INTRODUCTION

As the crypto space is gaining more and more adoption, many unscrupulous elements has arisen to take advantage of unsuspecting investors and scam them of their money. We see this scammers employing differing tactics and ingenuity, all geared at stealing. The very act itself has impacted on the Blockchain and crypto projects adversely. In 2018, it was estimated that at least nine million dollars are lost each day on crypto scams.

WHAT ARE CRYPTO SCAMS?

Crypto scams includes all the activities of bad players geared at defrauding investors in the crypto industrial. The scammers employ various strategies to scam people of their money. These methods include hacking -an attack on people's wallets to steal their fund. it includes phishing, fraud/fake crypto projects, exit scams etc.

When weighed in the scale of 100, it is believed that frauds constituted the major parts of the crypto currency scams taking up to 30%.

Another leading type of scams is the hacking attempts taking up to 22%; thereafter we have theft and exit scams constituting up to 17% and then phishing scams taking up to 13%.

Let' take a look at few of these scams and see how it works.

FRAUDS/FAKE PROJECTS

Most crypto scams are as a result of fraudulent projects. Some of these projects includes ponzi schemes, pyramid schemes, scam ICOs.

ponzi schemes

One of crypto scams that falls in this category is ponzi schemes. Ponzi schemes promises high yield returns on investment, money contributed by recent investors in the schemes are used to pay earlier investors. I would say that greed is at the backbone of such investments and unwitting investors becomes preys to these acts. One example of such ponzi schemes is the plustoken.

PLUSTOKEN

The plustoken is a ponzi crypto wallet platform established in 2018 dominant in China and Korea, a project that has raised over $2 billion. Users are to invest their bitcoins in the platform; the platform will use the bitcoins to do arbitrage, and pay the investors monthly percentage according to their investments.

PLUSTOKEN promises 9% to 18% return on investment for every investment made. However higher investors of up to $500 receives up to 30% return on investment and other incentives.

The schemes seems to be further sustained by various campaigns and referral programs. Users earn commissions as they refer new members. The more they refer, the more they earn. You can reach them through social media like, WeChat, one - one meetups and the rest.

Doubts about plustoken began in June 2019 when users were having delays withdrawing their funds. Users noticed that they could not get their funds even after 35 hours of placing withdrawal. Leader's of plustoken in an effort to calm investor's mind claimed that the delay was due to high gas fees on Bitcoin network. Moreover the scammers were just laying preparatory grounds to run with people's money. When the platform withdrawals began going again, users noticed their are no money in their accounts. They have been scammed!

Further study about the platform shows that it was simply a ponzi schemes with the intent of scamming investors, the funds of users were not used to do **arbitrage in actuality, rather the money donated by new investors was used to settle earlier investors in the platform. When the circle cannot be sustained, the scammers ran.

** It is noticed that prices of crypto assets may vary from exchange to exchange. It may be that some exchanges sell at a lower cost when compared to others. Arbitrage refers to the process of buying and selling same asset from one exchange to the other while making profit from the variance in the price of the said asset.

According to chainalysis, it is believed that plustoken has made away with at least $185 million worth of stolen bitcoin. Before the very incident, they tried to make a pretence transaction of up to 24,000 transfers using 71000 addresses. This transactions was done using an anonymous program named coinjoin. Coinjoin mixes multiple Bitcoin transactions into one single transaction making it difficult to decipher who was paying and who receives, so it wasn't clear if the funds were actually paid to investors.

The news has it that Chinese authorities has arrested six person's,Chen Bo, Yuan Yuan, Ding Zanqing, Peng Yixuan, Wang Renmi and Dong Jianhua. These are allegedly major leaders of this ordious scam project. Others who are involved in this scam are still being hunted by the authorities.

According to Bitcoin news.com. latest news, 109 person's has been arrested altogether. References

PLUSTOKEN is just one example of ponzi scheme scams on the crypto space. At the start it appears so real. They were paying and everything seems normal untill they couldn't. Unsuspecting investors were scammed at the end of the day.

Current news suggests that plustoken scammed Chinese and Korean more than the said $2 billion. According to gadget 360, reference

the value is between $3 billion and $4 billion.

PYRAMID SCHEMES.

Many are aware of the scam of pyramid schemes. They are sustained by new investors. New investors Money are used to pay earlier investors and the circle continues. As we often know from many pyramids, it gets to the stage when the "center can no longer hold". A typical example of that on the Blockchain is the popular "forsage". Although forsage is paying at present, however it is a pyramid scheme. I am here not trying to be critical. But no project of pyramid will last forever.

ICO scams.

ICOs are initial coin offerings. Unlike IPO which are regulated, ICOs are not. You may simply dig up few information about them through their whitepaper and other info surrounding the project, like the teem of developers and more. ICOs are good ways new cryptocurrencies raise funds for the project. However it has become soft spots for scammers too.

During ICOs early adopters of the crypto invest money in the project in exchange for the crypto token. It is believed that when the project is fully launched, holders can earn more in their investments as the value of such crypto coin rises. This hope of high yield returns has become an easy trap for unsuspecting investors. In 2017, it is reported that 80% of the ICOs are barely scams.

Other method of scams could be dead projects. This happens due to "pump and dump". Scammers could spread misleading news creating a hype of a crypto project. This is with the intent of attracting people to buy the cryptocurrency. Once people have bought the coin, they will sell off, leaving the coin with no value and as more and more people continue to sell, it could result in the coin becoming valueless, turning to a "dead coin"

Here below are few examples of the ICO projects that raised funds but were scams.

1: Pinkcoin and Ifan. raised $660,000,000

2: Plexcoin 15,000,000

3: Bitcard 5,000,000

4: Opair and Ebitz 2,900,000

5: Benebit 2,700,000

6: Bitconnect 700,000

7 Confido 375,000

Ref.

Other types of scams done on the crpto world are hacking scams where hackers tends to attack wallets of exchange platforms. Coincheck Inc reports a hackers attempt where it claims that hackers made away with $500 million in virtual currencies of users.

Exit scams are another kind of scam done in the crypto currency space. This is where known crpto platforms fold and exit with investors funds. Typical example of exit scams is that of a crpto lending platform bitconnect. This platform reportedly shot down it's operation and made away with people's funds. The estimated amount loss amounts to $250 million.

Phishing scams. Phishing scams are another kind of scams on the crypto space. Bad players mimics original crypto sites by changing a small aspect of the wordings, making it difficult for a person to differentiate the fake site, social media handle etc. Unsuspecting investors could become a prey of such scams.

For example, suppose an original crypto site is mobi.com and a scammer creates a platform with m.obi.com, unsuspecting person's may mistake it to the real site and may get scammed by the fake.

TO WHAT EXTENT HAS CRYPTO SCAMS AFFECTED THE CRYPTO SPACE?

The answer is not far fetched. Just take a look at few of the amounts lost to scams as mentioned above. The impact is serious on the crpto space. We have another example of the Arisebank that aims to raise $1 billion by convincing retailers to invest in their proposed first decentralized bank.

The project has already raised $ 600 million during ICO only to be stoped by SEC. This ended up being a $ 600 million scam.

Estimate has it that every day, over $9 million are lost to fraudulent activities within the crpto space . When we put the entire sum together, it has become even enough to save some nations in Africa and Asia who are ravaging in abject poverty.

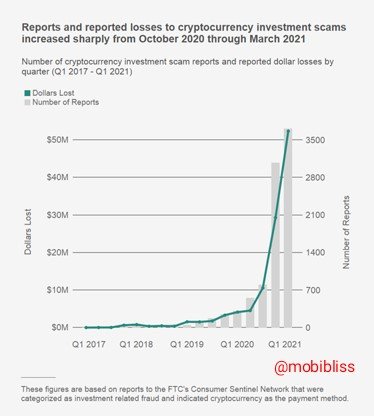

American federal trade commission reports that over 7000 users has reported to have been scammed on crypto related issues. The chart shows to what extent fraudulent activities has affected the crypto space.

The truth remains that the crypto space suffers the effect of bad players. One of the implications would be doubts and fear.

- When doubts are created in the mind of people in the crypto space it results to low adoption. People would be naturally skeptical in investments where there are possibilities that their money could be endangered.

WILL REGULATION IN THE CRYPTO ADD VALUE TO THE CRYPTO SPACE?

Well, in my opinion, I will give the emphatic "yes"!. It will!

Let us take a look at few of the problems listed above.

** 1: Regulation could remove fear or doubt**. In the United States of America for example. It is said that up to 75% of youths have heard of Bitcoin. 55% adults have heard of Bitcoin too, yet it is only 2% of Americans has actually invested in cryptocurrencies. The reasons includes fear or doubts. Not many people understand the crypto concept,. Yet when regulated it gives people confidence to make investments.

2: Regulation could fish out bad players

If there are no other benefits of regulation in the crypto space, we cannot exempt the impact it could have in limiting bad players. For example, fake ICOs and Ponzi schemes could be detected before hand at it's beginning, not after the harm has been done.

Regulation could prevent fake price hypes.

In 2017, it is believed that the very rise of Bitcoin value was due to fake news and hypes by person's who already own bitcoins. However, regulation could help to control such events.

Regulation could help control the speculative view of crypto assets. Prices of cryptos are often speculative, regulation can minimize such notion.

Bottom line

The crpto space offers opportunities for good profitable investments. Yet, they are full of risk too. Aside from the volatile nature of the markets, scams are another big issue facing the crpto space. Before considering investments in cryptocurrencies. Here are few tips. I offer these as suggestions.

- Scrutinize the project. Make sure that you have made a foundamental analysis of the project. Consider not only it's whitepaper but also the teem members. If you see fishy things about the teem members like forgery, it might be a red flag. I'd the project has no Blockchain backing, then it is another red flag.

- Make sure of your news source. Remember, hackers can create a phish social media handle of another to spread fake news in other to scam people**

- Do not put all your eggs in one basket

While investing, spreed your money. Invest in different assets. - Do not invest what you can not endure. Apart from scams, the crypto biz is a highly volatile one.

- Be careful with ponzi schemes. When a crypto offer appears too good to be true, then it probably is.

- Be wary of pyramids. Pyramid schemes has proven to fail in the long run.

Hi

Thanks for participating in the Steemit Crypto Academy

Feedback

This is good content. Well done with your research study on Crypto scams.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit