Cover Page created by me, @msquaretk | Canva App

It is a new week of the season 4 in the Crypto Academy.

This homework post is submitted to Professor @awesononso in response to the assignment given after his lecture on "The Bid-Ask Spread (Part II)." He gave 8 questions and I will be responding to the questions one after the other. So, follow me quickly.

Question 1

Define the Order Book and explain its components with Screenshots from Binance.

Order book is a terminology used in finance trading. Order book is like an electronic or manual book depending on what the trading venue uses, that contains the list of all orders opened for a particular pair of asset. It contains both buy and sell orders and the order are arranged with their price.

The order book has two sides – the bid side (showing the bid price of the asset) and the ask side (showing the ask price of the asset)

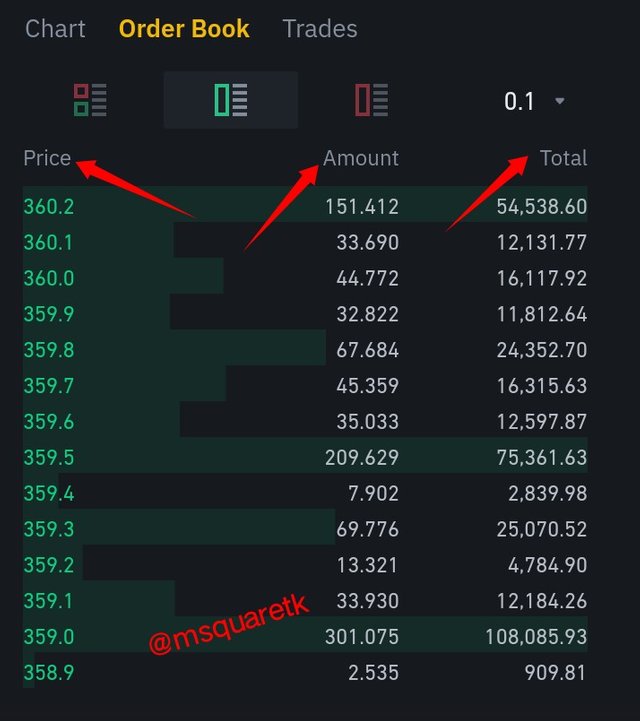

Now, let see the bid side of the order book in a screenshot below.

Fig. 1: Bid Side of the Order Book of BNBUSDT | binance.com

As it seen from the screenshot, the side called bid side contains price, amount and total. See also that the color of the price is green. So, this means every bid side in the order book is written with green color.

This bid side, the list of all buy orders is recorded and as it seen, the price is arranged from the highest to the lowest. Also, the amount of orders is found beside the price and the total which is the product of the bid price and amount is written, too.

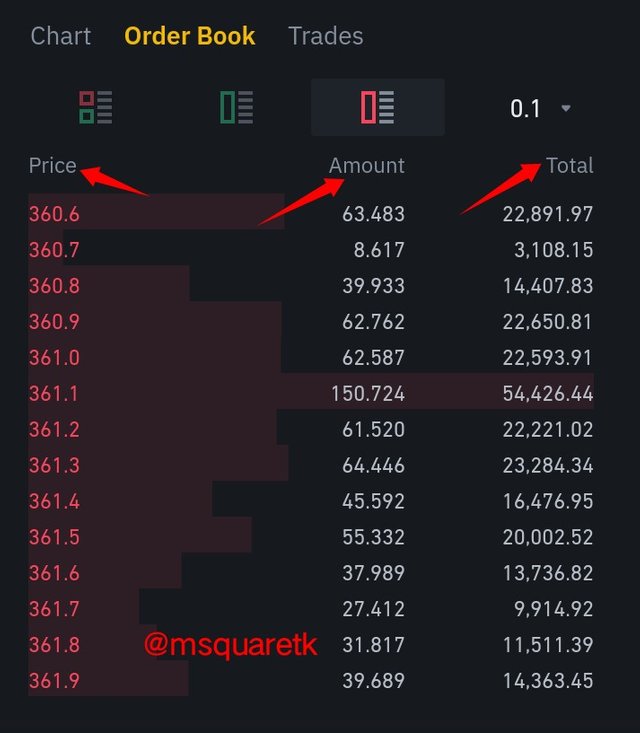

Now, having seen the bid side of the order book, let's see the ask side as well. The screenshot below shows the ask side of the pair BNBUSDT.

Fig. 2: Ask Side of the Order Book of BNBUSDT | binance.com

The ask side of the order book also contains price, amount and total.

As it is seen in the screenshot above, **the price column of the order book is written with red color. And the price of the order made by the sellers on this pair, BNBUSDT is arranged from the highest price to the lowest. The amount of orders which traders have made are also written beside the price and the total is also included.

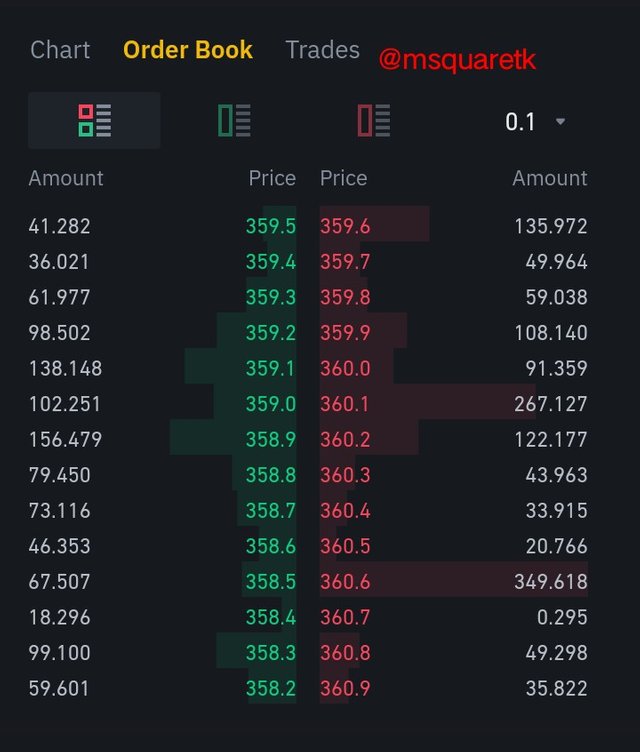

These two sides of the order book can be seen together by clicking on the "first icon" at the top side of the order book. But, what you view both together, you won't be able to see the total.

Fig. 3: Ask Side and Bid Side of the Order Book of BNBUSDT | binance.com

Viewing these sides together, we can compare the bid and ask price. If you look at the above screenshot, you will notice that the ask price is greater than the bid price and that one is written with red color and the other with green color.

Question 2

Who are Market Makers and Market Takers?

Market makers are the traders who buy or sell asset at a future price. These people don't agree with the current price simply because they may want to buy at a discount price(A discount price is a low price than the current price of an asset) to be able to make enough profit. Also, traders may want to sell at premium price(The extreme peak of price of an asset. Usually when the asset is overbought). So, market makers place limit orders to buy or sell at the price of their choice.

Simply put, market makers are traders who place limit orders(buy and sell orders). The order they place will be in the order block and will be arranged I column based on the price.

Market takers are direct opposite of market makers. These are people who are ready to execute the trade at the current market price at a particular time. They agree with the price of an asset and instantly execute the trade. In essence, market takers are traders that place market order execution. Buyers who are market takers accept the bid price of the market at the market order and place an instant buy order. Also, sellers who are market takers accept the ask price of an asset and place an instant sell order.

Question 3

What is a Market Order and a Limit order?

A market order is a type of order which is supposed to be executed immediately it is placed. Remember I said in question 2 above that market takers execute their orders at market order. So, we can say that market orders are the orders that market takers place.

In other words, a market order is an instant order. It is the order that that's placed which agrees with the current price of an asset. That's, when a seller places a sell order at market order, he simply agrees to sell at the current ask price at a particular time. And when a buyer places a buy order at market order, he simply agrees to buy at the current bid price of an asset at a particular time.

A limit order is a type of order placed to be filled at a future price. Traders who don't agree with the current price of an asset place limit order to buy or sell when the price of an asset reaches a certain price in the market. In essence, a limit order is an order that market makers place.

A limit order is used to sell an asset at a specific price rather than the current ask price of an asset and also used to buy an asset at a specific price rather than the current bid price of an asset at a particular time.

Question 4

Explain how Market Makers and Market Takers relate with the two order types and liquidity in a market.

As I have discussed earlier, market makers are traders who place limit orders to buy or sell an asset at specified price while market takers place buy or sell order at market order. Now, it important to know how these relate.

Market makers who place limit orders are the provider of liquidity. As they place limit orders of buy or sell, a liquidity will be gathering up at a level in the market. The more the limit orders they place, the more the liquidity. It is important to know that the price levels which market makers have placed their limits, market takers will still execute orders here. This means, when the price reaches a place where limit orders are being placed, the execution of market takers will be quickly filled, as there have been a lot of orders waiting at the price.

So, the market orders that the market takers place will be matched with the limit orders that the market makers placed, then the order will be filled together. As we can see, the liquidity that market makers provided has now be taken by the market takers. Therefore, market makers are liquidity providers while market takers are liquidity grabber.

Question 5

Place an order of at lease 1 SBD for Steem on the Steemit Market place by (a) accepting the Lowest ask. Was it instant? Why (b) changing the lowest ask. Explain what happens. (Make sure you are logged in to your wallet).

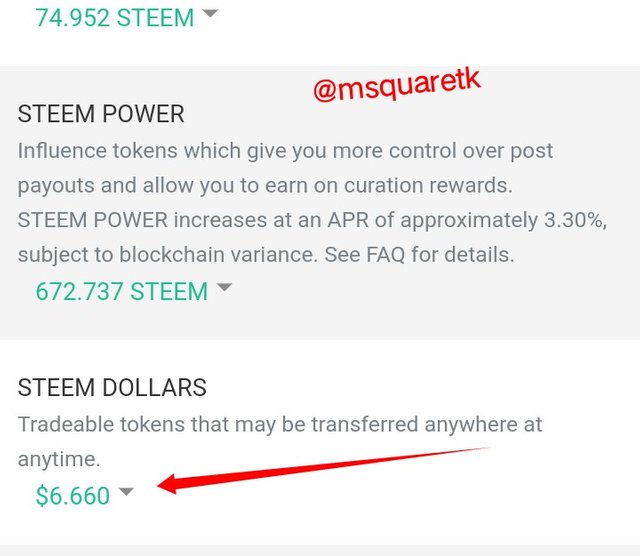

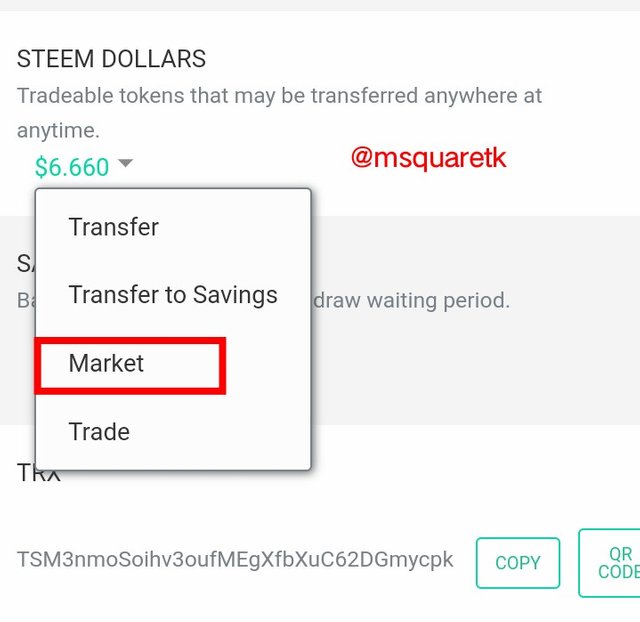

Now, to place an order on Steem wallet, log in to your steem wallet. In the wallet, scroll down and locate "steem dollar." Click on where the arrow is pointing at.

Fig. 4: Steem Wallet (steem dollar section) | steem wallet

Upon clicking on it, some pop features will appear, click on market.

Fig. 5: Steem dollar Features | steem wallet

upon, clicking on it, you will be taken to a page where you can exchange your steem dollar to steem. The first thing I'm going to do as requested is, I'm going to accept the lowest

(a) Accepting the Lowest Ask

Here, I'm going to buy steem by using the lowest ask. The lowest ask as at the time of taking the screenshot is 0.082866 and I'm buying at this price. See the screenshot below.

Fig. 6: Buying with the Lowest ask | steem wallet

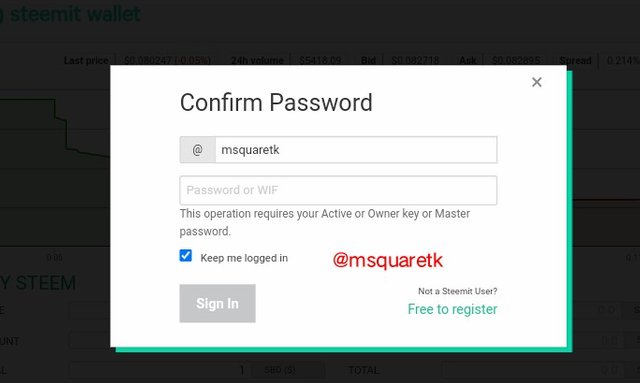

Then, after accepting the lowest ask to be the price at which we are going to buy, we click on "buy." Then upon clicking on buy, you are going to confirm with your steem private active key.

Fig. 7: Confirmation Page | steem wallet

As I clicked confirm, the order is filled immediately. The execution was instant. Because the price is the same as the lowest ask when the order was executed.

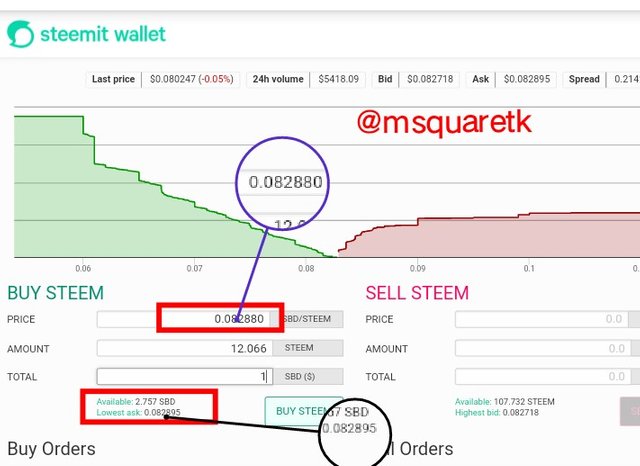

(b) Changing the Lowest Ask

Now, here, I'm going to change the the lowest ask and see if the order will be executed at instant or not.

As you will see in the screenshot below, the lowest ask is 0.82895. I changed this value to 0.82880

Fig. 8: Buying with a different price rather than lowest ask | steem wallet

Then, I placed a buy, then confirm the transaction with my steem private active key. As soon as I confirmed it, the order appeared at the bottom of the page.

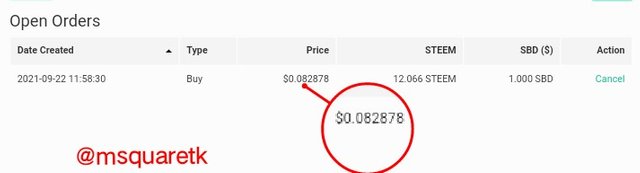

See the screenshot below.

Fig. 9: Open Order | steem wallet

As we can see in the screenshot above, I have an open order which has not been filled. The order has not been filled because, the price has not reached where I changed it to. Once the price reaches the level, the order will be filled.

Question 6

Place a TRX/USDT Buy Limit order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots).

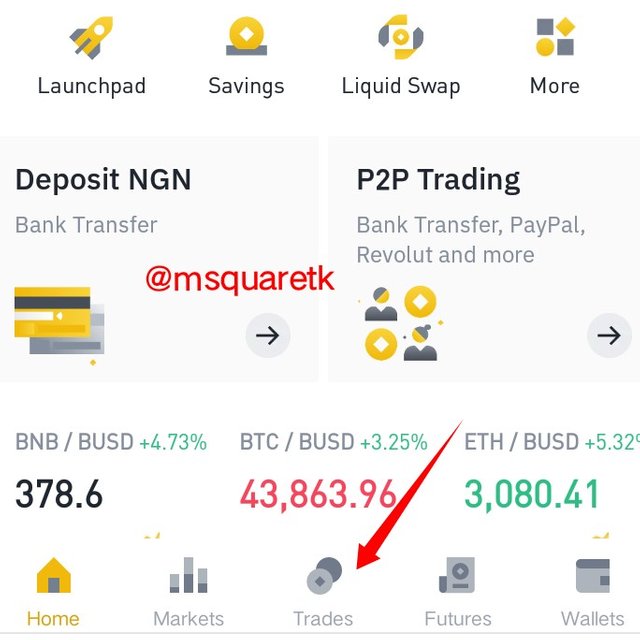

To place a buy limit order, log in to binance. For this task, I'm going to be using my binance app. As I clicked the binance app and logger in, it will open to the home page. At the bottom of the page, we are going to click trade.

Fig. 10: Binance homepage | Binance App

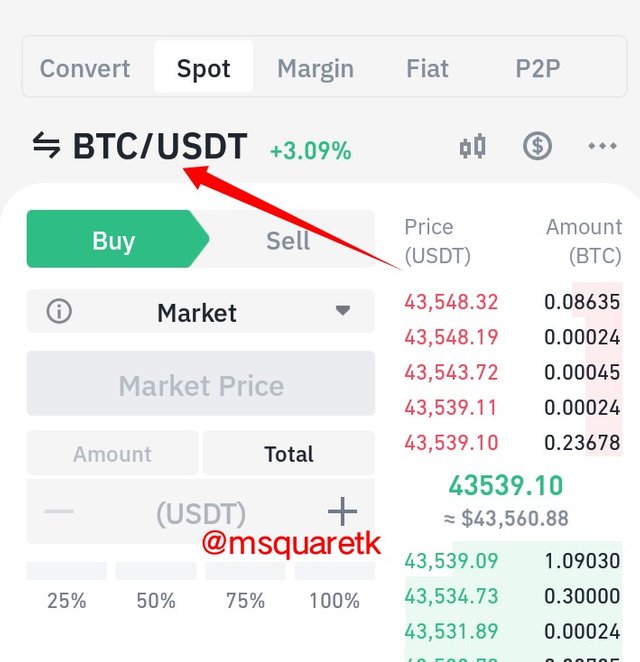

As soon as we click on trade, a page will appear where we can buy or sell. Im our car, we are interested in buying TRX at a limit order. So we search for the pair by clicking on "BTCUSDT", where the arrow is pointing at in the screenshot below.

Fig. 11: Trade Section | Binance App

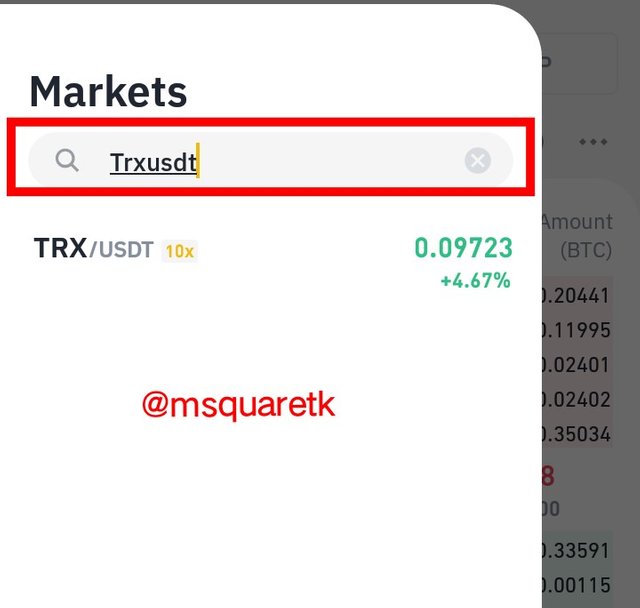

Upon clicking on it, a search box will appear. I'm searching for TRX/USDT. Once it appears, I will click on it.

Fig. 12: Search Box for searching for pair | Binance App

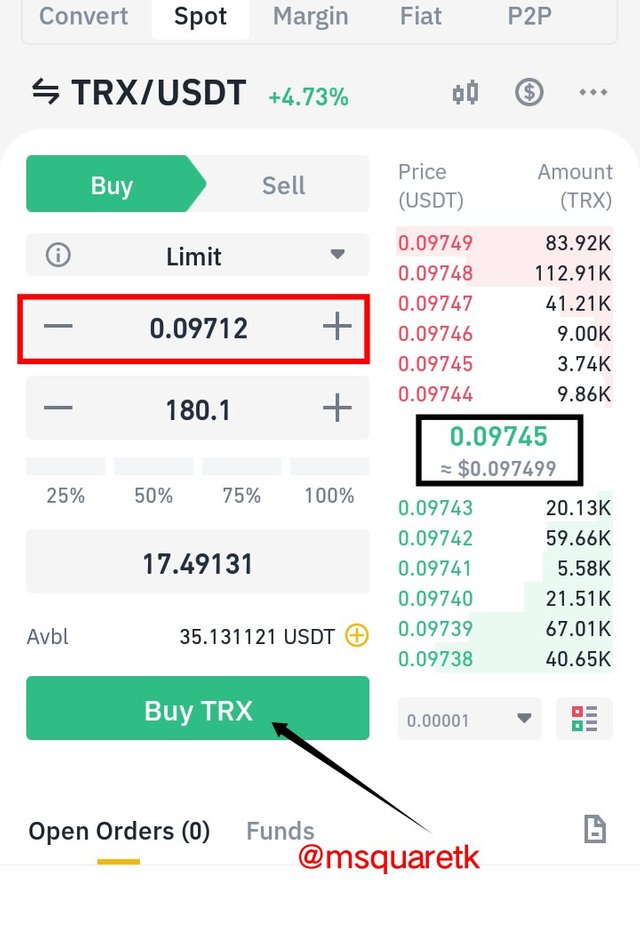

Then, we are going to be taken to the trade page with our desired pair selected.

Here, I'm going to buy TRX with my USDT. The buy order is not going to be at market price; it is going to be at limit order. The current price is $0.09745. And the price I'm willing to buy the asset is $0.09712. Then having input all the details, I placed a buy order. See the screenshot below.

Fig. 13: Buying TRX/USDT at a limit order | Binance App

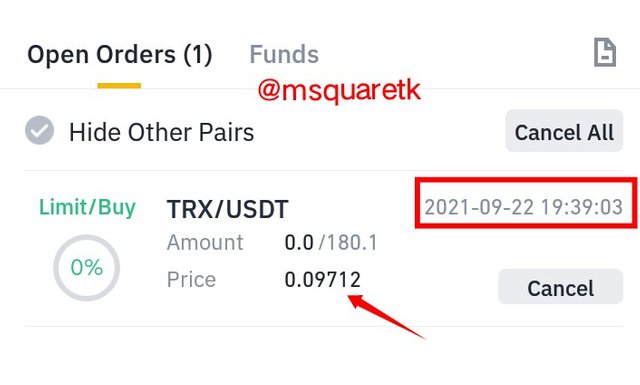

As a placed a clicked the buy, an order was opened. The order is opened around 22-09-2021 ; 19:39:03pm WAT. This means that the order will still remain open and be in the order book until the price of the asset gets to the limit price.

Fig. 14: Open order of TRX/USDT | Binance App

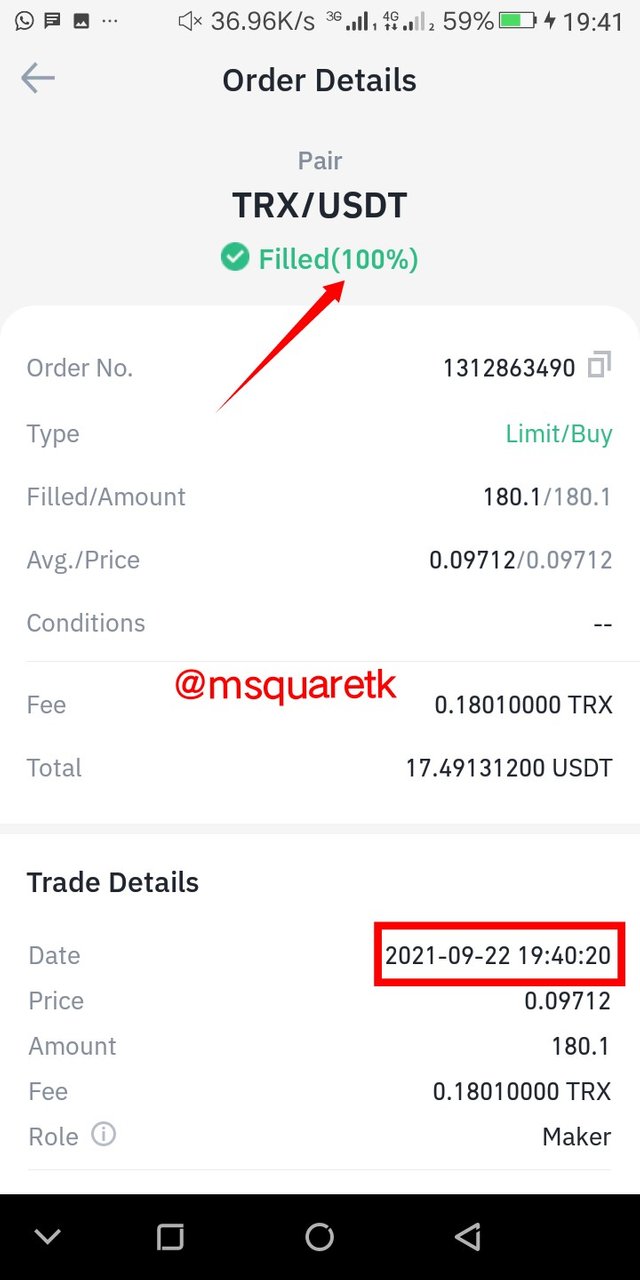

Now,the order got filled about 2 minutes after the order was opened. This means that the price of an asset has moved from the current price, $0.09745 where I met the market to the limit price, $0.09712. The screenshot below shows the order details.

Fig. 15: Order details of a buy limit of TRXUSDT | Binance App

As we can see from the above screenshot, the order is now 100% filled. Although it was not filled at instant because I changed the lowest ask price to my preferred price which is called, limit order. If you look at the bottom of the screenshot of the order details above, you will see that the role I played is maker. Any trader which uses limit order to buy or sell is called market maker

Question 7

Place a TRX/USDT Buy Market order on the Binance exchange for at least $15. Explain your steps and explain the impact of your order in the market. (Give Screenshots of the completed order).

In the previous question, we have seen how to place buy limit order and see the impact I has on the market. For this task, I am going to place a buy market order.

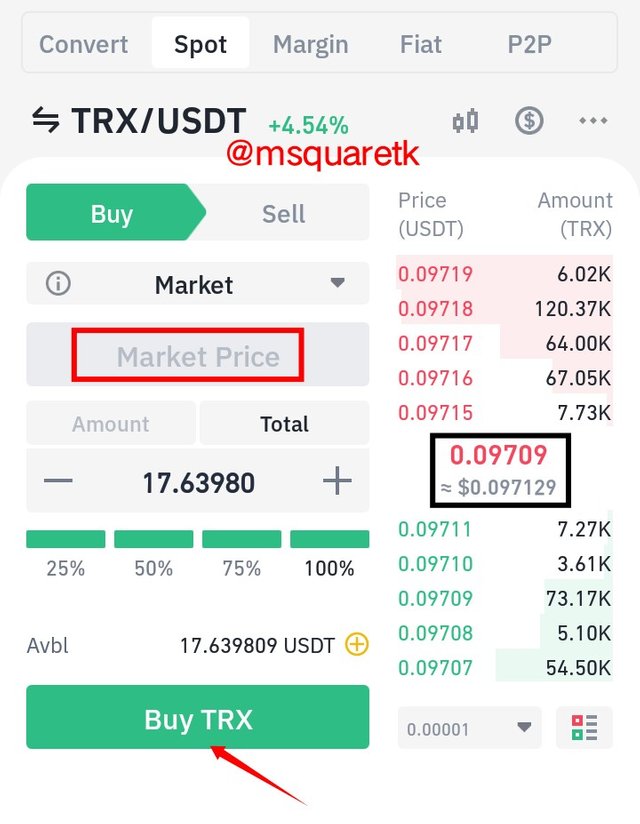

The same procedure will be used just as we did I the previous question, but this time around, what is different is that, we are going to select market price. Selecting market price means, we are buying at the current price, that is at the ask price.

The current or market price of the asset TRXUSDT at the time of playing the order is $0.09709. So I'm buying at this price which is the market price. Having filled all the details, I clicked on buy.

Fig. 16: Buying TRXUSDT at market price | Binance App

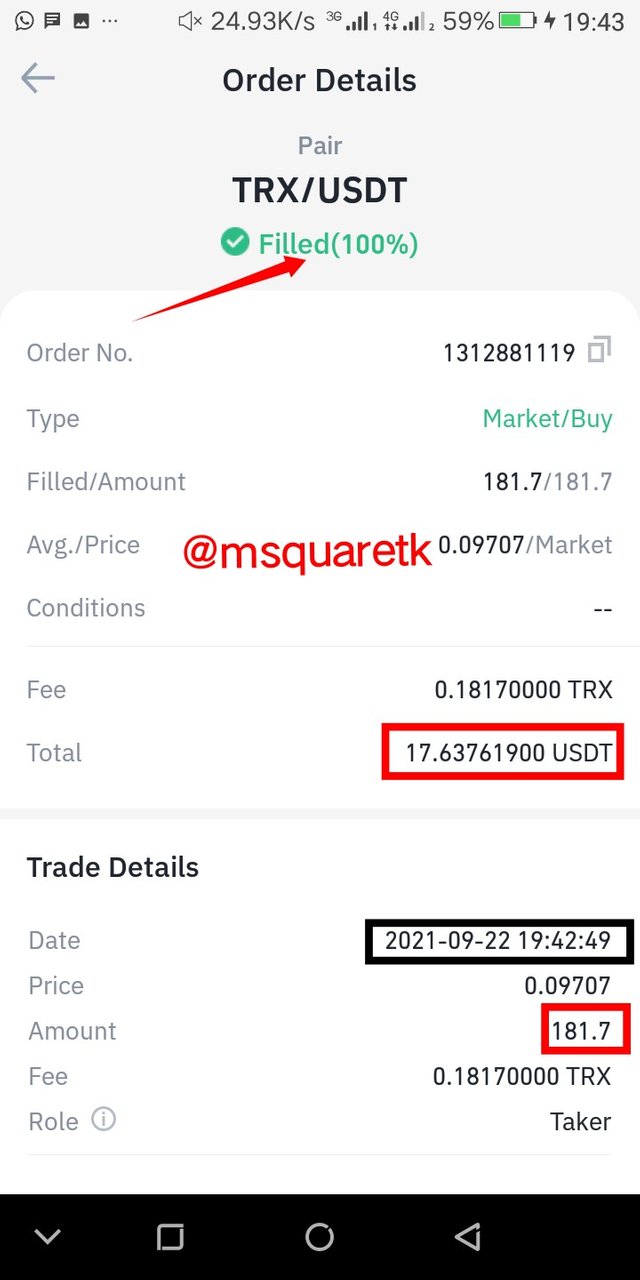

The order was executed and filled immediately. Unlike limit order that I placed in the previous question where the order, when placed, was seen in the open order before it was filled, the purchasing of TRXUSDT at market price wasn't like that, instead, the order was filled immediately.

Fig. 17: Order details of buy market order of TRXUSDT | Binance App

As it's seen in the screenshot above, the order is 100% filled. If you see the screenshot very well, you will notice that the order was actually filled at $0.09707 and if you remember, the market price I placed the order is $0.09709. The price has slightly changed and this is due to what is called slippage (Slippage occurs when the price when the order is filled is different from the actual price when it was placed).

Also, If you look at the bottom of the page of the order details screenshot, you will notice that the role I played is taker, and this is because I executed a buy at market price, I placed a buy market order. So market takers are traders which execute market order trades.

Question 8

Take a Screenshot of the order book of ADA/USDT pair from Binance on the day you are performing this task. Take note of the highest bid and Lowest ask prices: (a) Calculate the Bid-Ask. (b) Calculate the Mid-Market Price.

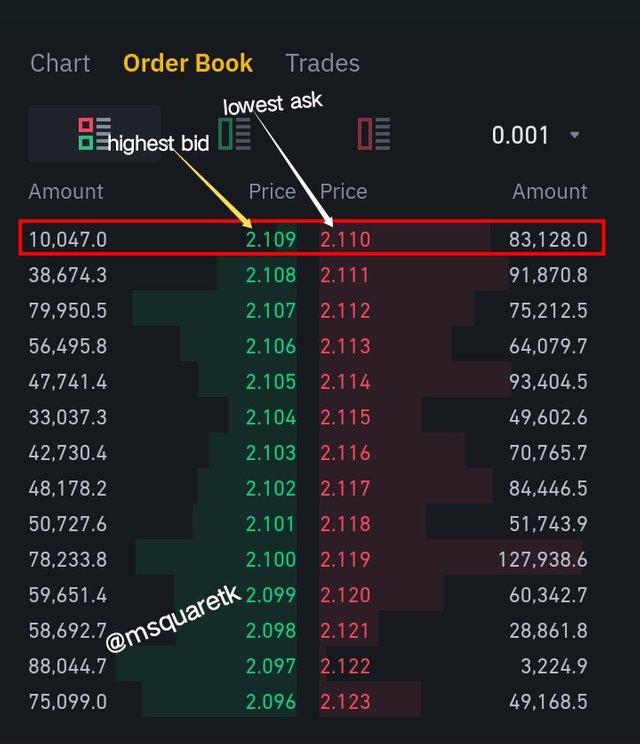

Here, I will be showing the highest bid and lowest ask of the ADA/USDT.

Let's see the screenshot below.

Fig. 18: Order Book of ADA/USDT | binance.com

As it is seen in the screenshot above, the highest bid is $2.109 and the lowest ask is $2.110.

So, having known these values, I'm going to be using them to calculate the Bid-Ask Spread and mid-market price.

(a) Calculating Bid-Ask Spread

Given:

Bid price = $2.109 (The highest bid I indicated above)

Ask price = $2.110 (The lowest ask I indicated above)

We know that:

Bid-Ask Spread = Ask price - Bid price

Substituting the values of ask price and bid price into the formula, we have:

Bid-Ask Spread = $2.110 – $2.109

Bid-Ask Spread = $0.001

Therefore, Bid-Ask Spread = $0.001

(b) Calculating the Mid-market price

We know that:

Mid-Market Price = (Bid Price + Ask Price)/2

Bid price = $2.109

Ask price = $2.110

Substituting these values in to the formula, we have:

Mid-Market Price = (2.109 + 2.110)/2

Mid-Market Price = 4.219/2

Mid-Market Price = $2.1095

Hence, Mid-Market Price = $2.1095

Conclusion

Order book is one of the terms which is very important that every trader should understand. One of the importance of the order book is that it shows the amount of orders placed at certain price. It also helps determine the direction of price of an asset at a particular period of time. For example, if there are more orders on the bid side, it may mean that the asset is bullish or in an uptrend as many traders are willing to long the asset.

Thanks to Professor @awesononso for continue the topic. I have really learnt one or two things from this week topic.

CC: @awesononso

Written by @msquaretk

Hello @msquaretk,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

Great job on this work. You did very well.

You did not provide a screenshot of the completed order in 5a.

You did not properly state the impact of your order for questions 6 and 7.

Thanks again as we anticipate your participation in the next class.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the review Professor @awesononso.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit