Cover Page created by me, @msquaretk

| imarkup app

Hello Stemians.

We are already in the week 5 of the season 4 in the crypto academy. Today, I am going to be writing based on the questions Professor @imagen gave after his lecture on "Bitcoin's Trajectory"". He explained succinctly on the said topic. So, I am going to be writing based on my understanding about the topic and research made. Follow me closely as I take you through.

Question 1

How many times has Bitcoin been "halved"? When is the next expected? What is the current amount that Bitcoin miners receive? Mention at least 2 cryptocurrencies that are or have halved.

The block producers, those who validate the transactions by solving mathematical puzzles using the proof of work consensus mechanism or protocol, receive what is called block reward when they successfully produce a new block. These block producers are also called miners. The first person to solve the mathematical puzzles and validate receive the block reward for the new block formed.

The block reward for the miners is constant for a certain period of time. But at every 210,000 blocks, the reward changes. This will lead us to halving. Simply put, Bitcoin halving means reduction by half of the block reward at every 210, 000 successfully blocks produced and added to the blockchain network. That means, at every 210, 000 blocks formed, the reward of the miners will be cut to half. It is said that before 210, 000 blocks will form on the bitcoin blockchain, it would take approximately 4 years because a block forms at every 10mimutes.

How many times has bitcoin been halved?

The launch of bitcoin was on 3rd of January 2009. During the time, 50BTC was given as the block reward. That is, 50BTC will go to circulation when a block is formed.

The first halving then took place on the 28th of November 2012 where 50BTC was cut into half. During that period, the block reward was 25BTC.

The second halving was on the 9th of July, 2016. The block reward on that day was cut into half, which is 12.5BTC.

The third halving took place on the 11th May, 2020. The reward was cut half to 6.25BTC.

In essence,

First halving was on the 28th November 2012

Second halving was on the 9th July, 2016.

Third halving was on the 11th May, 2020

Therefore, Bitcoin has experienced halving three (3) times

When is the next expected?

Remember I said halving takes place at every 210, 000 blocks.

First halving was on the 28th November 2012 at 210, 000 blocks

Second halving was on the 9th July, 2016 at 210, 000 blocks + 210, 000 blocks = 420, 000 blocks

Third halving was on the 11th May, 2020 at 210,000 blocks + 210, 000 blocks + 210, 000 blocks = 630, 000 blocks

First halving = 210, 000 blocks

Second halving = 420, 000 blocks

Third halving = 630, 000 blocks

Now the next expected halving, which is the fourth halving will take place at 630,000 blocks + 210, 000 blocks = 840, 000 blocks

Let's look at the year it would be. The last halving which is the third halving took place on the 11th of May, 2020. And we know that, for the fourth halving to take place, 210, 000 blocks will be added. Also, a block forms at every 10minutes

Now, let's quickly do simple.

The time in minutes for the 210, 000 blocks to be added to the bitcoin blockchain woul be

10 minutes × 210, 000 blocks = 2, 100, 000 minutes

So, for 210, 000 blocks to be formed,it will take 2, 100, 000 minutes

Taking this to hour, we have:

2, 100, 000 / 60 = 35, 000 hours

35, 000 / 24 = 1458.333 days

1458.333 / 365 = 3.995years ≈ 4years

So, it means 210, 000 blocks will be formed in 4years. That means, adding four years to 2020 when the last halving occurred, it would be 2024.

Hence, the next halving, fourth halving will take place at 840, 000 blocks in the year 2024

What is the current amount that Bitcoin miners receive?

The current amount of bitcoin the miners are receiving is 6.25 BTC since we are still in the phase 3 of the bitcoin halving. This reward will last for about 4years and after the next halving takes place, the reward will be slashed to half.

Remember I said the third halving which is the last halving occurred on 11th may 2020. From that time till the year 2024, the miners will still be receiving 6.25 BTC.

Mention at least 2 cryptocurrencies that are or have halved

Here, I am going to mention two cryptocurrency that are or have halved. The first I am going to start with is LITECOIN.

LITECOIN (LTC)

.png)

Fig. 1: Litecoin's Symbol

Image Source

Litecoin is one of the first coins that came into existence after bitcoin. The coin was launched in the year 2011. A block is formed at every 2.5 minutesand added to the blockchain. Litecoin halving takes place at every 840, 000 blocks.

At the time of launch, the block reward for miners was 50LTC. But the first halving took place in the year 2015 in which the reward was cut into half, 25LTC. Also, the second reward took place in the year 2019 and the block reward for miners was 12.5LTC.

So far, litecoin (LTC) has experienced halving two times

FIRO

Fig. 2: Firo's Symbol

Image Source

This is another cryptocurrency that has halved. Firo was launched in the year 2016. A block is formed at every 5 minutes on its blockchain. At the time of its launch, the block reward was 25 FIRO. But the first halving took place which made the block reward reduce from 25FIRO to 12.5 FIRO

FIro has experienced only one time halving since its launch.

Question 2

What are consensus mechanisms? How do Proof-of-Work and Proof-of-Staking differ?

Consensus mechanisms are also known as consensus protocols.

The word consensus means agreement. And we know that mechanism means process.

Therefore, consensus mechanisms is referred to as a mechanism by which agreement would be reached on data on a particular blockchain. Consensus mechanisms enable connection of several computers to a network to work together and be secured.

In essence, consensus mechanisms are they major determinant of how transaction will be verified on the blockchain. There various types of consensus mechanism used in the blockchain. Examples are, proof of work (PoW), proof of stake (PoS), Proof of history (PoH) , delegated proof of stake (DPoS) etc.

Proof of Work (PoW)

PoW is a type of consensus mechanism where the validation of transaction is done by miners through the solve of mathematical puzzles with their high sophisticated computers. The first miners that solves the puzzles receive the block reward for that particular time.

Proof of work requires more energy and high sophisticated gadgets to be able to solve the mathematical puzzles as fast as possible.

Proof of Stake (PoS)

PoS is also a consensus mechanism used in some blockchain to reach agreement on the decentralized system or network. It's a consensus mechanism where the verification of transactions are done by validators. To be a validator on the blockchain which uses this mechanism, the participants will need to lock up their coin and stake it. The participants which have the maximum coins being staked for the period of time are liable to be the one who produce the block. And they will receive the block reward for every transaction and activities performed on the block.

How fo Proof of Work and proof of stake Differ?

In proof of stake, miners are not needed, instead, validators are employed to stake their fund. But to be a validator, one will need to have certain amount of coins.

Unlike, proof of work where miners compete to solve the mathematical puzzles to be able to validate the transactions and valid block added to the blockchain, validators are not in competition in proof of stake; validators are selected at random based on the algorithm. In essence, validating a block in proof of work has to do with how much work is done by the miners, whereas validating a new block in PR of stake is a measure of the coins the validator stake, the more the stake the more the chance to produce a new block.

In PoW, the first person or miner to solve the mathematical puzzles receives what is known as block reward. No block reward is given to validators in proof of stake, but they are given what is known as network fee

Miners need to invest more on the hardware and the equipment they need to solve the mathematical puzzles. Validators only invest in their stake to be able to build their reputation to have influence or edge to be able to produce new block.

In proof of work, more energy and expensive and highly sophisticated equipment are needed so miners can have edge to compete in solving mathematical puzzles. Whereas, there's nothing like solving puzzles in proof of stake.

In term of scalability, proof of stake is more scalable than proof of work. PoS consensus mechanism can handle more transactions per second than PoW.

Examples of blockchains that use proof of work (PoW) consensus mechanism are, **Bitcoin blockchain, Bitcoin cash, litecoin, monero etc. Examples of blockchains that use proof of stake (PoS) are EOS blockchain, Cardano blockchain, Lisk blockchain, etc.

Question 3

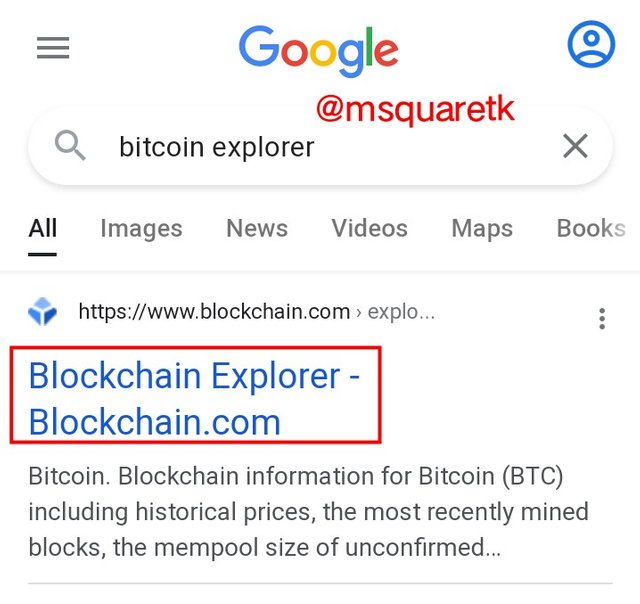

Enter the Bitcoin explorer and indicate the hash corresponding to the last transaction. Show Screenshot.

In this part of the question, I am going to use Bitcoin explorer to indicate that hash of the last transaction. To use one of the bitcoin explorer, type "Bitcoin explorer" on google. You will get different result. I'm going to be using the first result it brought , blockchain.com

which is the popular Bitcoin explorer.

Fig. 3: Searching for Bitcoin Explorer | google.com

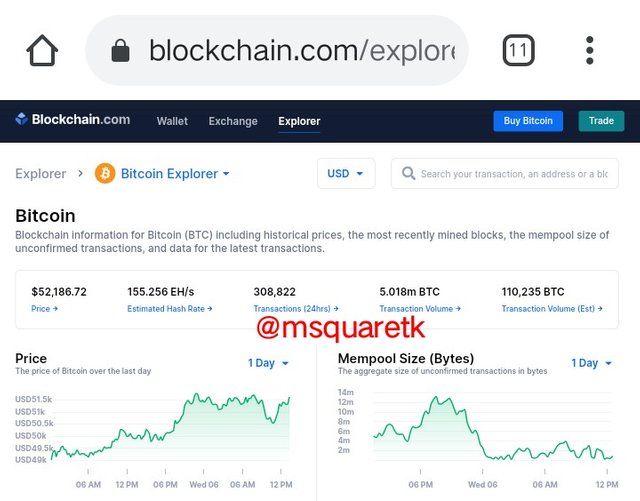

Upon bringing the result, click on blockchain.com. And you click on it, the homepage of the explorer will be loaded for you.

Fig. 4: Home page of blockchain.com blockchain.com

Scroll downward the page to see where the transaction are listed.

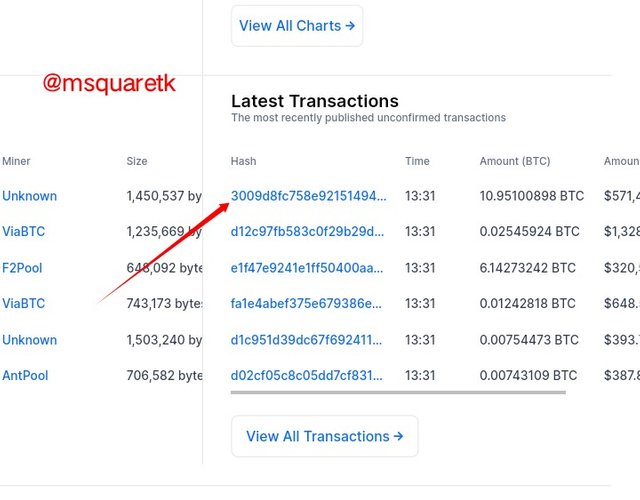

Fig. 5: Latest Transaction | blockchain.com

To see the hash and the details very well, click on the hash written with blue color. It is pointed at with a red arrow in the figure below.

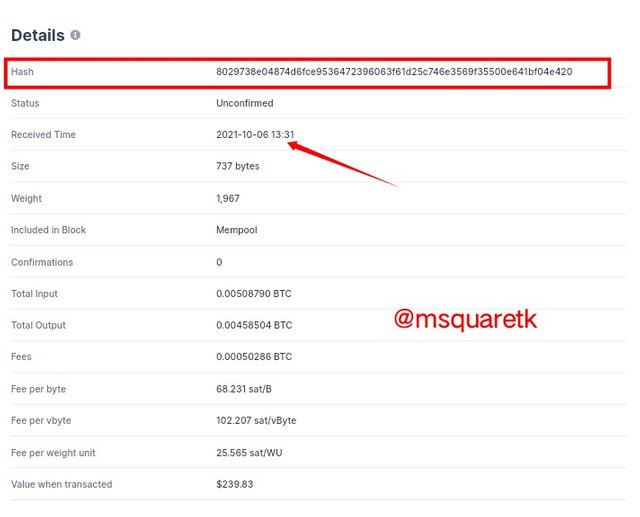

Fig. 6: Transaction Details | blockchain.com

As it seen in the screenshot above, the last transaction was at 13:31pm (WAT) / 06 / 10/ 2021.

And the Hash : 8029738e04874d6fce9536472396063f61d25c746e3569f35500e641bf04e420

Question 3

What is meant by Altcoin Season? Are we currently in Altcoin Season? When was the last Altcoin Season? Mention and show 2 charts of Altcoins followed by their growth in the most recent Season. Give reasons for your answer.

In this part of the question, I'm going to be explaining altcoin season and show two charts of altcoin. It is pertinent to what altcoins are.

The word Altcoins comes from two words, alternative and coins. So, Altcoins means alternative coins. Altcoins are coins that came into existence after the the birth of Bitcoin which is often regarded as the father of cryptocurrency. Although, some people claim that the first ten coins that follow Bitcoin should not be regarded as altcoins. Now, let see what altcoin season is.

What is meant by Altcoin Season

Bitcoin is the popular cryptocurrency which has a very high dominance Dominance means the percentage of market capitalization of a cryptocurrency with respect to the total market capitalization of all the coins. For example if the market capitalization of of a coin Y is $260, 000 and the total market capitalization value is $2, 000, 000, then the dominant of the asset will be $260, 000 / $2,000, 000 × 100 = 13%. That means, coin Y has a dominant of 13% I the market.

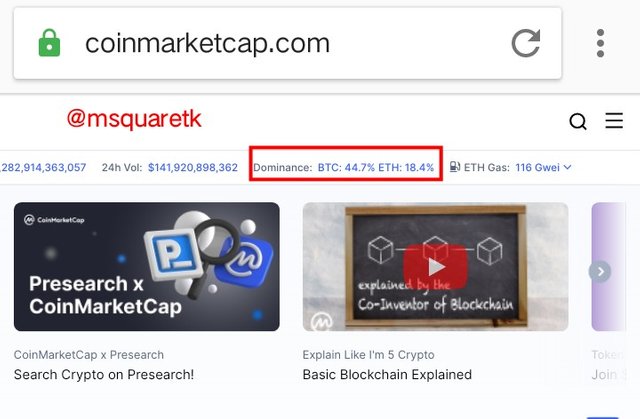

So, Bitcoin is the cryptocurrency which has the high dominance in the market. Although, some people claim that its dominance is not included over the first 10 coins closest to it in term of market capitalization. No matter the case, Bitcoin still dominate with a very great percentage. For example, at the time of writing this post, the dominance of Bitcoin is 44.7% and the of its competitor, ETH is 18.4%. See the screenshot below.

Fig. 7: Bitcoin and ETH 's Dominace | coinmarketcap.com

It means, Bitcoin is dominating with 44.7%. But what is the essence of showing this? Now this will let us understand altcoin season.

There will always be seasons when bitcoin will begin to lose its dominance and the Altcoins begin to rise in price and market capitalization. This season is known as altcoins season. At the Altcoins season, many Altcoins will be seen rising and are competing with Bitcoin. It believed that when the season represents a period when about 75% of the of top 50 Altcoins in the last 90days begin to gain percentage more than Bitcoin.

Are we currently in Altcoin Season? When was the last Altcoin Season?

We are not in Altcoins season. Bitcoin is currently rising and there is no sign of any cryptocurrency moving closing to it. Thanks Altcoins season is often caused as a result of barriers that Bitcoin experience. At that time, it will turn bearish after a very long bull run. At that time, people distribute most of their bitcoin assets in order to gain and later buy at a very considerable look price.

Looking at the Bitcoin dominace which 44.7 %, we can see that it has almost claimed half of the entire dominace.

When was the last Altcoin Season?

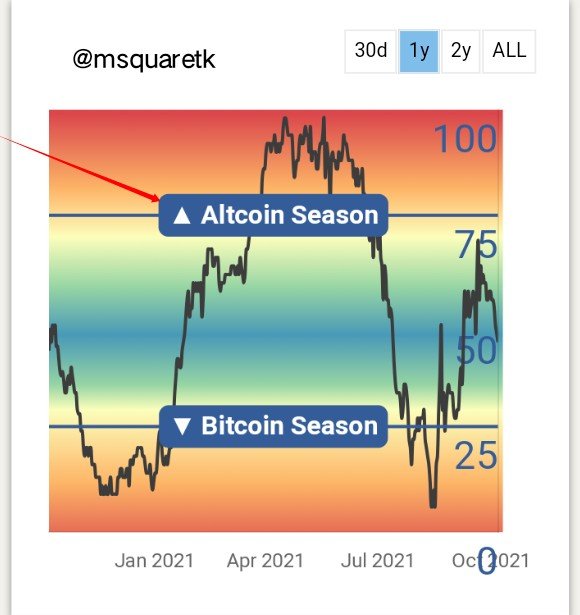

The last altcoin season was around March 2021 and July 2021. At that time, Bitcoin price experienced a major decline and lost its dominance. See the screenshot below.

Fig. 9: Last Altcoins Season | blockchaincenter.net

According to the scale in the screenshot above, you would notice that Altcoins out performs bitcoin between March and July 2021. You notice that Altcoins crossed 75% and above during the period.

Mention and show 2 charts of Altcoins followed by their growth in the most recent Season. Give reasons for your answer.

In this part of the question, I am going to be showing 2 charts of altcoins.

For this task, I am going to use coinmarketcap.

1. AXS

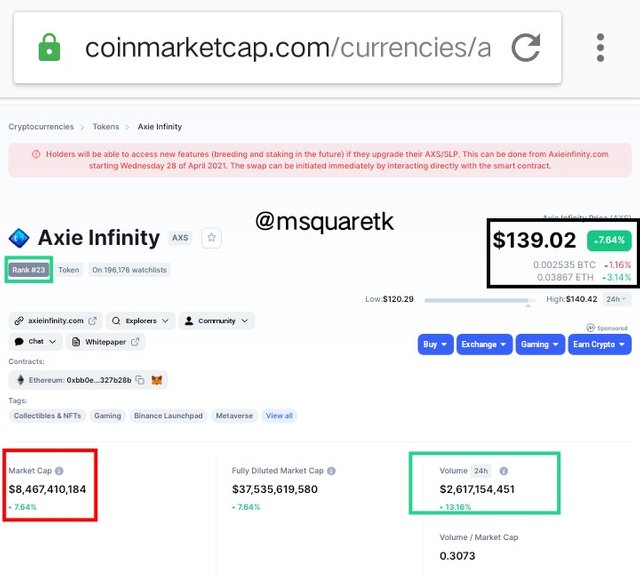

AXS is a native token of axie infinity blockchain, a blockchain based trading and battling game.

As at the time of writing this, AXS is ranked 23, its current price is $139.02, and has a market capitalization of $8, 467, 410, 184 and has the volume of $2, 617, 154, 451. See the screenshot below.

Fig. 10: AXS rank, price , market cap and volume | coinmarketcap.com

The graph of AXS is shown in the screenshot below.

Fig. 11: Graph of AXS | coinmarketcap.com

AXS just made its all time high two days ago. It hit the price of $155.88. And you look at the chart above, you would notice that it has been on uptrend for a long period of time.

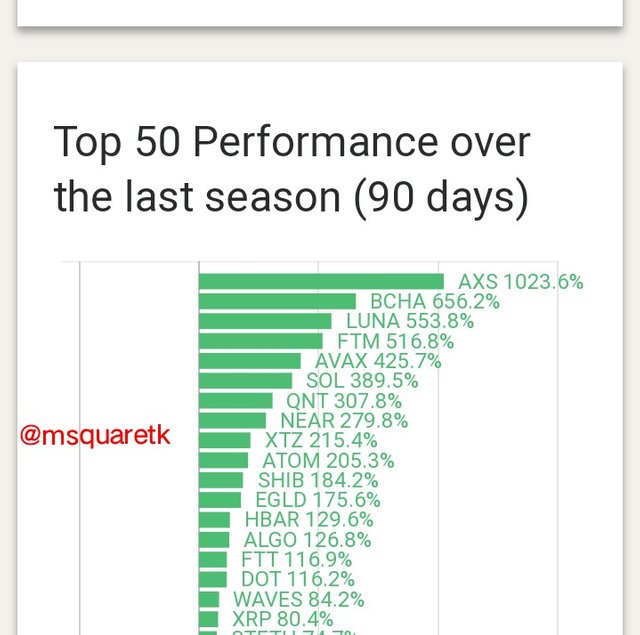

AXS I the first Altcoins which performed greatly in the last season. It rose up greatly with a percentage of 1023.6%. This shows that money really flow into the asset. See the screenshot below.

Fig. 12: List of Coins Top Performance | blockchaincenter.net

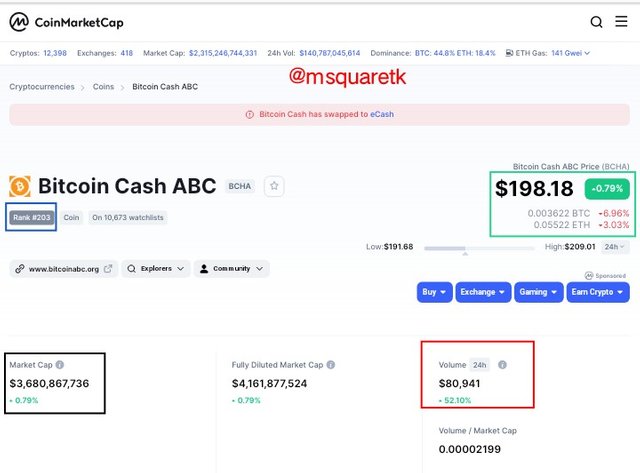

2. BCHA

The next chart of the tolen I will be showing is BCHA. **BCHA means Bitcoin cash ABC, and it is the coin that came into existence as a result of hard fork of bitcoin cash. As at the time of writing this,

BCHA is ranked 203

BCHA price is $198.18

BCHA Market capitalization is $3, 680, 867, 736

BCHA volume is $80, 941

Fig. 13: BCHA rank, price , market cap and volume | coinmarketcap.com

The graph of BCHA is shown below.

Fig. 14: Graph of BCHA | coinmarketcap.com

BCHA also made the all time high and hit a price of $392.29. During the last season, BCHA was the second Altcoins that people hold. It rose above all other coins with a percentage of 656.2%

Question 5

Make a purchase from your verified account of the exchange of your choice of at least 15 USD in a currency that is not in the top 25 of Coinmarket (SBD, tron or steem are not allowed). Why did you choose this coin? What is the goal or purpose behind this project? Who are its founders / developers? Indicate the currency's ATH and its current price. Reason for your answers. Show Screenshots

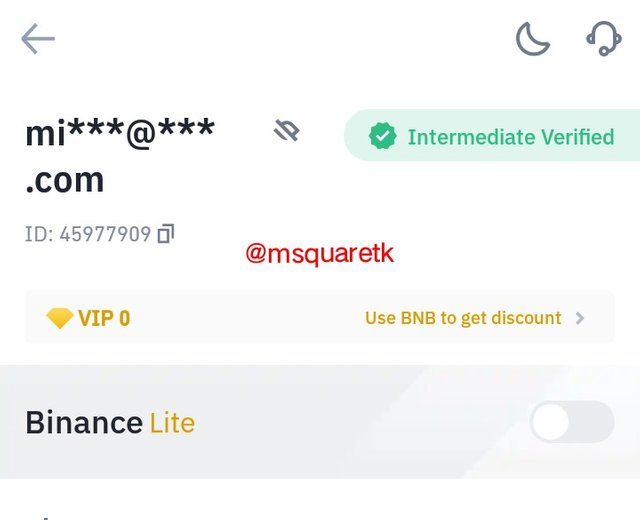

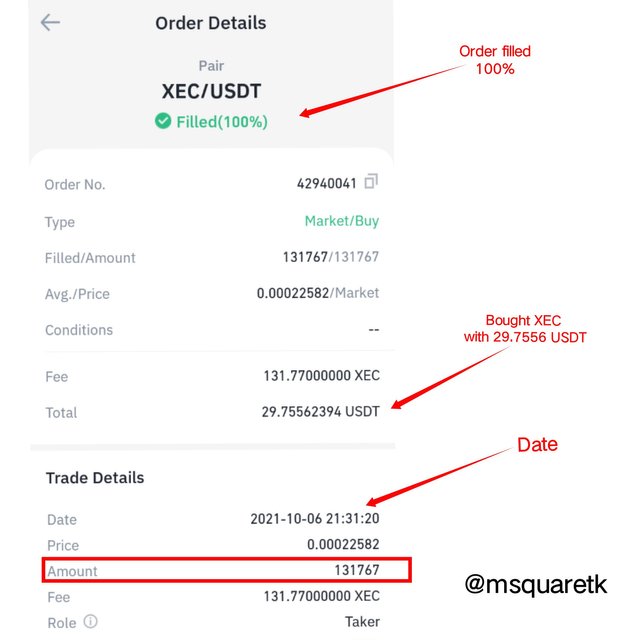

In this part of the question, I am going to buy XEC through my verified binance exchange. See below the screenshot of my verified binance exchange.

Fig. 15: My Verified Binance exchange | binance app

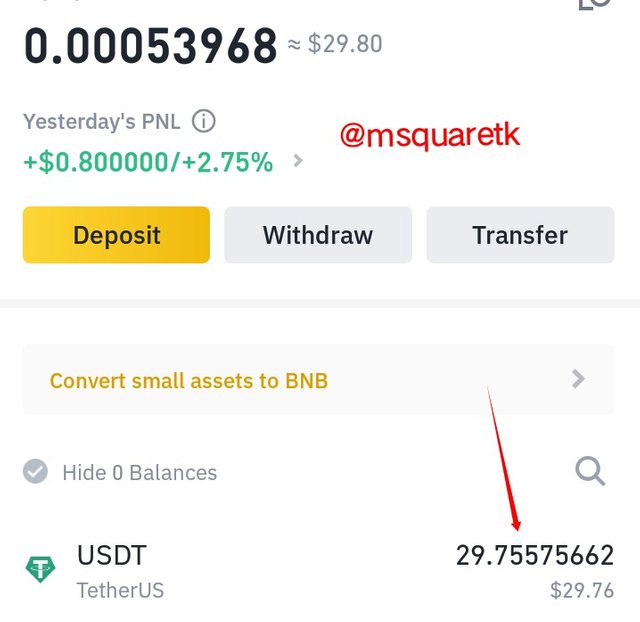

I have 29.755 USDT in my wallet which I am going to be investing to buy XEC.

Fig. 16: Wallet Section showing my USDT Asset | binance app

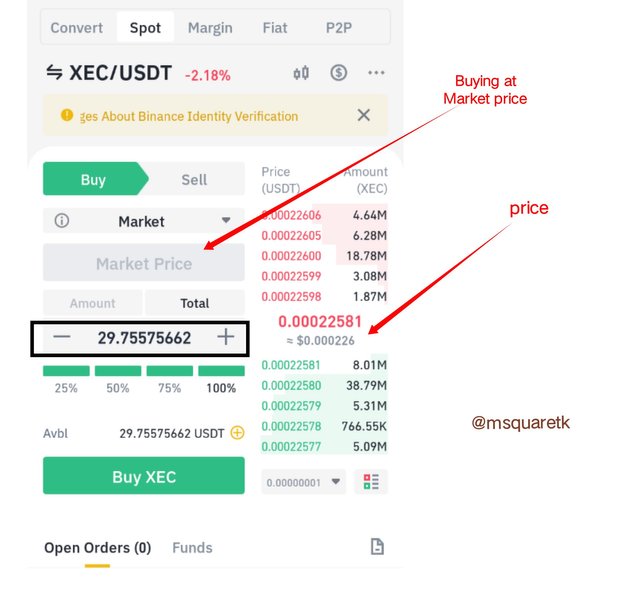

Now, the next thing is to go to the trade section and search for XECUSDT so I can buy XEC will my USDT asset. I'm going to be buying at market price and use all my USDT asset to buy XEC. See the screenshot below.

Fig. 17: Buying XEC with USDT | binance app

Then, as soon as I filled all the details, I placed buy. And the order filled immediately. See the screenshot below for the order details of the trade I made.

Fig. 19: Order Details | binance app

As it seen in the screenshot above, my 29.755 USDT bought 131, 767 XEC,and the order was 100% filled. The dates and all other things are in the screenshot.

Reason For choosing the coin

E cash (XEC) is a token that came into existence as a result of hard fork of Bitcoin cash. E-cash was introduced so as to provide some features which Bitcoin lack. Features such as fork free network, staking and subschain. So, providing this features and letting them available is the sole aim of building e-cash.

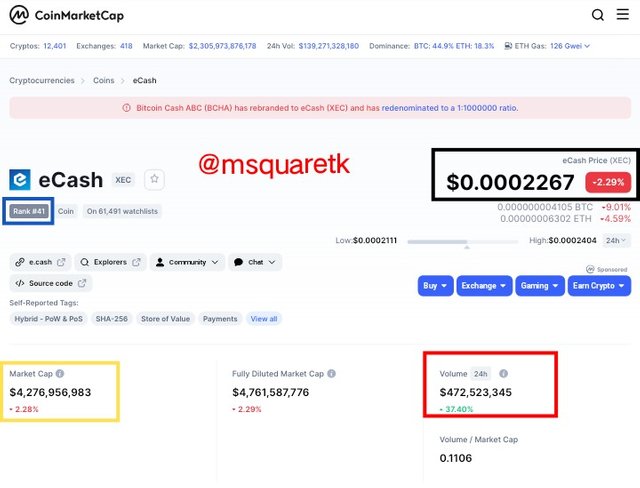

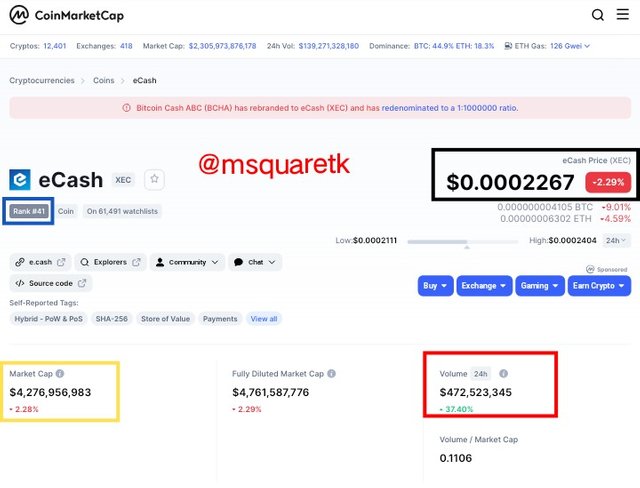

What drew my attention to pick this coin and analysis it properly is its price. Let's see the screenshot below.

Fig. 20: Price, rank, volume, and Market capitalization of XEC | coinmarketcap.com

As it seen in the screenshot above, as at the time of writing this article, the price of XEC is $0.0002267, it is ranked 41 , with a market capitalization of $4, 276, 956, 983 and volume of $472, 523, 345

Now, this token is worth investing in. Thanks current price of the token is $0.0002267 which means it is very affordable and one can accumulate a large number of the token. For example, my investment of 29USDT let me have 131, 767 XEC. In the next few years if I live the investment, it may yield great profit. For example, if 1 XEC turns to $1 in the next 3years, that means my $29 investment today would be $131, 767

Developers

XEC is developed by experienced developers of Bitcoin who are also the builder of bitcoin cash.

The developer use price of stake consensus mechanism.

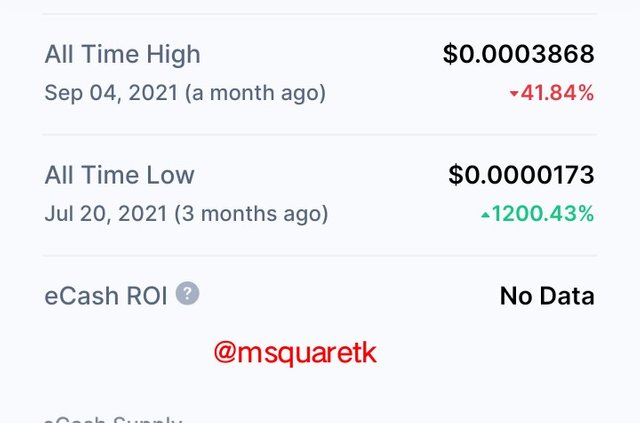

XEC ATH and Current Price

The all time high of XEC happened on the 4th of September, 2021. The all time high is $0.0003868 and the all time low is $0.0000173

Fig. 21: All time high and low of XEC | coinmarketcap.com

The current price of XEC as said above is $0.0002267. See the screenshot below.

Fig. 22: XEC Price | coinmarketcap.com

Let's also see the chart of XEC in the screenshot below.

Fig. 23: XEC Graph | coinmarketcap.com

Conclusion

Bitcoin halving is a phenomenon that occurs at every 210, 000 blocks where the block reward is cut into half. A block on the bitcoin blockchain forms at every 10minutes and for 210,000 blocks to form, it would take 4 complete years. There are many cryptocurrencies which undergo halving. There are three times that Bitcoin has experienced halving. The next one is expected to take place in the year 2024 when the reward will be reduced from 6.25BTC to 3.135BTC.

Altcoins are alternative coins. They are coins that came into existence after the birth of Bitcoin, the father of cryptocurrency. There are more than 12, 000 coins today. Altcoins have season and it is called Altcoins season. The period signifies rise in price of altecoins which is often caused as a result of people investing in the Altcoins when Bitcoin seems bearish. When 75% of top 50 Altcoins out performs bitcoin in the last 90days, it's often reffered to as altcoins season.

Thanks to Professor @imagen for the teaching. I have learnt one or two things from the lectture. I look forward to seeing your next lecture.

CC: @imagen

Written by @msquaretk

Gracias por participar en la Cuarta Temporada de la Steemit Crypto Academy.

Continua esforzandote, espero seguir corrigiendo tus asignaciones.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit