Cover Page Created by me, @msquaretk | Made on imarkup app

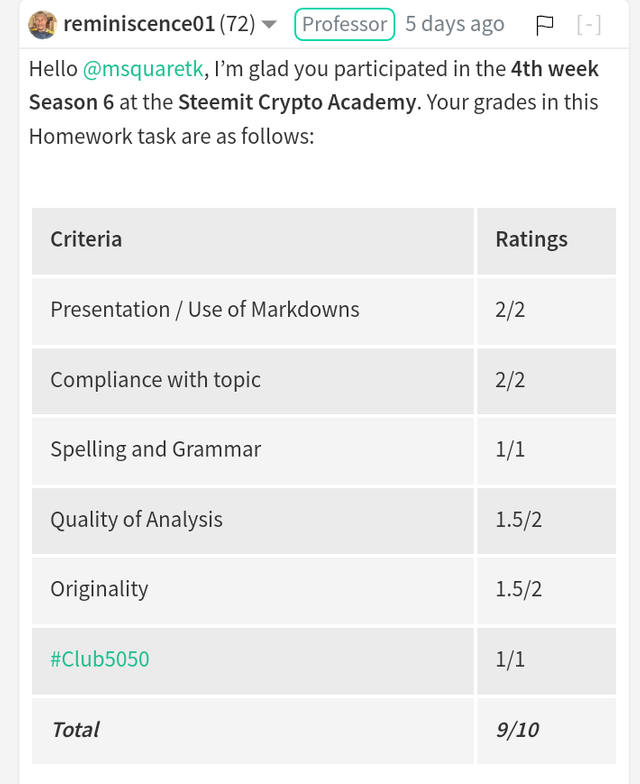

It's week 4 of the Steemit Crypto Academy. The past few weeks have been awesome. Thanks to the Admins and all the Professors in the Academy. This post is written in response to Professor @reminiscence01 's assignment. He taught "Psychology of Trend Cycles" and gave us some questions to answer after the lecture. I will be responding to his questions one after the other. Follow me closely.

1. Explain your Understanding of the Dow Jones Theory. Do you think Dow Jones Theory is Important in technical analysis?

In this first task, I'm going to be explaining my understanding of Dow Jones theory and my opinion on how important it is in technical analysis. Dow Jones theory is a theory used in finance trading which is postulated by Charles H Dow. It's a theory which says market is either in an uptrend, downtrend or side ways.

Dow is a stock Analyst. He believed that every activity in the market is as a result of demand and supply, economic news and all other measures of price action are discounted price. Through this theory, he believed that the overall measure of the condition of business in the economy can be analyzed by determining the overall market. And once you are able to analyze and identify the overall market direction, you can guage the condition.

This theory rests on about six components which traders studies extensively in analyzing the market conditions. Dow believed that everything is discounted by price. This means that the price of any asset integrates or include every information available in the market.

He also believed that three types of trends form primary trend. There is a trend which goes as long as years, and secondary trend which I like a pull back which lasts for about months and minor trend which lasts for only weeks. Also, it's believed that primary trend has three phases. There's a phase called accumulation phase which is a bull market phase, and distribution phase which is a bear market phase and there's a phase called panic phase.

Furthermore, Dow also said that asset or indices have a way of confirming each other. This means that assets that move together, have the same trend, must be in agreement with each other. If an asset is showing a sign of an uptrend and the other is still in a bearish trend traders should wait for them to come in to agreement.

He also said in his theory that volume plays vital role in the market. If the market is in the direction of the prevailing, primary trend, then the volume should increase and should be low when it's against it. If the primary trend in the market is to the uptrend, then there should be increase volume and when there's a pull back against this trend, the volume should low.

Finally, he postulated that price keeps going in the direction of primary trend until the reversal occurs which change this direction of the primary trend which forms another one. It's however important that the traders should be careful because sometimes secondary trend may look like a reversal in the market .

Dow Jones theory is very important in technical analysis. Its importance in technical analysis can never be overemphasized. As traders, when we open our chart, we want to see which trend the market is. And Dow Jones theory postulated theory on how to determine this.

Also, we know the importance of volume to trend using this theory. He said the high volume is always towards the direction of primary trend. Knowing this is helpful in technical analysis since we will want to trade in the direction of market and towards where there is high volume.

Phases of market which Dow Jones postulated is also very important in technical analysis. Whn see accumulation or reaccumulation and distribution or redistribution in the market, we can interpret which side the trend is going and that's very advantageous to traders.

2. In your own words, explain the psychology behind the Accumulation and Distribution phases of the market. (Screenshots required).

Here, I'm going to be explaining the psychology behind accumulation and distribution phases in the market. In the previous question, I have explained that Dow postulated that market can be in accumulation or distribution and that these phases are very important because they signify important information in the market. And like I said earlier, traders look for the trend in the market when they open their charts. They want to know if the trend is to the upside or to the downside and see where they can join the trend since they want to make.profit in the market. Price can either be in a bullish or bearish trend. Traders open buy position when the asset is an uptrend and open sell position when it's in a downtrend. Accumulation and distribution form in the beginning of the trends. We will look more at how and what makes they form.Let's begin with accumulation.

ACCUMULATION

Majorly, the people who control the price of an asset are big institutions and whales. Whales are those who have large percentage of the asset. They can open a position which will determine how the price will move. No one has their lot. Retail traders are just trying to predict how these people, institutions and whales move so we can take advantage of them.

When price starts dropping from the peak of an uptrend, there will be a point when the market will want to reverse and change trend from downtrend to uptrend. Mostly, this occurs when the price is oversold and the big institutions and whales have taken profit in the market. Most of the time, when they take their profit of sell position they have opened, the market goes into a position of pause in which there won't be volatility compared to before. This time, the volume is seen decrease and it's called accumulation. This time, the retail traders may not be aware that the big players are out of the market. They will be panic and as soon as they see a change in trend, they close their sell positions in loss to join the bull move again. The volume is injected to the market and a bullish run starts.

Screenshot from Mt4 App

When volume is injected and price breaks the accumulation zone, the price is seen in an uptrend. The uptrend persists until there's a pull back. And when pull back occurs, the big players would have taken profit before a new bull leg occurs. The period of pull back is often called reaccumulation. This time, the volume is seen decrease and there is a low volatility.

Screenshot from Mt4 App

It's important to know that, the period of reaccumulation can be confused with a reversal and that's why traders must learn to identify this phase correctly. Reversal has not occurred until the price breaks the some of reaccumulation and if that happens, then it can no longer be called reaccumulation.

DISTRIBUTION

Distribution phase occurs at the peak of an uptrend and it's a signal for reversal in the market. It occurs when the big institutions and whales who bought an asset from the accumulation phase take profit when the price has been overbought at the peak of the trend. As they take profit, the price goes into side ways and the retail traders who has also bought began to close their position too. The volume during this time is seen decrease and no volatility in the market. Then sellers comes in and pushes the market to the downside and this is always accompanied by a great volume.

Screenshot from Mt4 App

As a bear leg with momentum occurs to the downside, the sellers and more retail traders join the market to take advantage of the bearish trend. It gets to a point when the price pauses in the market and a pull back to the bearish move forms. This period the volume decreases as well as the volatility. It's often called a redistribution phase. The phase often gives more strength to drag the price to the downside.

Screenshot from Mt4 App

The end of redistribution phase is also accompanied by a great volume since more more positions will be opened in the market. Retail traders are often confused redistribution phase with reversal or accumulation in the market and they get caught or manipulated by the big players. It's not an accumulation or reversal signal until the price breaks the zone to the upside.

3. Explain the 3 phases of the market and how they can be identified on the chart.

In this part of the task, I'm going to be explaining the three phases of the market and how they can be identified. If you remember very well, I have mentioned about these phases of the market in question 1. I said, the market can be in either an uptrend, downtrend or side way. I'm going to be explaining here in details these phases.

Basically, the three phases of the market are: uptrend, downtrend and sideway. As a trader who wants to make profit in the market, we trade when market is trending, either bullish or bearish and we stay away from the market when it's in sideway. In the previous question, I have discussed the importance of accumulation and distribution to the trend. They help us in determining when the trend is about to reverse and I the continuation of the trend in case of reaccumulation and redistribution.

Traders use many tools or methods to identify these phases in the market. Some people use trendlines, technical indicators, and market structure. Indicators such as moving averages, bollinger bands etc can be used to identify the trend. But indicators are not good identification of trend because they lag behind and trend would have almost finished before they identify it. It's therefore pertinent to know that market structure is a good method or tool to identify trend in the market.

Although, while using market structure to identify the trend, you can add technical indicator as a confirmation tool.

When the market moves from lower concentration of price to higher concentration of price with a series of higher highs and higher lows, then the trend is said to be in an uptrend. And this phase is called uptrend or bullish phase. In the screenshot below, you will see an example of an uptrend phase. The market moves from a low area of price and goes to the high area.

Screenshot from Mt4 App

As we can see in the screenshot above, the price made higher high and higher lows. It's an uptrend phase. At this phase, the buyers are in control of the market and drive the price as high as possible until they are weakened.

Similarly, when the market moves from higher concentration of price to lower concentration of price with a series of lower lows and lower highs on the price chart, the market is said to be in a downtrend. This phase is called downtrend or bearish phase. It's a phase that's controlled by sellers because they are capable of influencing the price of the asset more than the buyers. See the screenshot below.

Screenshot from Mt4 App

We can see in the screenshot above that the price made lower lows and lower highs which signifies that the phase of the market at that particular time is uptrend phase. The phase persists until buyers overpower the sellers and the trend change phase.

Sideways market occurs when there's no clear trend in the market. That's when the market doesn't show either bullish trend or bearish trend. At this point, neither the buyers nor the sellers are in control of the market. They are both making efforts to push the price to their favorable direction. Sideways market is often reffered to as a time when strength is being gathered either by the sellers or buyers depending on which side the breakout occurs.

The accumulation and distribution phase could also be regarded as a sideway market as the market is in price range and moves between a support and resistance level. The price is said to be at equilibrium at these phases.

Screenshot from Mt4 App

In the screenshot above, you can see an example of distribution phase which occurred. This is a side ways market. No volume at this point and we can see how price moves between the resistance and support of the range.The sellers gather momentum to drag the price to the downside

It's pertinent to know that during a trending market, we have two types of legs or moves. There's what's called impulsive leg or move. It's the move in the direction of the prevailing leg. Then, there's a leg called retracement leg. This move is a corrective move to the prevailing leg and it's also known as pull back. According to Elliot wave, there are three impulsive wave in the the direction of the prevailing move and two correctives wave that correct these legs. See the screenshot below.

Screenshot from Mt4 App

4. Explain the importance of the Volume indicator. How does volume confirm a trend? Do this for the 3 phases of the market (Screenshots required).

In this part of the task, I'm going to be explaining the importance of volume and how it confirmed the trend. In the previous question, I have explained the three phases in the market. I will be explaining how to use volume indicator to determine this trend.

Volume is very important in technical anlaysis. It's importance can never be overemphasized. Nobody wants to trade when there's no high volume in the market. Because there is volume, there's volatility and that brings pips which money to your wallet. Often volume indicator confirms that the market is in sideways or retracement leg when there's low volume and high volume means the market is in a trend.

Volume Indicator has been used by many traders to filter false signals from other indicators. By combining volume with other indicator, one can actually detect if the signal is false /fake out or real signal. It's used with price action to predict the direction of price. Volume has been used with chart patterns to help increase the success rate of these pattern. Majorly, traders wait for pattern to break and see what volume indicator will read before taking position in the market.

Volume is very useful in confirming a trend. When the market is in the phase of accumulation or distribution, a very low volume will be seen on the volume indicator. This means there's no or low movement in the market. And this period is a period of low volatility in the market. See the screenshot below.

Screenshot from Mt4 App

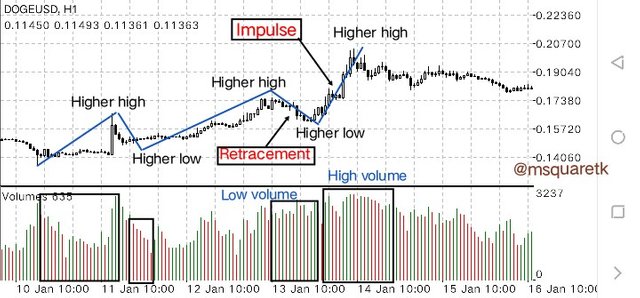

Volume is also useful during an uptrend phase. We already discussed that price makes higher highs and higher lows in an uptrend market. But, price doesn't just go high without retracing, so there's also retracement during this trend. During an impulsive move there is a great and high volatility in the market with the volume be seen increase on volume indicator whereas, retracement leg shows a low volatility with a decrease volume on Volume Indicator. See this screenshot

Screenshot from Mt4 App

As we can see in the screenshot above, the market was in an uptrend, the was a low volume when PRI retraced and high volume at the impulsive move.

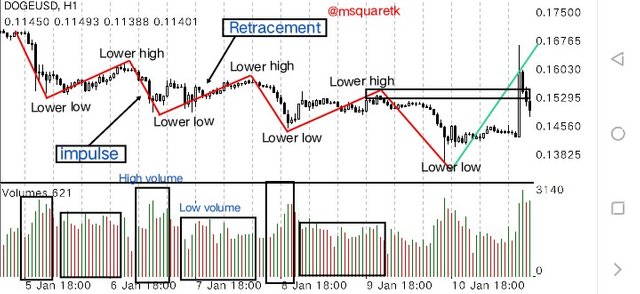

Similarly, when the market is a downtrend phase, the price makes lower lows and lower highs. The retracement of a downtrend move should show a low volatility in which low volume from volume indicator should confirm this and the impulsive move will show high volatility in which high volume from volume indicator should confirm it. See the screenshot below.

Screenshot from Mt4 App

Looking at the screenshot above, we can see that there was low volume during the retracement leg and high volume during the impulsive move. Volume indicator can be of help if the traders know how to read it very well.

5. Explain the trade criteria for the three phases of the market. (show screenshots)

In this part of the task, I'm going to be explaining the trade criteria for the three phases of the market. Let's start with uptrend phase.

Uptrend Phase.

- The first to lool out for is to look for a clear uptrend. That's, price must be making higher high and higher lows. Once this is confirmed, then you know you have an uptrend phase.

- Next is to wait for the retracement leg of this uptrend to come to an end. You will want to join the trend at the beginning of a new impulsive move.

- Once the retracement leg is over, look for a reversal pattern and at the same time make sure there is an increase volume on the volume indicator. Then enter once these are met.

- Stop loss should be placed below the low created and take profit should be placed to have a risk reward of 1:1 or 1:2.

See the screenshot below.

Screenshot from Mt4 App

Downtrend Phase

- Make sure the market is in downtrend That's, price must be making lower lows and lower lows. Once this is confirmed, then you know you have a downtrend phase.

- Next is to wait for the retracement leg of this downtrend to come to an end. You will want to join the trend at the beginning of a new impulsive move.

- Once the retracement leg is over, look for a reversal pattern and at the same time make sure there is an increase volume on the volume indicator. Then enter once these are met.

- Stop loss should be placed above the high created and take profit should be placed to have a risk reward of 1:1 or 1:2.

An example is shown in the attached screenshot below.

Screenshot from Mt4 App

Sideways Phase

Trading sideways market is not advisable for newbie because it's very risky. The market can break out of the range at anytime and caution must be taken when trading it. It's therefore important that traders manage their risk very well.

- To trade sideways, identify the support and resistance level.

- Wait for the price to reach the support or resistance level.

- When price reaches the support level, open a sell position. Stop loss should be placed below the support and take profit at the resistance level.

- When price reaches the resistance level, open a buy position. Stop loss should be placed above the resistance and take profit at the support level.

An example is shown below.

Screenshot from Mt4 App

6. With the Trade criteria discussed in the previous question, open a demo trade for both Buy/ Sell positions.

In this part of the question, I am going to be showing the trades I took with the trade criteria I discussed in the previous question. I will do both buy and sell trades. Let's start with the buy trade.

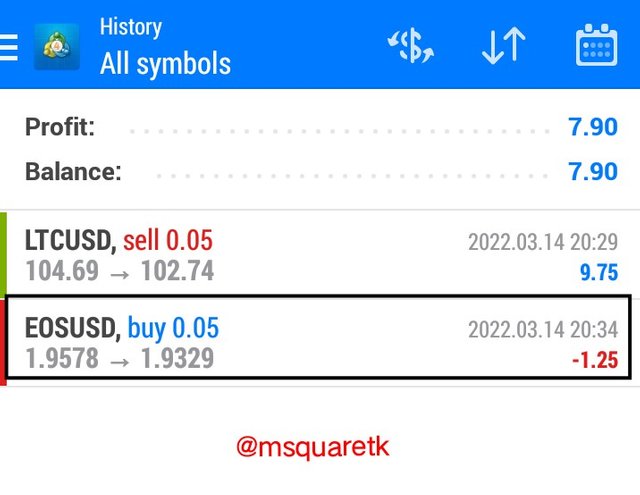

Buy Demo Trade (EOSUSD)

The buy demo trade I took was on the pair of EOSUSD. The first thing I did on opening the chart was that i identfied the trend which is often what is very important to us. And the trend is seen bullish with higher high and higher highs. Then the next is, I wanted to enter a buy position at the end of the retracement of the bullish trend. And upon the completion of the retracement, hammer candlestick patter formed which is also a signal for a bullish move. See the screenshot below.

Screenshot from Mt4 App

Upon seeing that, I entered after the formation of this reversal pattern at $1.9536 and stop loss was placed below the low created and take profit was placed to have a risk reward of 1:1. So that means if the trade goes in my predicted direction, I will make profit equal to the loss. And if it goes in opposite direction, I will lose and that means the trade setup is invalid.

Screenshot from Mt4 App

Then, after the execution of the trade, I made this screenshot below. It's taken while the trade was still running.

Screenshot from Mt4 App

Then, some hours later, the trade hit my stop loss. That means the set-up is invalid. See the screenshot below.

Screenshot from Mt4 App

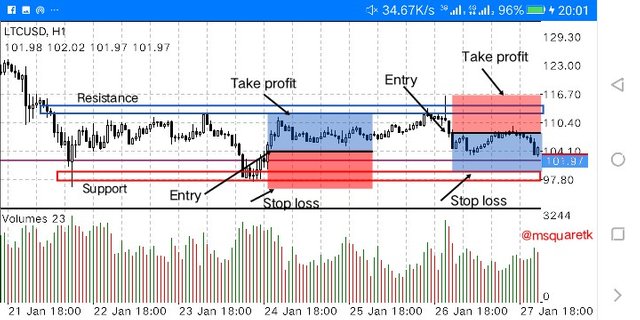

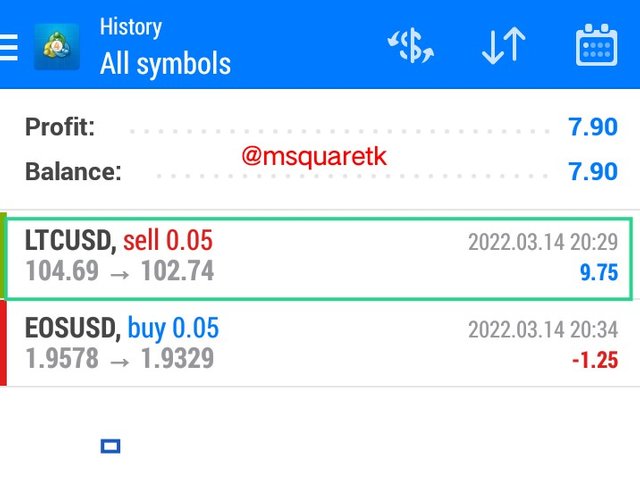

Sell Demo Trade (LTCUSD)

The sell demo trade I took is on the chart of LTCUSD. To trade a sell with the strategy, we first Identify the trend. If the price makes lower lows and lower highs, that means the trend is in a Downtrend Phase. Then we can continue. Then after identifying the trend we will wait for the retracement to end. In the chart of LTCUSD, M30 timeframe, I saw the price making lower lows and lower highs which is a clear Downtrend. Then, the retracement is already complete and a reversal pattern has even formed. It's a perfect opportunity. Also, the volume indicator shows that the volume has increased. See the screenshot below.

Screenshot from Mt4 App

Then, will every criteria met, I entered an instant sell order after the formation of the shooting star candlestick pattern at $104.73 and stop loss was placed above the high created and take profit was placed to have a risk reward of 1:1. If the price should go and hit the stop loss, that would mean the set-up is invalid. See the screenshot below.

Screenshot from Mt4 App

This screenshot below is taken after the execution of the trade while the trade was still running.

Screenshot from Mt4 App

Thanks about 3 hours later, the trade hit my take profit. See the screenshot below.

Screenshot from Mt4 App

Conclusion

Dow Jone theory is a theory which very helpful in technical analysis. The theory was postulated by Charles Dow. He believes that market is either in an uptrend , downtrend or side way. There are about six components in which his theory rest on. Accumulation and distribution phase are in which there's low volatility in the market which is even accompanied by low volume. Volume plays a vital role in the market. When market is in a trend, the volume will be seen increase and when the market is in sideways, volume will reduce.

The three phases of the market are uptrend, downtrend, and sideways. Market structure is one of the best methods to determine the phases of the market. When the price makes higher highs and higher lows, then the market is said to be in an uptrend, and when the price makes lower lows and lower highs, the market is said to be in a downtrend. A sideway market is characterized with a low volatility and neither sellers nor buyers are in control of the market.

In this task, i have placed two demo trades, one buy and the other sell using the strategy taught in class. Thanks to Professor @reminiscence01 for the lecture. I have learnt one or two things from the lecture.

CC: @reminiscence01

@steemcurator02

Written by @msquaretk