Cover Page created by me, @msquaretk | created on imarkup app

This is the fourth day in the second week of the trading competition. I am a Team member of team "fredquantum-kouba01 Traders". Today, I will be giving the full details of the trade I took on 03/03/2022. I will be showing the project background of the token and the technical analysis done on the trading view. Then this post will also show the screenshot of the margin trade I took on Binance Exchange after the analysis on trading view platform. So follow me closely.

The name and introduction of the project token, and which exchange it can be traded on, project/team/technical background

Before I move on to technical analysis, i will show a brief details of the project background of the token. So, here, you are going to see the team or developers who created the token, the growth and the use cases of the token. The name of the token is ALGO. And I am going to be trading the pair ALGOUSDT. I will be doing the analysis on the trading view platform and a margin trading on binance exchange app.

ALGO is a native token of Algorand blockchain; an open and decentralized blockchain. Algorand was created by Silvio Micali in the year 2017. He was working with MIT during the time. The platform has a company as well as the foundation. The function of Algorand blockchain is o monitor the growth of the platform, oversee the on-chain governance and decentralization of the Ecosystem.

The test network of the Algorand was introduced in March 2019 and the main network was launched in June of that same year, 2019. Silvio has many people who worked with him during the creation of the platform and so many individuals supported to ensure the growth of the blockchain.

Algorand uses a consensus protocol that's different from old blockchains. Bitcoin uses proof of work in which miners are expected to solve a mathematical puzzles with complex and expensive devices before the a block will be generated and be rewarded with block reward. Ethereum uses proof of Stake which is also different from that of Bitcoin but validators have to Stake some amount of coins here. Algorand uses a pure proof of stake (PPoS) consensus protocol.

In Algorand pure proof of stake, the influence of the validators is dependent on the number of tokens they stake. Meaning the more token they stake, the more their influence. This protocol allows selection of every ALGO token at random to be staked. 1 ALGO can be staked and the price is not as high as that of Ethereum. This means there will be more validators as many people can afford it. Staking is very easy in Algorand. However, to become part of it, participants will need to confirm that they available and send some ALGO token (minimum is 1 ALGO) to the Algorand wallet.

The main reasons for he creation of Algorand blockchain was to solve the blockchain Trilemma. We know the core features of blockchain are just three: security, scalability and decentralization. Trilemma means no blockchain can achieve these three features at the same time. And we have seen some blockchains in which two are functioning and the remaining one is not functioning well. So Algorand aimed at solving this. Meaning there should be a blockchain which can achieve the three features.

Today, Algorand is one of the blockchain which has achieved that. The blockchain is very scalable. It can handle tons of transaction in a jiffy. It takes 4.5 second before a block can be produced on this blockchain. This is unlike other blockchains. Then there's high security as there are more validators on the ecosystem. And this is due to the fact that the cost of acquiring 1 ALGO which I the minimum number of coins for staking is not expensive. This also brings about decentralization as many people will be participating.

ALGO has many use cases. It's a native token of the Algorand blockchain which is used as a means of payment on the Ecosystem. It's also used for staking. I have said that to participate in staking, you will need just 1 ALGO. The validators use ALGO to propagate new blocks and they are also paid in ALGO for their rewards.

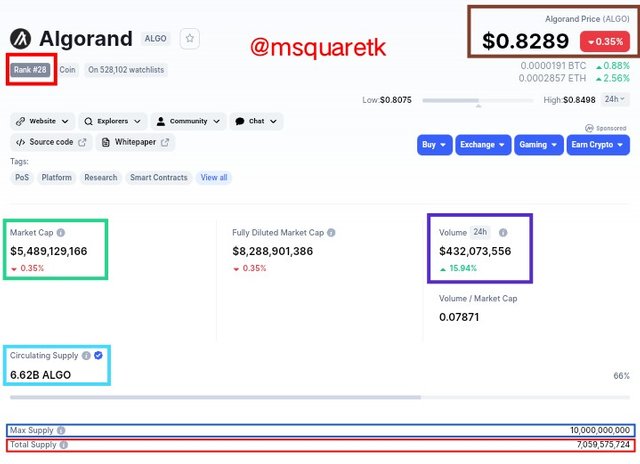

According to Coinmarketcap, ALGO is ranked #28 and it is currently trading at $0.8289.

It has a market capitalization of $5, 489, 129, 166;

Volume of $437, 072, 556;

Circulating supply of 6.62B ALGO;

Maximum supply of 10, 000, 000, 000 ALGO and

Total supply of 7, 059, 579, 724.

The screenshot below shows these details according to Coinmarketcap.

Screenshot From Coinmarketcap | SOURCE

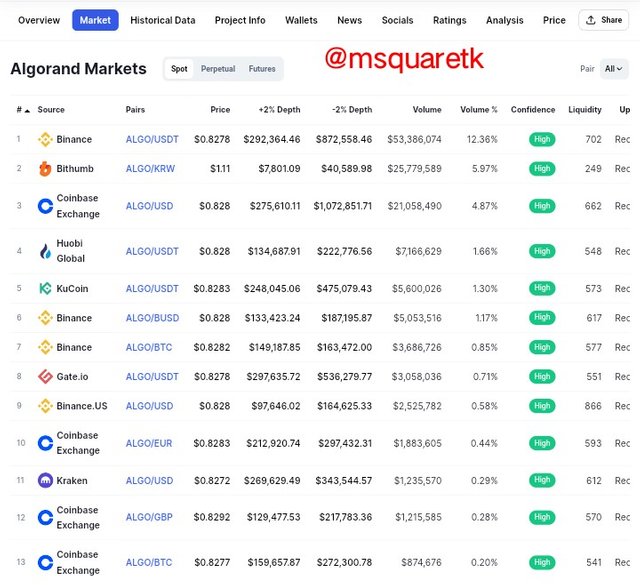

Now having shown that, let's see exchanges where ALGO can be traded on.

Exchange It can be Traded on

ALGO has been listed on many exchanges and been paired to many other tokens. These are some of the exchanges it can be traded on.

- Binance

- Kucoin

- Huobi Global

- Coinbase exchange

- Kraken

- Bithumb

Etc.

The screenshot below shows these exchanges according to Coinmarketcap.

Screenshot From Coinmarketcap | SOURCE

Why are you optimistic about this token today, and how long do you think it can rise?

I'm optimistic about this token because I saw that the area it's, there should be a potential rise based on my analysis. Although I did a margin trade and I bought the asset. According to my analysis, the price of ALGO should rise to at least to 0.8602 and it should take more than 48 hours before the price will reach this area.

Having seen this, let's quickly move to the technical aspect, which is the most important part of this task.

Technical Analysis of the Token, ALGOUSDT.

Having seen the project background of the token, ALGO , the founder and the use cases, here I am going to move to technical analysis of the token. I did this analysis on trading view platform. Then, I will also be showing the screenshot of the real margin trade I placed on binance exchange.

The strategy I will be using to do the analysis comprises of price action and technical Indicators, relative strength index, stochastic oscillators and bollinger bands.

Now having added all the Indicators to the chart, I began to switch to different pairs which I have not traded since this competition began. Then I was looking for an opportunity to have confluence. On switching to ALGOUSDT, H1 timeframe, I saw that previously, the market was in a bearish trend as it kept making lower lows and lower highs.

Then at the bottom of the trend, the price broke above the last high of the bearish trend. That's a signal that the bearish trend is over. In the screenshot below, you will see where the break of structure happened. I indicated it by pointing at it and wrote "break of structure". See the screenshot below.

Screenshot From Trading View | SOURCE

On the same timeframe, H1, I added a bollinger band to confirm the break of structure. If you notice what the price was doing in a bearish trend, the price was between the lower and middle band of the bollinger band. This confirms that bearish trend. But when a break of structure occurred, the price crossed above the middle. This signifies a break of structure.

In addition to that, before a break of structure happens, a bullish divergence formed. You will see that the price made lower lows and the RSI made higher lows. Bullish divergence signifies that the sellers are getting exhausted and the momentum is reducing.

Further, when the break of structure occurred, the price retraced back to the middle band (red line of bollinger band). The middle band has started supporting the price. The hammer candlestick formed. This candlestick pattern is capable of sending the price up especially when it forms at a key support level.

Screenshot From Trading View | SOURCE

So, having seen these many reasons (confluences):

- Break of structure using price action and bollinger strategy

- Bullish divergence using price action and RSI and

- Hammer candlestick pattern forms on the middle band after a break of market structure,

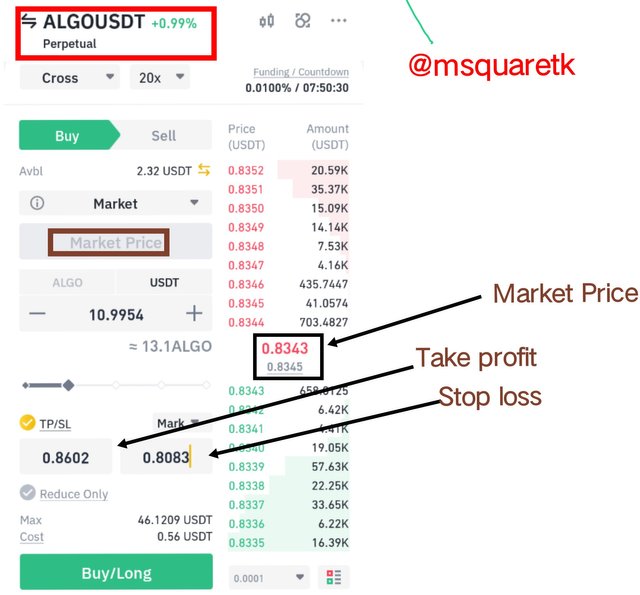

I opened a buy entry at the current market price at $0.8310 and the stop loss was placed below the last low created at $0.8083 and the take profit was placed at the nearest resistance level at $0.8602.

See the screenshot below.

Screenshot From Trading View | SOURCE

Then, having had the entry and exit price levels, I opened a sell order on my binance exchange app using margin trading option. The screenshot below shows when I was placing the margin trade.

Screenshot From My Binance App

Also, this screenshot below is taken after executing the trade. The trade is still running. I will update the results as soon as it hits my exit.

Screenshot From My Binance App

Your plan to hold it for a long time or when to sell?

I don't plan to hold the trade for long. Based on my analysis I did, it should not take more than 48 hours before the price will hit my exit. Also I am not in possession of the asset, because I did a margin trading. You only take advantage of the rise and fall of price in margin trading and you can't hold it. So, I will be out of the market when price reaches my exit.

Do you recommend everyone to buy? and the reasons for recommending/not recommending

Yes. I can recommend people people to buy the asset. However, if I would recommend them to buy, it would be when I bought it. Then the reason for recommending would be based on the analysis I have done and the confluence I had with my strategy. It's therefore pertinent to also state the risk involved when recommending. I would encourage them to manage their risk very well because cryptocurrencies are very volatile.

Conclusion

In this fourth day of the second week of the trading competition , I have been able to successfully show the project background of the token, the founder, the use cases and the growth so far. Also, I have done technical analysis on trading view platform using the knowledge and experience I have gained. Then I proceeded to take a real trade using margin trading option on Binance exchange.

Thanks to the Admins of the Steemit Crypto Academy and to my team leaders, @frdquantum and @kouba01 this second week.

Consulted Article 1 SOURCE

Consulted Article 2 SOURCE

Consulted Article 3 SOURCE

CC: @fredquantum

@kouba01

Written by @msquaretk