Hi beautiful readers, it has been an enlightening experience to read through the lesson presented by professor @shemul21, a lot has been learned as regards Crypto Trading using Moving Average indicator and without wasting much time, I will go straight to answering the questions presented after the lecture has been received.

Explain your understanding on Moving Average

In order to have a smooth trade experience, traders make use of trading tools, and one of those trading tolls is the trading indicator. Indicators help the traders identify the presence of a trend either it is an upward or a downward movement , identify points of entry and exit, as well as the appropriate time to take advantage of the market and gain profit from it.

Moving Average (MA) is an indicator that is common amongst traders making it easy and convenient for traders to identify the presence of possible market trends and trend reversal. Moving Average as an indicator provides ease for traders by taking out every form of disturbance and noise (false signal) from the market chart, providing traders with a clear view to realize what exactly the market is saying. It is an indicator that is embedded in the chart and not below like oscillating indicators and with this, it moves with the market price allowing it to be found right below the price, above the price or in between the price.

When MA indicator is noticed above the price it indicates the presence of a downward trend, on the other hand, when the indicator is found below the chart, it signifies the presence of an upward trend, and when it is found in between the price, it is known as a trading range (sideways trend). Moving Average indicator can also be easily used to identify entry and exit point, also, it is a very good indicator to identify a trend reversal. Traders can easily identify a point of entry and exit from just looking at the market.

The Moving Average (MA) line is usually extended after an initial close of a candlestick, it works efficiently by plotting the calculated average of a price within a particular period and dividing it by the period. Moving Average (MA) can be customized to the taste of the user, it can be used to select how thick or how light the indicator should appear and even the type of color that the indicator should have. Of course this is to get a convenient trading experience for the trader.

What are the different types of moving average? Differentiate between them.

There are basically three main types of Moving Average Indicators that traders use to help their trade experience more interesting, they are:

- Simple Moving Average Indicator (SMA).

- Exponential Moving Average Indicator (EMA).

- Weighted Moving Average Indicator (WMA).

Simple Moving Average (SMA).

SMA indicator is a trade movement that follows price movement and calculates the average price over a given period. This trade indicator helps traders to correctly identify the values of a price and then come up with an exact average price resulting in the identification of a trend.

When an SMA line is drawn and it is found below the price, it indicates an upward trend. On the other hand, when SMA is found above the price, it indicates a downward trend. The visualization of trade occurrence happens according to the time set to make it happen, if the SMA indicator is set for a longer period, then we will be able to understand trade activities for long term and if we set the trade for a short term period, it will guide us through making short term trade decisions, this is highly dependent on perspective.

SMA has a mathematical calculation which can be expressed as:

--

n

Where:

X= Price at a given interval.

n= number of periods.

Exponential Moving Averages.

EMA indicator could be likened to SMA indicator and this is because of the great similarities between them. However, EMA indicator provides a greater level of accuracy and precise average data, it provides more in-depth details even from the calculation. It carefully calculates close price in-depth therefore providing traders with a better analysis of fast market change and areas of support and resistance.

When EMA is rising, it is considered as the presence of a bullish signal and when it is falling, it indicates the presence of a bearish signal.

EMA is calculated with the formula:

EMA= CP X multiplier + EMA PREV X (1-multiplier)

Where;

CP = Closing price.

EMA prev = EMA for the previous day.

Multiplier = Calculated value using (multiplier =2/ periods + 1).

Weighted Moving Average (WMA).

WMA functions by applying more weight to recent price data and the application of less weight to previous price data. WMA indicator multiplies price data and then sums up resulting data in order to find average value.

Just like the other types of Moving Averages, traders use the WMA for the identification of trends, and points of support and resistance. The period signified on the chart is completely dependent on the choice of the trader, who can either set the time based on higher or lower periods.

Formula for calculating WMA:

WMA = P1 X n +P2 X (n-1) +……. Pn / [NX (N+1)] /2

n = Number of periods.

P = Price points.

Differences between Simple Moving Average, Exponential Moving Average and Weighted Moving Average.

Despite the clear similarities between the types of moving averages, they also have notable differences between them.

| Simple Moving Average | Exponential Moving Average | Weighted Moving Average |

|---|---|---|

| SMA is the most slow indicator amongst the other types of MA indicator | EMA is the fastest of the three MA indicators because it’s focus is on current trend price data | WMA is faster than SMA but slower than EMA. |

| Average price is calculated over a particular time | Average price is calculated based on current trend and data | Average price is calculated based on the most recent price data. |

| SMA has more benefits in long term trades | EMA has more significance when used in short term trades | WMA is useful in both short and long term trades |

| SMA has a slow reaction to price | EMA has a faster price reaction and this is as a result of its priority to recent price change | WMA has a faster price reaction compared with SMA and EMA and this is because of the priority it has towards recent price points. |

Identifying Entry and Exit Points Using Moving Average.

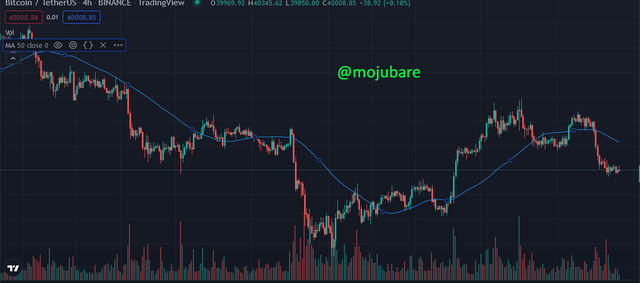

Identifying point of entry and exit using a moving average is quite easy as moving average is a trend indicator. Using the 50 EMA, the market is good to enter a long position when the price crosses above the Exponential Moving Average. and the market should be exited when the price changes direction and crosses below the exponential Moving Average.

With BTC/USDT, a long trade is opened when the price crosses above the EMA with a risk to reward ratio of 1:5. The trade is exited when the price crosses below the EMA.

For a short position entry, the trade is entered when the price crosses below the 50EMA and it is exited when it crosses above the 50 EMA.

Understanding Moving Average Crossover.

Moving Average has numerous applications, amongst the applications of Moving Average is the Crossover. Moving Average crossover, can be described as the combination of two or more Moving Average to get information about available buy and sell signals. We need not forget that Moving Average is a lagging indicator and the use of crossover will help remove Whipsaws and position traders in a better position to earn.

The crossover combination is usually done with a slow and a fast moving average type, the fast-moving average will react faster to a price since it only considers few data points while the slow-moving indicator, will take into consideration large data points. The combination of these two indicators will give room for one to cross over another at some point during trade.

In a situation where the faster moving average gets to cross over (above) the slow moving average, there is an indication of trend reversal and an open opportunity to make purchase. On the other hand, when the faster-moving average crosses below the slower moving average, it is the indication for traders to sell.

Limitations of Moving Average.

Traders are advised not to use technical indicators as the only tool to make trading decisions because while they may have great advantages as we have described in this post, they also have limitations that could make a trader run into great loss. Below are some of the limitations of a Moving Average Indicator;

There are various factors that could affect prices and price changes, but Moving Average depends only on historical price data for calculation, this means that customers are not guaranteed adequate results while using this indicator.

Moving Average is extremely sensitive to the use of periods, in a situation where traders accidentally selects a wrong time frame, a false trading signal will be generated and this will definitely lead to loss for the trader involved.

Moving average is more effective during a trending market, which means that traders cannot make of Moving Average during a sideway market movement since it will not provide any useful price information.

Conclusion.

Moving Average is a very useful indicator, however it is one that should not be completely relied upon if adequate result is expected. Using more than one indicator while trading, will help traders get an accurate trade result.

However, if a trader decides to only trade in a trending market, then Moving Average Indicator is the most appropriate indicator to help the trader get an accurate trade result. We must also bear in mind that the crypto market is an extremely volatile one which could give a trader huge profit in one minute and the next minute, the trader loses everything. Extreme care is required while trading in order to prevent huge loss from occurring.

Thanks to the steemit team for another opportunity to learn, thanks to professor @shemul21 for the great lesson on Moving Average.