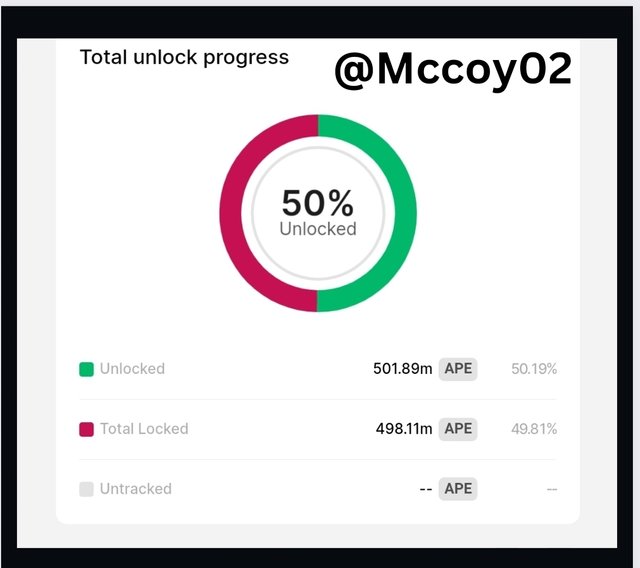

ApeCoin (APE) is a popular coin in the crypto space its known for its Bores Ape Yatch club NFT the project had a maximum supply of 1 billion APE coin which will be released to the market gradually it first released a portion of it supply it unlocked 15.6 million units of APE which is estimated at $33.5 million at the price of $2.15 per APE after this unlock there were increase in supply of APE which affected it price currently APE is traded above $1 in the market the Image above shows that 50% of APE token have been unlocked to the market.

4. Do you think that all cryptocurrency ecosystems have developed this kind of lock? Steem.Inc Among them? If yes or no, do you think it is or will be beneficial if used or added to its ecosystem? For what?

We can't actually categorize for sure if all crypto project out there practice token lock but majority of crypto project I've come across practical token lock since this process increase transparency in a project as well as increase commitment of project investors to believe a project have long term vision for their investors. That been said most Proof of stake blockchain project practice token lock to control supply of their token.

Steemit is a delegated proof of stake blockchain DPOS which means the blockchain or platform itself allow token vesting and unlocking for investors and authors this process is beneficial as authors or investors power up their steem power (SP) it helps reduce excess supply of steem token in the market and thereby increase price value of the token long term.

5. List the risks and benefits of unlock tokens in a simple and understandable way.

Benefits of unlocking token

Increase market activity; when token which are previously locked become accessible to investors there will be increase in market performance of such token this can be positive if there is increase buying pressure and negative when those investors choose to sell off their released token

Increase liquidity; when token are unlocked there will definitely be increased liquidity which can trigger buying or selling of such token in this case liquidity most be added to enable smooth market sales.

Investors flexibility; released token gives holders freedom to transact their token in the market they will choose to either sell or hold.

Risk of unlocking token

Price volatility; this is caused by increased supply of the said unlocked token once token are unlocked desperate investors will quickly sell their holdings to increase price volatility.

Dumping risk; unlocking a token definitely increases it chance of getting dump in the market by whales who are large holders.

Market manipulation; with large portion of token unlock and release to investors there are high chance of price manipulation from large token holders.

In conclusion

Token unlock is an interesting topic in crypto space and it's important for anyone looking to learn from this technology to understand the principle and concept behind token lock and unlock with their benefit there are project who have rug pull its investors using the concept of vesting by reportedly dumping their locked token in the market and increasing token circulation and leaving investors with worthless token it is advisable to always carry out good research on any token before investing or participating in their locking process thanks for your time.

Thank you for participating in this challenge, however, there are rules that must be followed. You must be active in other communities, you must belong to club5050, club75 or club100.

Although you have put all posts at 100% Power Up, you have removed more than your Power Up in this month, therefore you do not belong to any club.

Invalid entry.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the feedback

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Can i participate using club 75 or 50 sorry for too many questions

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You've provided a detailed explanation of token unlocking, its methods, impact on crypto prices, and benefits/risks. It's clear and informative. Great job!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks much friend best regards.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great explanation of token unlocking and its impact. You've covered the methods of locking and releasing tokens comprehensively. Monitoring token unlocks and discussing ApeCoin's example adds depth. Token locking benefits, risks, and its relevance in various crypto ecosystems are well-clarified. Excellent contribution bro👊

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks much buddy do appreciate the feedback.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hola Mccoy 😊

Lamento mucho tu entrada no haya sido valida, siempre es bueno leer detalladamente las reglas. Particularmente en esta comunidad, son muy estrictos y hay que ser muy cuidadosos siguiendo las reglas.

Te deseo suerte y exitos para la proxima

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Has realizado un buen contenido además cubriendo toda la información del desafío.

Gracias por tus esfuerzos.

Saludos y mucha suete.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit