designed using canva

THEORY

Explain and define in your own words what the "VWAP" indicator is and how it is calculated (Nothing taken from the internet)?

Definition of VWAP

VWAP which is Volume Weighted Average Price can be defined as outstanding inputs capable of taking advantage of the market in a fairly clear trend phase. It is an indicator.

VWAP takes cognisance of three main indices namely: volume, price and number of daily candles.

VWAP is said to be a useful tool that serves as an advantage to many traders in the industry. There are so many indicators but VWAP is one of the best indicators in the work because of its unique feature.

VWAP can also be the measure of the average trading price for a particular time frame. It is calculated for a period of one day (VWAP reset their data daily). VWAP is among one the few indicators that reset their data on a daily basis, it is compared with the EMA( Exponential Moving Average) because it is one of those that react with more precision to the movement and development of the price.

VWAP works as a magnet for the price, it is a very good tool to determine " Support and Resistance".

VWAP indicator gives us a set of very clear signals because of the fact that it gives a super precise average price.

It is used as a measurement for trade fills, it is a great technical indicator because it accounts for the price and volume, it assigns more weight to price point with high volume.

VWAP averages the closing prices during the given time period, and at the same time, it puts emphasis on the periods with higher volume.

Finally, VWAP is a single curved line on the chart, so it usually confuses people because of its moving average and it could be interpreted in two different ways.

HOW IT IS CALCULATED

VWAP is calculated by adding up the money traded in every transaction. VWAP calculation gives the same result regardless of the trade time frame used.

What to put into consideration when calculating VWAP.

- Price

- Volume of the money trading.

- Number of daily candles.

VWAP is calculated thus:

Price+Volume of money traded/ Number of daily candles

VWAP = P+V/NDC

Example:

Where:

P = Price

V = Quantity of money traded

NDC = Total number of daily candles

Explain in your own words how the "Strategy with the VWAP indicator" should be correctly applied (Show at least 2 examples of possible inputs with the indicator, only own charts)?

Volume weighted average price (VWAP) is a technical tool that helps traders to obtain an asset at the best available price.

This indicator (VWAP) highlights the typical price financial assets has been trading at the entire day, keeping both volume and price in check.

The indicators provide a standard for all traders who desires to carry out winning trade, as it gives them valuable information on when to execute a trade and as well as staying away from the market for a moment using the avenue to wait for a better opportunity to get in.

HOW VWAP STRATEGY SHOULD BE APPLIED

1. Wait for breakout

VWAP indicator can be used in a trending market, this indicator helps a trader to understand what the market is saying. Therefore, to execute a better trade-in in a trendy market, you will have to wait for a good signal from VWAP. It is advised to go short when the price is right Above the VWAP and you go long if the price is below the VWAP. Prices are not constant, therefore, prices may vary on daily basis.

A trader can buy in an uptrend as price tally below the VWAP. Alternatively, they can sell in a downtrend as the price pushes up toward the line.

The VWAP indicator also provides invaluable information in a market that is ranging.

For rapid trades in a range market, traders can purchase when the price crosses above VWAP and sell when the price crosses below VWAP. This method enables traders to maximize their potential profit and avoid running lose in the cause of trading. Additionally, the use of other indicators such as the ones that highlight the area of support and resistance alongside VWAP enables a trader to buy especially if the price is beneath the VWAP and go short right after the value of the digital assets is at the top of the VWAP

2. Retracement is another golden opportunity to enter the market, wait for it!

The Fibonacci retracement tools provide the trader with a core entry point to join the market which is the 50% and 61.8% entry zone, at this level the favourable moment to enter the market can be seen.

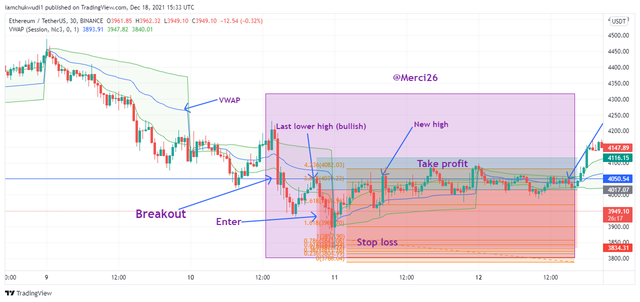

Let's apply the knowledge to the crypto chart below.

In the chart above, the VWAP indicator has been applied to the chat in the appropriate location through the indicators section in TradingView. This is along with a Fibonaci retracement tool to confirm signal and complete the trading strategy using VWAP.

Explain in detail the commercial entry and exit criteria to take into account to correctly apply the strategy with the VWAP indicator?

The trading entry and exit criteria for this VWAP trading strategy are straightforward, but they must be followed to carefully in order to maximize your profit whether in a bullish or bearish market.

Therefore, When trading, it is important to pay attention to the price as it reflects the previous maximum or minimum, and we must ensure that the price clearly breaks either the minimum or maximum zone limit, that is, it must be so evident that these limits have been overcome, regardless of how much or how little.

In the absence of this, the strategy to trade with VWAP will fail, that is why it is preferable to hunt for another chance that meets this exact requirement.

After confirming that the break is valid, we must trace our "FibonacciRetracement" at the last impulse and wait for the price to enter the 50 per cent and 61.8 per cent zone in conjunction with the"VWAP as soon as the price begins to retreat

in either direction be it Bullish or Bearish.

If this does not occur exactly as I have described, it is best to seek out another entry point in order to get a winning trade with this technique.

Our "Stop Loss" must be below 50% and 61.8 per cent to ensure proper risk management, as it will not provide enough back in the event that the price declines much further.

Based on our SL, our "Take profit" must be 1.5 times higher, implying a risk-to-benefit ratio of 1-1.5 and a maximum of 1-2.

PRACTICE

Make 2 entries (one bullish and one bearish), using the strategy with the indicator "VWAP". These entries must be made in a demo account, keep in mind that it is not enough just to place the images of the entry, you must place additional images to observe their development of them to be able to be evaluated correctly.

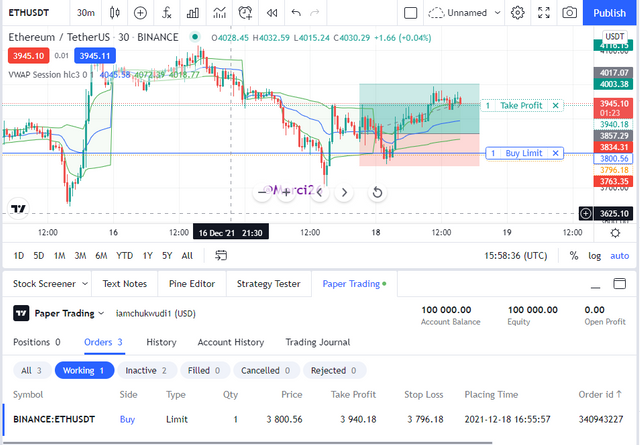

Bullish Entry (buy)

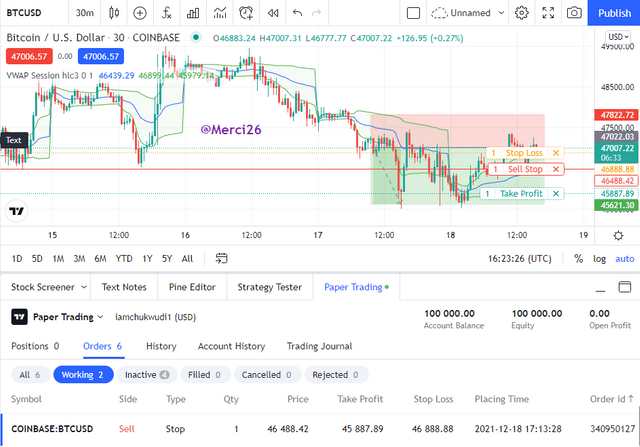

Bearish Entry (Sell)

Conclusion

Technical indicators are one of the tools that traders utilize in technical analysis and remain a trader's greatest buddy. VWAP is a fantastic indicator for determining where to enter the market. This task's technique incorporates the VWAP indicator, market structure, and fibonacci retracement tools. And, by combining these powerful tools, traders can forecast price movement with some precision.

Cc;

@lenonmc21

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@steemcurator02 my work is yet to be curated

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit