Greetings everyone I hope you will be fine and enjoying good health by the grace of Almighty Allah who is most merciful and gracious to everyone. Today I am here to submit my crypto task given by professor @fredquantum, it is really an amazing lecture full of information about the Crypto Assets Diversification (CAD) and I have learned a lot of things from this lecture. So if you want to learn new things about your crypto trading then come forward.

As we know that it is the era of cryptocurrencies trading as everyone is joining crypto trading, and they use different tricks for a good trade. Similarly, Crypto Assets Diversification (CAD) is a trick that is very helpful in crypto trading to maintain your portfolio in green.

1. Explain Crypto Assets Diversification

Crypto Assets diversification is an important investment technique used in trading to maintain a portfolio in profit, and by using this we can avoid loss of assets. Crypto Diversification is a strategy in which we divide our investment into different assets to decrease the risk of loss.

It is really a good strategy, let us suppose that we invest all our investment in a single crypto asset and we hope that this crypto coin will go up and we will raise profit. It is a very rare case that if we invest in a single crypto asset, that we make a profit because the market does not follow our thinking but it follows the trend of the market and the investment of others. So if that asset loses its value and falls down then all the investment has been lost and we are completely at loss.

But if we divide all the investment into different parts and then we invest in different assets, this is called Crypto Assets Diversification (CAD). And by using this technique we can become successful as all the assets can not go down, if one goes down then the other will surely go up and we will not lose our value and investment.

In order to Diversify our crypto portfolio, we have to do research, we have to make fundamental as well as technical analyses before considering any cryptocurrency. We have to know about the trend of that cryptocurrency, holders, investors of that cryptocurrency, and the demand of that cryptocurrency in the market. After knowing it all we can now invest and diversify our portfolio.

So after doing a lot of research then we can choose at least 2 or 3 assets and now we can diversify our portfolio. But we also have to do complete research according to our trade, for example; if we want to take an entry for the short term then we have to choose crypto coins accordingly and if we want to take an entry for the long term then we have to choose coins accordingly.

The most important point is that prices of most of the cryptocurrencies co-relate each other and if it happens that all the selected coins are crashed then we have to focus on the positive points. But before investing and choosing different coins we have to make research on the price fluctuation of those coins to each other. We just have to choose in such a way that if one coin goes down then the other should not follow that one and that other should go upward.

Here I want to quote an example of such coins which are opposite to each other. These coins are made on the basis of the basic coin, for example, BNBUP and BNBDOWN these both the coins are opposite each other and if one coin goes low in price the opponent go up in price, and these have been made on the basis of the basic coin BNB.

2. What are the Benefits/effects of Diversifying one's assets?

Assets diversification is the most important strategy and it has a lot of benefits, some of them are given below which I am going to share.

Save Portfolio From Bigger Loss

We know that all the coins do not follow each other and when the fluctuation in the prices occurs all the coins do not behave as worst as only one can behave. Diversification of the assets reduces the negative impacts if we invest in only one and it goes down in price then our capital will go into the danger zone but if we have diversified our assets then it will not happen to us.

It is a well-known thing that when the market moves in a positive behavior then we can make more profit by the diversification. As we know that all the coins do not rise to the same extent.

And if we have invested in a single coin and that one does not go up than others then we can not make a huge profit. But if we have invested in several coins by the diversification of our assets then it is obvious that we can make more profit.

More Investment Opportunities

Diversification can provide us more investment opportunities, and in this way, we can gain more experience with different cryptocurrencies. As when we diversify our assets then we become able to invest in the different cryptocurrencies, not in a single cryptocurrency. So diversification can give us more opportunity for the investment and consequently we can make more profit and make our portfolio greener and bigger.

For Example: If we have a total of $100 portfolio and we diversify it and we invest 20% of this investment in different coins then we can invest in at least 5 cryptocurrencies. And hence the profit margins can be increased.

Effects of crypto asset diversification

We know that there are two sides to every picture similarly as far as Crypto DIversification has benefits it also has its own downsides and dark aspects. Some of the effects of crypto diversification are given below:

Managing Difficulty

We know that it is a common example of daily life that if we are handling one thing then it is easy and if someone adds something more to our tasks then it makes it hard for us to manage our duty. Similarly, when we take entry for the trades in the crypto market then it becomes a difficult task for us to manage our trades. If there is only one trade then we can easily overlook that one but if we had several trades then it becomes difficult for us to manage them at a time.

Transaction Fees

Everyone knows that when we place an order it requires some fees to be filled. So when we make many trades in different cryptocurrencies it costs more fees and according to the coin price. But when we want to do a single trade then we have to place only one order and resultantly it costs low fees.

Less Profitable

No doubt if this strategy works correctly then we can make a lot of profit than a simple direct investment in a single coin. We know that there are some coins which rise a lot than the other coins. So if we have invested in that coin then we can make a lot of profit.

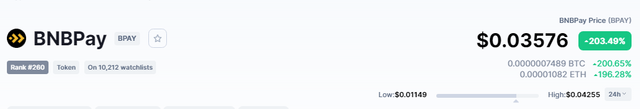

Here you can see that it is a coin named ass BPAY which has raised 203% in the 24 hours so who bought it with a lot of assets and with all their portfolio they have become a millionaire. But who did not do it and adopt diversification has lost this amazing opportunity and now he will be crying somewhere. so we can say that diversification gives us low profit.

3. Construct Crypto Assets Diversification according to the 1 - 4 Rule - Choose 4 crypto-assets (State the reasons for choosing them), discuss each of the assets, and perform a detailed fundamental/technical analysis on them. Invest a part of at least 15 USD into each of the assets based on the diversification constructed earlier, proper stop loss and take profit levels must be put into place. A real trade on a centralized exchange is expected here. (Graphics/Screenshots/Charts are required). Note that: You are expected to show your verified account screenshot, your reservoir, and the steps involved while investing (For example, if you are investing a part of 15 USD at a time, then, the reservoir must have been 60 USD clearly shown, you can use Fiat or Stablecoin for construction). Kindly take note.

I have USDTs in my wallet so I will use this stable coin for the trade. So now I am going to tell you about the 4 coins which I have selected to invest in and to show you. These are given below with the selected reasons:

1. Bitcoin (BTC), The largest Cryptocurrency

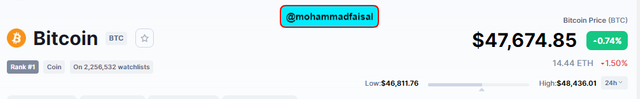

BItcoin is a well-known cryptocurrency, there is no introduction required for this as its name is its introduction. It was introduced by Satoshi Nakamoto and bitcoin is the first cryptocurrency which is now the largest cryptocurrency according to its market cap. It has dominated the whole crypto market. Mostly it dominates 42% of the crypto market.

The main reason to choose this cryptocurrency is that it has the largest community and investors, it has a lot of followers and people has a lot of trust in it and they invest in it as like the closing eyes as they know that it will surely give them a lot of profit. It is really the biggest cryptocurrency as you can see that it is currently trading at the price of the $47674.85 at the time of this screenshot.

2. Ethereume (Ether)

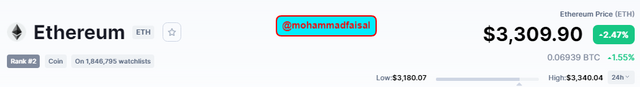

Ether is the second-largest cryptocurrency in the world of cryptocurrencies. It has a lot of market cap after the bitcoin. It is the fastest growing cryptocurrency with a lot of new users and adopters who are coming into this cryptocurrency. I have chosen this cryptocurrency as the second as it has a lot of potentials. It has the biggest community and followers.

The team of the ETH is also very dynamic as recently London Fork has been introduced in it and after that hard fork, the transaction speed of this network, as well as the price of ETH, has raised. So it is a good coin to invest in. It is currently trading at the price of $3309.9 and it is still booming.

3. Binance Coin (BNB)

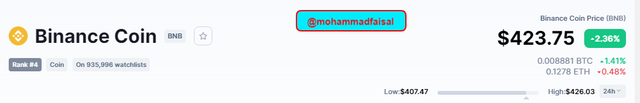

I will love to add the Binance coin at the 3rd, it has been proved really a gem. It is a coin of the Binance exchange and it is governing the market with its largest market capitalization. The main reason to choose this cryptocurrency to invest in is that it has the biggest community with a lot of followers and the team is always active and guiding the users on their social media. And secondly, it is the major cryptocurrency of the world's largest cryptocurrency exchange Binance.

It is currently trading at the price of $423.75, I want to tell you that it raised more than the bitcoin and I was a lucky one who took an entry in this trade, and then I have printed money from this gem.

Tron (TRX)

TRX is a gem itself, it is growing rapidly it has been introduced by the Justin Sun after the development of the Tron Blockchainmj. It is a governance token, and all the transactions in the trx are managed by this coin. If someone is using Tron Wallet then he can simply pay the transaction fees by the Tron and the transaction speed of the Tron blockchain is greatest than all other coins.

It is has a large community and has a market rank of 29 which is really a good sign. There are a lot of investors in this coin and it is still a hidden gem and it will give a lot in the future. So currently I am also considering this coin to invest in. It is currently trading at the $0.09454 and rising side by side.

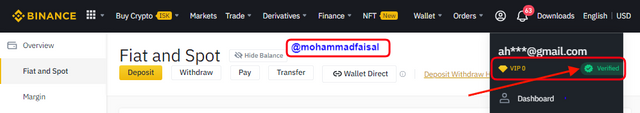

Crypto Exchange Working (Binance)

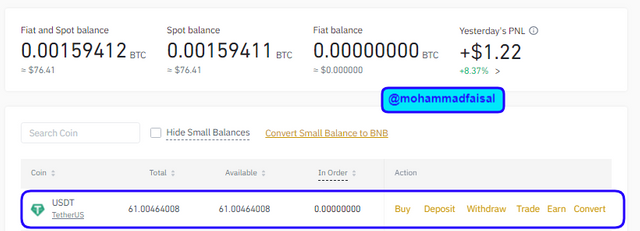

I use Binance exchange so now I am going to do the next procedure by using Binance exchange. It is a verified account and I have shared it below.

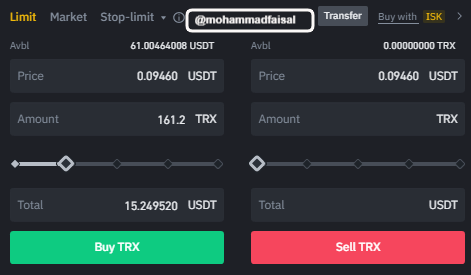

And here I have almost 61 usdts and I am going to use these for the diversification.

You can see that I have $76.41 in my spot wallet but it is the total balance and I have only $61 in my wallet for the trading. Now for the trading, we have to adopt the following procedure:

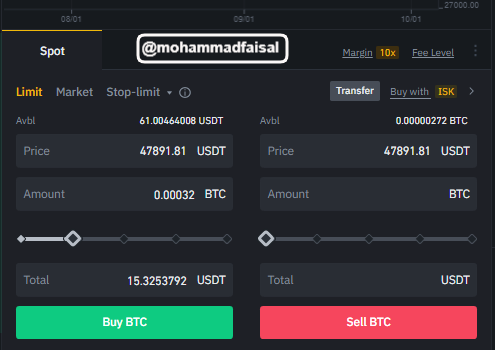

- Go to trade and then select classic trade.

- Now you can buy and perform your trades.

Bitcoin

Firstly I am going to share the bitcoin trade.

As I have diversified all the investment into 4 parts so the fourth part(25%) has been invested in the bitcoin. As bitcoin is looking bullish but I have set a stop loss of the trade below the recent support and I have set take profit above the recent resistance with a ratio of 1:2.

Ethereume (ETH)

Here you can see that I have invested another 25% of the investment in the ETH and have set the stop loss and take profit just like as I set in the bitcoin. I have set the stop loss below the recent support level and the take profit above the recent resistance level with a 1:2 ratio.

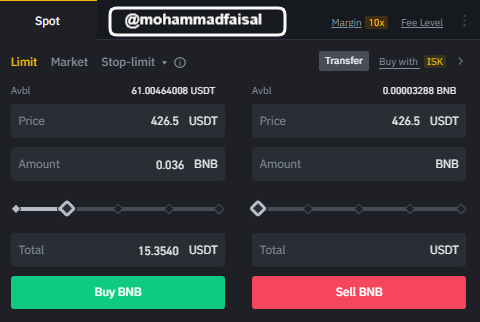

BInance Coin (BNB)

Now it is the turn for the Binance coin (BNB) which is also making great candles and giving a lot of profit to those who made their trade.

So here you can observe that I have invested another 25% of the whole balance in the Binance coin. It is looking so much bullish from its chart and it also following bitcoin as it always tries to follow. I have set its stop loss below the recent resistance line and take profit above the resistance line. I am setting all the SL and TP the same with the ratio of 1:2.

Tron (TRX)

Yes here is trx the most favorite coin of everyone, now I have invested the last 25% of my balance in the TRX and it is time to see which coin gives us more profit and which gives us more loss. I have set its stop loss below the recent support level and take profit above the recent resistance level with the same ratio of 1:2.

I have set all the coins to stop loss to below the recent support level and take profit to the recent resistance level and now time will decide which hit its target first.

4. Explain Arbitrage Trading in Cryptocurrency and its benefits

Arbitrage trading is a kind of trading in the traders buy security from any exchange and then sell it to the other exchange at a high price. It can be defined as making a profit from the different cryptocurrencies.

For example:- If I buy a cryptocurrency with the stable coin USDT and then I have it in my wallet and there is a person who does not have USDT to buy it directly from the exchange then he will contact me and then I will sell BTC to him by accepting fiat currency which he has currently. And I will sell it with my own demand and desired price.

And similarly, we can buy a cryptocurrency from the cheaper exchange, and then we can deposit that cryptocurrency to the costly exchange, and then there we can sell it at a high price and can make a profit. This is known as Exchange Arbitrage Trading.

5. Discuss with illustration how to take advantage of Exchange Arbitrage.

As I have mentioned earlier that buying a cryptocurrency from a cheaper exchange and then selling it on the costly exchange at a high price is called Exchange Arbitrage trading. And anyone can easily take advantage of this thing.

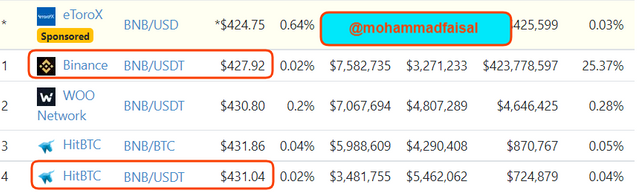

Here you can see different prices of the BNB/USDT in the different exchanges. At the time of the writing, you can see that at the eToro Exchange one BNB is selling at the $242.275 and at the same time Binance is offering One BNB for the $427.92 and at the same time, the price of one BNB in the HitBTC exchange is $431.04. So we can buy BNB from the Etoro or Binance at a cheap price and then we can sell it at the HitBTC and can make a profit.

No doubt there is not so much difference in the price and it can be risky as well but it can give you profit just by buying an asset from the cheaper platform and then selling it to the costly platform.

6. Creatively discuss Triangular Arbitrage in Cryptocurrency. How to identify Triangular Arbitrage opportunities and the risks involved.

As it has been discussed earlier that triangular arbitrage is due to the difference in the price of the same asset in the different crypto exchanges. As I have given an example of the BNB coin in the above section.

We can identify triangular arbitrage after visiting different coin listing websites such as coigecko and coinmarketcap, where we can see all the markets of any coin. And after deeply visiting them, we can make a triangular arbitrage and can make a profit. Mostly it is done in the different trading pairs of the same cryptocurrency.

For Example:

Someone has observed a good triangular arbitrage between the BTC, BNB, and ETH, and currently that investor has only one BTC. Firstly he sells his BTC to buy BNB and he gets 110.570 BNB and then he again sells these with the trading pair of ETH and now he gets 14.5308460 ETH. Now he has to complete the triangle and then he again sells these ETH for the BTC. So after selling 14.5308460 ETH for the BTC he gets 1.02834472 BTC so now we can observe that he can make a profit of just 0.028+ BTC. So in this way by using arbitrage triangular we can make a profit.

But due to the volatility of the market and fluctuations in the prices in the crypto market, there is a lot of risks. It may happen that during the triangular arbitrage the price of that asset fall which we have bought and then we have lost our asset value and we are at loss. It happens due to the simultaneous buying and selling of cryptocurrencies and the whales can drive the market where they want.

Conclusion

Crypto Diversification is one of the most useful tricks and techniques in order to maintain our portfolio, we can use it to protect ourselves from greater loss. After the diversification, it happens that the profit and loss are divided into different assets with different ratios and levrage.

Crypto Diversification has its own benefits as well as its effects but careful management and research are necessary everywhere whether you use diversification or simple techniques for trading.

Arbitrage trading is also very useful for trading and to make a profit by buying cryptocurrencies from the cheaper exchanges and then selling them to the costly exchanges.

Cc:- @fredquantum, @sapwood

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit