This is my submission for the Assignment assigned by Professor @reddileep.

Q#1:Define Arbitrage Trading in your own words.

Arbitrage Trading:

First of all, what is the meaning of Arbitrage, So the literal meaning of arbitrage is "The simultaneous buying and selling of securities, currency, or commodities in different markets or in derivative forms in order to take advantage of differing prices for the same asset."

Now, what is arbitrage trading on the highest level well to do this you need to find an asset that has different prices even though it's the same asset in different markets you can do this technique with stocks bonds Forex and more basically the idea is that you buy this asset in one market and then sell it in another market where it's a different price to profit off the difference this is considered a risk free trade or pretty close to it if there ever is one that's why it's kind of hard to find in traditional markets because it's an old technique and many people are already taking advantage of it or have systems in place automated systems do most of the arbitrage traits these days to keep prices stable across markets that's why retail traders like you and me can't really do this anymore.

however, what about in the crypto world because this is quite a different market from the traditional ones, there are over 200 exchanges with a large price distribution just go and look at the www.coinmarketcap.com click on a coin and click on markets, you can see all the price differences they are due to imbalances and supply and demand and also price discovery is kind of done separately for each exchange so you have a larger Changes with liquidity driving the price and then small ones following them but it's not immediately sometimes the big ones change and then the small ones are slow to catch on that is where the arbitrage opportunities exist.

Q#2: Make your research and define the types of Arbitrage (Define at least 3 Arbitrage types)

There are many different types of arbitrage, Some of them are:

1. Simple Arbitrage:

Simple Arbitrage is quite simple you buy a coin on what exchange and sell it on another exchange at the same time or close to At the same time, you can earn the spread which is the difference between the prices instantly in this case so in some situations you can transfer the coins between exchanges but that takes some time another technique to do this is to have fiat and crypto balances on both exchanges so you can effectively buy and sell on one exchange in another one At the same time here's an example litecoin is $60 on Binance and 62 on Coin base you can buy 50 like coins on Binance and sell 50 on Coin base and earn an instant $100 profit.

2.Fiat triangular arbitrage:

Now, what about fiat triangular arbitrage what is this all about this is when you have three assets or two asset pairs involved with one shared asset between the example of the pair is Bitcoin USD and Bitcoin Korean Won, Now bitcoin is a shared asset but there's three total that we're dealing with For example buy 1 Bitcoin for 3000 dollars on coin base send it to a Korean exchange and sell it for 4200 worth of Korean Wons and then you can convert your Korean Won to USD at a bank for 400 dollar profit, This opportunity is often there for exchanges serving local or regional markets. Now you can also do this triangular type of arbitrage with crypto even within one exchange, you can apply this technique, you take advantage of mispricing between 3 pairs of coins for example ETH/BTC, ETH/LTC, and LTC/BTC they form a triangle so if you recall or look on www.coinmarketCap. com the ratios between the coins are denoted in USD value as well that's why you can take advantage of arbitrage, for example, let's say ETH converted to bitcoin and litecoin converted bitcoin those are two separate markets right so they have different supply and demand that's why there are price differences and that's how you can take advantage by going through the pairs to get that price differential in terms of USD value and you can make more Bitcoin or whatever coin you're trying to make in that scenario and there are also BOTS available to do this.

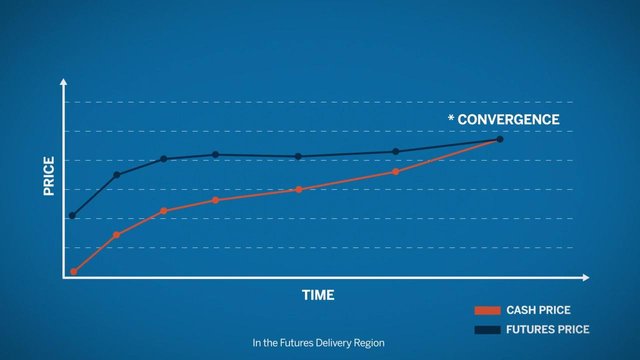

3.Convergence arbitrage(Short Selling):

Convergence arbitrage is based on the idea that when there are market inefficiencies eventually the prices will converge due to other people for example taking advantage of arbitrage opportunities so what you can do is buy a coin on the exchange where it's undervalued and then you short sell it on the exchange where it's overvalued and of course, you need to find an exchange that allows shorting of that particular coin, FOr example, buy LTC on Gemini for 51 dollars and then short it on Kraken where it is 56 dollars when the price is converged you'll have made $5 with a profit of course shorting is kind of complicated.

4. Cash and Carry arbitrage:

This strategy is based on gaining from the price difference between an underlying asset and its futures. The focus is on using market discrepancies between the asset and its derivative to one's advantage. Let say for example Suppose Mr. Micahel, who works for FIC brokerages notes that wheat is currently trading at 500 Rs per bushel, The price of wheat futures that expires in 3 months from now is Rs 700. Now Mr. Michael takes into account all the storage costs and other expenses for 3 months. They add up to Rs100. So wheat futures should only cost Rs600. This is because the price of buying wheat now and storing it should equal the price of buying it after 3 months. Therefore, at Rs700 wheat futures are overpriced. Mr. Michael then takes a short position on the wheat futures contract at Rs700. This means he agrees to make delivery of the wheat in 3 months and buys actual wheat at Rs 500. He stores the wheat incurring expenses of RS100. Then he finally sells it at Rs700 as per the futures contract. The profit earned is Rs700-Rs600=Rs100.

Q# 3 Explain the Triangular Arbitrage Strategy in your own words. (You should demonstrate it through your illustration)

THE TRIANGULAR ARBITRAGE:

The triangular arbitrage strategy as explained above is when you just on one exchange usually doesn't have to be one exchange but it can be just one exchange and what you're looking to do is to buy a coin sell it for a different coin and buy back the original coin all on one exchange taking advantage of miss pricing in the order book.

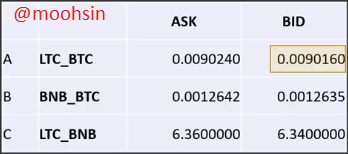

I am going o use 3 pairs of coins as shown below:

- LTC/BTC

- BNB/BTC

- LTC/BNB

Assume that I have 1000 litecoins and according to the above pairing(BID) it will give me 1000x0.0090160=9.016BTC

Now, I have 9.016BTC and I am going to Buy BNB at Ask so I need to divide 9.016 by 0.0021642 and now I have 7132 BNB. Now the good news is you can actually buy your litecoin back you can take your 7132 BNB and divide it by 6.36 and it will give you 1121 litecoin which means I have made 121 litecoin in profit. Which is 12.13% of arbitrage and is actually a pretty good arbitrage.

Q#4 Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price. (Explain how you get your profit after performing Arbitrage Strategy, you should provide screenshots of each transaction showing Bid, Ask prices)

Now, The strategy is to buy TRX from an exchange where the price is low and then sell it to another exchange where the price of TRX coin is higher than the previous one.

I am using two exchanges Binance and Huobi

Steps:

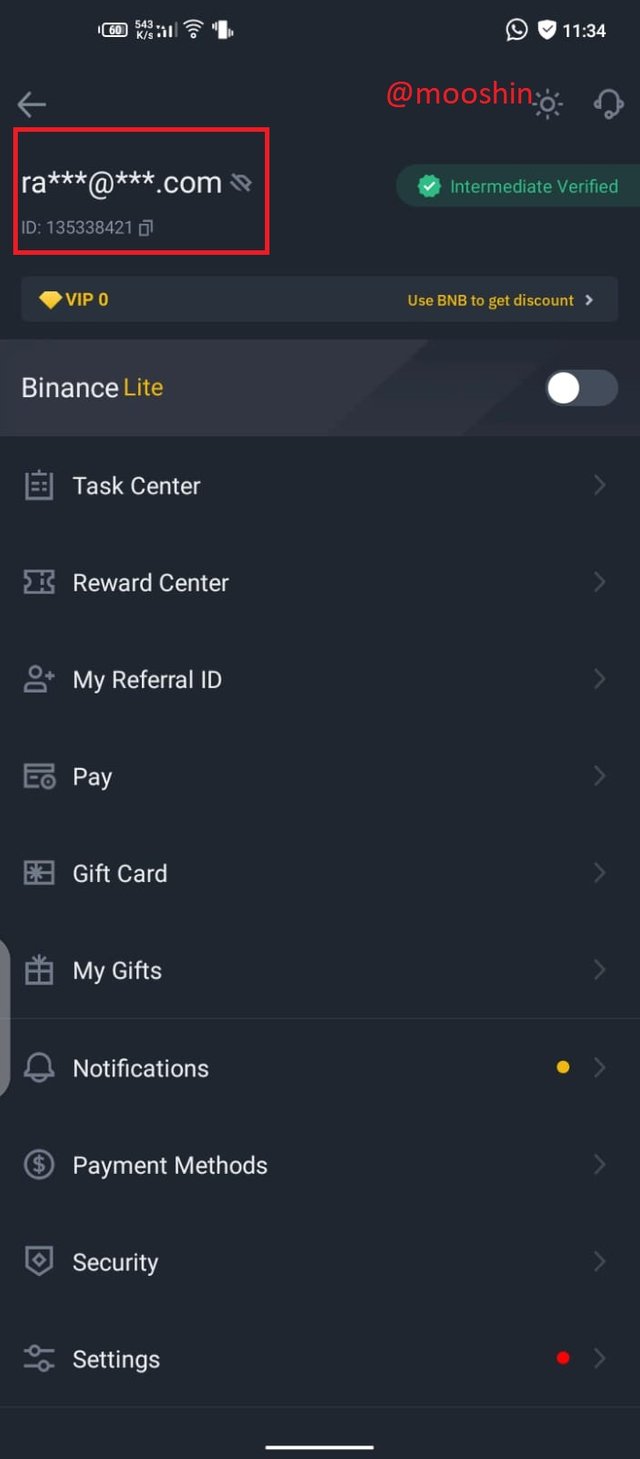

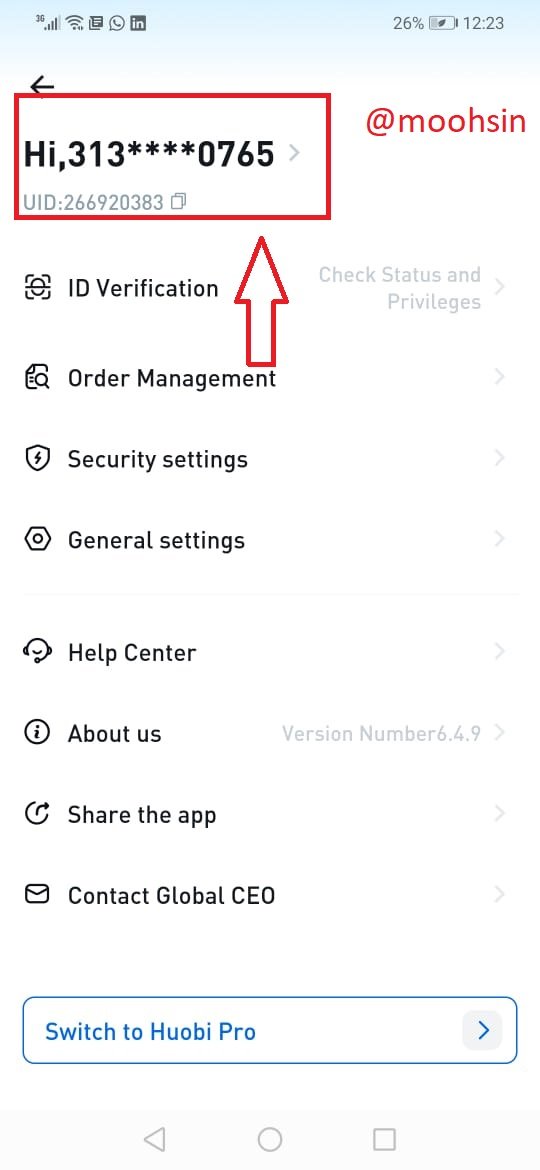

1.FIrst of all I am going to login to my verified Binance account and Huobi account as you can see below :

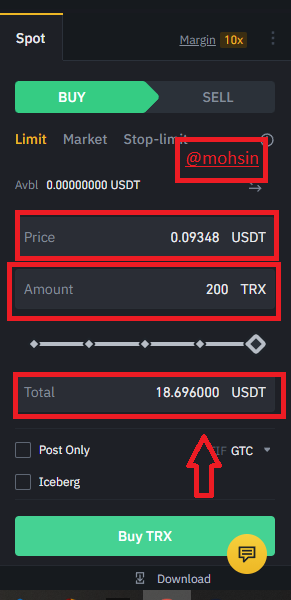

2 . Now in the next step I am going to buy 200 TRX coins from the Binance exchange which has a worth of 18.6960 USDT as you can see below:

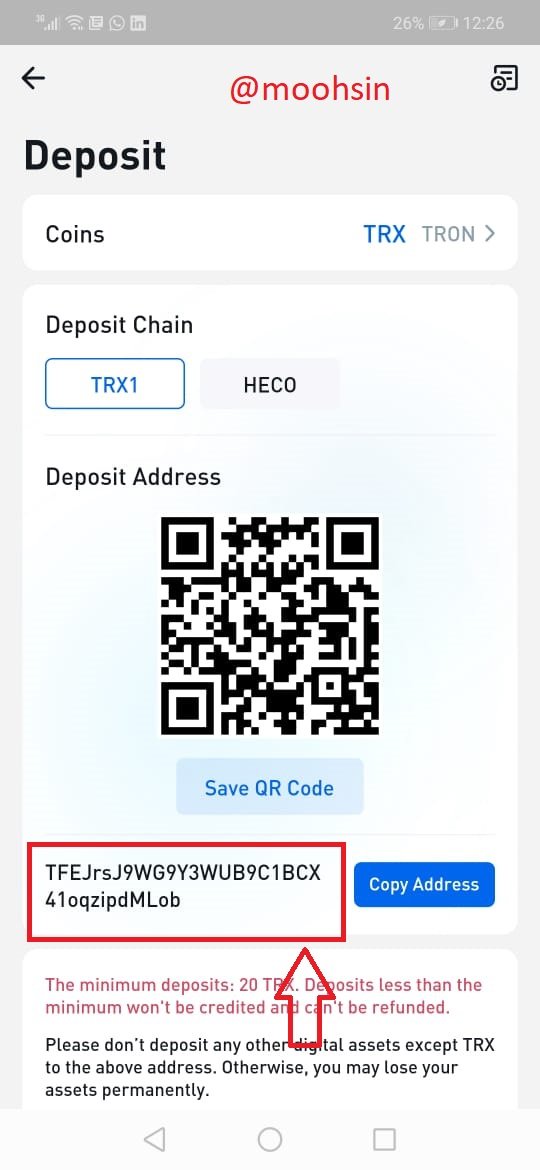

3 . Now I am going to transfer these 200 TRX coins to my huobi exchange account, For this first, I have to copy the TRX address from my Binance account as shown in the pictures:

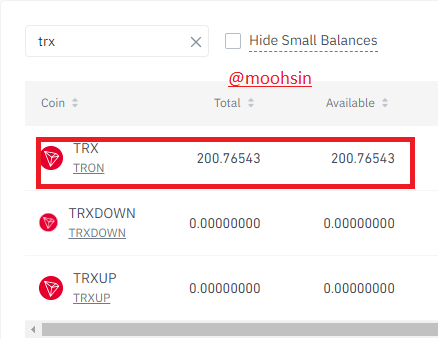

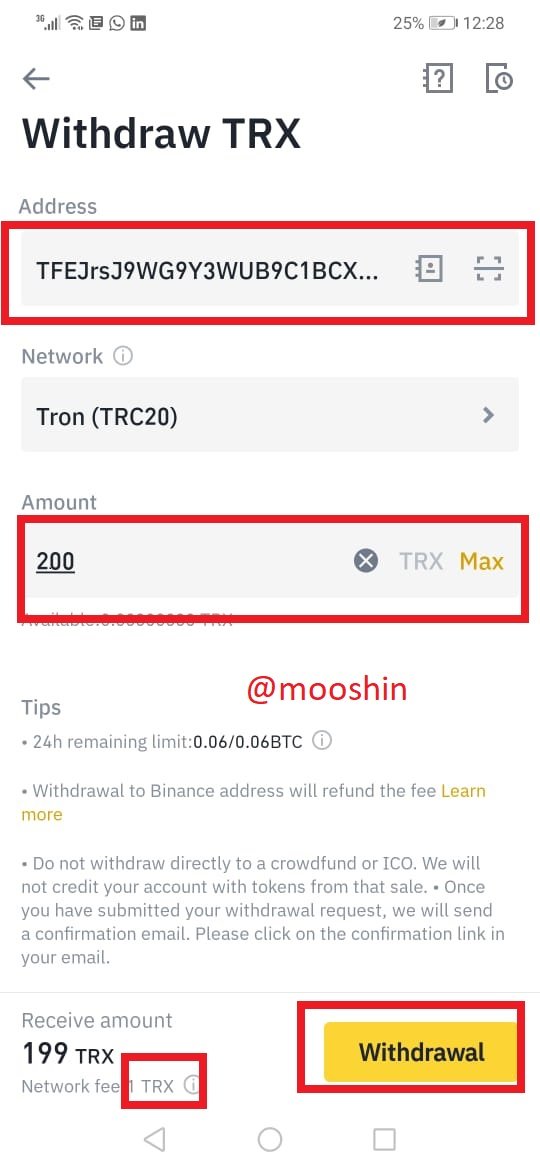

4 . I then pasted the address to the withdrawal menu of the Binance account and also entered 200 TRX but now it will charge 1 TRX as network fees which means I will receive 199 TRX in my huobi account

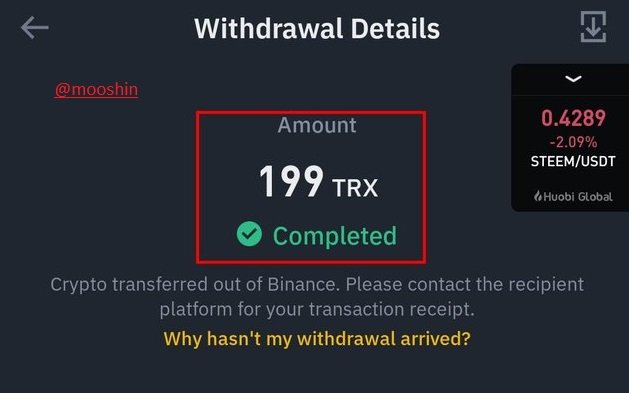

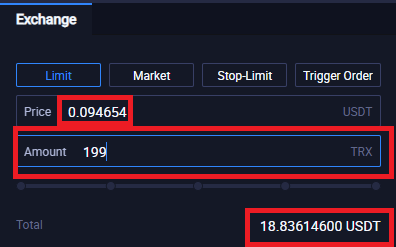

5 . After checking those 199 TRX transacted prices which were 18.836 dollars as shown below so, in this way, I saved a profit of 18.836-18.696=0.14 dollars which is not bad at all and is called arbitrage opportunity.

Q#5. Invest for at least 15$ worth of a coin in a verified exchange, and then demonstrate the Triangular Arbitrage Strategy step by step using any other coins such as BTC and ETH. (Explain how you get your profit after performing Cryptocurrency Triangular Arbitrage Strategy, you should provide screenshots of each transaction)

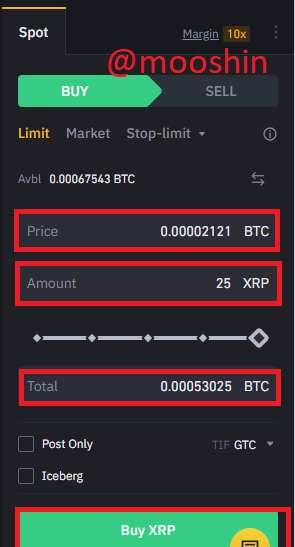

Now for the illustration of the Triangular arbitrage, I will be using three coins BTC, XRP, ETH. I am going to buy 25 XRP by selling 0.00053025 BTC at the rate of 0.00002121 making the pair XRP/BTC.

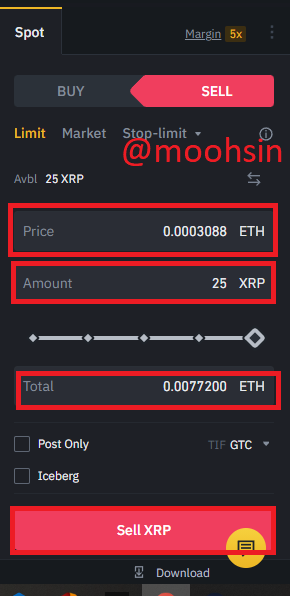

After buying 25 XRP, I proceed to buy 0.0077200 ETH for 25 XRP at the rate of 0.0003088 ETH making the pair XRP/ETH

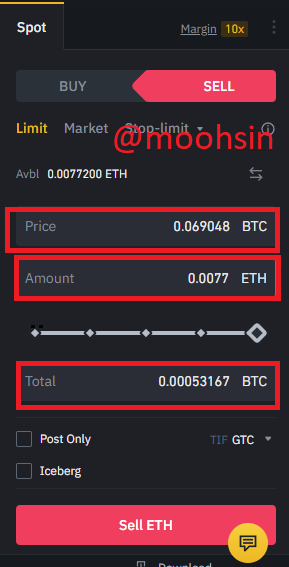

Now, In order to complete the process of arbitrage, I am going to buy BTC again using the pair ETH/BTC at the exchange rate of 0.069048. It will give me 0.00053167 BTC making the arbitrage opportunity of 0.00053167-0.00053025=0.00000142 BTC in profit as shown below:

In the real world at Binance exchange, the worth of 0.00000142 BTC is 0.067857 USD which is not bad at all.

Q #6 Explain the Advantages and Disadvantages of the Triangular Arbitrage method in your own words

| Pros(Advantages) | Cons(Disadvantages) |

|---|---|

| It is assured for the investor that he is going to get profit with no risk and no loss. | Low liquidity in arbitrage is a negative factor because in triangular arbitrage there involves 3 assets less liquid assets are relatively more expensive as a result of spread which affects the targeted profit of asset invested |

| Since the trade-in, triangular arbitrage of three assets occurs in the same exchange so the risk of losing the money is very low as compared to trading in different exchanges. | Triangular arbitraging involves significant initial investment, mainly because the price difference between the currencies is usually narrow. To earn a substantial profit, you would need to trade in large volumes. Using margin will increasing your risk manifold |

| It takes a small amount of time to make a significant amount of profit just by buying some extra coins. | The trader needs to be smart with his calculation and also fast to transact the amount of cryptocurrency asset other than that he can lose his money. |

CONCLUSION:

In Conclusion, I can say that arbitrage trading is one of the most risk-free tradings in which an investor can earn a lot of money just by using some tricks and techniques. I am thankful to professor @reddileep for this session we have learned a lot from it.