%20Finance%20Pitch%20Deck%20Presentation%20(1).png)

Qst No 1: Understanding of Price Action and the Engulfing Candlestick Patterns | Steps to be able to execute it with examples?

Source

Trading strategy by Price Action is a strategy that permits a trader to make investment decisions after a careful watch of the price movements of a coin.

Price action depends on the strong movements of the price which is a result of whales or institutions that influences the price value of a coin. To clearly understand how this strategy works, an observation for trendy movement of the price leading to a strong movement is the price either downward or upward consistently for a period of time is considered a strong movement, as you then begin to anticipate a reverse movement in respect to the previous movement.

To simplify, If the first strong movement is bearish then the next strong movement would be bullish. With the above, you can clearly make your investment decisions after considering and observing when the new trend continues movement and then with enough liquidity.

After then comes Engulfing Candle pattern, which could be Bullish or Bearish. In simple terms, an engulfing pattern is considered bullish when the Green or candlestick is taller and completely covers the Red candlestick in a manner we can describe as being engulfed.

It is then considered Bearish when the reverse is the case - red candlesticks directly covers a previously formed green candlestick.

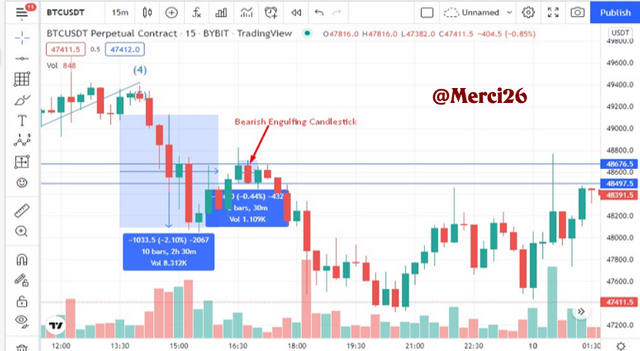

The above image is a typical example of a valid Engulfing candle pattern.

The formation of an engulfing pattern usually signals a shift in direction. To use this strategy, there is a need to seek a definite trend direction with the price action approach and the engulfing candle pattern, which can be bullish or bearish and will undoubtedly affect our future actions. The overall trend is unlikely to continue; there will almost certainly come a moment when it reverses. When the price chart deviates from the net trend, we wait for the market to break and then look for a large amount of liquidity to keep the new trend going, which is where the engulfing candle pattern comes into play. For best results, it is recommended that a trader utilize numerous timeframes when using the price action strategy and the engulfing candle pattern.

Steps to execute Trading Strategy with "Price Action and the Engulfing Candle Pattern"

When you choose your Asset to trade, then choose a period of time of "15mins"

Establish a clear harmonic movement on the chart within the 15 minutes time frame, while looking for the is harmonic movement take into account, ensure you can establish a trend direction.

When you must have established that the chart is an orderly graph that has a harmonic movement, the next step is to Observe and Identify the Strong Movement against the trend

It is now time to be patient and watch the strong movements to settle while you wait to observe the next trend movement which would begin as a result of the whales popping in their money into this particular asset in a bullish reversal or whales leaving the market in a bearish reversal. As a result, you will have to keep an eye on the current movement looking out for a Bullish or Bearish Engulfing Candlestick Pattern

Next is to map out your draw 2 horizontal lines at both ends of the Engulfing Candlestick. This is to confirm that the candle is actually an engulfing one.

Next to change the time to "5mins". From 15mins to 5mins

Then it's time to set your stop-loss, We wait for the price pullback again and just when a red candle is thrown at us and the price starts to retreat, we enter our entry immediately. Placing a stop loss a little above that last retracement and our “Take Profit” at the last support we can identify. In this case, it is supported because the entry is to the downside.

Qst No 2: Explain in your own words the interpretation that should be given to a big strong movement in the market. What does the price tell us when it happens?

Strong movements in the market occur as a result of huge institutions and large investors entering the market and investing large sums of money at the time (bullish) or pulling out large sums of money (bearish), causing the price chart to move strongly in the opposite direction of the prior dominant trend. If the current trend is bullish, a big move to the negative side signals a bearish trend reversal. If the current trend is bearish and then there is a large move in the other direction, it will imply a shift in the trend's direction to positive.

A powerful strong market movement tells us to make smart investment decisions by recognizing the trend movement, alerting us when to enter the trade, when to take profits, and even when to reverse the deal. All of this is in relation to the price's up and down movement, as the price action with engulfing pattern will be utilized to observe clearly what's going on with the price movement.

Qst No 3: Explain the trading entry and exit criteria for the buy and sell positions of the Price Action trading strategy and the Enveloping Candlestick Pattern on any cryptocurrency of your choice

"Trade Entry and Exit" Criteria for Trading Strategy with "Price Action and Engulfing Candle Pattern"

- If we are done selecting the asset we want to use, on the chart we want to make sure that the chart is on the 15-minute time frame, next we identify a clear or defined trend (it could be uptrend or downtrend), we need to make sure that the trend price structure is orderly & harmonious. If the market has a sideways market, avoid it and find another chat.

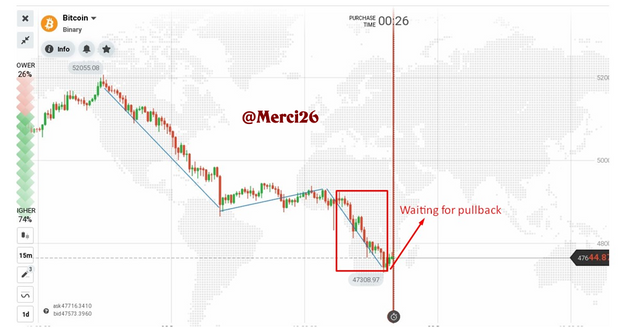

The chart above shows a clear example of a market with a trend going downward.

- The price Action must have a strong movement & clear forceful candlesticks, 3 to 4 candles with a good body, if we find it we need to check how the engulfing candlestick worked in the previous market if it works correctly we can say it meets the criteria if not change chart.

The area highlighted with transparent blue is a great example of a strong downward movement and judging by the previous price action the engulfing candles works fine.

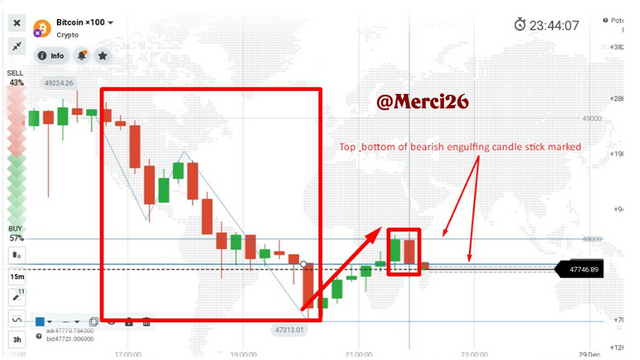

- If all criteria are met we need to wait for a pullback from the dominant trend in our case downtrend after the pullback is complete we wait for a bearish Engulfing Candlestick to form, if it has been identified go ahead & use a horizontal line to highlight the top & bottom of the Engulfing candlestick also use a vertical line to mark the position of the bearish engulfing candlestick then change the charts time frame to 5 minutes.

- In the 5-minute chart the vertical & horizontal lines should help us identify the area where the bearish engulfing candlestick was formed. After we have identified the area, the next step is to wait for a break out of the horizontal line downward to take our trade. If the area is already broken in the 5-minute chart we need to wait for the price to move to the horizontal zone & reject, once it rejects & start going our desired direction in our case downward we need to take our trade immediately. After taking the trade we want to make sure that our stop loss is above the bearish candle that marks our entry point, the take profit must be at the last support or resistance area in our case support area as seen in the picture below.

Note; if any of these criteria is not met do not take your trade change the chart & find a new setup.

Practice

- Bullish Entries

- Bullish Entries

Conclusion

The Price Action and Engulfing Candlestick Pattern Strategy combines price action and the engulfing candlestick pattern. You can make a profit by selling and buying entry signals using these two tactics. However, a trader must use these patterns with care. Observe all of the criteria outlined in this lesson. Thank you for your lectures, @Lenonmc21.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Please @lenonmc21 please note that the second heading bearing bullish, is supposed to be bearish. I dont want to edit the post. Thanks for your understanding.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit