What is Zethyr Finance?

Since the advent of DeFi, the ecosystem has seen numerous innovations of dApp that are helping Blockchain users to execute their transactions more conveniently than before without any interference of third parties. With these new innovations, users can lend and borrow assets and make substantial profits. Our concern now is on Tron Blockchain dApps which have over 40 dApps built on it. One among them is Zethyr Finance, so what is it? Let's see.

Zethyr Finance, is one in the midst of several other decentralized finance protocols developed on Tron Blockchain. It is one that aid users to perform lots of transactions like lending out owned Tron assets such as TRX, BTT; USDT and WIN using a feature called SUPPLY then in return make some profits. This DeFi platform is doing well given its having a good standing in the general ranking among its DeFi counterparts though the ranking fluctuates in view of market conditions.

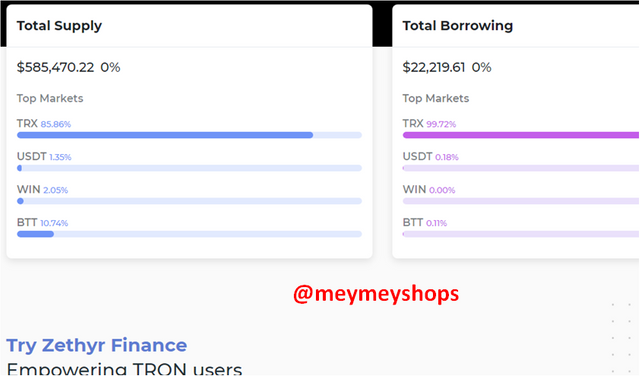

Another major transaction carried out in Zethyr Finance is borrowing of other cryptocurrencies provided by others in the liquidity pool. But the borrower must be backed up by the collateral of Tron assets he had already deposited, and to repay at a certain time. Lending out assets this way attracts some percentage rewards in return. The image below depicts the state of affairs of Zethyr Finance at the time of compiling this report.

$585.470.22 is the worth of its total supply while $22,219.61 belongs to its Borrowing capacity all in the four assets traded in the protocol as shown in the image below.

What are the features of Zethyr Finance? Discuss them. What's your understanding about DEX Aggregator?

I will be discussing about four features of Zethyr finance.

- Swap tool

- ztokens

- Stable

- Lending and Borrowing

The first to be discussed among the features of Zethyr Finance is

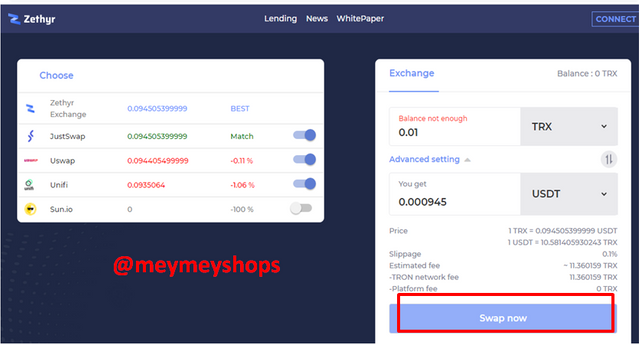

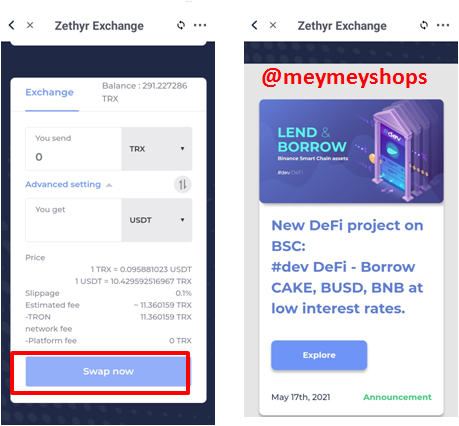

The Swap tool: This is a tool that enable Tron users to swap between Tron, USDT and Etheruem with the lowest of swap fees. Zethyr promise to make this process secure and an instantaneous performance of transactions. Users are free to use their Tronlink wallet or any other Tron wallets for such purposes without having to register on the platform.

Feature two is

The ztokens: As a user of Zethyr Finance, your wallet balance is ztokens which are a make up of your interest on liquidity provided as well other accruals in the system. ztokens are compatible with other TRC-20 assets so they deliver the same purposes like other tokens. Again, acquisition of ztokens means the user have a collateral for borrowing other assets in the network. See the image of ztokens below:

The third feature is

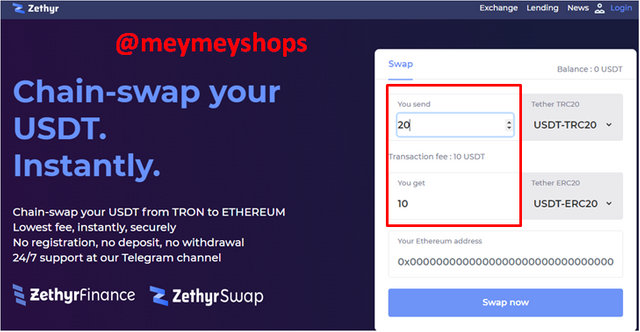

Stable: With this tool, a user can perform the actual swapping of assets from TRC-20 to ERC-20 but with a higher fee unlike the swapping done within TRC-20 tokens which are feeless. Stable is a feature that goes between the Zethyr Finance and Zenthyr Exchange, it takes 10USDT to swap 20 TRC-20 to ERC-20 tokens. Just enter your Ethereum wallet address and your coin is transferred instantly without the rigor of signing up. The image below shows the process.

The fourth feature herein discussed is

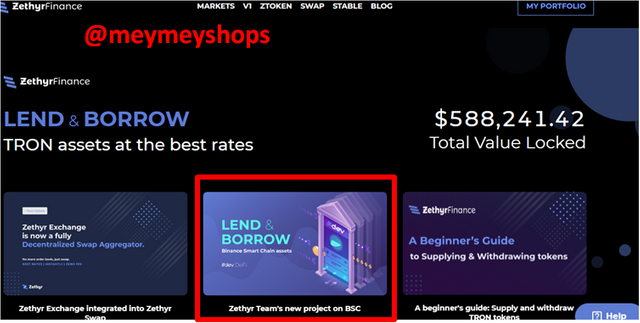

Lending and Borrowing: Every user is entitled to benefit from this feature provided as aforementioned, the user first made deposits to the pool which in turn serves as a collateral to any future borrowing of other assets from the protocol. Every liquidity provider is rewarded with interests on assets deposits while borrowed funds are repaid with interests margins. Deposits are on the increase as can be seen on the image below which showed a higher lockup funds than that on my first image, as of the little time elapsed, a total of $588,241.42 have been provided.

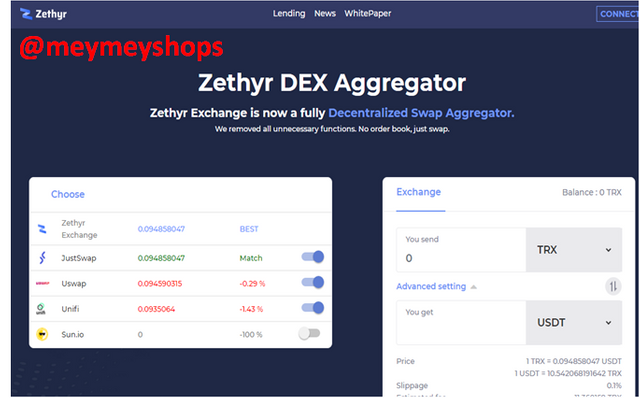

My understanding of DEX Aggregator

Dex Aggregator is a make-up of Zethyr Exchange and Zethyr Swap. The platform team came up with the idea that the order book has become an old fashioned model lacking future benefits to their many users. So a new model was designed to meet up with the advancing needs of their users by removing the order book inherent in the two applications then unite them as one where users can do their swapping with ease of transaction fees. It also creates room for more Exchanges to come on-board the protocol such as JustSwap; Sun.io(coming soon) and Uswap in order to give users the cheapest services. The version is 2.2.8.

Explore the Zethyr Finance Markets and show your observations in terms of profitability of Supply and Borrow (Hint: Best Supply/Borrow APY). Screenshots required.

Moving straight to the website, we are going to navigate through all features of the platform to see they work and their beneficial functions, thus:

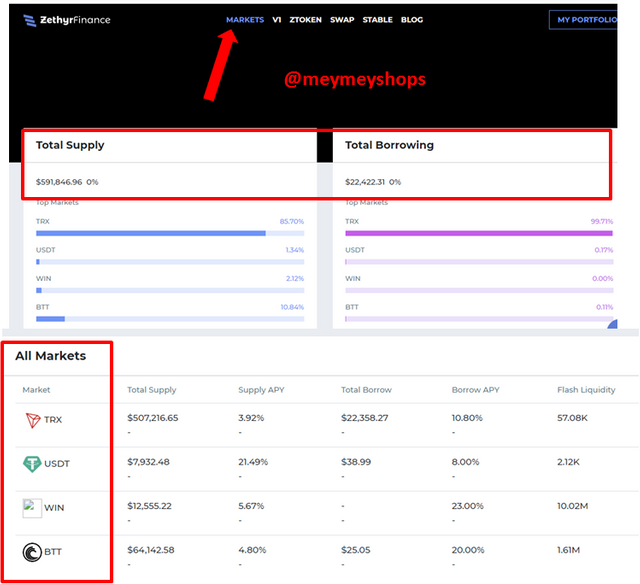

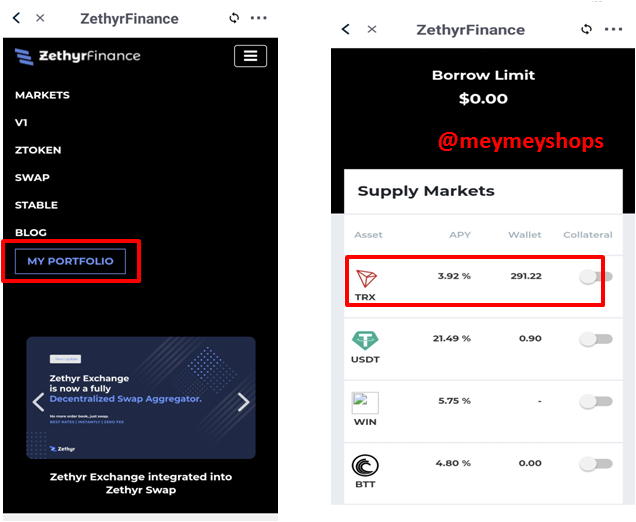

On the home page, you are greeted with the five features earlier discussed and then at the far right stands another one named My Portfolio. For the purpose of clarity, those five features are Market; VI; ZTOKEN; SWAP; STABLE and BLOG but our focus is on the major deal of the platform which is MARKET.

Market: Once you click on this button, you are introduced to the total SUPPLY and BORROWING of the period of time which keeps changing according to market condition. The total percentage supply of TRX is 85%; USDT have 1.34%; WIN has 2.12% while BTT has 10.84%. On the other side of Borrowing, only TRX has 99.71%; USDT has 0.17%; WIN has 0.00% and BTT is with 0.11%. One can rightly conclude that TRX is well accepted by all probably because of its Borrowing APY of 10.80%.

Now let us itemize the supply amount of each asset traded as well as their APY value, we will also do same with the borrowing aspects. Always take note the changing value due to time frame of the compilation.

TRX

Total Supply = $507,216.65

APY percentage = 3.92%

Total Borrow = $22,358.27

APY percentage = 10.80%

Flash liquidity = 57.08K

USDT

Total Supply = $7,932.48

APY percentage = 21.49%

Total Borrow = $38.99

APY percentage = 8.00%

Flash Liquidity = 2.12K

WIN

Total Supply = $12,555.22

APY percentage = 5.67%

Total Borrow = Nil

APY percentage = 23.00%

Flash Liquidity = 10.02M

B.TT

Total Supply = $64,142.58

APY percentage = 4.80%

Total Borrow = $25.05

APY percentage = 20.00%

Flash Liquidity = 1.61M

From the foregoing, one can deduce that what makes an asset profitable is its percentage APY in both supply and borrowing capacity in the market. No wonder USDT is seen to be the most feasible venture so far because it has 21.49% Supply APY with Borrowing APY of 8.00%. High Supply APY and low Borrowing APY makes USDT a very profitable asset.

All are shown in the screenshot below.

Show the steps involved in connecting the TronLink Wallet to Zethyr Finance. (Screenshots required).

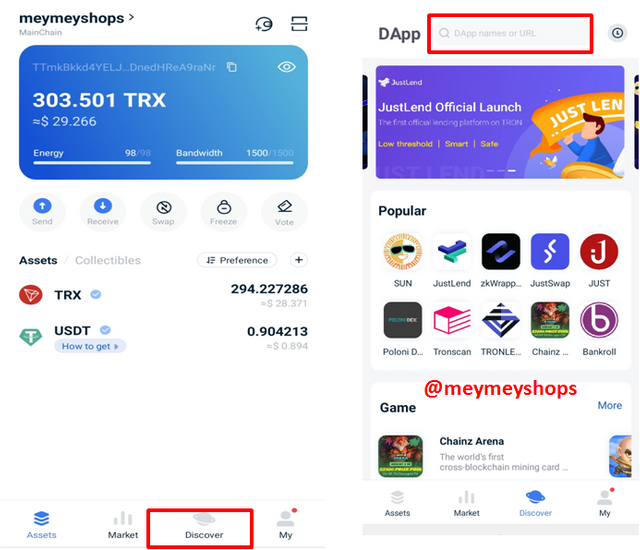

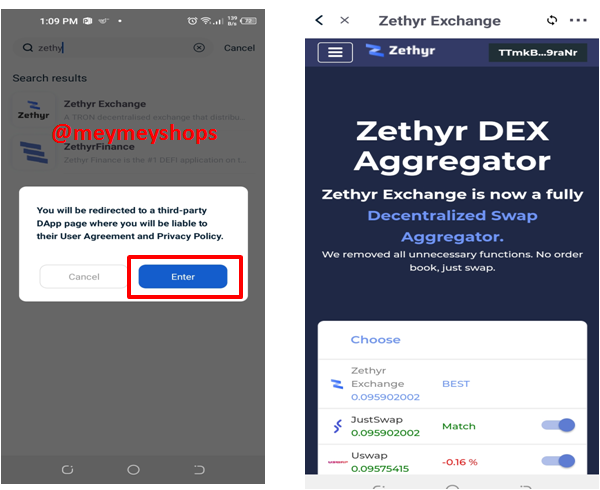

I have already downloaded the TronLink Wallet on my phone, so the following steps were taken, thus:

- From the home page, click on 'Discover' icon below the page.

- Type in Zethyr on the search bar

- Select Zethyr Exchange

- Allow the process to finish loading

- The next interface shows the connecting process is successfully done.

- You can explore by scrolling down to view the whole features.

Screenshots speaks below

The above are the steps taken to connect my TronLink to Zethyr Finance.

Give a detailed understanding of ztoken and research a token of another project that serves the same purpose as it.

zToken as a native token of Zethyr is a representation of all the TRC-20 tokens a user may accumulate or owned in the Zethyr Finance ecosystem. We have seen that tokens acceptable in platform are TRX, USDT, WIN and BTT. Therefore all assets provided as collateral for lending and/or for borrowing in the liquidity pool are said to be ztokens and can be used for whatever need be it voting; making proposal for improvement in the network and otherwise. Interests received from lending, rewards on transactions and all balances in a user's account are generated as ztokens, meaning they have z attached to them.

Another token similar to ztoken is jToken. It is a TRC-20 token and serves a corresponding receipt for deposits made in JustLend platform. If you deposit TRX, USDT, or BTC in the platform's liquidity pool, what you receive in return is minted and send to your wallet as jTRX, jUSDT or jBTC.

Like zToken which is a native token in Zethyr, jToken is also a native token in JustLend. Just as the former is minted as rewards for providing liquidity and are burned as soon as the user withdraw his tokens, same happens with jTokens. So all the features of zToken as a TRC20 token are found in jToken in making deposits and transfers of fund to other users or institutions. It serves as an invoice note for goods delivered.

Perform a real Supply transaction on Zethyr Finance using a preferable market. Show it step by step (Screenshots required). Show the fees incurred.

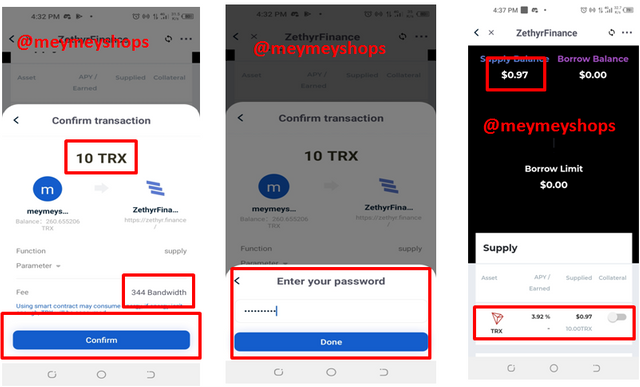

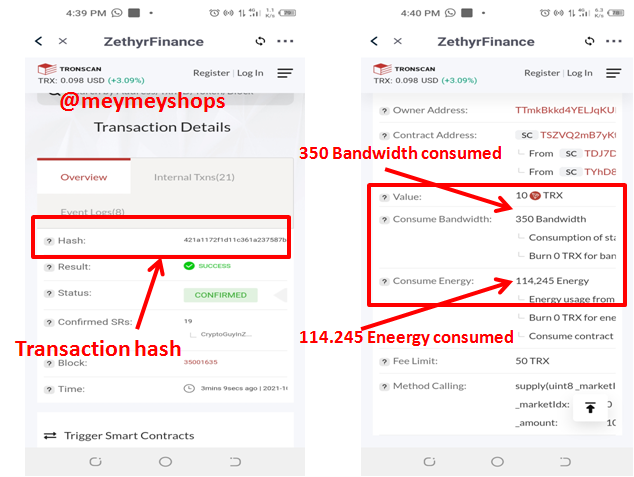

A real Supply transaction will be made with the steps below:

- On the home page, click on My Portfolio.

- Choose your preferred market, mine is TRX since I have Tron assets in my wallet.

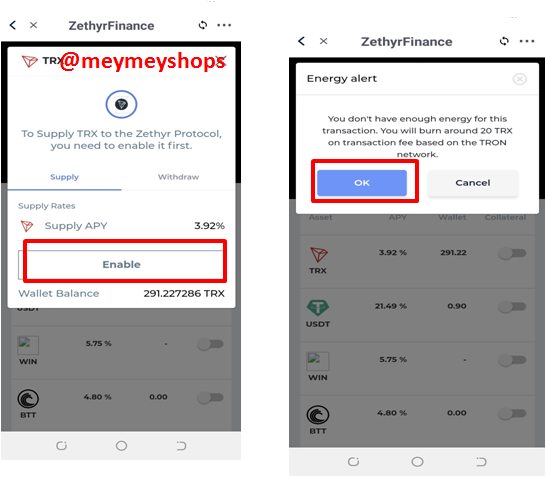

- Click on Enable

- On the next dialogue box click to burn 20 TRX

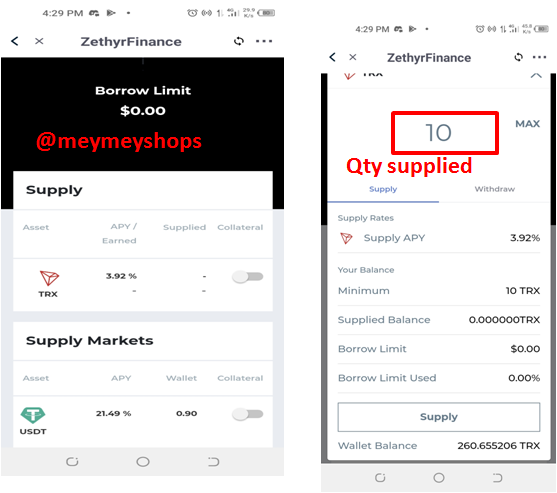

- Add the amount desired to supply, mine is 10 TRX and then click on Supply

- Click on Confirm on the next page

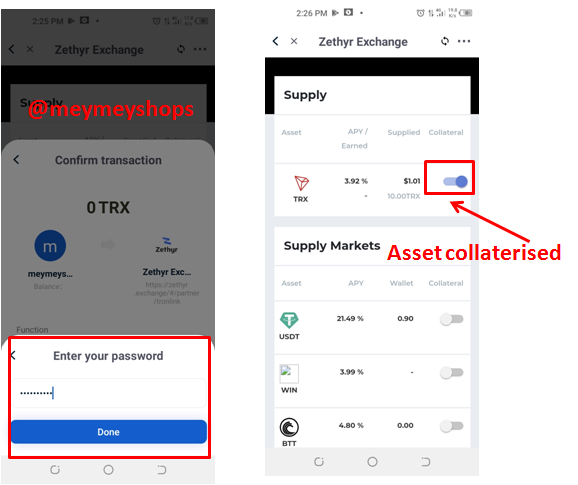

- Enter your password and click on Done

- Check your transaction details to see both the hash of the transaction, the Bandwidth consumed and the Energy consumed.

The screenshots below explain more better.

Collateralize your asset to Borrow on Zethyr Finance, repay the borrowed asset and withdraw your supply. Show the steps involved and your observations (like the fees incurred). (Screenshots required).

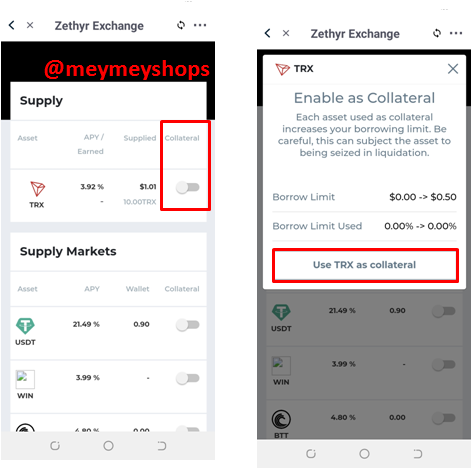

Asset Collateralization Procedure

- On my supply page, I clicked on the slide button directly under the Collateralize button.

- A dialogue box appears to enable Collateral, then I clicked on option

- Click Ok to confirm energy alert.

- On the next page, I clicked on 'Continue' to authorize the process which takes me to the next page.

- Click on confirm and enter the password and tap on Done.

- The Collateral becomes activated.

Confirm with the screenshots below:

....

....

....

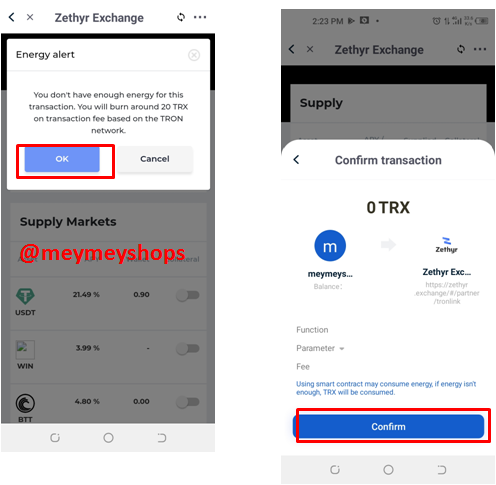

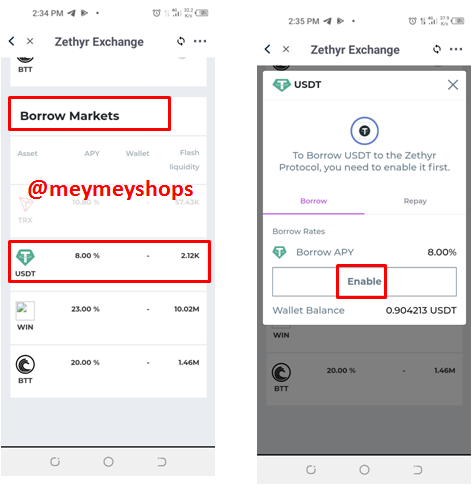

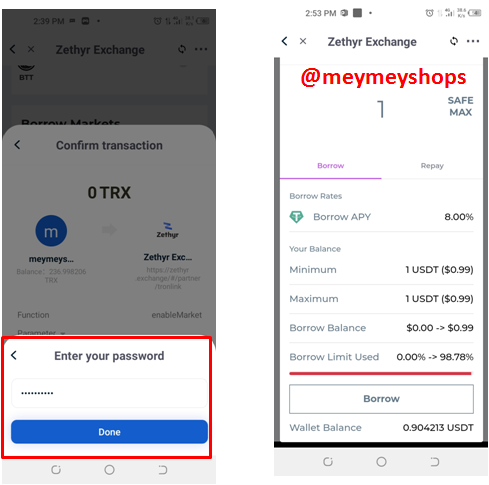

Then moved on to use the collateralized asset to Borrow other asset.

- My target asset for this purpose is USDT, yes because it has the cheapest transaction fee.

- So scrolling down to the Borrow column, I tapped on USDT.

- On the next page, I Click on Enable

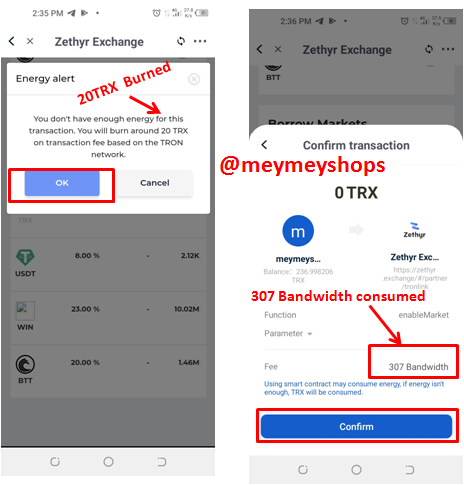

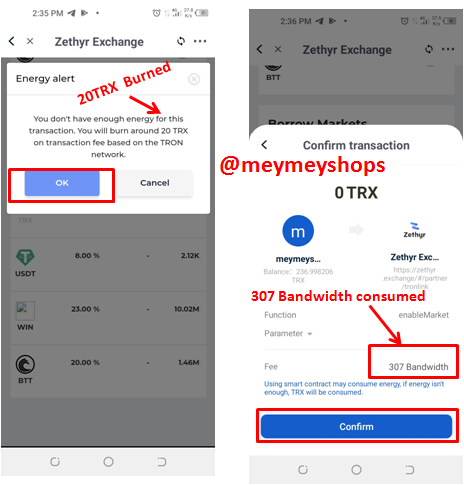

- Click on OK to confirm Energy alert of 20 TRX

- Also click on confirm transaction and enter password.

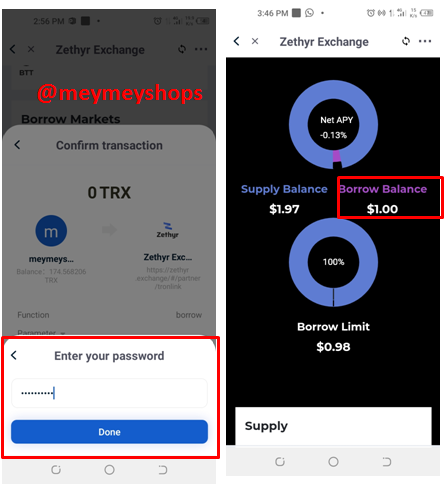

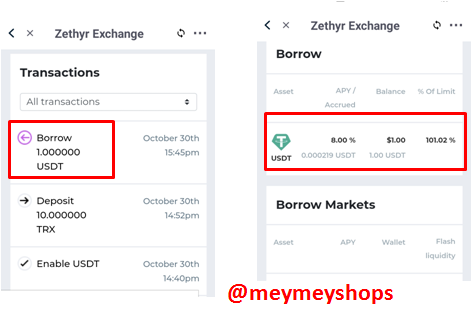

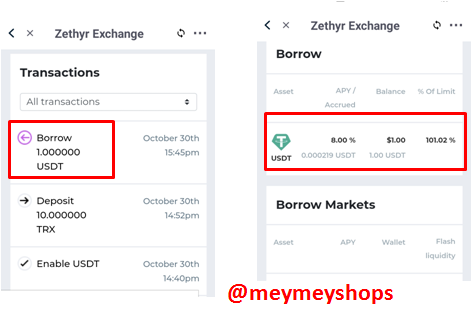

- Enter the desired amount to borrow, mine is 1

- This is going to use a borrow APY rate of 8.00%

- Click OK to authorize Energy alert of 20TRX

- On the next phase, click confirm, check the Bandwidth consumed to be 339.

- Enter password and click Done.

- Go back to the menu to see the Borrowed amount of $1.00

- The percentage of limit is 101.02%

The Hash of the transaction is

1f413b2962055ec6da14fa02f9108ed8bc4345da1d753710484acde590cf82eb

Below are the screenshots of the whole process of borrowing 1 USDT.

....

....

....

....

....

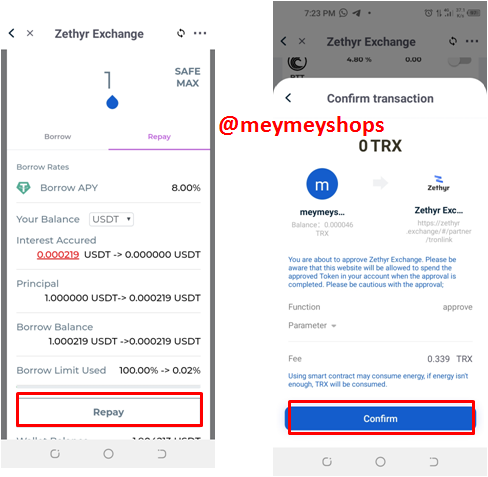

Proceeding to the repayment column the following processes were followed:

- Click the asset borrowed (USDT)

- Click on repay by right side.

- Enter the value to be repaid which is $1

- click on Repay

The process is well understood but unfortunately, I lost 100 Tron repaying the borrowed 1USDT. At that juncture I stopped, I end up spending more than 200 Tron.

What do you think of Zethyr Finance? Is it great or not? State your reasons.

The innovation which Zethyr Finance in providing liquidity and earning rewards as well as borrowing other assets by using deposits as collateral makes it an attraction to traders. The procedure followed in these operations are simple coupled with its security of assets.

Another reason for grading this protocol high is in its SWAP feature which provides that a user can exchange one's asset to another of his choice provided its of compatibility, that is ERC-20 OR TRC-20 coins.

Reservation

Caution should be placed when borrowing assets due to market fluctuation of prices and the risk existing in the process of repaying borrowed fund because sometimes the process will keep repeating thereby sweeping away your assets. Like I complained above, I lost over 200TRX from my wallet in the bid of repaying 1USDT.

Conclusively, Zethyr Finance is a great decentralized platform that is user friendly, secure and fast in delivering transactions. That is why its ranking is within 3000 number platforms. The fee charged for swapping of tokens though higher than others is instantaneous because of removal of order book and sign-up requirements.

Thank you Prof @fredquantum for yet another privileged.

I remain,

@meymeyshops.

Invest/Delegate your Steem Power and be assure of your daily income. Click here for more details.

Join our Discord Server & Community for more details

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit