CENTRALIZED & DECENTRALIZED EXCHANGE

Centralized exchanges

Currently, in the cryptocurrency market, approximately 99% of transactions are processed on centralized exchanges. Centralized exchanges is an exchange that provides higher liquidity and greater transaction volume. They provide fast transactions and support multiple users at once.

Centralized exchanges are somewhat similar to traditional stock exchanges. Trading is controlled by the owner of the exchange.

Transactions can only be conducted through mechanisms provided and approved by central agencies. These exchanges depend on the entity or broker that controls the flow of trading assets.

Decentralized exchanges

Decentralized exchanges are exchanges that are independent of intermediaries. No company support decentralized transactions and uses blockchain technology.

The server is obviously controlled and centralized, but the transaction itself is not. Secondly, decentralized cryptocurrency exchanges have been designed to prevent funds from being stolen-users can control their funds.

Third, in a centralized exchange, users funds are sent to a wallet which is controlled by an entity (switch), while in a decentralized exchange, they depend on digital signatures that is authorized directly to their transaction orders.

This is why decentralized exchanges are slower than centralized trading.

Decentralized exchange only provides the possibility of transactions, and does not store private information about users.

Currently, in the cryptocurrency market, exchanges do not support users because they will not act according to the needs of the community. They decide to add and delete tokens.

This complete centralization has had a negative impact on the industry. The exchange will not reward users who support the development of the industry. It is believed that'll the community should influence the decision and differentiation of projects.

DIFFERENCE BETWEEN DECENTRALIZED AND CENTRALIZED EXCHANGES

Centralized exchanges provide higher liquidity and greater transaction volume. They provide fast transactions and support multiple users at once.

therefore, it is impossible to create a decentralized exchange that can run smoothly and execute a large number of instant transactions per second.

Centralized cryptocurrency exchanges are managed by a central authority, they are vulnerable to failures, such as those caused by hacker attacks..

No company supports decentralized transactions and uses blockchain technology. The server is obviously controlled and centralized, but the transaction itself is not.Decentralized exchanges only allow payments in cryptocurrencies, while centralized exchanges can use traditional payments.

Therefore,Centralized ecchange has the level of trust given to users in a given exchange which are security and transparency while some decentralized exchanges work on smart contracts, allowing tokens to be added without verification , which results in items with questionable trust levels being added to the exchange.

Decentralized exchanges has the security associated with running on trustless systems. In 2011, there have been at least 56 known cyberattacks on centralized cryptocurrency exchanges.

Millions of dollars owned by individual investors are stolen by Hackers, these digital coins were kept in a centralized transaction wallet.

This is possible because digital coin traders use public key encryption to access the cryptocurrency they hold on public exchanges. Public key encryption is very safe and reliable, but it does not tell you whether the centralized switch that has the associated private key follows all necessary security measures.

Once cybercriminals enter a centralized cryptocurrency exchange, there is little to stop them from plundering coin purses until they run out of money.

More importantly, although decentralized exchanges only offer to trade cryptocurrencies, the latter allows fiat currencies to be exchanged for cryptocurrencies and vice versa

BEST CENTRALIZED EXCHANGES

With over thousands crypto currencies exchanges available in the world,it is sometimes difficult to decide , choosing an exchange is not an easy task,there are a lot of things to put into consideration like whether it can be accepted in your country, payment method,fees and verification process and supported coin.

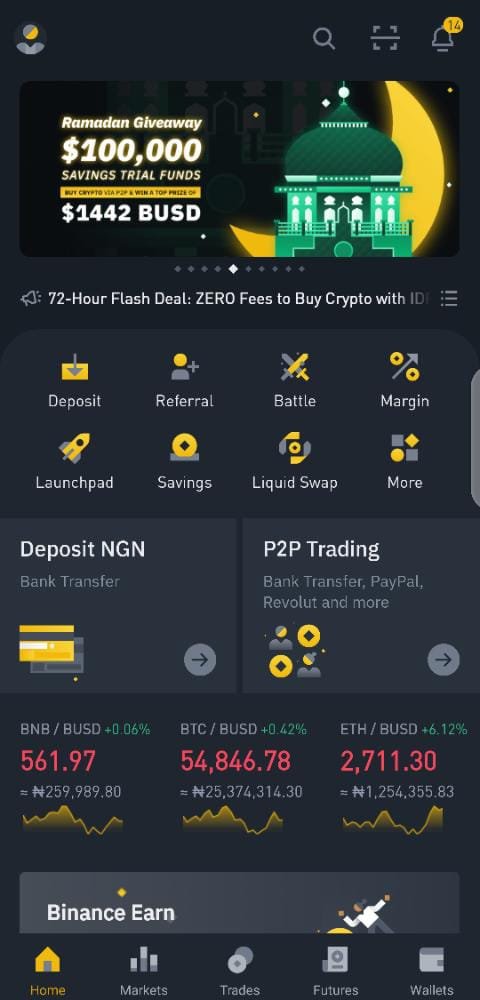

One of them is Binance

Binance is now the leading crypto currency exchange which was founded in the early 2017,it supports over 200 coins and offer a lot of different financial services which is consider a great platform and a beginner-friendly,it has other advancing trading features

Another is coinbase ,the benefit of all centralized exchange is that they are not difficult to use and they have a friendly way if trading & investing in crypto.They are also reliable when it comes to transaction and trading

METAMASK

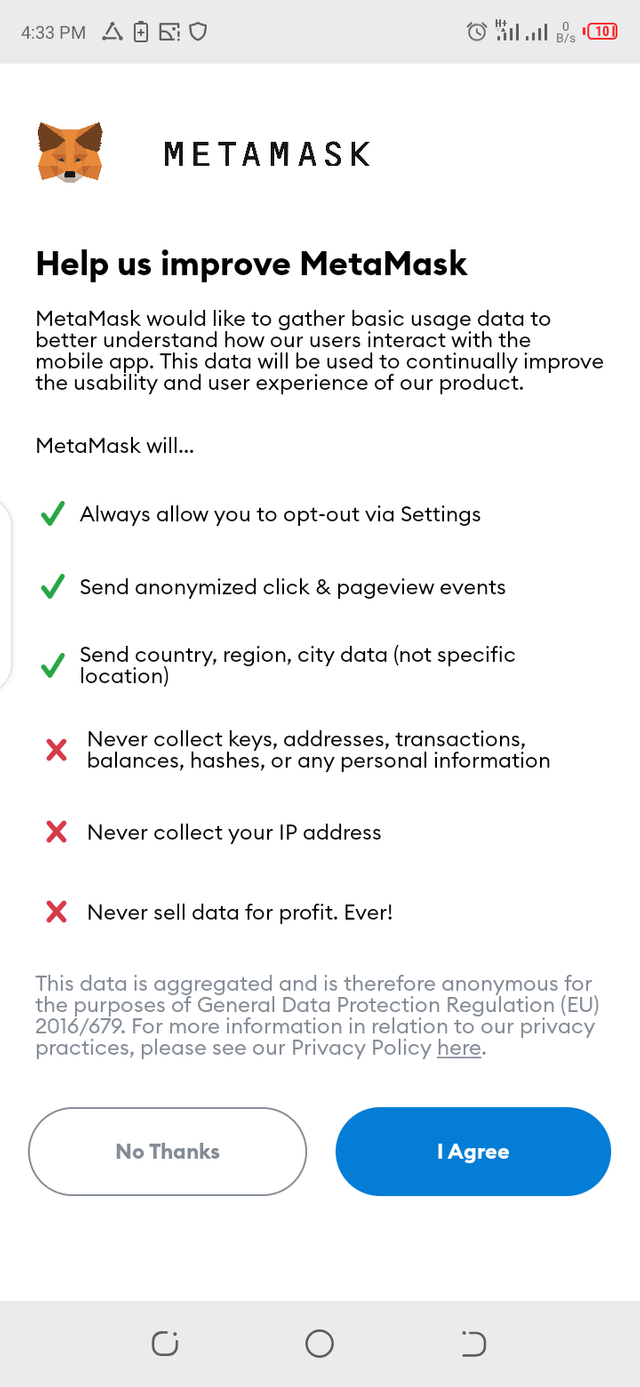

MetaMask is a cryptocurrency wallet from the Ethereum blockchain network,it allow users to have the accessibility to their Ethereum wallet through an app,it is used for the intrreaction of decentralized application.It store,send and spend digital assets like tokens, Ethereum

HOW TO USE META MASK

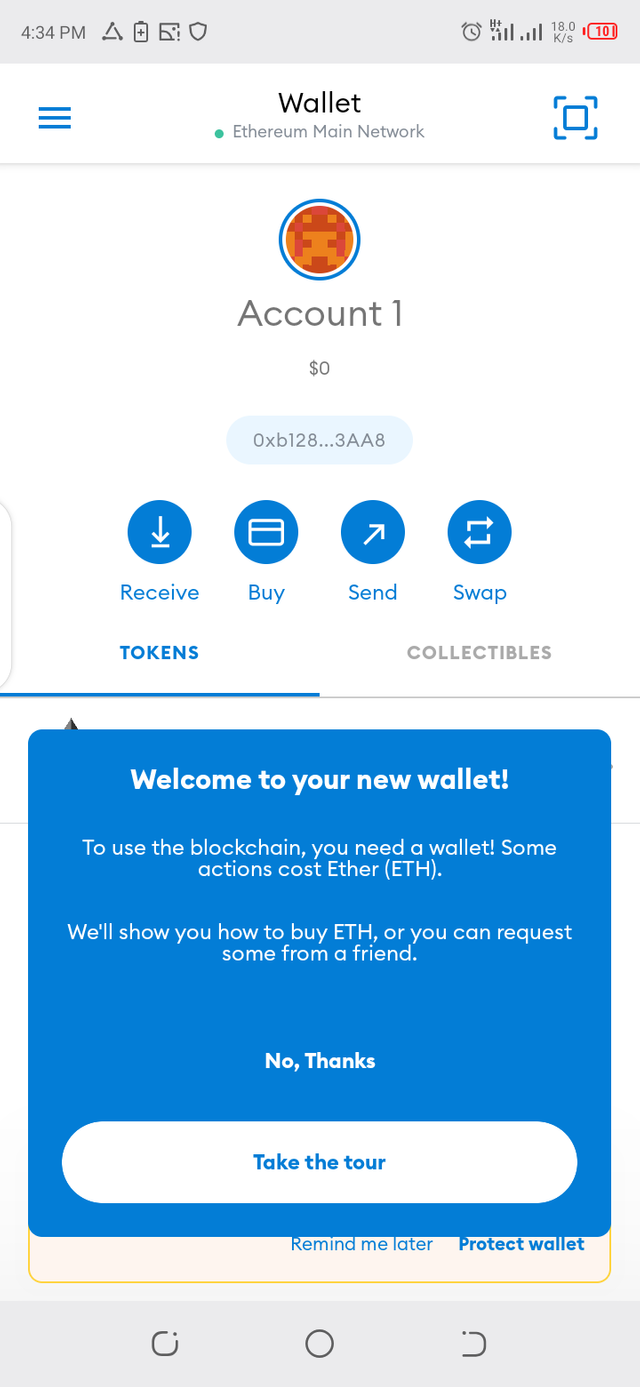

After downloading the application through Google play for Andriod users and Apple store for iPhone users.u Open the app and choose "create a new wallet" then create a password this will open a tab below:

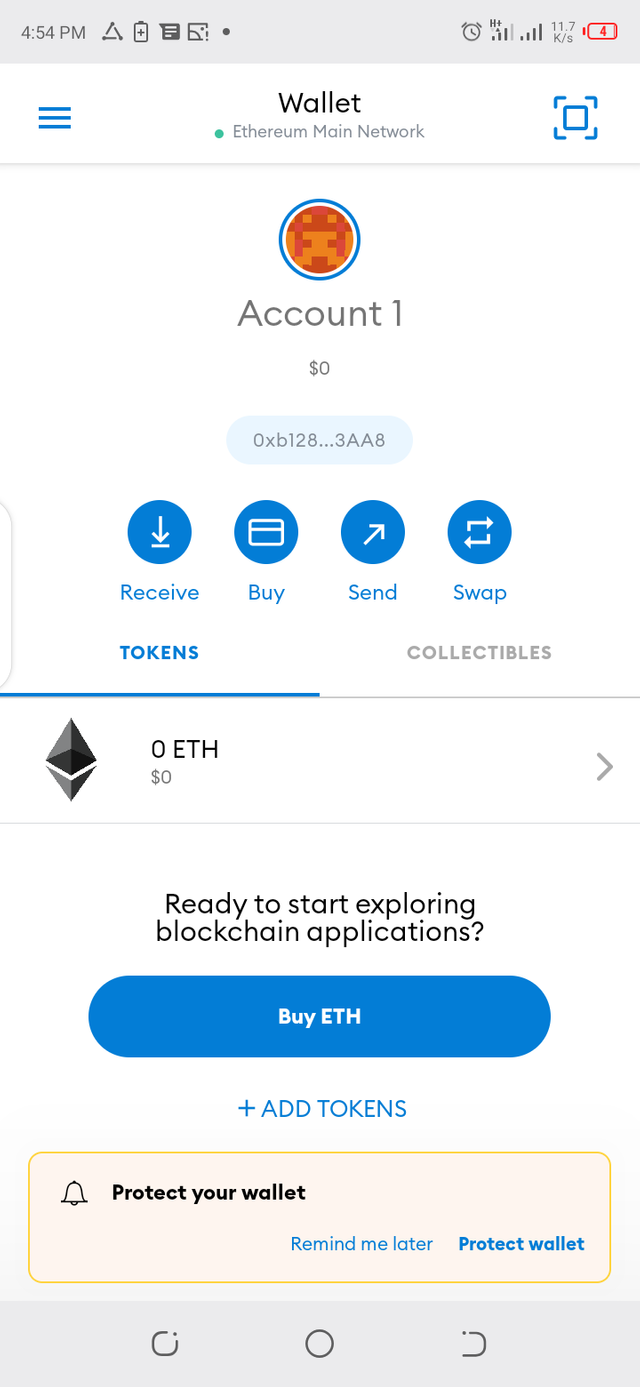

After it has shown your wallet,you will be able to choose the option of your choice

UNISWAP EXCHANGE

Uniswap exchange To exchange is to provide something in return. The act of obtaining items brought from others.It is an exchange that deals with exchanging different coins with a token.for example, exchange Ethereum with SKL,UNI, and so on.It is a decentralized exchange protocol that is built on Ethereum.

It allows users without the usage of a third party with a high level of decentralization and also, we need to understand the structure of the Uniswap protocol.it is made of two types of components-plant and token exchange contract.

Plant contract / Factory Contract to manage token exchange contracts, which is responsible for creating a new generation of currency swaps and maintain a token ERC20 each have their own tokens from the address mapping table token exchange contracts instance tokens Exchange Contract , which is responsible for completing the exchange of two tokens.

HOW TO USE UNISWAP EXCHANGE

To use a uniswap exchange,there are some procedures to be taken

First Download a uniswap exchange app on play store or Apple store for iPhone users or you could use the metamask for the transaction by clicking on "swap* on the app if you are willing to choose the Ethereum wallet

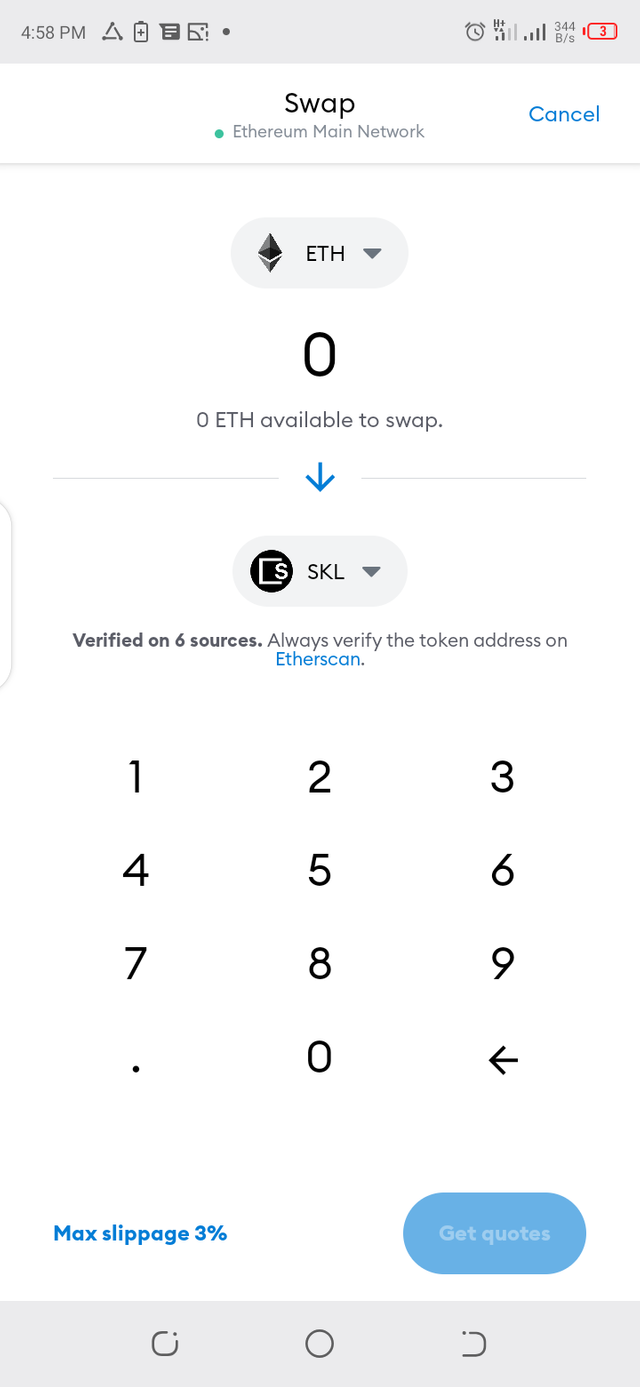

After clicking then a new page shows indicating a selection of the amount of Ethereum you needed to swap with any of the selected token given like SKL,UNI and so on

Then chose your preferred coin you will like to swap and click on "get quotes".preview your transaction and confirm it in your wallet..

First respected student Thank you very much for taking participate in Steemit Crypto Academy Season 2, Week 3 course class..

i could not see your swap of any coin after connecting with uniswap reason of insufficient asset

you did not show the cex trade

thank you very much for taking interest in this class

grade : 4

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit