Hello everyone.

Season 4 of the crypto academy has started already.

This homework is posted for Professor @awesononso. I must confess that I enjoyed every of the lecture I attended last season as they were very educative, and I so much believe that the season will also be.

Prof. taught "The Bid-Ask Spread", and the end of the lecture he gave seven questions to be homework.

These questions are:

- Properly explain the Bid-Ask Spread.

- Why is the Bid-Ask Spread important in a market?

- If Crypto X has a bid price of $5 and an ask price of $5.20,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.- If Crypto Y has a bid price of $8.40 and an ask price of $8.80,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.- In one statement, which of the assets above has the higher liquidity and why?

- Explain Slippage.

- Explain Positive Slippage and Negative slippage with price illustrations for each.

Let's look at these questions one after the other.

1. Properly explain the Bid-Ask Spread.

In order to understand the Bid-Ask Spread, it is important we look at the bid and ask price.

What is bid and ask price?

If you have ever gone to the bank to exchange fiat money, you will see that the bank will display two prices on the screen. One is bid price and the other is ask price. Now, for example if you want exchange your local currency, say naira (#) to foreign currency, say united state dollar ($) in your local bank. You are the one who is acting as buyer, because you really want to buy USD with Naira and the bank is acting as seller, because they want to offer you want you don't have that you want or need. The bank will then give you the ask price, which is the price they will sell USD for you.

On the other hand, you go to the bank because your brother came from abroad, and brought USD ($) currency and you want to exchange it to naira. The bank will give you their bid price which is the price they are willing to buy USD currency from you. It should be noted that the ask price is always very higher than the bid price. Nobody want to do business and lose.

Therefore, bid price is the highest price a buyer is willing to buy a commodity at a particular period of time. And ask price is the lowest price the seller is willing to sell the commodity at that particular period of time. Notice that a particular period of time is attached to it because, the bid and ask price is for a particular period. It is not constant; it may change due to some factors.

So, when we talk of crypto assets, there are bid and ask price given to cryptocurrency pairs. This is because we sell and buy these assets, too. Having seen what bid and ask price is, let's now look at Bid-Ask Spread

Bid-Ask Spread, also known as spread is the difference between the bid and ask price. For example, if the bid price of a commodity is $30 and the ask price is $35*, the difference between them is $5 which is the Bid-Ask Spread for that commodity.

So, Bid-Ask Spread = Ask Price - Bid Price.

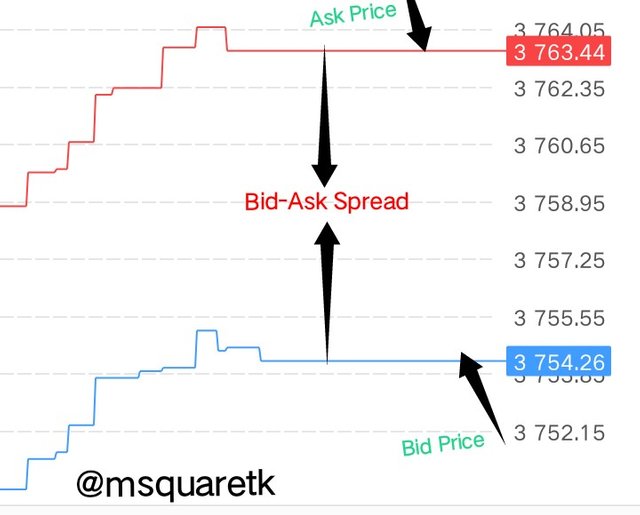

Below, is the screenshot showing the bid price and ask price of a cryptocurrency asset.

Fig. 1: Bid-Ask Spread | MT4 Platform

As seen from figure 1 above, the spread is the difference between the two lines, red and blue, which represents the bid and ask price.

Enough of this. Let's go to another question.

2. Why is the Bid-Ask Spread important in a market?

The concept of bid-ask spread is very important which every trader must understand. Bid-Ask Spread is very useful to know and calculate the liquidity of a particular asset.

In every market, there's what is called demand and supply. When supply is higher, the number of sellers will be more than that of buyers.

And of course, we know from our knowledge of basic economics we know that demand is readiness of people to buy the particular asset at a certain price over a particular period of time. So, when the demand is greater than supply, that means, more people are willing to buy a particular asset and as such, numbers of buyers would be greatly increased than that of sellers.

When the demand and supply in the market are at equilibrium (when they are balanced), the market will tend to be liquid and the trades would be easily executed. Liquidity means that the ratio of sellers in the market is or almost equal to that of the buyers. In such a case, the buyers are willing to buy a particular asset and the sellers, too are willing to sell that asset. This is often results in a very low spread, as the bid price and ask price will be very close to each other. And so, since the difference between the bid and ask price is small, the spread, Bid-Ask Spread will will be very small. In other words, the spread of that particular asset will be very low.

It's should be noted that when the spread is low, we will have a liquid market, and as such, the volume of that asset will be high and vice versa. So we can see the importance of Bid-Ask Spread. It's very helpful in knowing how liquid a market is. As a traders, once you know how liquid a market is, you will know how to trade it – what lot size to use, when to trade such an asset etc.

3. If Crypto X has a bid price of $5 and an ask price of $5.20, (a.) Calculate the Bid-Ask spread. (b.) Calculate the Bid-Ask spread in percentage.

Solution

Given:

Name of the asset = Crypto X

Bid Price = $5

Ask Price = $5.20

(a)

To calculate the Bid-Ask Spread,

We know that the formula for calculating

Bid-Ask Spread = Ask Price – Bid Price

Substitute the given bid and ask price into the formula.

Bid-Ask Spread = $5.2 –$5

Bid-Ask Spread = $0.2

Therefore, Bid-Ask Spread = $0.2

Now, let's go to (b).

(b)

To calculate the bid-ask spread in percentage.

The formula is:

%Spread = (Spread/Ask Price) x 100

Substitute the spread calculated in (a) and ask price given into the the formula. Then we have:

%Spread = (0.2 /5.2) x 100

%Spread = 0.03846153846 × 100

%Spread = 3.84615 %

%Spread = 3.85% (2 s.f)

Therefore, %Spread = 3.85% (2 s.f)

4. If Crypto Y has a bid price of $8.40 and an ask price of $8.80, (a) Calculate the Bid-Ask spread. (b) Calculate the Bid-Ask spread in percentage.

Solution

Given:

Name of the asset = Crypto Y

Bid Price = $8.4

Ask Price = $8.8

(a)

To calculate the Bid-Ask Spread,

We know that the formula for calculating

Bid-Ask Spread = Ask Price – Bid Price

Substitute the given bid and ask price into the formula.

Bid-Ask Spread = $8.8 –$8.4

Bid-Ask Spread = $0.4

Therefore, Bid-Ask Spread = $0.4

Now, let's go to (b).

(b)

To calculate the bid-ask spread in percentage.

The formula is:

%Spread = (Spread/Ask Price) x 100

Substitute the spread calculated in (a) and ask price given into the the formula. Then we have:

%Spread = (0.4 /8.8) x 100

%Spread = 0.04545454545 × 100

%Spread = 4.54545%

%Spread = 4.55% (2 s.f)

Therefore, %Spread = 4.55% (2 s.f)

5. In one statement, which of the assets above has the higher liquidity and why?

The spread of the asset, Crypto X = $0.2

The spread of the asset, Crypto Y = $0.4

The asset, Crypto X has the higher liquidity. The reason is, the lower the spread, the higher the liquidity, and we can see that the the bid and ask price of crypto X is very close to each other which gave the asset its low spread.

6. Explain Slippage.

The term slippage is used in finance trading. You must have placed an order, either a sell or buy whereby the price at which order is placed is different from the price at which it is executed. What actually happens is called slippage

Simply put, slippage occurs when an order is executed at a price different from the price at which the order is placed. The price may be higher or lower, depending on the direction which the price follows at the particular time. More on this later in question 7.

What actually causes slippage is the volatility. You may place an instant market execution order and between the second for your order to be executed, the price may have moved very quickly either up or down making the price to change from the intended price you met the market. This is very common to crypto assets, because they are very volatile. They can move very quick with seconds.

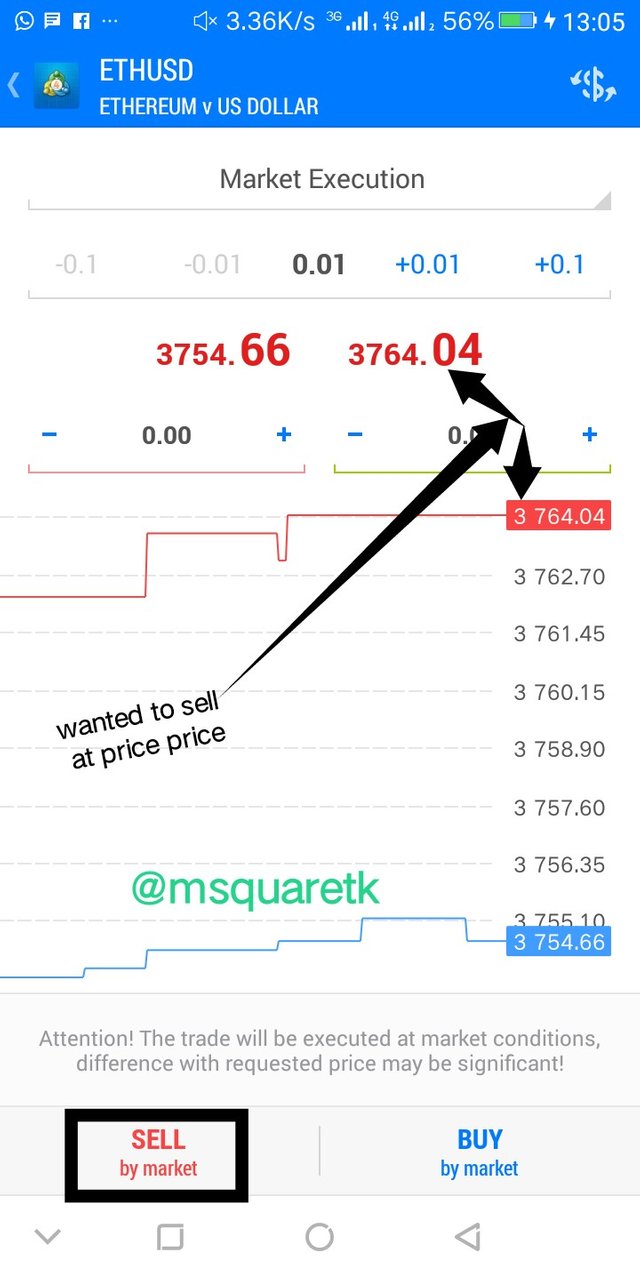

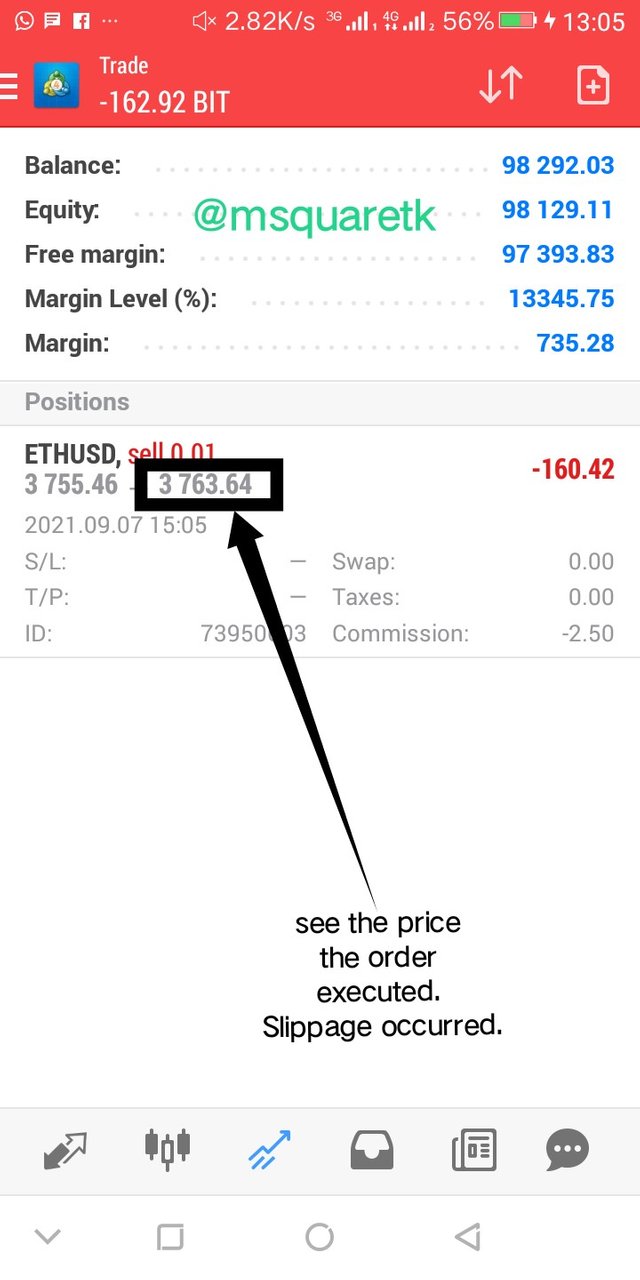

Now, let me show you a practical example of what I have been talking. In the screenshot below, I wanted to sell a crypto asset, ETHUSD at the price 3764.04 and then placed a sell instant market execution order. But, the price of has changed to 3764.64 upon executing the order. This is to let you know that the little change in price when the trade was placed and when the order is actually executed is known as spillage.

See the screenshots below.

Let's quickly see the last question.

7. Explain Positive Slippage and Negative slippage with price illustrations for each

You remember I said, when I was explaining spillage in question 6 above, that the price when the order is actually executed may go higher or lower than the actual price where you sold or bought an asset depending on the direction of price. This will now lead us to positive and negative slippage

Positive Slippage

An order is said to have a positive slippage when the order is filled in favor of the trader. In essence, if a buy order is placed and being filled at a lower price than the actual price where the buyer placed the order, then a positive slippage has occurred which is like "plus" on the side of the buyers because he has bought at very lower price than what he intended to buy at first place.

In the same way, if a sell order is placed and being filled at a higher price than the actual price where the seller placed the other, the a positive slippage order will be created.

To illustrate this with price:

If a trader placed a buy order at $120 and the order was actually executed at $118, the positive slippage would be

$120 – $118 = $2

Also, if a trader placed a sell order at $52 and the order was actually executed at $53 the positive slippage would be

$53 – $52 = $1

Let's look at the negative slippage.

Negative slippage

Negative slippage is a direct opposite of positive slippage. In positive slippage, the order is filled at a price which is not in favor of the trader.

A negative slippage occurs on a buy order when the execution occurs at a higher price than the actual price that the trader places the trade.

Similarly, for a sell order, if the order is filled at a price lower than the price the trader places the trade, then the order will experience a negative slippage.

To better understand this, let me show you an illustration with price.

If a trader placed a buy order at *$3 and the order actually got filled at $3.1, the negative slippage on the order would be:

$3.1 – $3 = $0.1

Also, let's say a trader placed a sell order at $1.5 and the order was filled at $1.45 the negative slippage on the order would be:

$1.5 – $1.45 = $0.05

Conclusion

In Professor @awesononso lecture, I have been able to understand some important terminologies such as Bid Price, ask price , Bid-Ask Spread, spillage, liquidity etc. These terms may seem little but they are very important aspect in finance trading which are not to be overlooked.

The spread which is normally used to know and calculate the liquidity of an asset was properly taught by Prof. , and I have more understanding of the those terms mentioned above. Thank you, Prof.

CC: @awesononso

Written by @msquaretk

Hello @msquaretk,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

You have done very well on the topic. Great job!

There is just a small point missing on the second question and on the explanation of Slippage.

Always follow ever instruction as careful as possible.

Thanks again as we anticipate your participation in the next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks Prof . @awesononso for the review

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit