Hello steemains, nice to be part of this week's class by professor @awesononso on BID-ASK SPREAD 2. Great lecture as usual, below is my homework task. Thanks.

Define the Order Book and explain its components with Screenshots from Binance.

An Order Book can be simply defined as an electronic book with the list of various buy and sell orders by traders made available in the market for a commodity. The Order books gives a full detail of price value of a commodity set by buyers and sellers, shows information on availability of commodity in the market, persons involved in the transactions and also the trade depth. An order book is a ledger used by various financial systems for like stock market, Crypto market etc.

Sample of Order Book from my Binance account (source is Binance)

The Order Book is made up of five components; Buyers and sellers side, Bid and Ask part, Prices, Total, Trade history. But the order book is mainly divided into two parts; Bid and Ask part. These are the first striking components noticed in an open order book.

•Bid part: is the part that has all the bid prices set for a buy order, with the amount for each commodity and its total cost(gotten by multiplying Amount and Price). The bid prices are usually at the left side of an order book and written with green colour. The intending buyers of a commodity bid for a certain amount of commodity at a specific price within a particular time frame. The bid price with highest value is usually at the top of the order book.

Bid side from an order book(source is Binance platform)

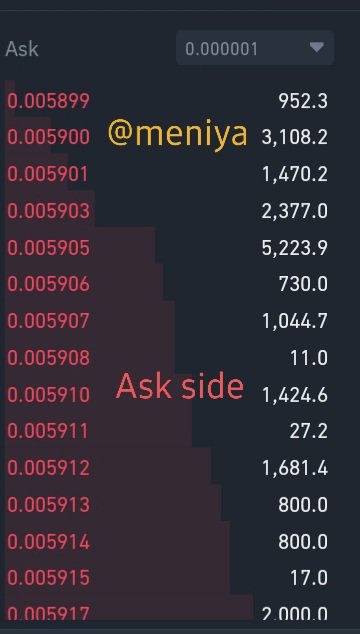

•Ask part: is the reverse of Bid part. This component is made up of sell orders with ask price for a commodity available in the market. The Ask part also contains the amount for each commodity and its total cost (gotten by multiplying Amount and Price). The Ask prices are usually at the right side of an order book and written with red colour.

Also, the ask price with the lowest value is at the top of the order book.

Ask side from an order book(source is Binance platform)

The most fascinating feature of Order Book is that, it constantly updates the buy and sell order prices in real-time, giving traders more information about the market and price trends every moment.

It improves the transparency of trades in the market, making it a great tool for short-term traders to know and understand the nature of the market, its major trends and security level of the traders(buyers and sellers). Order book depicts who is in charge of the market (whether its the bears or bulls), and also gives a faint view of the support and resistance levels of a commodity.

For instance, if there is more sell orders than buy orders, it could indicate a downtrend movement due to selling pressure in the market. Apart from these fascinating feature outlined above, Some usefulness of Order Book includes;

• Serves as a Liquidity indicator:

From the previous class, i was made to understand that the Bid-Ask spread can the indicate the liquidity of a commodity. With a proper study of the oder book one can indicate the liquidity level of a commodity, by calculating the Bid-Ask spread which give us a shallow view of liquidity level of a commodity in the market.

• Shows the prevalent market direction:

As have earlier said, the order book can show the current market direction. The studying of the amount column can give an insight of where the market is headed, whether it is bullish or bearish. When there are more orders on Bid Side it is an indication of high selling pressure and the price is likely to increase as the demand is much. If the ask side is high, the opposite is the case, as prices will be reduced due to limited supply of commodity in the market.

•Helps determine support and resistance levels:

A close study of the Order Book can help determine support and resistance levels. From observation, support level is determine when there's accumulation at the Biders side, and resistance is observed when there's accumulation at Ask Side.

2-Who are Market Makers and Market Takers?

•Market Maker is a person that creates a sell or buy price order in market, by themselves and the order is placed in the order book untill it fits into the price before the trade is executed. Market Makers creates a Limit Order and provides market depths and liquidity, with the aim of making profits from Bid-Ask spread or price predicted when the market was volatile. Market Makers are short-term profit oriented and are able to make more profits when their trading volume is high, and the market is highly volatile.

•Market Takers, on the other hand are traders/investors that buys or sells a commodity in market with its current Bid or Ask price. Market takers gets their trade order executed instantly, as they accept the current prices without binding for Bid or Ask prices. Market Takers makes market order and takes more risks as their is instaneous and they take liquidity in the market. They aim to make profits immediately and take risks later.

3-What is a Market Order and a Limit order?

I have earlier mentioned these terms, now let's go deep into it.

•A Market Order is an order set based on the current trade price of an asset in the market. These market orders are executed immediately once traders shows interest.

•A Limit Order is an order set by a trader themselves at a price suitable for the trader to buy or sell a commodity, to make more profit. Once a Limit order is placed, it is filled into the order book pending when the price fits it before the trade is executed. One advantage of Limit Order is that, it gives traders full control to set the buy or sell price ny yourself, but it's disadvantage is that the there's no guarantee that the trade set will be executed, because if the set buy or sell price reaches the limit price, the trade will not be executed and also if it hits the limit price, there may not be enough demand or supply to support the order.

4-Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

The market makers creates Limit order, this increases market depth and increases liquidity of an asset in market. The more the Limit Order, the more orders are placed in order book, with various market prices. Market Makers tends to get profit when a higher price value is gotten from market takers, in turn provides constant liquidity in the market. The market takers who create market orders, needs to accepts the fact that they must take the liquidity provided by market makers when need to enter or exist a trade arises.

In a nutshell, the relationship between

Market Makers and Market Takers with the limit and market order and liquidity in a market is that, both are harmonious and both need each other to thrive well, as Market Makers provides and increases liquidity in a market, so the market takers reduces liquidity in the market, all in the course to help close the Bid-Ask spread differences.

QUESTION 5

▪︎Accepting the Lowest ask. Was it instant? Why?

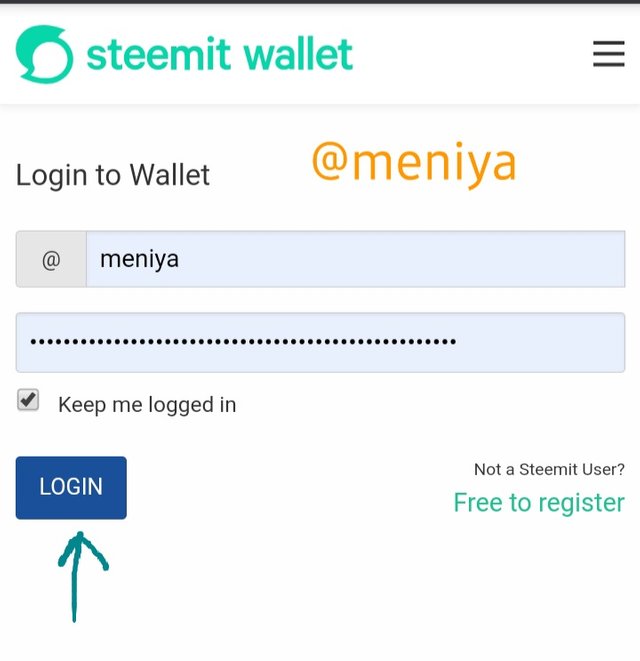

First, I had to login to Steemit Market place to access the market. After logging, I clicked on market option to carryout the order.

Steemit Market

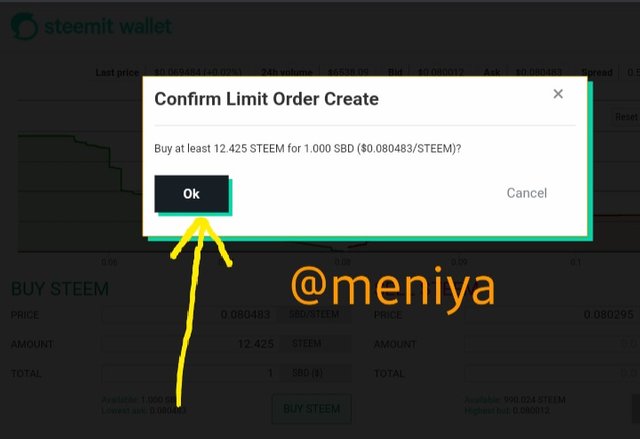

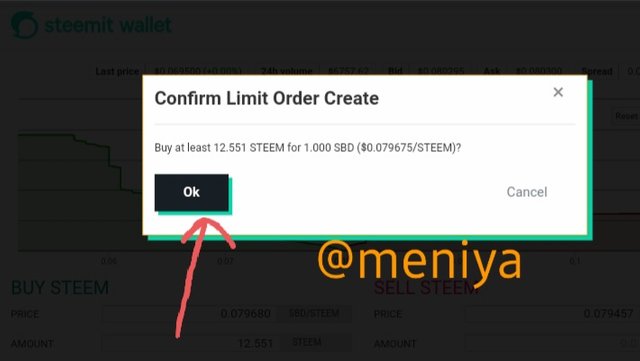

From the screenshot above the lowest ask value is 0.080483, i filled it in as my ask price (0.080483) and clicked on Buy Steem. After clicking on Buy Steem button, a confirmation page appeared and i clicked on OK

Source

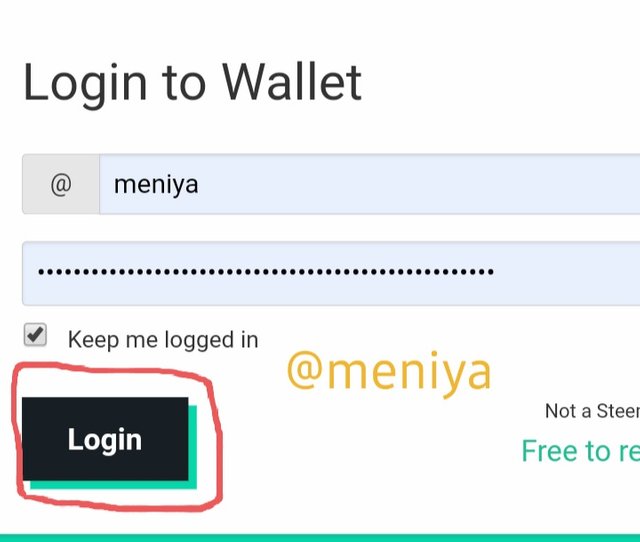

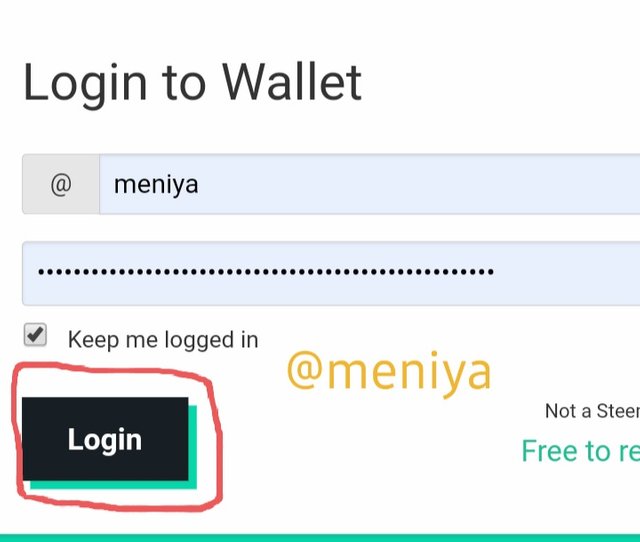

After clicking on OK, it was required i login to wallet again with my user name and activate key.

Source

Impact

Since the Limit Order was the same as the Lowest Ask value, yes my trade was executed immediately in 12secs, because I made a market order with the current makert price. I bought 1SBD for 12.425Steem. I can say, the Limit Order here was equal to the Market Order.

▪︎Changing the lowest ask. Explain what happens.(Make sure you are logged in to your wallet).

While in the process of doing this task, the Lowest ask value was 0.080300, I set my order at 0.079680.

Confirmation Page comes up, i click on Ok

I was requested to login again with my user name and activate key password, i did so and click Ok.

Source

Here is my Limit Order placed in Order book

Impact

My order was not fulfilled because my ask price was lower and different from the current lowest ask price in the market. For this reason, my order will be kept in the Order book record untill it gets a match to fill the order.

QUESTION 6

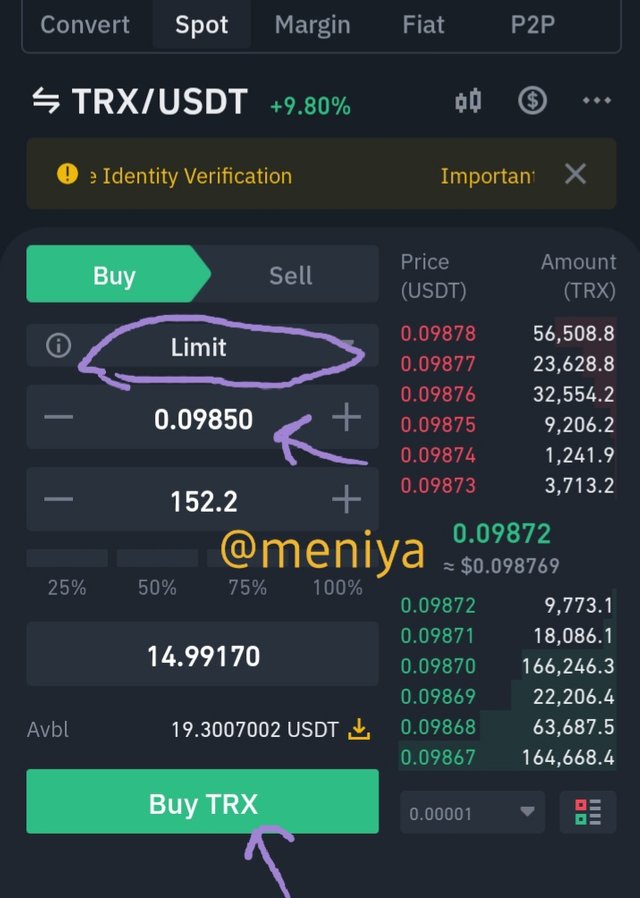

First, i login to my Binance account, click on Markets, and searched for TRX/USDT

I clicked on TRX/USDT pair, and placed a limit order on the TRX/USDT pair at a price of 0.09850 lower than the current market price. My order was filled in the order book pending when it will be executed.

Impact

I acted as a market maker, and my act lead to the increase of market liquidity of the TRX/USDT pair in the market. I noticed my order was added to Bid prices on the order book and it was not executed. This is because my order was placed at 0.09850 which is lower than the current market price TRX/USDT pair and will have to wait to get a match in the market before it is executed. Which means there must be a drop in price of TRX/USDT pair in the market. Also, since my order is lower than the current market price, it tends to cause a decrease in the market price of the asset.

Screenshots for this question was taken from Binance

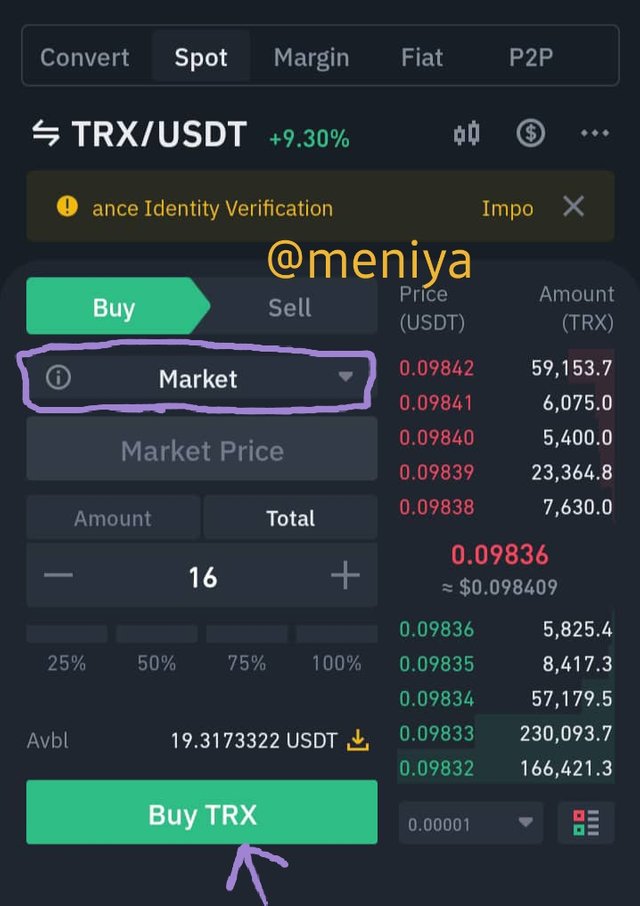

QUESTION 7

For this task, I placed a market order for TRX/USDT pair on Binance with the current market price. I selected the market order option, clicked on Buy and my order was filled immediately.

Impact

My order was filled and kept open in the market order for an interested trader, after 24secs my order was fulfilled. Hence, the creation of my order will reduce market liquidity. This is because i took liquidity provided by a market maker.

Screenshots for this question was taken from Binance

QUESTION 8

From the screenshot of ADA/USDT pair above, the highest bid price was 2.263USDT and lowest ask price was 2.264USDT, as at the time of writing this task.

Calculating the Bid-Ask Spread

Using the formula:

Bid-Ask spread= Ask price - Bid price

Therefore;

Bid-Ask spread = 2.264 - 2.263

Bid-Ask Spread = 0.001

Calculating Mid-Market Price

From the formula:

Mid-Market Price = (Bid Price + Ask Price)/2

Recall;

Bid price = 2.263USDT

Ask price = 2.264USDT

Therefore,

Mid-Market Price = (2.263 + 2.264)/2

Mid-Market Price = 4.527/2

Mid-Market Price = 2.2635 USDT

Conclusion

Order book is a vital part of trade market and a useful instrument for traders, it gives much information about the market like knowing the strength of the market, if it's safe or not to trade. It can show the future market price of an asset due to its transparent guide. The study of an order book can help a trader understand the current situation of the market and when to enter or exit a trade.

THANK YOU FOR READING THROUGH

CC:

@awesononso