Cover Page Created by me, @msquaretk | Made on imarkup app

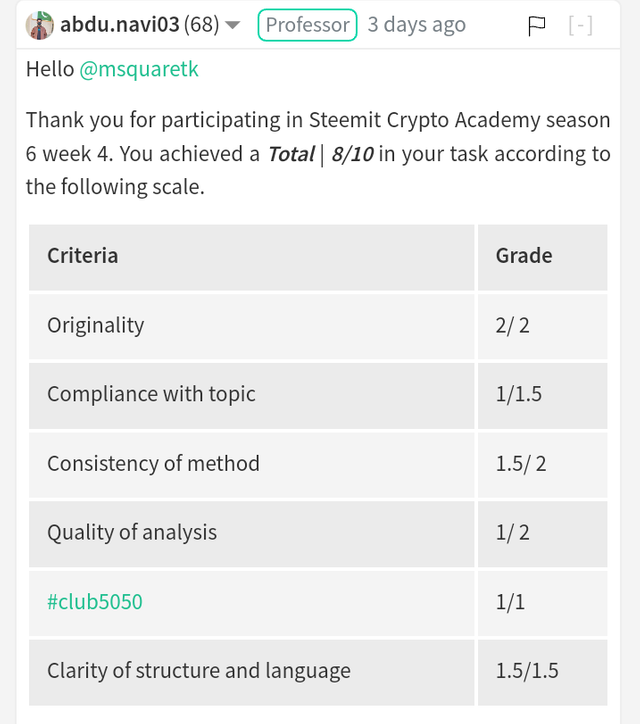

It's a week 4 in the Steemit Crypto Academy. The past few weeks were awesome and full of experiences in the Academy. Thanks to all our Professors for sacrificing their time to produce quality contents and lectures. This post is written in response to Professor @abdu.navi 's assignment. He taught Median indicator and explained that indicator the indicator very well by showing how to use it to identify trend, take buy and sell signal in the market, and some other functions. I will be responding to his questions one after the order. So, follow me closely.

1. Explain your understanding with the median indicator.

In this first task, I'm going to be explaining my understanding of the Median Indicator. In finance trading, one of the things traders need to learn is how to measure the inflow and outflow of money. This is because when they learn how money is flowing they will understand the direction in which they are to trade.

There are many tools traders can use to predict the direction of price and trend. Some of the widely used tools today is technical indicators. Technical indicators are of different types, there are those which measure momentum, volume, trend and volatility of the asset. It's important that traders learn how to use them to their advantage so they can be able to take advantage of the direction of price.

Median indicator is a type of technical indicators which is very useful and easy to read and understand. It's a trend-based indicator which measures or identify the trend in the market. One of the things traders look for when they open their chart is to identify which trend an asset is, they will want to know if the market is trending up /down or if it's ranging. This indicator shows the trend in the market.

The indicator displays the mean value of the low and high over a period or length on the price chart. It consists of a lower and single bands and a thick middle line which has green and purple/pink line (median MA)) which supports and resists the price. The color of the middle line has to do with the direction of price.

The indicator looks like Bollinger bands indicator which also has bands. The green band of the Indicator is seen when the price crosses above the median MA and the pink or purple is seen when the price crosses below the Median MA. The indicator shows buy and sell signal. Although, it's advisable to combine other tools with the indicator to increase the efficiency or success rate of the indicator.

2. Parameters and Calculations of Median indicator. (Screenshot required

In this second task, I'm going to be mentioning the parameters and calculation of the median indicator. Like I said earlier, Median indicator is trend based indicator which is very good in Identifying trend in The market. It also shows but and sell signals.

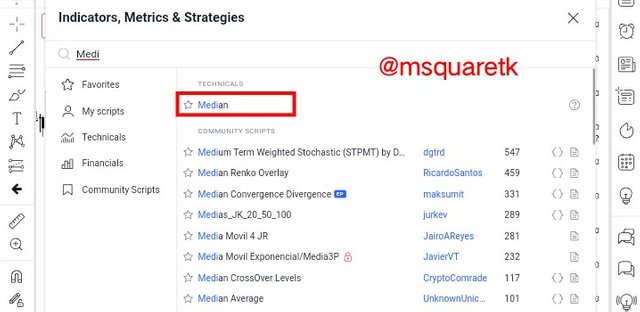

To add the indicator to the chart, I'm going to use the trading view platform. It's a platform where technical analysis can be performed. So, on opening to the chart, look for indicator fx at the top of the chart and click on it.

Screenshot from trading view | SOURCE

Then once you click on it, a page will appear. Type "median indicator" in the search box and wait for it to bring result. Click on median just once.

Screenshot from trading view | SOURCE

Then you have successfully added median indicator to the chart. As you can see in the screenshot below, the Indicator has been added.

Screenshot from trading view | SOURCE

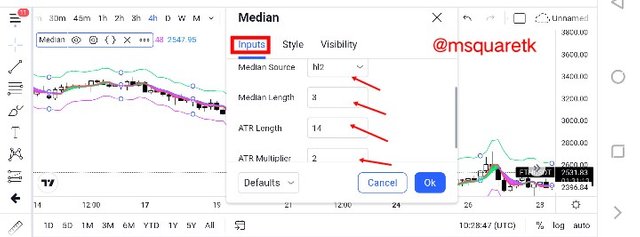

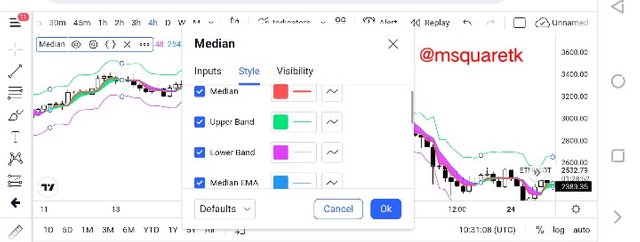

You can also configure the Indicator. To do this, click on gear like icon beside the indicator. It's the setting indicator.

Screenshot from trading view | SOURCE

Once you click it, you will see the input, style and visibility sections you can configure. You can change the period or length of the indicator by clicking on the input and change it to the period that fits your trading strategy.

Screenshot from trading view | SOURCE

Also, you can change the color of the bands. By clicking on the style section, you will see this.

Screenshot from trading view | SOURCE

The parameters of Median are:

- Upper band: It's upper line of the indicator which is green in color. The upper band acts as resistance in a downtrend market.

- Lower band: Lower band is the lower line of the indicator. It's pick color by default. It sometimes acts as a support in an up trend market.

- Median EMA: This median EMA is an exponential moving average which is included in the calculation of the Median Indicator. It supports the price in an Uptrend market and resists the price in a downward market.

- ATR: ATR means average true range. This is included to know the true range of price over a particular period. By default, 14 length is used for ATR

- ATR Multiplier: Then, there's multiplier for the ATR used. So, 2 is used by default. But traders can edit it.

- Median: The median is the mean of the price and it's very close to the Median EMA. They oscillates as the price of the asset moves.

Median = HP+ LP / 2

Where:

HP= Highest price

LP = Lowest price

EMA = C x M + EMA (previous day) x (1-M)

C = Closing Price

M = Multiplier

EMA = Exponential moving average

Median indicator = ATR %change (median, EMA)

3. Uptrend from Median indicator (screenshot required)

In this part of the question, I'm going to be explaining how to identify the Uptrend with median indicator and the buy signal. Like I said earlier, the median indicator is a trend-based indicator and hence it works well when the market is trending.

Uptrend signal is given when the median line is above the EMA, the green cloud will appear and that means the market is bullish. Traders can open a buy order when this appears and place the stop loss below the low created. The take profit is when the Indicator shows a sign of change in trend.

Screenshot from trading view | SOURCE

In the screenshot above, we can see that the green cloud appears when the median line was above the EMA. That's an indentification of bullish trend. See how price rallied to the upside.

4. Downtrend from Median Indicator (screenshot required)

In the previous question, I have shown how to identify an Uptrend and buy signal using median indicator. Here, I will be explaining how to determine the downtrend and see signal using median indicator. Don't forget that the indicator works well in a trending market because it's trend based indicator.

A downtrend can also be identified using the Median indicator. The market is said to be in a downtrend when the median line is below the EMA and the cloud turns to purple/pink color. This signifies that the sellers have gained enough strength to drag the price of an asset to downside. Traders can open sell position when they see this and place stop loss above the current high and follow the trend until the indicator shows a change in trend to the upside. See the screenshot below.

Screenshot from trading view | SOURCE

In the screenshot above, we saw an example of a downtrend that occurred. The media line was below the EMA and the cloud turned to pink/purple and the price rallied to the downside.

5. Identifying fake Signals with Median indicator(screenshot required)

As good as Indicator are, they are not hundred percent accurate and they can fail sometimes. That's why it's often advisable not use an indicator as a stand alone tool to analyze or predict the market. Most of the times, these indicators lag behind the price, and trend would have almost finished before they pick the change in trend. Some lead the price and may fail because traders would have take position with little fluctuation in price whereas , the price may still continue in its direction.

Median Indicator is also not hundred percent efficient. And hence it works well it's combined with other technical tools or indicators. Here, I will combine the indicator with RSI and explained how to identify fake signal and when to take trade and when to stay away from the market. Let's see a screenshot below in which median and RSI indicator have been added to the chart.

Screenshot from trading view | SOURCE

In the screenshot above, we saw that the median and RSI have been added to the chart. RSI is an indicator that shows when the price is oversold and overbought. The oversold region is below 30 and overbought region is above 70. When price enters the oversold region, it's a signal for bullish trend and when price enters the overbought, it signifies a change from uptrend to downtrend.

In the screenshot below, we saw that the price was in a done fir a period of time, then we received a bullish signal from RSI as it entered the oversold region. But if we look at the Median indicator, there's no signal for a bullish move. We can see how Median indicator helps to identify fake signal of the RSI. If a trader had added only RSI, he could have take a buy position and price will still continue in the downward direction.

Now, in the second instance, RSI enters the oversold region and we also saw Median Indicator give a bullish signal as the median line was above the EMA and the cloud turned to green. See how the price rallied to the upside. See the importance of combining Median with RSI. It help filter false signal.

6. Open two demo trades, long and short, with the help of a median indicator or combination that includes a median indicator (screenshot required)

In this part of the task, I'm going to be placing two trades using the strategy of Median indicator, one long and the other short. Let's start with the long (buy) trade.

Buy Trade (ETHUSDT)

The first trade i will be taking using the strategy of the median indicator is on the chart of ETHUSDT. Upon opening the chart of ETHUSDT, the price was seen in a beautiful trend. But shortly after that, a green cloud appear which means that the median line is now above the EMA. This is a bullish signal. See the screenshot below.

Screenshot from trading view | SOURCE

Then, upon seeing this, I marked my entry and exit level. The entry is taken at the market price level, the stop loss was placed below the lower created and take profit was placed at a nearest resistance level. But take profit is usually not set, he traders follow the trade until a change in trend is seen.

Screenshot from trading view | SOURCE

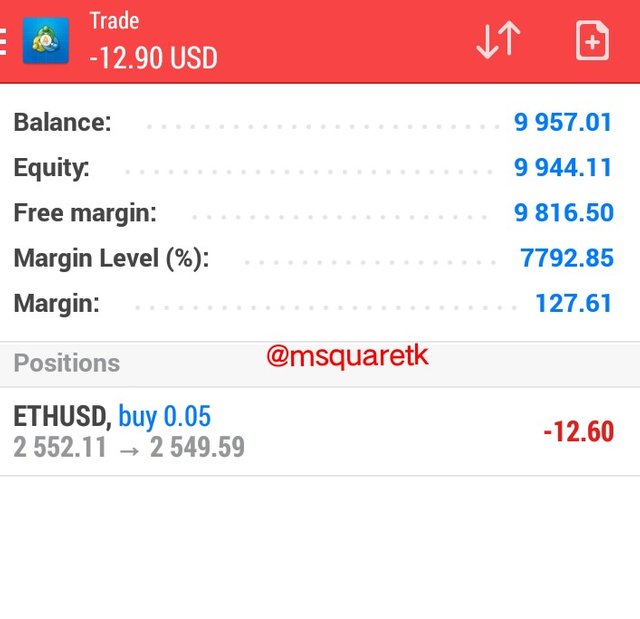

The screenshot below shows the screenshot from trading view. You will see I have executed the trade using the information, the entry and exit price levels got from the trading view.

Screenshot from Mt4 App

Also, this screenshot below is taken after the execution of the trade. It sjows the trading running.

Screenshot from Mt4 App

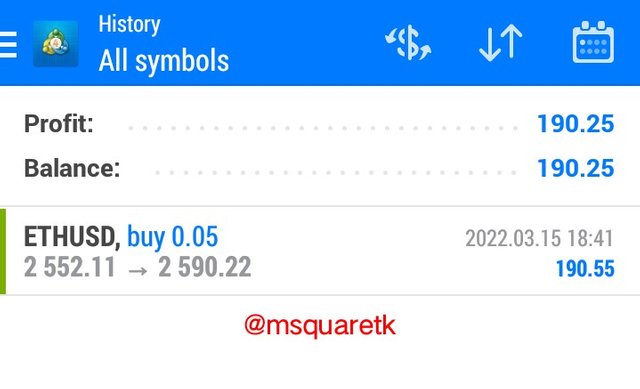

Then, some hours later, the trade hit my take profit. The screenshot below shows the profit I made from the buy trade of ETHUSD

Screenshot from Mt4 App

Now, having done with the buy trade, let's quickly see the sell trade.

Sell Trade (DASHUSDT)

The sell trade I will be placing is on the pair of DASHUSDT. I will also be using Median indicator strategy to place the trade. Upon opening the chart of DASHUSDT, the price was see on a short uptrend, meaning that it's retracing to the upside after a considerable fall in the price of this asset. Then, upon completion of that retracement, a purple cloud appear. This means that the median line was below the EMA and this signifies a bearish trend. See the screenshot below.

Screenshot from trading view | SOURCE

Having seen this, I marked my entry and exit price levels. The entry is at the current market price, the stop loss was placed above the high, and take profit was placed to have a risk reward of 1:1. Actually take profit is not always set because traders take profit when there is change of the trend. But it's advisable to set take profit if you can't monitor the trade.

Screenshot from trading view | SOURCE

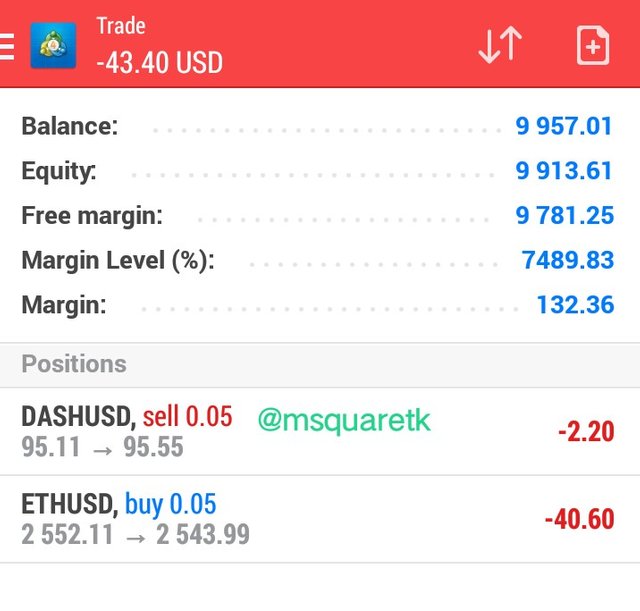

Then, having the entry and exit price levels, I opened an instant trade execution on my app. The screenshot below shows that the trade has been executed.

Screenshot from Mt4 App

Also, this screenshot below was taken immediately after the execution of the trade. This shows that the trade is still running.

Screenshot from Mt4 App

I will keep monitoring this trade and see how it's going to end. If the price hits my stop loss, that means the setup is invalid.

Conclusion

Technical indicators are one of the important tools in technical analysis. Traders use them to predict the direction of price and measure the inflow and outflow of money. In this task, I have discussed Median indicator. It's a trend-based indicator which is used for trend identification in the market. It has upper, lower and median bands. The median line and the EMA works very closely. When the median line is above the EMA, the cloud is green and the trend is an uptrend. And when the median line is below the EMA, the cloud is purple or pink and the trend is a downtrend.

Although this indicator shows or predict the trend very well, but it's advisable not to use it as a standalone tool. It works well when it's combined with other technical tools or indicators. It can be combined with RSI, stochastic, MACD etc to increase its success rate.

Thanks to Professor @abdu.navi03 for this insightful and educative lecture. I have learnt one or two things from this level.

CC: @abdu.navi03

@steemcurator02

Written by @msquaretk