Hello everyone! I hope you will be good. Today I am here to participate in the contest of Steemit Crypto Academy about the Algorithmic Trading with Moving Averages on Steem. It is really an interesting and knowledgeable contest. There is a lot to explore. If you want to join then:

.png)

Question 1: Introduction to Algorithmic Trading

Explain the concept of algorithmic trading and its significance in modern markets. Provide an example of a basic algorithmic strategy using moving averages and show how it could be applied to the STEEM/USDT trading pair.

Algorithmic Trading is the type of trading in which we use computer programs and algorithms for the autonomous trading experience. In the algorithmic trading we can place trades based on the pre defined conditions and criteria. We can set specific conditions and when the pre defined conditions will met the trading orders will be performed automatically.

Algorithmic trading helps us to trade with precision and at great speed because while trading humans are not involved the program automatically runs the trading when the specific conditions are met. It uses complex mathematical models and statistical analysis. We can use algorithmic trading in various markets such as stocks, commodities, cryptocurrency and foreign exchange.

Significance of Algorithmic Trading in Modern Markets

Speed and Efficiency: As I have mentioned already that this trading includes bots not humans so they perform the trades with great speed and efficiency. It ensures high precision while trading. It allow the market participants to capitalize on the short market inefficiencies.

Reduced Emotional Influence: Algorithms do trading based on the pre defined logic and data. It removes the emotional biases from the decision making which can happen in the volatile market.

Increased Liquidity: Algorithmic trading performs buy and sell order quickly. And these automatic orders cause in the increased liquidity.

Lower Transaction Costs: As we know that the algorithms perform trades automatically so they can help to reduce the transaction fees. They manage the order sizes, time and the prices efficiently.

Scalability: Algorithm trading can manage the multiple trades. Trading can be done in different classes and markets. So they offer scalability beyond what human traders can handle.

Example of a Basic Algorithmic Strategy

A common strategy in the algorithmic trading is the Moving Average Crossover strategy. It uses two moving averages of different periods. Using these periods it generates buy and sell signals. This strategy works as follows:

Short Term Moving Average (SMA1): It is the fast moving average for example 10 day moving average.

Long Term Moving Average (SMA2): It is the slow moving average. For example 50 days moving average.

Steps

Buy Signal: If the short term moving average crosses the long term moving average. And after crossing short term moving average goes above the long term moving average. At that time it suggests a bullish signal. We can take a buy entry in the market.

Sell Signal: It is opposite the buy signal. If the short term moving average crosses the long term moving average. And after crossing short term moving average goes below the long term moving average. At that time it suggests a bearish signal. We can take a sell entry in the market.

Applying the Moving Average Crossover Strategy to STEEM/USDT

We can apply moving average crossover strategy to STEEM/USDT trading pair in the following steps:

- Select Timeframe: First of all we need to choose a time frame for the moving average based on the trading style. For example if we do swing trading then we can choose daily candles.

Calculate Moving Averages

Short Term MA (SMA1): We need to calculate the 10 period Simple Moving Average of STEEM/USDT. We generally represent it in a short way by writing SMA.

Long Term MA (SMA2): We also need to calculate the 50 period Simple Moving Average of STEEM/USDT.

Trading Signals

Buy Signal: If the 10 day Simple Moving Average crosses above the 50 day Simple Moving Average. It signals upward momentum. At that time we can place a buy order for STEEM.

Sell Signal: If the 10 day Simple Moving Average crosses belwo the 50 day Simple Moving Average. It signals downward momentum. At that time we can place a sell order for STEEM.

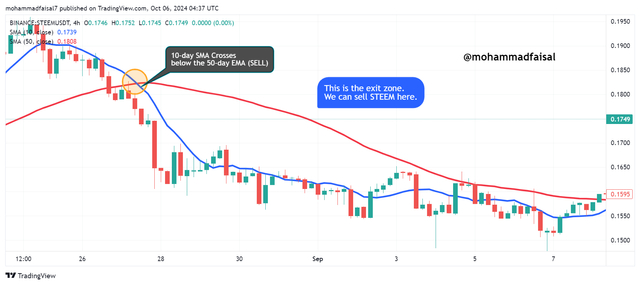

Here you can see I have added two moving averages. One moving average is short term which is 10 day SMA and the other is the long term which is 50 day SMA. Short term SMA is represented by the blue line and red is representing the long term SMA.

When the short term is crossing above the long term then it is the buy signal and we can use this zone to take a buy entry. And we can see that after this bullish signal the price rose up. Similarly after some days the short term SMA crosses below the long term SMA which indicates a sell signal and we can sell our STEEMS at this point. After this bearish signal we can see that the price went down.

Question 2: Moving Averages in Algorithmic Trading

Compare different types of moving averages (SMA, EMA, WMA) and discuss their benefits and drawbacks in an algorithmic context. Which one would you prefer for your algo-trading strategy and why? Provide a practical example on a Steem chart.

In the algorithmic trading we use different kinds of moving averages. Different types of moving averages help to identify the smooth price data and trends. Each type has unique properties to respond to the price behaviours and to make them suitable to use for the different strategies.

Simple Moving Average (SMA)

Simple moving average is the arithmetic mean of prices over a specific period of time. For example a 10 period SMA averages the last 10 closing prices.

Benefits

- Simplicity: It is easy to calculate and explain.

- Smoothness: It provides a clean trend signal. Because it clearly shows price fluctuations.

Drawbacks

- Lagging Indicator: As it provides equal weighting of past prices. So the SMA is slow to respond to price changes. And it causes to miss the early signals.

- Delayed Response: In the volatile market when sudden market moves appear the SMA responds very slow. It is slow and it is not actionable in the volatile markets.

Exponential Moving Average (EMA)

Exponential moving average highly focuses on the recent prices. And it is more responsive to the recent price movements. It uses a multiplier to adjust the weight of the recent data of the market.

Benefits

- Faster Reaction: The exponential moving average responds more quickly to recent price changes. And it can be useful in volatile markets.

- Timely Signals: It reduces the lag as compared to the SMA. It provides early and quick signals for the trend changes.

Drawbacks

- Prone to Noise: As we know that EMA responses the changes in the prices quickly. So EMA cause cause market noise and this can also lead to false signals.

- Complex Calculation: It needs more steps for the calculation as compared to the SMA.

Weighted Moving Average (WMA)

Weighted moving average focuses progressively to the recent price and data points. For example in a 10 period weighted moving average the 10th period may get 10x focus and weight as compared to the 1st period.

Benefits

- More Emphasis on Recent Prices: Just like the EMA the WMA focuses more on the recent price data. And it does it in a linear way. It gives more clear signal during the volatility of the market.

- Smoother than EMA: It is faster that SMA. It is also smoother than the EMA. Because it avoids extreme sensitivity to the recent data.

Drawbacks

- Complexity: It has benfits but on the other hand it has more complex calculations than the SMA and EMA. It requires to sum up all the weighted values.

- Not as Widely Used: This is not a popular moving average. A few traders and the systems use this moving average. It reduces the effectiveness in terms of the market psychology.

Comparative Summary

| Moving Average | Strengths | Weaknesses |

|---|---|---|

| SMA | Simplicity, smooths out price movements | Lags behind price action, slow to respond |

| EMA | Responds quicker to price changes, provides earlier signals | More prone to noise, less smooth |

| WMA | Focuses heavily on recent data, smoother than EMA | Complex to calculate, less commonly used |

Preferred Moving Average for Algorithmic Trading Strategy

By seeing and observing the advantages and disadvantages of all the moving averages I am choosing exponential Moving Average as my preferred strategy in algorithmic trading. And it has following reasons:

*Speed and Responsiveness: EMA quickly responses to the price changes. And it helps us to identify the emerging trends. And it helps us in the quickly moving markets such as cryptocurrency market.

Reduction in Lag: As compared to the SMA and EMA provides a balance between the smoothness and responsiveness. It reduces the lag in the signals. It provides actionable insights on the market.

Volatility Sensitivity: Volatile markets are hard to trade but EMA helps us to generate buy and sell entries in the volatile market as well. So it can react properly to the market even when it is volatile.

So for an algorithmic strategy EMA is the good choice. Because its quick response and reaction in markets such as STEEM/USDT is helpful where the price fluctuations are common.

Applying the EMA Crossover Strategy on a Steem (STEEM/USDT) Chart

Here is a step by step guide to apply EMA dtrategy on STEEM/USDT chat:

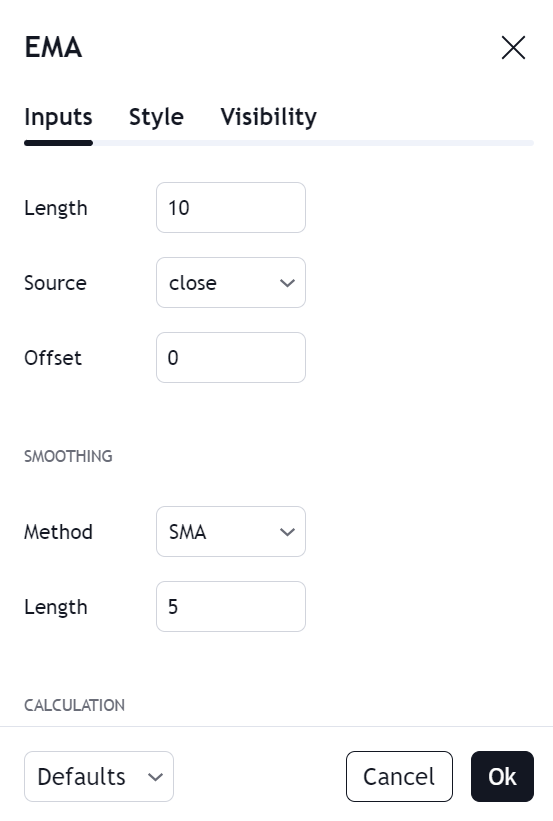

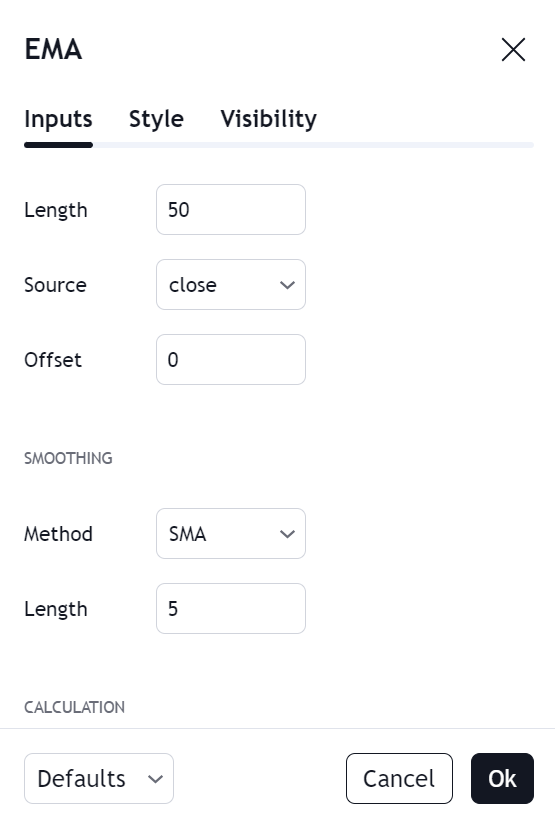

Select two EMAs

- Short Term EMA: I have selected a 10 period short term EMA. It tracks the recent price actions closely.

- Long Term EMA: For the long term I have set an EMA as 50 period. It will provide a broader view of the trend.

|  |

|---|---|

Identification of Buy Signal using EMA

When the 10 day period EMA or short term EMA crosses above the 50 day period EMA or long term EMA. It gives us a buy signal and upward momentum. It is also known as the golden cross.

|

|---|

Here we can see that the 10 day EMA or short term EMA has crossed above the 50 day EMA or long term EMA. It is the the golden cross and a buy signal for the STEEM/USDT chart. It will drove the price in the upward direction. This buy signal drove the price from $0.1663 to $0.2021.

Identification of Sell Signal using EMA

|

|---|

Here again if we seethe short term EMA is crossing below the long term EMA. It is the death cross or in simple words it is the sell signal. We can sell STEEM here at this point. And we are trading future then we can take a short entry here of STEEM/USDT trading pair.

We can observe that this death cross pushed the price downward from $0.1926 to $0.1608. In this way we can identify the buy and sell signals with the help of the EMA in the algorithmic trading by using the short term and long term EMAs.

Question 3: Design an Algorithmic Trading Strategy

Create an algorithmic trading strategy for the Steem token using moving averages. Define your entry and exit signals, risk management rules (such as stop-loss levels), and explain how you would backtest your strategy to ensure its effectiveness.

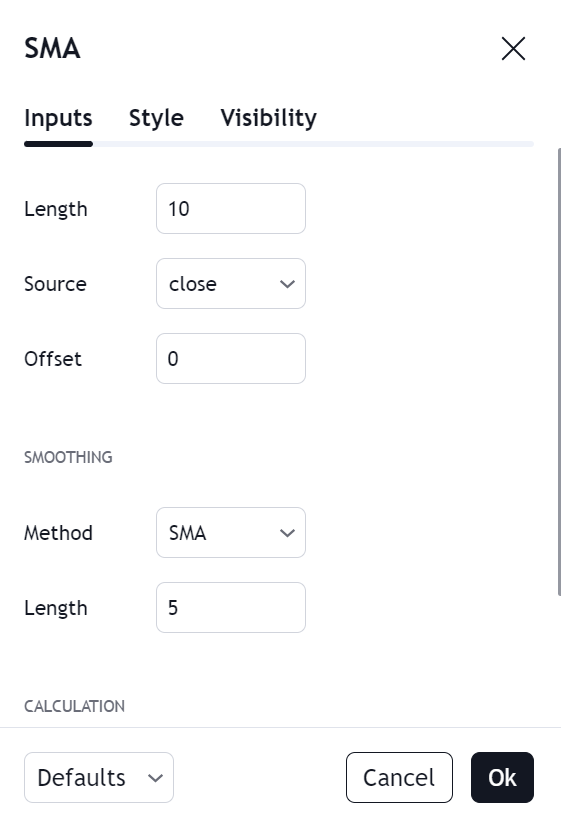

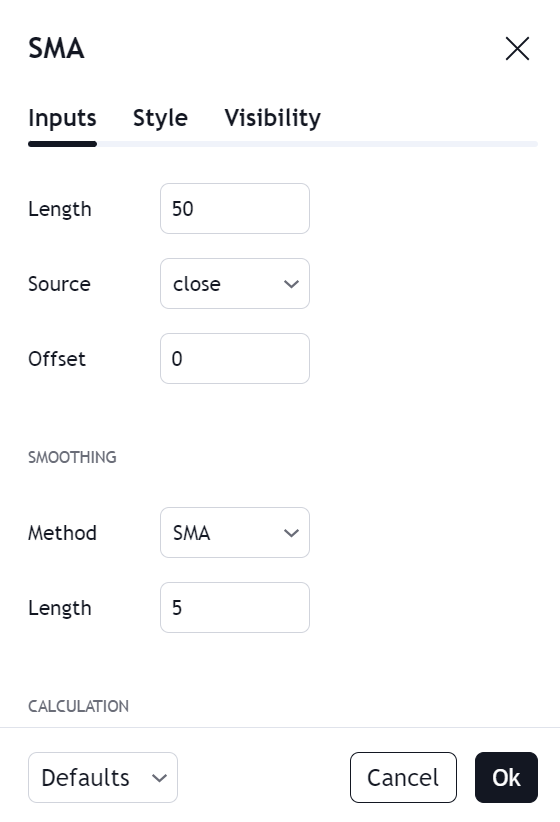

Here is a complete structure of the algorithmic trading strategy while using the moving averages. I will using Simple Moving Average for the STEEM/USDT trading pair. This strategy will help us to determine the entry and exit points for the for the STEEM/USDT. It will help us in risk management and backtesting. We can implement this strategy to any trading pair.

Algorithmic Trading Strategy for Steem Token using SMAs

I will use Simple Moving Average indicator. I will use it as short term moving average as well as for the long term moving average. For the short term I will use a 10 period moving average. It will help me to capture the short term price movements.

Similarly I will use 50 period moving average for the long term and it will help me to identify the long term trends.

Entry and Exit Signals

With the help of the SMA we can easily set entry as well as exit points for our trade. It is simple to use. First of all I am going to set my SMA for the short term as well as for the long term. Here is how we can set SMA on the chart:

|  |

|---|---|

SMA setup for the short term and long term has been installed now we will use these setups to determine the entry and exit points. Here is how we we will determine the entry as well as exit points.

Buy Signal

As we have mentioned it earlier that when the 10 day period moving average crosses above the 50 day moving average then it is a bullish signal. It is the buying zone and we can accumulate STEEM here as after this an upward movement occurs.

|

|---|

Here in the above chart we can see that the golden cross has happened where the short term moving average has crossed above the long term moving average. At Monday 19 August 2024 , 4:00 the short term moving average represented by the blue line crossed above the long term moving average represented by the red line. So it indicated a bullish buy signal. And this signal proved to be a very significant signal which drove the price from $0.1675 to $0.1960. So in this way we can spot buy signals with the help of the moving averages.

Sell Signal

We can also spot sell signals or exit points with the help of the moving averages. As we know that when the 10 day period crosses below the 50 day period then market indicates a bearish signal and at that point we can exit our long trades and can start selling.

|

|---|

In the above chart we can see a death cross where the 10 day SMA is crossing below the 50 day SMA so it is a bearish signal. Furthermore if we see the chart more keenly we can observe at Tuesday 27 August, 2024 8:00 the short term moving average crossed below the long term moving average and the price was driven in a downtrend. And this bearish signal pushed the price to move from $0.1826 to $0.1474.

And in order to manage the risk of the loss we can consider the death cross as an exit zone. As soon as the death cross happens we can exit our long entry. If we are holding in the spot market then we can simply exit the trade in profit. And if we do not exit the trade at the death cross then we will loose our assets and we will face loss.

|

|---|

Here is the complete setup which is showing different buying as well as selling zone. We can consider all the buying zone as entry zone and all the sell zones as exit zones. We can observe that whenever 10 day moving average has crossed above the 50 day moving average it was a bullish signal and it drove the price to move in the upward direction.

And similarly whenever the 10 day moving average crossed below the 50 day moving average it indicated a bearish signal and it drove the price to move downward by reversing the current trend.

So in this way we can apply moving averages in the algorithmic trading to automate the trades. In the algo trading when the 10 day moving average will cross above the 50 day moving average then the trading bot will place a buy order and it will accumulate STEEM. And similarly we will command the trading bot to sell the STEEM whenever the 10 day moving average will cross below the 50 day moving average. For the stop loss points I am heading towards the risk management.

Risk Management

Risk management is really very important in each trading strategy if we do not focus or manage the risk involved in the trading then we can become fail and we can lose all of our assets. Because we know that crypto market is very unpredictable and volatile. Here are some points through which we can do risk management:

Stop Loss Level

When the short term is crossing above the long term moving average and we are entering the buying zone. At that point we should place a stop loss below the recent swing low. It will make it sure if the price reverses its trend then our loss will be limited otherwise the loss will be unlimited.

For example

If we see a buy signal generated by the moving average at $0.30 and the recent swing low is $0.28. Seeing this we can place stop loss at $0.275. So if the price goes below $0.275 our trade will be cut automatically and we will be safe from the unlimited loss of the assets.

Take Profit Level

We can set a take profit level on the basis of the risk to reward ratio such 1:2 or 1:3. It means for every $1 risked for the aim of $2 or $3 profit respectively. We can also use technical indicators to define the target such as the next resistance level.

Position Sizing

The position size of the trade also matters a lot to manage the risk of the trade. We should not put all the eggs in one basket. We should use a small part of the assets for the trading and the other part of the assets should not be in trade. If we put all the assets at once then we will be at great risk of loosing all the assets. So always do trade wisely while investing a small portion of the capital.

Backtesting the Strategy

It is another important thing to check the effectiveness of the trading indicators and strategies. So in order to ensure the efficiency of the SMA crossover strategy we should backtest it on historical STEEM/USDT chart.

For the backtesting we need to analyze the history of the charts. We can implement the code strategy or backtesting frameworks to implement the algorithm and to analyze the historica behaviour of the price movements based on the strategy we are using. In current case we are using moving averages so we will backtest the historical chart by implementing the moving averages on the historical chart.

Simulating the Trades

For the simulation of the trades we can follow these steps using SMAs:

- We can simulate the trades based on the crossovers of the simple moving averages.

- Enter long positions when the 10 period SMA crosses above the 50 period SMA.

- Exit or sell when the 10 period SMA crosses below the 50 period SMA.

- Apply the stop loss and take profit levels.

Performance Analysis

We can analyze the performance of the backtesting based on these steps:

- Net Profit: Total gain/loss from the strategy.

- Win Rate: Percentage of winning trades.

- Risk to Reward Ratio: The average win compared to the average loss.

- Max Drawdown: The largest peak to trough decline in the equity curve.

- Sharpe Ratio: The risk adjusted return of the strategy.

In order to optimize the performance we can use different periods for the moving averages such as 20 and 100 or 50 and 200. And we can analyze the stop loss and take profit points according to those periods as well to determine which period of the moving averages is more suitable.

|

|---|

In the above chart I have analyzed the STEEM.USDT trading pair 5 times using the 10 day period and 50 day period for the backtesting.

First Crossover

In the first crossover of the STEEM/USDT chart we can see that the 10 day moving average crossed below the 50 day moving average. And it gave a bearish signal. The price moved in the downward direction.

Second Crossover

In the second moving average crossover of the STEEM/USDT chart the 10 day period crossed above the 50 day trading period. It gave a bullish signal. And we can see the price again moved in the upward direction.

Third Crossover

After the second crossover and upward movement in the price the third crossover again happened. It was same like the first crossover where 10 day period crossed below the 50 day period and it caused the price to move downward.

Similarly the fourth crossover as well as fifth crossover were bullish and bearish consecutively. Here we can say that this moving average crossover strategy followed the exact movement in the price at the bullish and bearish crossovers. So while backtesting the STEEM/USDT chart using the moving averages we can say it is a good strategy for the entry and exit points determination.

Question 4: Implementing Algorithmic Trading

Discuss the tools or programming languages you would use to implement your algorithmic strategy (e.g., Python, TradingView, MetaTrader). Provide a brief code snippet or logic diagram demonstrating how your strategy could be automated.

There are a number of tools and programming languages for the algorithmic trading. Some tools are given below which can be used for the SMA algorithmic trading:

Python: It is the widely used programming language in different fields of life. It can also be used for the algorithmic trading because it is simple and easy to use. It supports different libraries which are helpful in the algorithmic trading.

TradingView: We can also use tradingview for the backtesting. It offers backtesting using the Pine script language. We can create custom indicators and can trade with bots with the help of the different trading brokers.

Similarly there are more tools for the algorithmic trading such as MetaTrader 4/5, MQL 4/5 and interactive broker API.

Gate.io We can use gate.io exchange as well for the bot trading or algorithmic trading. It offers unique feature for the algo trading and we can easily backtest our strategies with different indicators in spot as well as in perpetual.

Here I have chosen gate.io for the more realistic algorithmic trading using SMA. The reason behind choosing is its live and real time data without any additional integrations and problems. We can simply create a bot and we can backtest our strategy in just a few moments and we can analyze the historical data.

**Here is a step by step guide to create a trading bot in gate.io and to backtest the algorithmic strategies using moving averages indicators.

First of all I went to the Gate.io desktop version for the better and easy working. Then I went to the Gate.io strategy page. There I saw this option to create a bot.

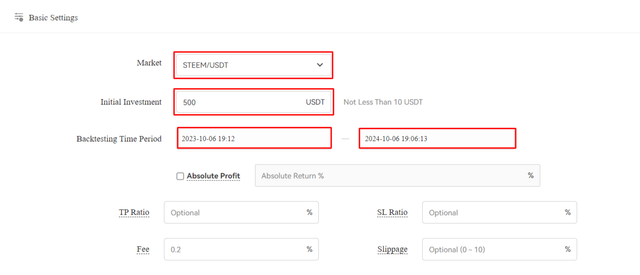

At the new page there were different options for the bot. I selected custom and then a number of different options appeared there. From all those options I selected Combined Indicator-spot because I want to apply algo trading in the spot section on STEE/USDT chart.

In the basic settings I selected STEEM/USDT trading pair for the bot trading setup. I have set initial investment as 500 USDT. I have set backtesting time period starting from 06/10/2023 to current date 06/10/2024. This period becomes 1 year. I have set other things by default or empty to test the entry and exit points for the STEEM/USDT trading pair. And by default fee is 2% for this bot setup.

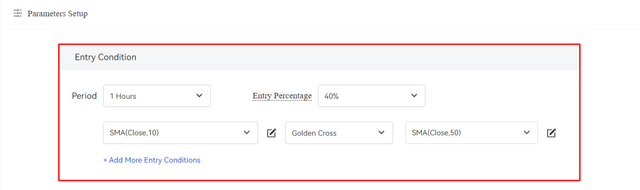

Next I have added parameters in the bot setup. These are the algorithmic command to drive the bot in the desired condition by defining the pre defined conditions. I have set a condition for the golden cross or you can say for the bullish signal.

According to the given condition when the 10 day moving average of the SMA crosses above the 50 day moving average of SMA of STEEM/USDT trading pair the it should take a buy entry in the market. So the bot will follow this instruction to an entry in the market when the condition is met. This is how algo trading works.

Currently I do not need any further conditions for reducing or increasing the my position sizes so I have neglected these conditions. I will just just golden cross for the entry zone and death cross fro the exit zone in the spot trading.

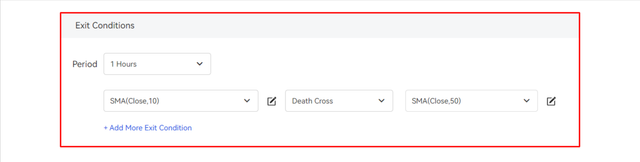

Here are the exit conditions for the algo trading bot setup. This condition will work as a pre defined condition for the exit zone. According to this condition when 10 day SMA period crosses below the 50 day SMA period then it suggests the bearish signal or death cross so the entry should be exit at that point to avoid potential loss. As soon as the market will satisfy this condition the trade will be exited.

Then I click on backtesting to get the results of my prepared trading startegy from the history of the chart. I faced an error to set the time period less than 365 days. So I reduced one day from the 365 days and again started backtesting. This time it run successfully.

So I click to get the backtest record data to analyze the performance of the bot before continue creating it.

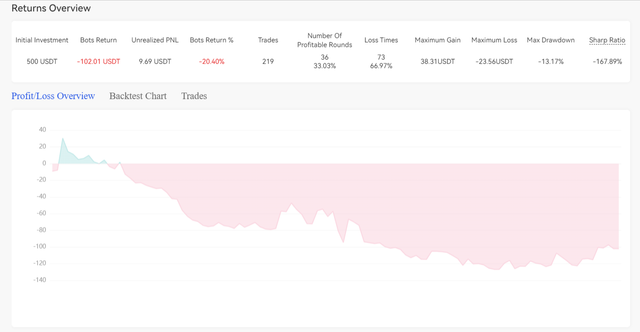

Here you can see the results of this auto trading setup. There were 219 total trades during the period of around 1 year. And from these 219 trades 36 trades went in profit and remaining 73 trades fell into the category of loss. From these trades the maximum gain was 38.31USDT and similarly the maximum loss was -23.56USDT. And it caused a total loss of -102.01 USDT (20.40%) of the initial investment.

I got this trading strategy very harmful for trading because it did not gave any profit except loss on the whole. So I decided to change the trading strategy.

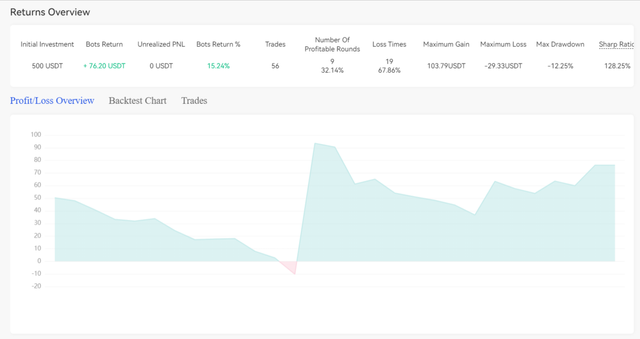

I just changed the time frame from 1 hour to 4 hour and you can see this strategy proved to be very beneficial according to the historical data and backtesting. There were a total of 56 trades. From these trades there were 9 profitable rounds and 19 rounds went in loss. But overall this strategy generated good profit. The maximum gain was very wonderful in this setup. It was 103.79USDT and the maximum loss was -29.33USDT.

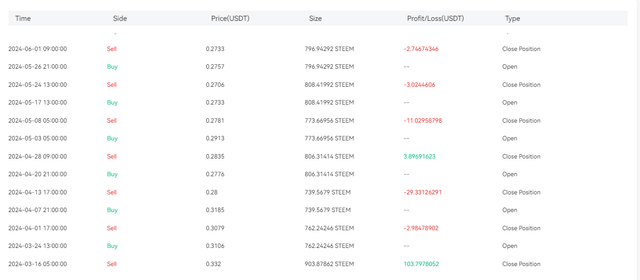

Here we can see a few trades which could be captured during this screenshot. Heer you can see that 1 trade went really well and it generated a total of 103+ USDt profit. So I can use this strategy for the algorithmic trading.

Question 5: Performance Review

Evaluate the performance of your algorithmic strategy using historical Steem market data. How well did it perform during different market conditions (bullish, bearish, sideways)? Provide your findings and suggest improvements.

It is not sure that the algorithmic strategy which we have developed will always work and will bring profit for us. As we have done backtesting recently and our first strategy became failed to generate profit for us but with that backtesting we saw a potential loss.

And when we used the other strategy just by doing a minor change in the condition. WE just changed the time frame from 1 hour to 4 hours and and it proved to be very fruitful and it generated revenue for us.

| Date & Time | Type | Price (USDT) | Size (STEEM) | Profit/Loss (USDT) | Position |

|---|---|---|---|---|---|

| 2024-09-30 21:00:00 | Sell | 0.1886 | 273.58772 | 16.20360 | Close Position |

| 2024-09-19 21:00:00 | Buy | 0.1752 | 273.58772 | -- | Open |

| 2024-09-16 21:00:00 | Sell | 0.1613 | 86.40164 | -3.63237 | Close Position |

| 2024-09-09 09:00:00 | Buy | 0.1621 | 86.40164 | -- | Open |

| 2024-08-27 21:00:00 | Sell | 0.1744 | 326.45178 | 9.75101 | Close Position |

| 2024-08-19 09:00:00 | Buy | 0.1664 | 326.45178 | -- | Open |

| 2024-08-16 05:00:00 | Sell | 0.1628 | 347.02056 | -3.80614 | Close Position |

| 2024-08-09 21:00:00 | Buy | 0.1651 | 347.02056 | -- | Open |

| 2024-07-31 09:00:00 | Sell | 0.1956 | 1123.26896 | -5.71879 | Close Position |

| 2024-07-28 09:00:00 | Buy | 0.1999 | 1123.26896 | -- | Open |

| 2024-07-24 17:00:00 | Sell | 0.2028 | 1190.4643 | 26.65973 | Close Position |

| 2024-07-10 21:00:00 | Buy | 0.1797 | 1190.4643 | -- | Open |

| 2024-07-02 21:00:00 | Sell | 0.1941 | 1082.1314 | -7.88679 | Close Position |

| 2024-07-01 09:00:00 | Buy | 0.2006 | 1082.1314 | -- | Open |

| 2024-06-30 17:00:00 | Sell | 0.1966 | 1096.87186 | -3.72191 | Close Position |

| 2024-06-26 05:00:00 | Buy | 0.1993 | 1096.87186 | -- | Open |

| 2024-06-01 09:00:00 | Sell | 0.2733 | 796.94292 | -2.74674 | Close Position |

| 2024-05-26 21:00:00 | Buy | 0.2757 | 796.94292 | -- | Open |

| 2024-05-24 13:00:00 | Sell | 0.2706 | 808.41992 | -3.02446 | Close Position |

| 2024-05-17 13:00:00 | Buy | 0.2733 | 808.41992 | -- | Open |

| 2024-05-08 05:00:00 | Sell | 0.2781 | 773.66956 | -11.02959 | Close Position |

| 2024-05-03 05:00:00 | Buy | 0.2913 | 773.66956 | -- | Open |

| 2024-04-28 09:00:00 | Sell | 0.2835 | 806.31414 | 3.89692 | Close Position |

| 2024-04-20 21:00:00 | Buy | 0.2776 | 806.31414 | -- | Open |

| 2024-04-13 17:00:00 | Sell | 0.2873 | 9.5679 | -29.33126 | Close Position |

| 2024-04-07 21:00:00 | Buy | 0.3185 | 9.5679 | -- | Open |

| 2024-04-01 17:00:00 | Sell | 0.3079 | 762.24246 | -2.98479 | Close Position |

| 2024-03-24 13:00:00 | Buy | 0.3106 | 762.24246 | -- | Open |

| 2024-03-16 05:00:00 | Sell | 0.3329 | 903.87862 | 103.79781 | Close Position |

| 2024-02-08 13:00:00 | Buy | 0.2161 | 903.87862 | -- | Open |

As we used the trading strategy from October 7, 2023 to current date. But it was not possible to capture all the chart in an efficient way so I have divided the chart in parts to explain the performance of the market and how our strategy moved through the bullish, bearish and sideways market.

Here you can see I have implemented the SMA as well according the condition which I used in the algorithmic trading. At the the chart is going on after a recent golden cross. Actually the market was in the consolidation phase and after the consolidation the 10 day moving average crossed the 50 day moving moving average and the golden cross happened. The price started moving in the upward direction.

Here we can see that the first buy trade happened on 2023-11-02 05:00:00 at the price of $0.2255 and it remained continue until 2023-11-16 01:00:00 and STEEM were sold at the price of $0.2834 and it returned a profit of 50+ usdt.

And at this range again a trade were open at the price of 0.259 on 11 November and it was cut on 25 November with the loss of $2.38 because the market started moving sideways.

In the next zone represented by the 2nd rectangle the market started moving sideways after the death cross. And it did not generate any profit. The overall trades were in loss because of the sideways and wrong detection of the signals. As the market was moving in the boring zone the bot did not understand the exact trend and it kept on placing trades but almost all of them caused loss.

Then in the next and 3rd rectangular zone the market formed a golden cross. And it drove the price to move upward. This time the bot again did some wrong trades but at last it captured an exact signal and caused a good profit. The bot placed a buying entry at the price of $0.2161 on 8 February, 2024 and the trade remained continue and it was closed on 16 March, 2024 at the price of $0.332. This was a wonderful swing trade with the maximum gain. It ave a gain of 103.79+ USDT.

According the historical data of the STEEM/USDT the bearish phase started after the death cross at 13 April 2024 when the 10 day SMA crossed below the 50 day SMA. And because of this bearish signal the price drove in the downward direction. And currently the market is also in this phase.

In this bearish phase many trades were executed but most of them went in the wrong direction causing the potential loss in each trade. Here you can see most of trades went in the loss. Most importantly the maximum biggest loss also happened in this bearish phase. And the price continued to decline in the downward direction.

According to my views and thoughts the algorithmic trading setup worked really great in the bullish market by generating the maximum gain of more than 103 USDT. And other small trades were also went in profit.

And similarly when the sideways phase started the trades went in profit as well as in the loss. Actually the bot failed here in this sideways market to detect the correct signal and direction of the trend. And the algorithmic strategy pushed the trading bot to place orders and close orders whenever a small move occur in the upward or downward direction which cause to loose the assets in the sideways. But not all the trades were lost it also generated some profit in the sideways market.

Then in the bearish market after the death cross the algorithmic trading strategy again became. Because of the in the volatility in the market and continuous selling pressure the market continued to dump. The bot tried its best but it was trapped by the market and the biggest loss happened in this bearish phase.

For the more better performance of the algorithmic trading strategy we should do backtesting by implementing different conditions. And we should collect the data of the all the strategies and then we can select one which gives more profit and trades with high accuracy. I will suggest to use other indicator along with the SMA to filter our the side ways trend to avoid loss in that phase.

Moreover we should apply different periods for the moving averages. One this which I have noticed in algorithmic strategy related to the moving periods is that if we use short trading periods and small time frame for the trading then it will cause more loss because in the small time frame it becomes difficult for the bot to determine the correct scenario of the market and it places the trades again and again.

Disclaimer: All the chart screenshots for the explanation have been taken from TradingView otherwise stated.

X Promotion: https://x.com/stylishtiger3/status/1843002379521892768

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations on bringing a quality content. You have earned a positive vote from team 2, and it is delivered by @starrchris.

Many Blessings...🙏🏻

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much @starrchris for this support. It is highly appreciated.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations on bringing a quality content. You have earned a positive vote from team 2, and it is delivered by @starrchris.

Many Blessings...🙏🏻

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for mentioning me my dear friend at first I didn't understand it well myself after working on it for a day or two I was able to present it Good luck for the contest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes it was technical to use it in first hands.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

🤝

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit