I am so glad professor @imagen, I followed your lecture and I must thank you for for your intuitive lecture; it was simple, and your points on #staking stood out. Thank you very much. However the homework task is as follow:

1.) Research and choose 2 platforms where you can do Staking, explain them, compare them and indicate which one is more profitable according to your opinion. (Binace is not allowed)

2.) What is Impermanent Loss?

3.) What is Delegated Proof of Stake (DPoS)?

4.) Conclusion.

I will like to take them one after the other, hoping that I meet your requirement.

1: Patforms to do staking.

There are lots of platforms for one to stake cryptocurrencies. Among these platforms are coinbase, binance, mycointainer, staked, stake.fish, stake capital, staking lab etc. These platforms function as third party platforms to stake coins with proof of stake consensus algorithm.

Stakers function as miners as applied in proof of work consensus algorithm. The difference is that while proof of work require high computational skills and equipments to mine or mint coins and validate transactions in exchange for new minted coins, proof of stake require individuals to stake coins for them to perform same function and in return they are rewarded for their investment with new minted coin tokens. Staking coins is similar to running fixed deposits in banks where you are paid interest for your investment based on duration.

In masternodes however, a staker invests at least a stipulated amount of coin worth of money as collateral. That coin will not be used, and it serves as his eligibility to mine. In return for his investment he will be rewarded with new minted coin tokens which he can convert as he wishes.

From the above understanding, to stake in most cases may require a huge monetary investments. What Platforms such as mentioned above does is to leverage, so that one with little amount of money can afford to participate in staking.

In view of this homework task, I am asked to:

1a• Research and choose 2 platforms where you can do Staking.

1B• explain them.

1C• compare them and indicate which one is more profitable according to your opinion.

2 platforms to do staking

1a• I have researched and chosen these two platforms. **Mycointainer ** and StakingLab

1b• Explain them

Mycointainer

Image source

Mycointainer is a staking and masternode automated platforms that allow stakes on most proof of stake coins. According to mycointainer, individuals can choose the coin they wish to stake on. One can either buy the coin from mycointainer platform or one can transfer it from other platforms to stake.

Just as I mentioned above, since participating in masternode will require a lot of fund and also for one to start getting reward from staking may require lots of coin; mycointainer allows everyone to stake by one involving in the staking pool. Staking pool combines the coins contribution of all investors into single pool for maximum profit and the rewards are distributed automatically according to one's contribution.

Below promises are from mycointainer.

To start earning money you will need an asset of your choice. Then you simply transfer it you MyCointainer’s staking wallet.

Keep coins in MyCointainer

MyCointainer will utilize the power of blockchain (Proof of Stake + Masternodes) to generate stable profits for you.

Enjoy your regular profits

Get notified when profits are generated. Now it’s time to enjoy your life and finally let your money work for you.

Mycointainer source

Mycointainer has a reward infrastructure that benefits everyone, even those with small number of coin once they join in the staking pool.

The platform is automatic and the reward is based on compound interest.

Moreover the return is depended on the rule guiding the particular crypto asset.

Most return on investment rewards are free while some attract fees.

Benefits

You can exchange and buy coin from the platform.

Everyone can benefit from participation in staking pool.

The reward is compound interest, so you can make more profit from your deposit.

There is also the introduction of mycointainer power. In this option users can earn 100% because there are no staking fees. Users have access to all masternodes coins on the platform There are two mycointainer power options, power plus and power max, these have different monthly charges; 3.90 eur for the plus and 8.90 eur for the max.

The very important benefit of mycointainer is the they are regulated by FINANCIAL INTELIGENT UNIT.

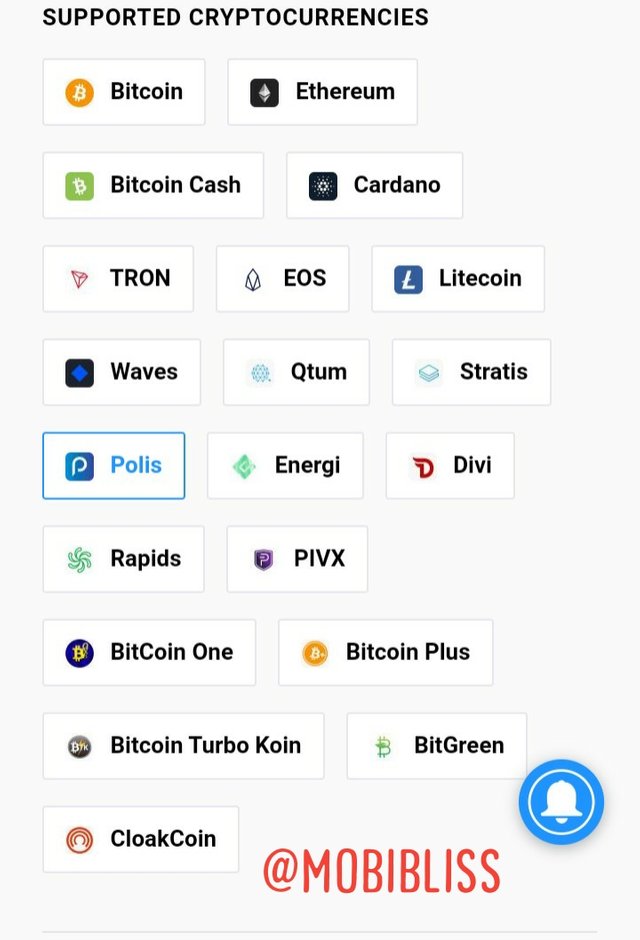

COIN SUPPORTED:

StakingLab

Image source

Staking lab is similar to mycointainer. It is a secured online platform where users gain profit in percentage over their staked coin as they participate in staking pool or they subscribe to masternodes.

Another addition to "staking lab" is their introduction of instant nodes option. In instant nodes, the platform purchases coins in advance and start a masternode. Investors can choose to join at anytime and exit at anytime. The rewards are given simultaneously.

Moreover, staking lab attracts charges; There is a 3% staking rewards fee for maintenance and a 0.1% withdrawal fee. They equally charge a 5% rewards fee for standard masternodes and a 7.5% rewards fee for instant masternodes.

Benefits

In staking lab, you can benefit from staking.

You can equally earn from masternodes and instant nodes.

There are up to 100 + coins to ivest in and more are added.

Staking lab also offers referral benefits for inviting people to their platform. You can earn also from up to three level downlines.

1c• compare them and indicate which one is more profitable according to your opinion

The two platforms are good for both staking and masternodes. Mycointainer runs on compound interest. Stakinglab has instant nodes, myointainer has mycointainer power, so the both platforms are profitable.

| Mycointainer | Stakinglab |

|---|---|

| Masternodes | masternodes |

| Power. | instant nodes |

| Compond inst. | normal interest |

| Lower charges. | low charges |

| Regulated. | not regulated |

In my opinion mycointainer is more profitable due to it's compound interest and lower charges. The mycointainer power is equally more promising.

In all, we need some caution before staking or participating in masternodes. One of the risk we need to be aware is that of impermanent loss.

Q2

What is impermanent loss.

As we already know, when staking or participating in masternodes, we adding liquidity to the project of that coin, that is why we gain rewards.

Moreover a trader may simply decide to hold his coin waiting for when the price improves.

Impermanent loss occurs when the profit we should make from staking (automated market makers ) is lower when compared to profit one could make when one simply hold the coin in our wallets; this is usually due to changes in price.

See example below:

1• I stake 1 ETH and 100 DAI in the respective pool on Uniswap

2• In a week 1 ETH is equal to 200 DAI

3• If I held my initial 1 ETH and 100 DAI, I would have gained 50% (100 DAI is the same, but my ETH is now worth 200 DAI)

4• Being a participant in an AMM pool on Uniswap, my gain is less than the 50% I would have made if I simply held the assets

The Chain Bulletin

The time we may realise the loss is when we are withdrawing our fund.

There is yet another way to stake; this is through Dpos.

3: what is delegated power of stake (Dpo)

Dpos is a consensus algorithm in which block validators are elected as such by collective staked pool of the users.

The concept of delegated power of stake is more democratic in nature. To reach a consensus on who validates the next block in the chain, the users elects individuals by pooling their funds together.

The platform chooses ( mostly from 20 - 100) who could be elected as the next block validator. The users votes by staking their coin in a pool for the witness of their choice. They do not transfer their coin to another address rather they follow a pre-designed method of the platform.

When their voted witness wins, he becomes the next block validator, he will be paid rewards and the returns will be shared among all who staked in the pool according to their stake.

CONCLUSION

Staking is a way of investing our coin hoping to get returns for our investment. It is comparable to fixed deposits of banks.

There are many ways available to stake: we have platforms offering both staking and masternodes in one go. By using a collective pool, they make it easy for everyone even with little capital to stake.

We need to be aware that loses could result from staking known as impermanent loss.

Delegated power of stake is gaining momentum and it is another to make profit by voting witness. Happily, this consensus algorithm is applied by #steemit.

You've got a free upvote from witness fuli.

Peace & Love!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @mobibliss. Thank you for participating in Season 3 of the Steemit Crypto Academy.

You did a good job and demonstrate mastery of the topics requested in this assignment, however, the use of quotes, even when properly referenced, is not recommended and may be cause for disqualification.

I hope to continue correcting your next assignments.

Grade: 6.0

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Please professor @imagen, this work is about to expire without vote .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit