Cover Page Created by me, @msquaretk | Made on imarkup app

In this post, I'm going to be explaining how I took my third trade for the third day of the third week in the Steemit Crypto Academy. I will be giving the project background of the token, the team behind it, the exchanges it can be traded and the technical analysis on the trading view platform, and the real trade will be taken on Binance. So, follow me closely.

The name of the token and introduction of the project. Technical background of the project and team in charge of the project. In which Exchange or exchange can be negotiated.

Here, I'm going to be explaining the project background of the token I'm trading, the team behind it, some statistics about the token and the exchanges it can be traded on. The name of the token I'm trading is Reserved Rights (RSR).

Reserved Rights (RSR) is a native token of the Reserved protocol platform, a cryptocurrency blockchain platform which aims to scale up the supply upon demand. The main aim of creating RSR token was to provide a way to control the of dollar pegged value of the stablecoins network known as RVS. Reservation right was created in the year 2019 by someone who is called Nevin Freeman. He was regarded as a successful person who has contributed greatly in the world of tech films.

During the funding raising for the project, reserved rights received funding from so many organization and individuals. The initial exchange offering for the project was held on Huobi prime platform. Some big investors invested in the project. Coinbase ventures and a co-founder of PayPal contributed or invested massively on the project and that's one of the contributions Reserved Rights received that made it a success.

One of the problems reserved rights aimed to solve is to provide the alternative way to store value, especially for the unbanked. There are still some places where people don't have access to financial services and where they do, centralized systems are gaining more advantages, as such Reserved protocol aimed at providing a very robust and efficient ecosystem for people in these areas. And knowing how it may be difficult for new users to join cryptocurrency Ecosystem, Reserved protocol also provided a means by which they can join the network through Fiat on / off ramps, thus they don't have to bother looking for this party DApps before they can enter into the market.

Reserved right has a way of maintaining the price of its stablecoins. Sometimes the price of the token may be above the the target price, and when this happens and the spread is high, the token will undergo auctioning automatically by the system. Thus, lowering the supply which in turns lower the price, and thereby reaching or attaining its stability back.

Reserved protocol actually uses two tokens to achieve their aim and objectives. They use RSR token and RSV token. RSV token is the stable coin of the reserved protocol. RSR is the utility token of the platform which is used for many things. It serves as a governance token on the network. It also guarantees for the collateral and also for the peg of the other token, RSV. These token work hand in hand so as to provide effective UX onn the network.

RSR is built on the Ethereum blockchain, being the best blockchain that supports Defi projects and the launching of other tokens. The holders of RSR tokens can store or save their token in ERC-20. Also, there are many exchanges in which the token, RSR can be traded on. We will discuss more about this later where I'm going to be listing some of the popular decentralized and centralized exchanges where we can purchase RSR.

According to Coinmarketcap, it's ranked #242 and it's currently trading at $0.01444.

It has a market capitalization of $213, 657, 785;

Volume of $47, 408, 698;

Circulating supply of 14.80 B RSR

Total Supply of 100, 000, 000, 000 RSR and

Maximum Supply of 100, 000, 000, 000 RSR

The screenshot below shows these details according to Coinmarketcap.

Screenshot from Coinmarketcap | SOURCE

Exchange it can be traded on

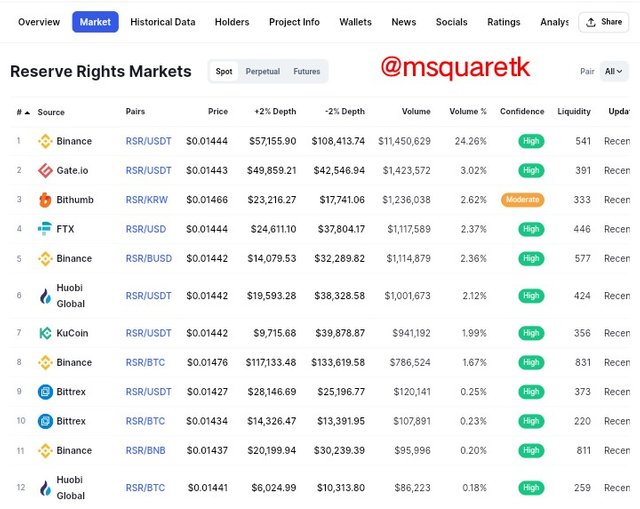

Reversed right token (RSR) has been listed on so many exchanges. Some these exchanges are listed below:

- Binance

- Kucoin

- Gate.io

- Coinbase exchange

- Huobi Global

Etc.

Let's see the screenshot below which contains some of the exchanges according to Coinmarketcap.

Screenshot from Coinmarketcap | SOURCE

Having seen a little about project background, the team behind and the Exchanges it can be traded on, let's move to the next thing.

Why are you bullish on this token today?

I'm going bullish on the token because of the analysis I did that confirms that the price may continue heading to the upside. According to the analysis, the price has seen to be broken the key resistance area and has now retested the area. So if the analysis is valid, the price should keeping going up and at least reaches the nearest resistance level. So, in essence, I'm going bullish on the token because of the Analysis I did which I'm, to some extent, certainly that the price should still go a bit up.

Now, having established this fact, let's me go quickly to the technical analysis and show how I actually took the trade. The analysis will be on the trading view platform.

Technical Analysis of the Token, RSRUSDT

Here, I'm going to be explaining how I did the technical analysis on the trading view platform and then I will show I placed the real trade on my Binance exchange app. The pair I'm trading is RSRUSDT.

Upon opening the chart of RSRUSDT to 15 minutes timeframe, I marked out the key levels. And as we will see in the screenshot below, the price just broke a key resistance level and the resistance is now turning to support level. As the price breaks the level, it's a signal that the price will continue to rally up to the downside. Let's see the screenshot below.

Screenshot from Trading View Platform | SOURCE

Then upon switching to 5 minutes timeframe, I can see that the price is an uptrend with a series of higher highs and higher lows. Trendline is also used to depict the trend. Then, as price touches the trend line, it keeps supporting the price. And now after the price broke the resistance level on 15 minutes timeframe, it came back to retest it, and it's also on the trendline marked on 5 minutes timeframe. This means I'm having confluence for the trade. Let's see the screenshot below.

Screenshot from Trading View Platform | SOURCE

Then having these reasons to take the trade:

- Price broke the resistance level turning it to support level.

- Price retested the key level area

- Price is an uptrend, making higher highs and higher lows on 5 minutes timeframe.

- Price is on a trend line drawn on 5 minutes timeframe.

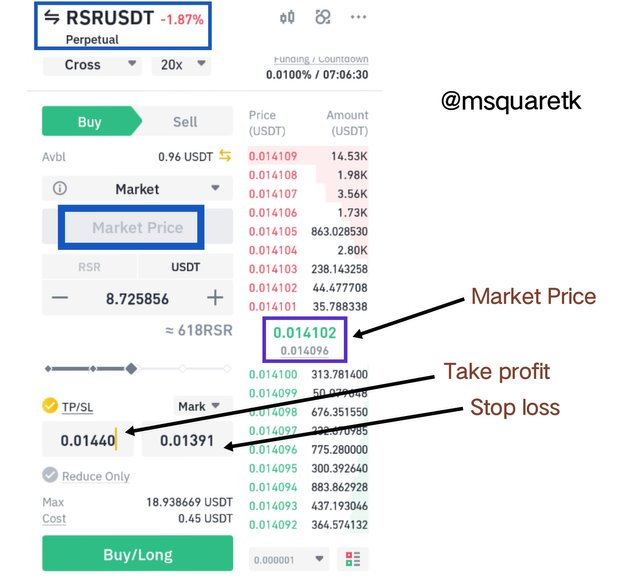

Then I marked my entry and exit price levels on trading view platform. The entry was at $0.01410 , stop loss was placed below the resistance that turned support at $0.01391 and take profit was at $0.01440. See the screenshot below.

Screenshot from Trading View Platform | SOURCE

Having the entry and exit price levels, I opened my Binance to place the real trade. I used the margin trading option to place a buy position on RSRUSDT. I entered everything appropriately. See the screenshot below.

Screenshot from Binance App

Then after the execution of the trade, I took a screenshot. The screenshot below shows that I have successfully placed a buy position on RSRUSDT. The trade is running and I'm going to monitor it and see how it's going to end.

Screenshot from Binance App

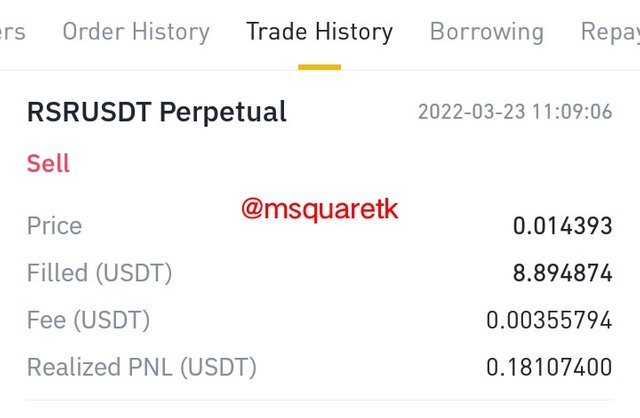

Some hours later after the execution of the trade, it hit my take profit. Below is the screenshot showing the trade history of RSRUSDT

Screenshot from Binance App

What is your plan? Do you want to keep it for a long time? Or when to sell it

I am not planning to keep the trade for long. Firstly, the analysis I did is for the intraday and price is expected to hit the exit on or before 48hrs. And so when the price hits it, I will be out of the market. Secondly, I did a margin trade, meaning I'm not in possession of the asset as in that of spot trading. So, whenever price hit the take profit or stop loss, that will be the end of the trade and I will be out of the market.

Do you recommend that all people buy it? The reasons for recommending or not recommending it.

Yes. I will recommend people to buy the token. But it's pertinent to say, I will only recommend that people to buy when I actually bought. This is because of the analysis I did and it's done on a lower timeframe. The reason I will recommend is nothing but because of my analysis. According to my analysis, I noticed that the price has a tendency of continue bullish because it broke a very key area which supposed to resist the price. Since it didn't resist the price, it now turned to support which supported the price. So, basically my recommendation would be because of my analysis. I should also sound a warning that anyone who wants to trade it should manage the risk very well because cryptocurrencies are very volatile.

Conclusion

In this post for trading competition, I have been able to explained briefly on the project background of the token, RSRUSDT I traded, the team behind and exchanges it can be traded on. I have also done technical analysis on the trading view platform, then I proceeded to take a real trade on my binance app. Thanks for the Admins for this great initiative and thanks to my team leader, Prof. @pelon53.

Consulted Article 1 SOURCE

Consulted Article 2 SOURCE

Consulted Article 3 SOURCE

Written by @msquaretk