Assalam-o-Alaikum friends! |

|---|

Welcome to my post. I'm @moazzamushtaq and I hope that you all will be fine and will be enjoying your life by the grace of Almighty Allah. I'm also fine and enjoying my life. Friends, I'm here today for participating in the Steemit Crypto Academy Contest/S16W4, organized by SteemitCryptoAcademy. The topic is about this platform and I want to get knowledge about steem by participating in this contest, it is titled: "STEEM Ecosystem Resilience". So get started without anymore waiting;

How has the STEEM ecosystem demonstrated its resilience to market fluctuations and changing trends over time? |

|---|

Steemit is a blockchain and and it has very vast ecosystem, this ecosystem demonstrated resilience through various mechanisms. The detail is given below:

1. Decentralization: |

|---|

STEEM is a decentralized blockchain, it means it is less susceptible to centralized control and also external market fluctuations. This decentralization helps this ecosystem to insulate it from sudden shocks happened in market.

2.Development and Innovation: |

|---|

Steem ecosystem is continuously evovled in development and innovation. This helps to explore new opportunities in the platform like different projects and applications.

3. Incentive Mechanism: |

|---|

Steem's incentive mechanism, like rewards of content creation and curations, hepls users to get many benefits and they intend to evolve in this ecosystem more. This incentive mechanism also helpful in market fluctuations.

4. Community Engagement: |

|---|

Activeness is also playing a role in steem ecosystem resilience. The users of steemit actively contribute in content creation, curation and in engaging within community.

Overall decentralization, incentive mechanism, community engagement and development and innovation has enabled STEEM ecosystem to demonstrate resilience to market fluctuations and changing trends.

How can the analysis of on-chain metrics, such as daily transactions, community participation and token distribution, provide insights into the health and robustness of the STEEM ecosystem? |

|---|

The analysis of on-chain matrics can provide insights in the robustness of the steem ecosystem in several ways:

1. Daily Transactions: |

|---|

Monitoring daily transactions on steem ecosystem can indicates the activeness and engagement within ecosystem. A healthy system of transactions, content creation, curation and also increasing volume of these

transactions are the some marks of a good ecosystem.

2. Stakeholders engagement: |

|---|

Analysing of stakeholders engagement within the ecosystem such as distribution of voting power and delegation of steem power to other users, reveal the level of involvement within the ecosystem. Stakeholders evovled in the ecosystem for its sustainability.

3. Community participation: |

|---|

The matrics, Community participation evovle activeness of community memebers and the activities like posts, comments, votes shows vibrancy of the ecosystem. An active community is characterised as interactions of users within the community.

4. Token distribution: |

|---|

A fair distribution of tokens including steem token promotes decentralisation and reduces the risks of centralisation or the risks of collection of tokens by stakeholders.

How can STEEM's Relative Strength Analysis versus other cryptocurrencies help investors identify potential opportunities in varying market conditions? (Provide an example that shows your analysis) |

|---|

Relative Strength Analysis (RSA) compares the tokens like steem with other cryptocurrncies for a specific period. It helps investors to find the potential of cryptocurrncies, their undergoing and outgoing performance in the market.

How RSA can be used for seeking opportunities using steem? is described below:

1. Identifying Strengths and Weaknesses: |

|---|

By comparing steem price with other cryptocurrencies such as Bitcoin, investors can find the periods in which steem is outperforming or underperforming it's compared tokens. For example, if steem is continually outperforms other cryptocurrencies in bullish market, it may indicate underlying strength in the steem market.

2. Spotting Trends: |

|---|

RSA helps investors to indicate the high price of steem in the market, when trending cryptocurrncies like Bitcoin, Etherium or BNB are showing bullish phase, mostly the steem will be high in the trend within the community.

3. Diversification Strategie: |

|---|

RSA helps in informing the diversification strategies by nominating the assets that s

Example: |

|---|

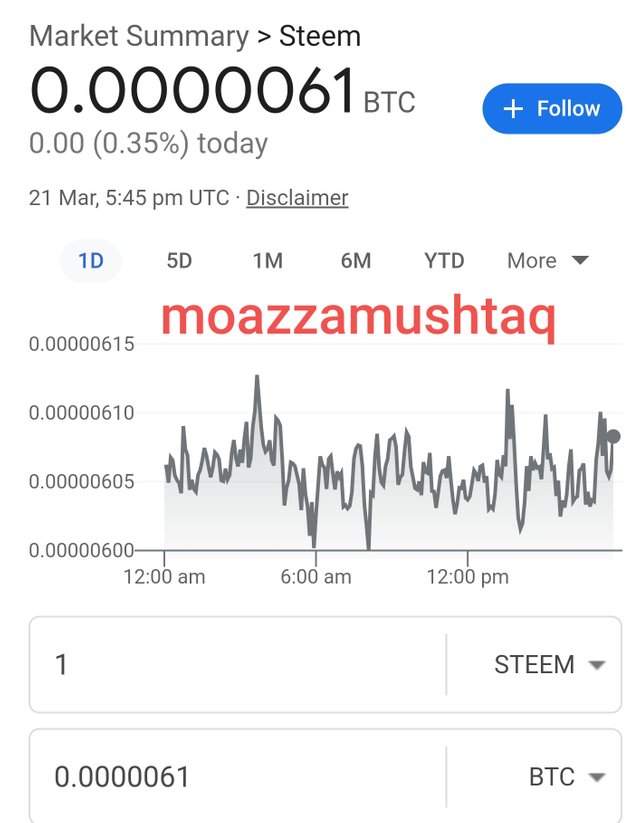

Let's see an example of comparing steem with btc or eth:

● During bullish market, if the relative strength line for steem/btc and steem/eth or upward this means steem is outperform with btc and eth.

● During bearish period, if the relative strength for steem/btc and steem/eth are downward means steem is underperforming compared to btc and eth.

By analysing these strategies the investors make decisions of buying, selling and holding cryptocurrncy so that they may not face any difficulty.

What are the possible implications of fundamental events, such as STEEM protocol updates, on relative strength dynamics and perception of the ecosystem by market participants? |

|---|

The fundamental events such as steem protocol updates have significant role on relative strength dynamics and perception of the ecosystem by market participants:

● Protocol updates often bring enhancement to functionality and technology of steem blockchain. Viewing these updates, these help in controlling security and transactions of steem token in the platfrom. This protocol update is very impactful on relative strength dynamic during bullish market.

● Protocol updates can provide the growth of this platform by providing attractive features to the steemit users, investors and developers. The updates which provide the beneficial experiences for content creation and decentralized applications (Dapps) can inreased the activity on steem. This will helpful for the growth of this platform.

● How market users percieve the steem ecosystem in light of protocol updates is very important. Positive updates received by investors and stakeholders have postive impact on the reputation of steem ecosystem. Rude or negative updates have negative impacts on market.

How does integrating on-chain analysis with relative strength assessment provide a comprehensive perspective for investors seeking to understand the overall strength of the STEEM ecosystem and make informed decisions? (Please provide an example showing your analysis) |

|---|

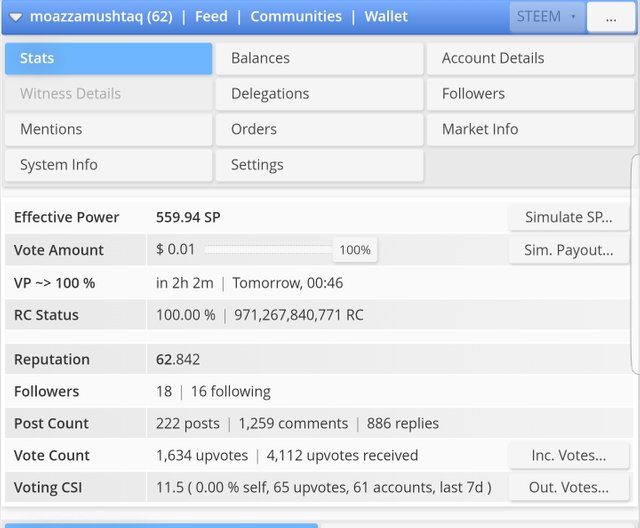

Integrating on-chain analysis with relative strength assessment provides a comprehensive perspective for investors seeking to understand overall strength of steem ecosystem by comparing important data with the market performance metrics. For STEEM, on-chain analysis may be involve by tracking metrics as transaction volume, active addresses and token distribution. RSA would involve comparing STEEMs performance with other cryptocurrencies or relevant market trends.

howing different performance in the market. For example if we compare steem to bitcoin and this comparison showing negative mark for steem for portfolio, we can be prevent from risks by looking the portfolio overtime.

Let's discuss one example, let's say we are analyzing STEEM's ecosystem on-chain data and it finds that it's transactions volume and active address has been increasing slowly over the past month. It indicates the growing network activity. Furthermore, we examine the point that STEEM's token distribution is becoming more decentralized in market, by few stakeholders which control a huge portion of the supply.

Now we assume a relative strength assessment (RSA) by comparing the price of STEEM performance with other similar cryptocurrencies like btc or eth or with a broader market index like the S&P 500. If we find this point that STEEM is outperforming with it's peers or the market trends consistently over a specific time, it conclud that investors have confidence in STEEM's fundamentals and growth prospects.

By comparison we can find that how much investors are confident about investing in steem. If the on-chain matrics of steem is positive or strong with it's peers it will show that overall steem ecosystem is good.

So friends this is all about my today post. It is a very nice topic and I participated in this contest with great pleasure. So in this contest I invite my friends @steemdoctor1, @zaink, @mubasherali, @shahid2030 and @abdullahw2 to participate in this contest. Hope you will get much knowledge while writing this topic as I get. Stay blessed friends.

Hey @moazzamushtaq thank you for sharing your insightful analysis of the STEEM ecosystem's resilience and dynamics. Your breakdown of decentralization innovation incentive mechanisms and community engagement really sheds light on how STEEM navigates market fluctuations. I appreciate how you've integrated on-chain metrics and relative strength analysis providing a comprehensive perspective for investors. Best of luck in the Steemit Crypto Academy Contest!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks for comment brother.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your comment has been successfully curated by, @kouba01 at 5%.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

STEEM's durability to market fluctuations appears through its decentralized nature, motivation devices as well as dynamic area interaction. By examining on-chain metrics like everyday deals, community engagement and token circulation, capitalists acquire important understandings right into the community's wellness as well as durability. In addition, STEEM's Relative Strength Analysis versus various other cryptocurrencies aids determine prospective possibilities, showing its efficiency about the more comprehensive market. This detailed strategy makes it possible for educated decision-making in differing market problems making certain continual development together with stability.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks for comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes you are very much true in saying that Steem is a decentralized platform having no external influence on it. You have beautiful explained all the on-chain metrics related things here. Yes this is true that these things show us the health of a crypto project.

Steem has a positive fundamentals and if we see it with it's comparing project Ms like Eos and Hive, it's quite obvious that Steem is performing well. From past few months we have seen a tramnadous boom in Steem price. Now we expecting a huge gaiiin it's price again this bull run.

Wish you get succeeded in this contest friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks for coming to my post and for leaving such a beautiful comment.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit