(1) Explain why Stability is important in Digital currencies.

ans: the stability in digital currencies is important because stable coins are cryptocurrencies that have their prices pegged to a real world asset . these currencies are backed by real world assets or another cryptocurrencies which serve as there reserves . stable coins are generally related to stability so we can say that stability is directly connected to stable coins . stable coins have become extremely popular over the years as the cryptocurrency space expands . last week there was important agenda was performed by US government they want to regulate cryptocurrency markets just because government and world have seen the future in cryptocurrency . so according to we should also think about as we know some time cryptocurrency was not legal in India but Indian government also make it legal in India . so its time to regulate cryptocurrency market. Jerome Powell chair person of the federal reserve , issued an argent call for regulation of stable coins to make stability in cryptocurrency in US. now here i explained that cryptocurrency is important, it is important because it can make the financial system safer: Allowing individuals, private sector companies, and non-bank financial institutions so that they can setttle directly in central bank money (rather than bank deposits) significantly reduces the concentration of liquidity and credit risk in payment systems.

by this statement we understood the real value of digital currency and their stability .

as we all know that each and every currency in the world wants stability like ( euro, Dollar, or Indian rupee ) without stability no any currency can perform well in their country growth so stability is the most important part of a currency.

As we know that nowadays cryptocurrency is the digital currency and we going to discuss a part of cryptocurrency that is stable coins.

- Commodiity backed stable coins

As, The commoddity backad stable coins are stabilized with hard assets such as gold or real estate.

2 Fiat backed stable coins

The stable coin are backed by fiat currencies like Chinese yuan keep a reserve of that currency as collateral. other forms of

fiat. includes precious metals such as platinum or silver and commodities such as corn or oil .

3 Siegniorage style stable coins

siegnioragge are. govverned through & backed by an algorithm or process rather than another asset or currency . the idea of thd sieegniorage as backing came from a white paper from noted cyrptographer .

The best stable coins right now

1 etether

2 true USD

3 Paxos standard

4 USD coin

5 Binance USD

(2)Do you think CBDCs would be good in the future? Weigh the pros and cons in your own understanding and state your position.

Ans: A Central Bank Digital Currency is a digital representation of a country's currency. THis is a digital curency with the same value as the currency of the country that issues it. The CBDCs concept is still new however it is certain that they would be issued by the central bank of a particular country. this currency is totally virtual which is not in the form of coin and notes and it is totally digital .

CBDCs currency is totally safe for us in future and i am sure it will give a proper growth to country and in India this time people are not giving more importance to it . but in another countries mostly people are showing faith to it and want invest there time and money on it so according to my thinking in future it will safe and good for us and be the best source of income .

Now we are going to explain pros and cons of CBDCs

1 here we are going explain pros of CBDCs that is this type of banks gives potential of returns and there must big amount

return in long time period so we should use such types of banks , we must have protection from payment fraud means

means that nowadays most of the peoples are facing cyber attacks on their bank account but CBDCs banks are too

much safe in comparison with normal banks, and one more thing is that there must be immediate settlements ,

international transactions as we all know these types of bank accounts are international bank accounts so it is too

much easy to done international transactions .

2 Now we are going to discuss about cons of CBDCs high volatility and potential for large losses digital currencies more chances to losses money to lose high amount of money. In this currency in long time period there is high volatility in cryptocurrency so many people disappointed by digital currency. In digital currencies so many up and downs so peoples are disappointed by this type of digital income. they are some cyber hackers the hacks innocent people account. Some people have lost there money in this profitable market but there is no policy to return there money.

3 Digital coin currencies are extremely volatile, rising and falling at a rapid rate. The Speculator wants profit from it, but genuine investors see it as too dangerous, so on one invests in bitcoins.

(3)Explain in your own words how Rebase Tokens work. Give an illustration.

ans - A rebase is also known as price-elastic or Elastic Supply Tokens . this is a very special type of cryptocurrencies a rebase token is designed in a way that circulating token automatically according to token price fluctuation . Token suply is a given number of tokens. ,

the ssupply of the token comes in different flavours: Initial Token Supply: number of tokens in circulation when tokens start to be traded on the secondary market (crypto exchanges — i.e. Finance). These, expansions & contractions are what we call a rebase

mechanism.

a rebase token are some what a kind to stable coins , in the sense that they both have price targets . however , unlike stable coins , rebase tokens have an elastic supply , meaning the circulating supply that adjust accordingly to supply and demands , without changing the value of the tokens in users wallet .

Now we going to explain about its working .Rebase is another way to integrate changes from one branch to another. Basically the rebas, compresses..all the changes into a single “patch.” Then it integrates the patch onto the target branch, unlikethe concept of merging, rebasing flattens the history because it is transfers the completed work from one brranch to another. therre is a very popular example of rebase token is ampleforth represented as AMPL . When the value of re-base token goes above 1 dollar then a positive will develop & when its value goes down to 1 dollar then there is a negative rebase will develop.and so this was the all important points explained by me on rebase tokens and was all conclused by me .

(4) Go to the https://www.ampleforth.org/dashboard/. Check the necessary parameters and calculate the rebase %. What else can you find on the page?

ans-

To calculate the Rebase%;

Oracle Rate = $1.021

Price Target = $1.061

Rebase % = {[(Oracle Rate - Price Target) / Price Target] x 100} / 10

={[(1.021 - 1.061) / 1.061] x 100} / 10

= [(-0.04/1.061) x 100] / 10

= (-0.037700282752 x 100) / 10

= -3.7700282752 / 10

= -0.37700282752%

On this page show many things like Next Rebase time ( 15h:46m:30s ), Oracle Rate($1.021), Price Target($1.061), CIRCULATING / TOTAL SUPPLY, PRICE Chart, MARKET CAP Chart, AMPL CAM video.

Using the Rebase% values on this table, you can calculate the amount of Ampleforth Rebase tokens added to your wallet during a positive or more rebase, or removed from your wallet during a negative or less rebase.

5) Trade some tokens for at least $15 worth of USDT on Binance and explain your steps. (Give necessary Screenshots of the transaction).

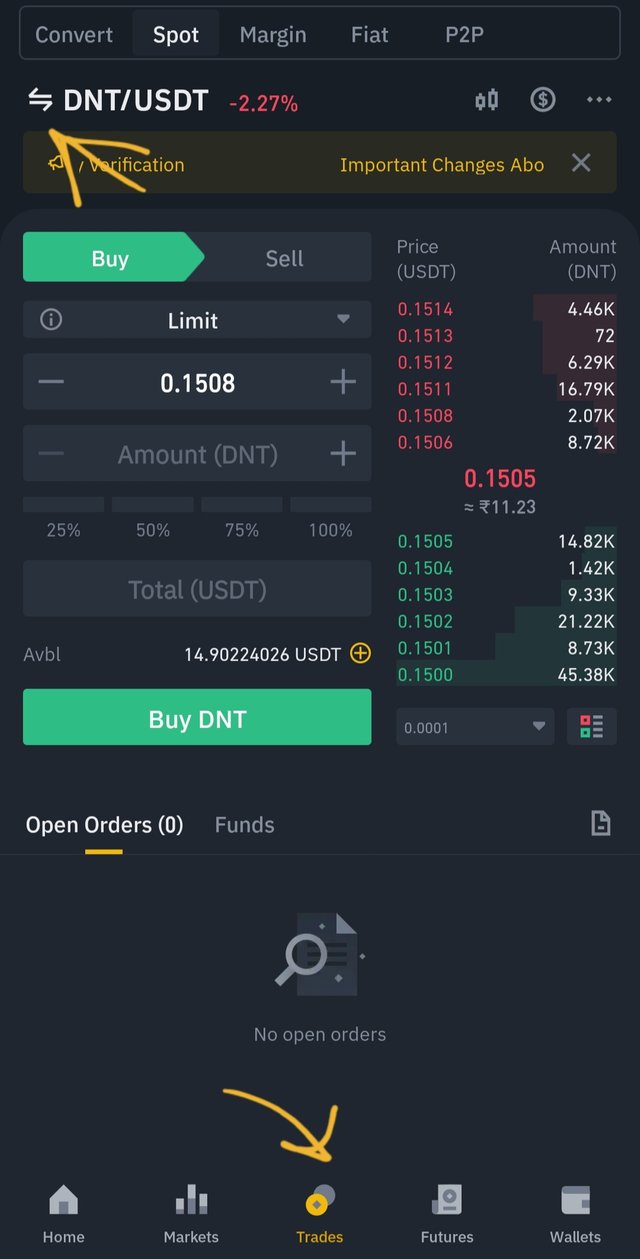

Now, for this go to the binance app and then clcik on the trades option in the middle down corner and click on the two arrow on the top left corner to enter the search bar.

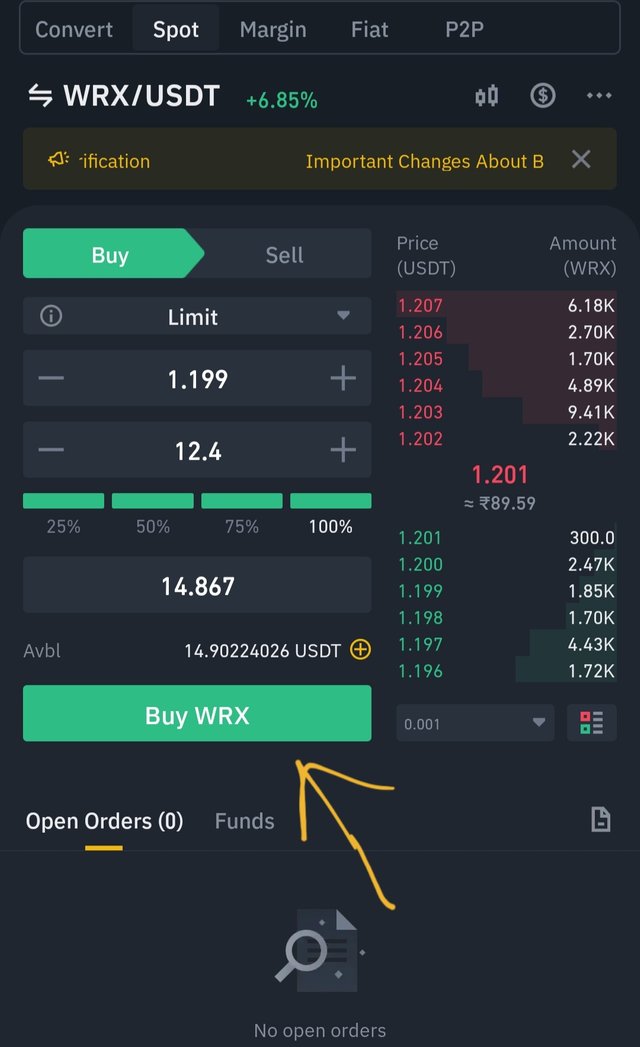

Search for the coin you want to trade. Search the coin in pair of usdt. I have selected wrxusdt.

Then enter the price of the coin at which you want to buy or sell. I have bought wrx. Then enter the amount of coin you want to buy or sell in the second column. At the last column enter the amount of usdt for which you want to trade which will automatically filled after the filling of second column.

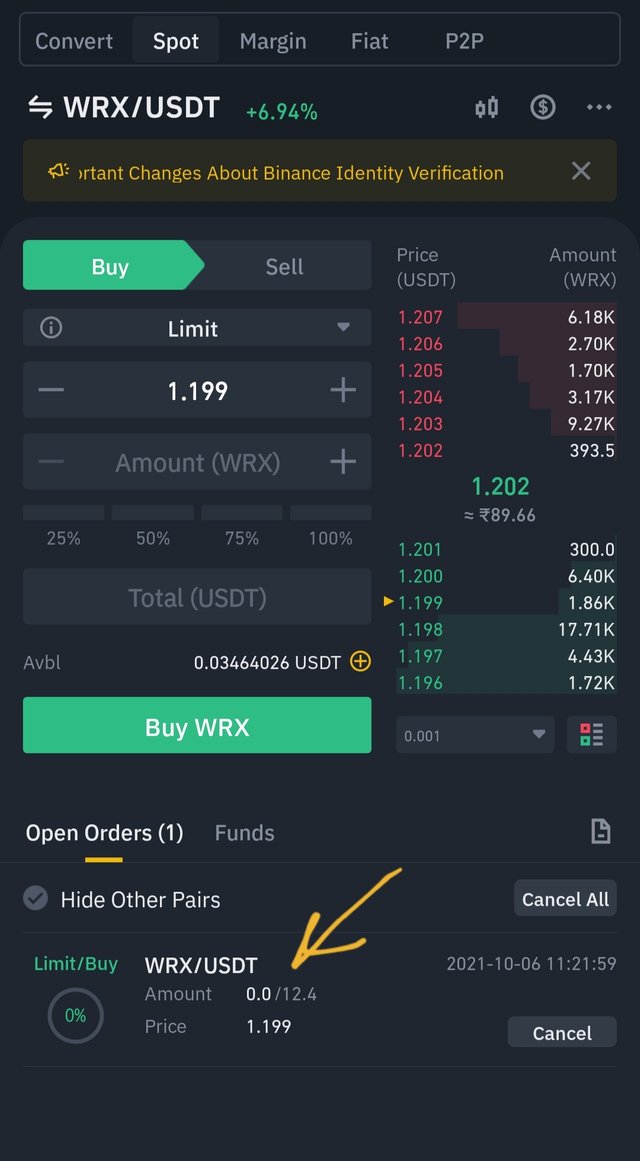

Then click on the buy option. My order was placed at the price I have marked and when price reaches to that price the coin will buy.

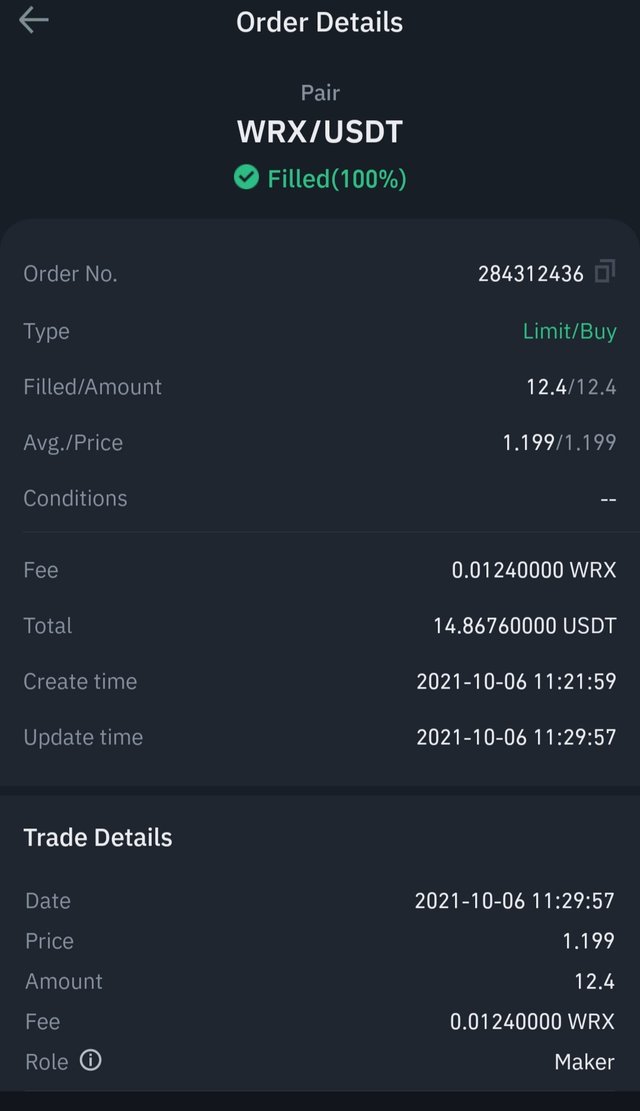

I have purchesed the wrx coin and the details of the transactio is given.

6) Transfer the USDT to another wallet with the Tron Network. From the transaction, what are the pros of the stablecoin over fiat money transactions? (Give Screenshot of the transaction).

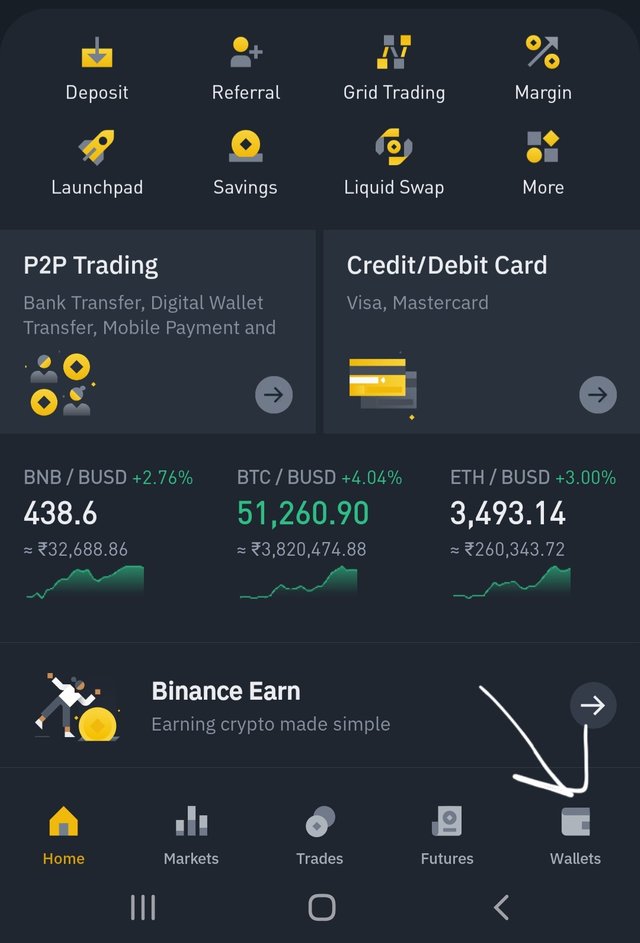

Now, to transfer usdt from one to another wallet, click on the wallets option in the bottom right corner.

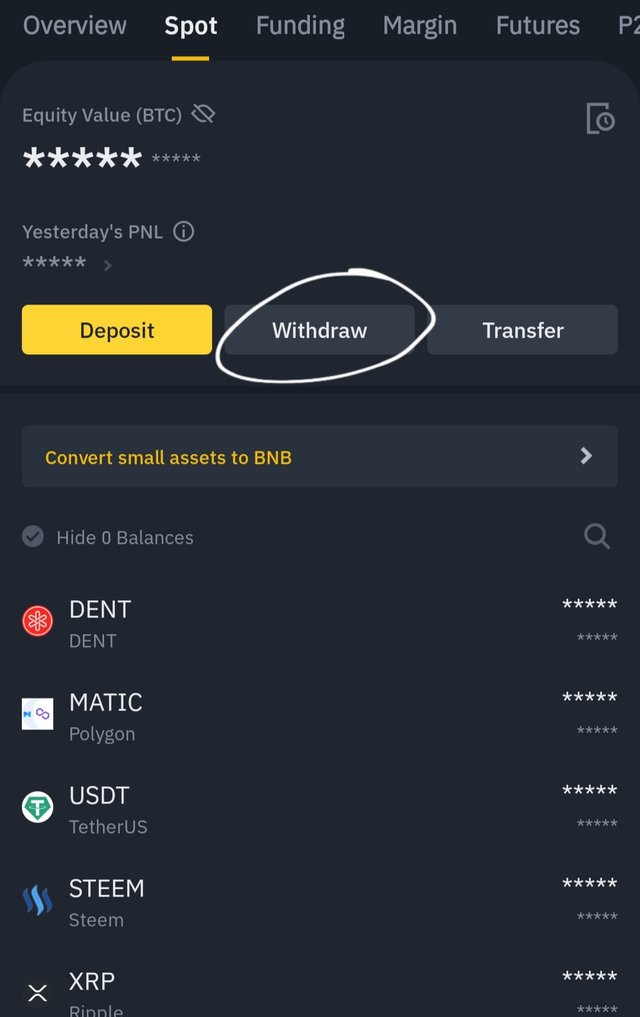

In the wallets section, clickon the withdraw option.

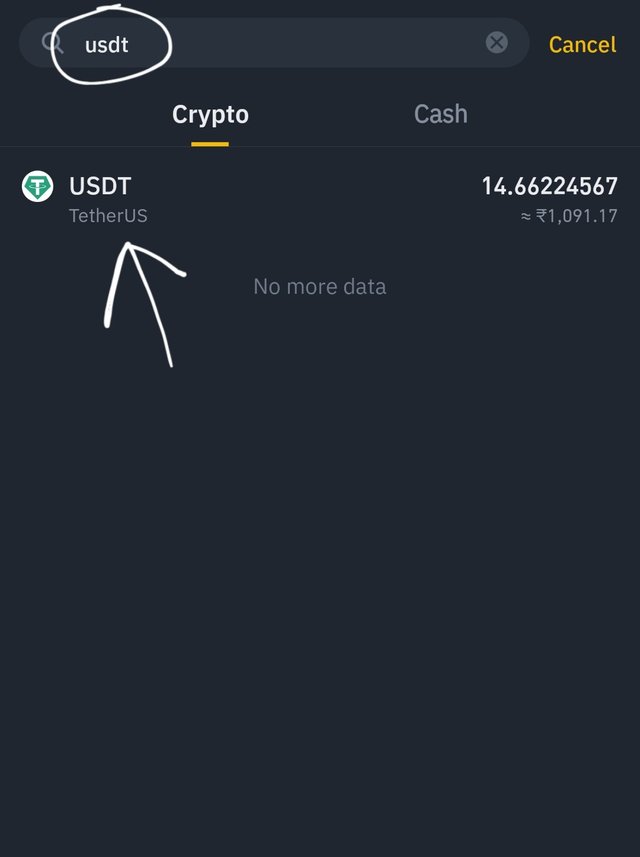

In the search bar type USDT and click on it.

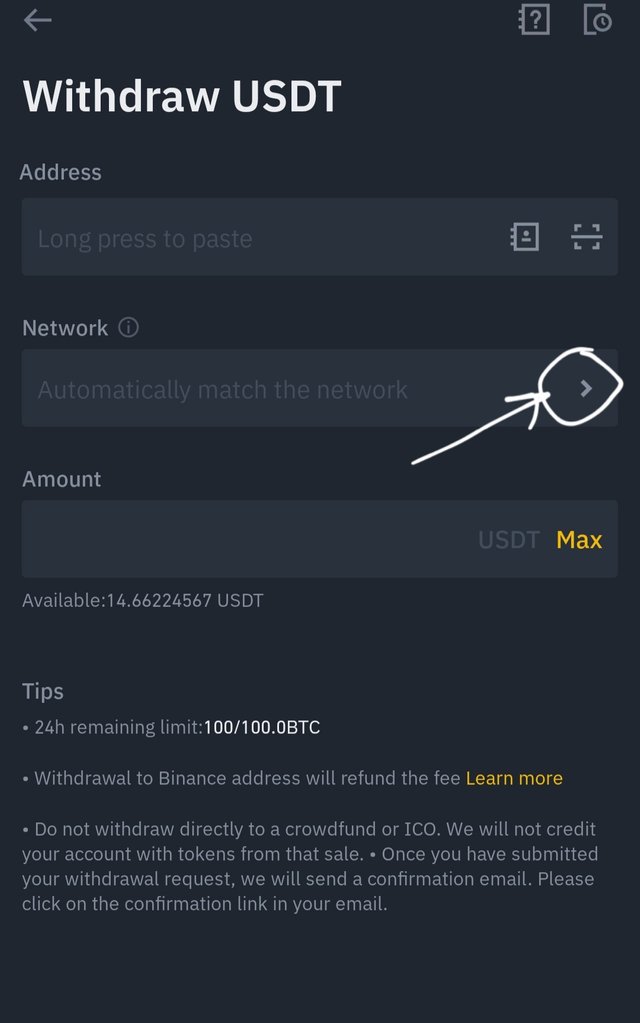

Now, in the network column, click on the arrow in the right.

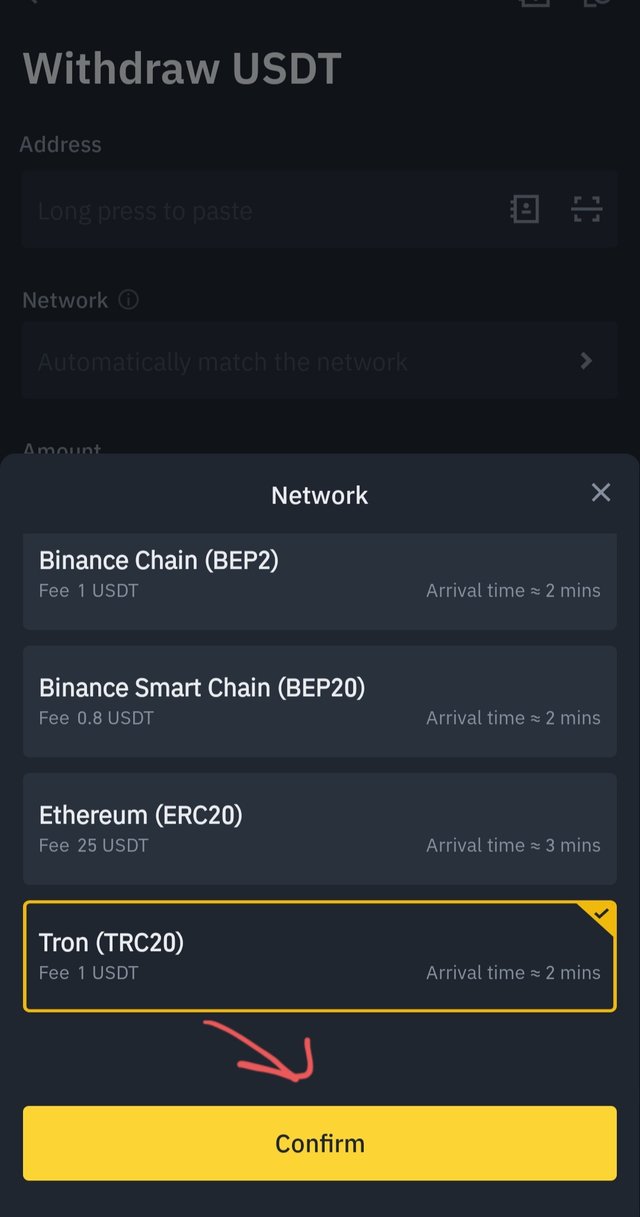

Now, the four options appears in which select the Tron(Trc20) option and click on confirm button.

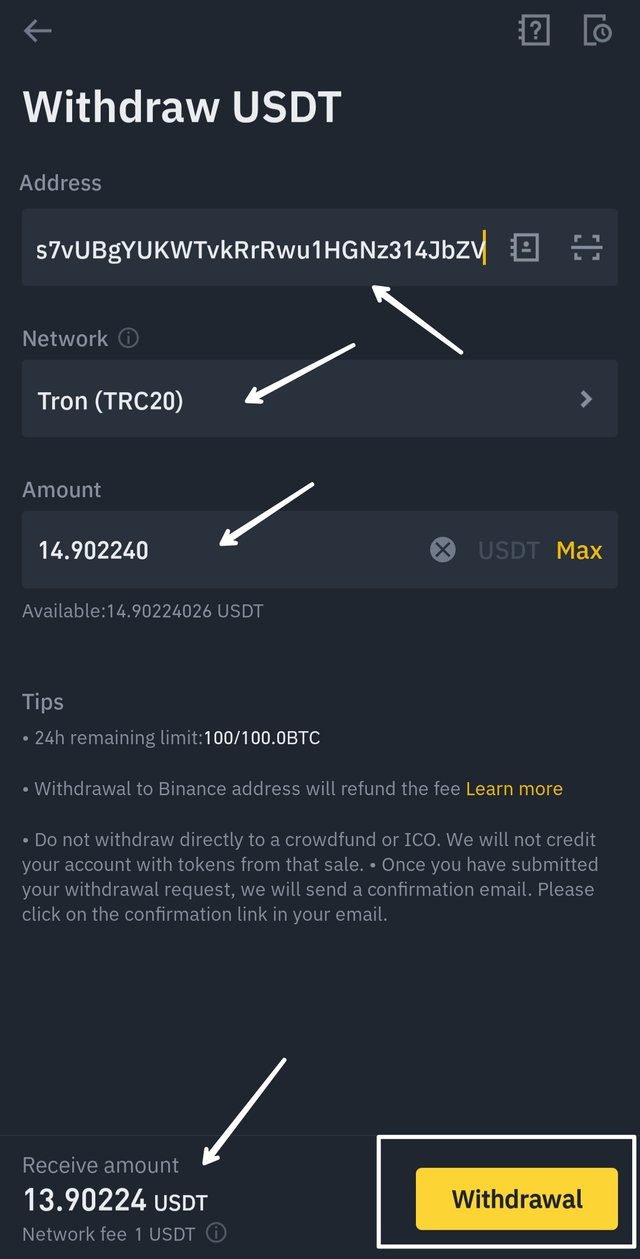

Then ,fill the remaining details in which enter the address of receiver's wallet address and enter the amount of usdt you want to transfer. I have transferred 15 usdt. The fees of 1 usdt will be cut in transaction. Then click on the withdraw option.

conclusion

The statble coins are become popular in the recenet years and they provide benefit to many of the people and these are related to stability.

By the lecture of professor @awesononso i have got much information and this lecture proved much beneficial for me and I want to thank to professor for this lecture.

.jpg)

👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit