Cover Page Created by me, @msquaretk | Created on imarkup app

It's another week in the Crypto Academy. This is the week two of the trading competition. It's an initiative organized by the Admins of the Academy to allow us display our skills and test what we have learnt so far in the academy. For this week, I will like to join the team of "fredquantum-kouba01 Trader". So, in this post, I will be giving the full details of the trade I took today, Monday 28/02/2022. So, follow me closely as I will be analysing the asset.

The name and introduction of the project token, and which exchange it can be traded on, project/team/technical background

Firstly, before we look into the analysis, we will look at the project background. That's the team behind the coin I am trading, the background and the growth so far etc. The name of the token is Litecoin (LTC). And I am going to be trading the pair LTCUSDT with the anlaysis to be done on trading view and real margin trading on binance exchange.

Litecoin (LTC) is a native token of litecoin blockchain. It is a peer to peer cryptocurrency which was founded by Charlie Lee in the year 2011. The token is a project fork of Bitcoin. Charlie created the token as a result of mining experience of the users on bitcoin network. The aim was to reduce the block generation, increase the maximum number of coins as well as to modify GUI.

The aim of introducing litecoin token is to make sure that the block generation time is very fast compared to that of bitcoin. And so litecoin block generation time is 2.5 minutes while bitcoin's is 10 minutes, thus litecoin generates four times faster than bitcoin. Also, the litecoin uses a consensus protocol different from that of Bitcoin. Although it has uses a proof of work consensus protocol, but it includes a scrypt in it's protocol.

The circulating supply of litecoin is about four times greater than that of bitcoin. Litecoin has a circulating supply of 84, 000, 000 LTC while Bitcoin has a circulating supply of 21, 000, 000 BTC. Litecoin is difficult to create because of the devices which are employed for its mining. Hence it's very expensive to produce litecoin token.

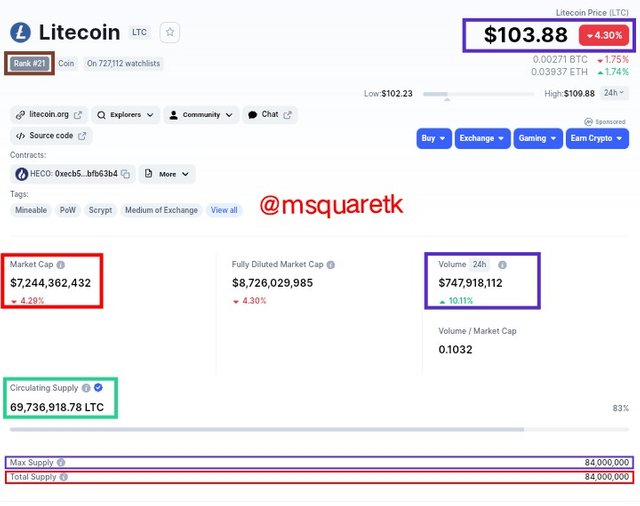

According to Coinmarketcap, litecoin is ranked #21 and it's currently trading at $103.88.

It has a market capitalization of $7, 244, 362,432;

Volume of $747, 918, 112;

Circulating supply of 69, 736, 918 LTC;

Maximum supply of 84, 000, 000 LTC;

Total supply of 84, 000, 000 LTC

The screenshot below shows all these details according to Coinmarketcap. This screenshot was taken after the analysis on trading view and hence the price at which it's trading now may be different from entry price of the trade I took.

Screenshot from Coinmarketcap | SOURCE

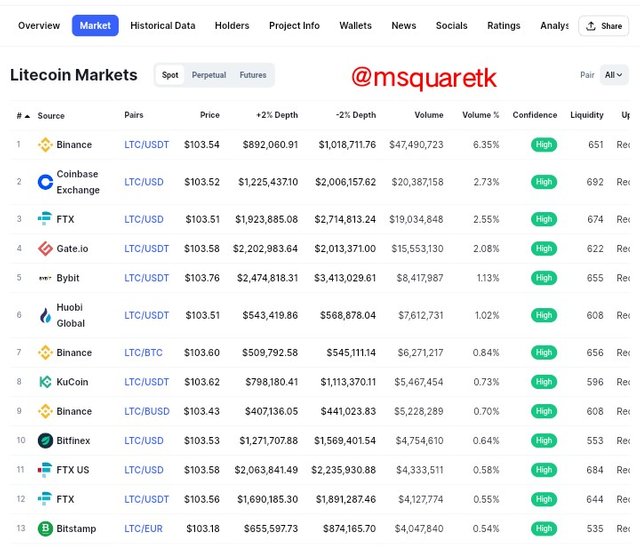

Let's see exchanges where litecoin (LTC) can be traded on.

Exchanges It can be Traded on

Here, I am going to be showing some of the Exchanges the litecoin (LTC) can be traded on according to Coinmarketcap. Some of these exchanges are: Binance, Huobi Global, Bitfinex, Coinbase Exchange, FTX, Gate.io, etc.

The screenshot below shows this exchanges. For me, I am going to be using Binance exchange to place my trade.

Screenshot from Coinmarketcap | SOURCE

Why are you optimistic about this token today, and how long do you think it can rise?

The reason for choosing this token to trade is because of my analysis which gave me confluence. So hence I'm optimistic to take the sell trade on LTCUSDT because of price aligning to my strategy.

I did my analysis on trading view and according to the strategy employed, the coin, LTCUSDT should fall to at least $101.0. The price movement to reach that level should not be more than 24hrs because it's an intraday trading.

So having seen that, let's now move to the important part of this post which is doing the analysis and placing a real live trade on an exchange.

Technical Analysis of the Token, LTCUSDT

Now, I am going to go on and show you how i did the technical analysis on trading view platform and then I proceeded to take a margin trade on my verified Binance App. Like I said earlier, the pair I analysed and traded is LTCUSDT and we have seen the introduction of the token, he founders/developers and the growth so far. So, let's see the analysis on trading view.

For my strategy., I am going to be combining relative strength index (RSI), Stochastic oscillator, and Parabolic SAR Indicator with the price action. So the first thing I did on opening the trading view was adding this Indicator to the chart and I began to look for crypto pairs which give me reasons to take a trade.

Upon opening the chart of LTCUSD to M 30 timeframe, I noticed that the price is on a bearish trend. The market structure confirms this as price is making love lows and lower highs as you will see in the screenshot below. Also, the level at which the price is, is a strong resistance level as price has resistance the area more than two times and now it's on the level again.

In addition, looking at the stochastic oscillator,it has already entered the overbought region. When price enters the overbought region of stochastic, it's an indication that the price is at the peak and that the sellers may take over the market soon. The crossing of the stochastic lines at overbought is a sell signal. Also, at the resistance level, a reversal candlestick pattern called shooting star formed . This is another confirmation for a bearish trend. See the screenshot below.

Screenshot from Trading view | SOURCE

Then going to lower timeframe, M15, it's observed that a reversal candlestick pattern shooting star also formed on the resistance level. Then Stochastic shows overbought and the lines has already crossed which is the sell signal I'm looking for. Also, RSI has entered overbought. When RSI enters overbought, it's a signal that the buyers are exhausted and that the sellers will take over the market. So, on this time frame, i have three signals confirming that the downtrend is certain: Price on resistance level, Shooting Star candlestick pattern formed on the resistance level, Stochastic overbought and its lines crossed, and RSI is at the overbought region. So with these four signals, I have a confluence and i can take a sell order. See the screenshot below.

Screenshot from Trading view | SOURCE

To confirm further, on M5 timeframe, the shooting star also formed on this timeframe and Stochastic as well as RSI have entered the overbought region. So, there's nothing to be waiting for, sell order can be placed.

Screenshot from Trading view | SOURCE

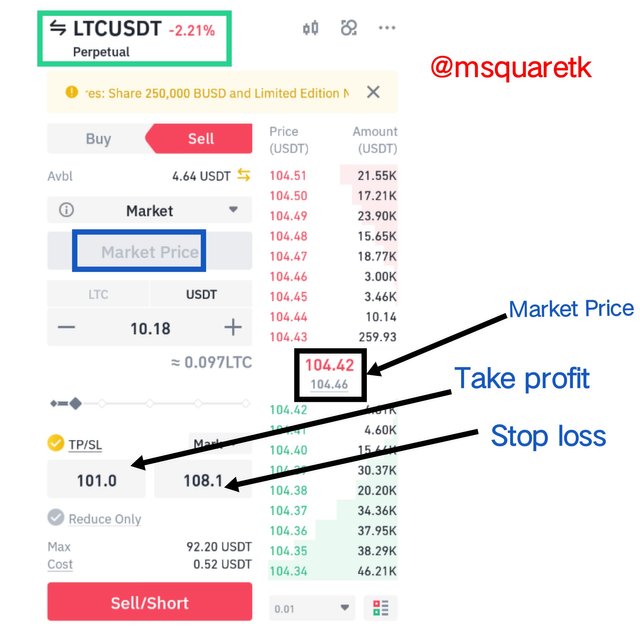

Upon having the confluence, I plan my trade that my entry should be marked price. So, my ementry is at $105.3 and stop loss was placed above the the entry price at $108.1 and take profit was placed at nearest support level at $101.0. See the screenshot below.

Screenshot from Trading view | SOURCE

Then, as soon as I was satisfied with my analysis and have the take profit, stop loss and entry price, I placed the real margin trade on my verified Binance exchange. The screenshot below shows the process of placing the real trade.

Screenshot from my Binance App.

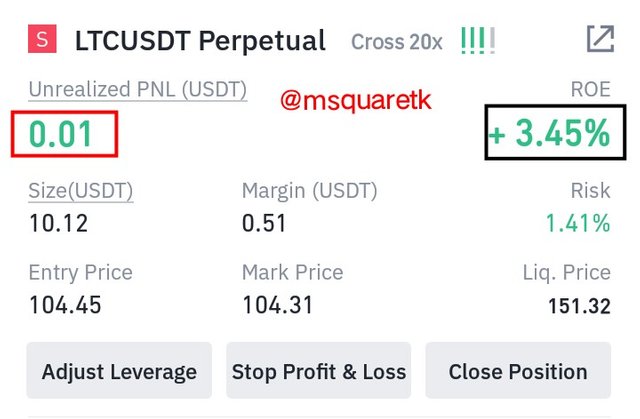

Also, the screenshot below shows the trade after the execution. It's running and has entered the profit already. I will keep monitoring the movement.

Screenshot from my Binance App.

I will update the results of this trade on Saturday and may edit the post if it hits the exit point to show the result here.

Your plan to hold it for a long time or when to sell?

I do not plan to hold the trade for long. It's a kind of intraday trading which is not expected to stay for long before it hits my exit points. I am not in possession of the asset as I took a margin trade. So when the price hits either my take profit or stop loss, I will be out of the market.

Do you recommend everyone to buy? and the reasons for recommending/not recommending

I took a sell trade. I took a sell trade with margin trade in my binance account. So if I would recommend anybody to sell the trade, it would be when I took the trade, and the recommendation would be based on my my analysis. I have about four reasons, signals to take the trade.

Conclusion

In this second week of the trading competition, I have done the first trade. I took a sell order on the pair of LTCUSDT. The trade was taking on binance exchange platform. I used my verified Binance Exchange platform. The sell is already going in the predicted direction.

I will update the result and use the Google form to record all the trades that will be taken this second week. Thanks to the Admins and the Professors in the Academy.

Consulted Article 1 SOURCE

Consulted Article 2 SOURCE

CC: @fredquantum

@kouba01

Written by @msquaretk