Cover Page created by me, @msquqretk | created with imarkup app

It's a new week in he steemit Crypto Academy. This is the seventh week of the season 5 in the Steemit Crypto Academy. Thanks to all our Professors for their efforts so far in delivering good and quality lecture and many thanks to the entire management of the Steemit Crypto Academy.

This post is written in response to Professor @lenonmc21 's assignment after his lecture on "Trading Strategy with "Price Action and the Engulfing Candle Pattern". He explained the strategy very well. I will be answering the questions based on my own understanding. So, follow me closely.

THEORY

1. Say in your own words that you understand about the Trading Strategy with “Price Action and the Engulfing Candle Pattern, also describe each step to be able to execute it (Place at least 2 examples in clear cryptographic assets and with your own charts mandatory) ?

In this part of the task, I am going to be explaining the strategy with "price action and the engulfing candlestick pattern". Trading requires proper strategy and that we must learn to master whatever strategy we want to use very well do we can be more profitable. For the past weeks, Prof. has been teaching strategies based on price action. In this task, we are still going to be discussing about a strategy that has to do with price action.

Now , talking about this strategy, it is totally based on the price action. The price must be in a very clear trend before we can set up this strategy. And knowing fully well that, we likely predict with some degree of accuracy when when we trade in the direction of the trend. Hence, the strategy requires that the trend follows a very neat harmonic and the price movement making lows and highs has a very equal or almost equal in the prevailing and retracement leg.

This, if the harmonic trend is okay, that's the prevailing legs have or almost the same move and also the retracement legs too are also with the same or almost the same move. The next thing to wait for is the a great movement or momentum in the opposite direction of the trend. This will mean that the trend is about to reverse and that the new trend will emerge. The great momentum to the opposite side will signify whales coming in to drive the price in the opposite side. On the price chart, we will often see consecutive candles with volume in this direction. Once we see this move, the next thing to do is to wait for the price to break the structure and retrace back.

Now, this is is where engulfing candle comes in to play. At the retracement leg, when we see an Engulfing candle form, then we mark the entire body of the engulfing candle. But, all this is going to be taken place in 15 minutes temporality. Once we mark the zone, we switch to another temporality, 5minute to take the entry. An example of a clear harmonic trend is shown in the screenshot below.

Screenshot from MT4 App

Now, to set up a trade with the strategy, we need to see that some requirements are met. If one of them fails, we may not have a successful execution being carried out. Hence, I am going to be explaining steps to be taken into consideration in setting up a trade using the strategy.

Steps for the strategy

1. Search for a chart with a clear Harmonic trend.

The first step is to look for a chart which gives us clear trend in the movement of price. That's the trend harmonic must be correct in the sense that the prevailing legs must be or almost the same and the retracement legs should also be equal in their movement. It's very important that the trend is in clear move, otherwise, the setup may fail. So, in essence, any market or cryptocurrency pair which doesn't show harmony in the impulsive legs and retracement legs should be avoided. Then, 15 minutes timeframe or temporality will be used to find the trend which is very valid and harmonic. Once, we have found the trend, we have completed the first step to setting up the strategy

Screenshot from MT4 App

Screenshot from MT4 App

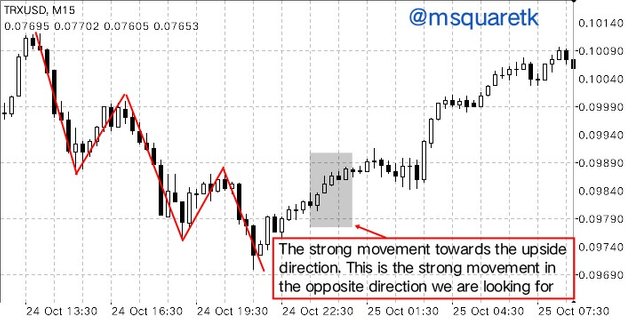

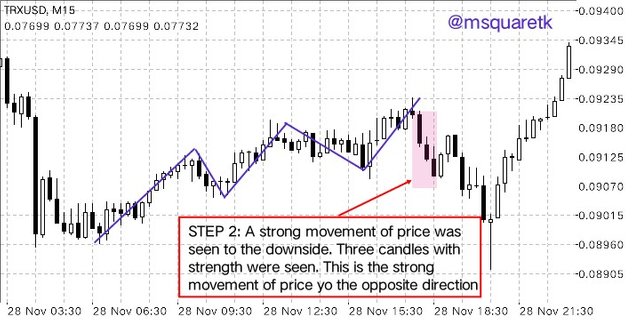

2. Looking for great movement or momentum in the opposite direction of the prevailing trend.

Now, the next step after we have identified the healthy and harmonic trend is to be on the lookout for a great counter move against the prevailing trend. When there's a great move, the candlesticks will be showing a very high volume which will be represented by large bodies. This means, the trend is shifted to the opposite direction and it's often a signal that the whales are pumping money to the other side of the trend. Now, if the prevailing trend identified in step 1 is bullish, we look for a strong movement of price in the opposite direction, towards the downside. And if the prevailing trend identified in step 1 bearish, we look for a strong movement of price in the opposite direction, towards the upside.

Screenshot from MT4 App

Screenshot from MT4 App

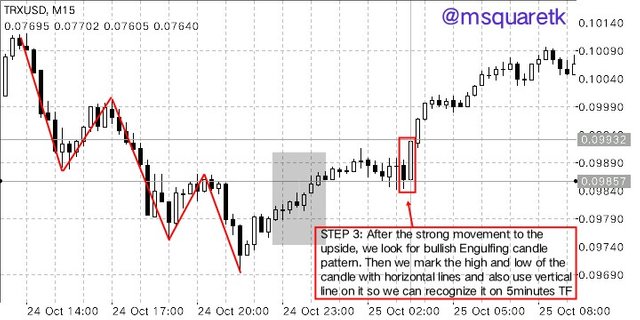

3. Look for a clear break of structure and Engulfing Pattern.

The next step is to wait for the the strong movement of price to break the the structure. If the strong movement of price is to the downside, that means the prevailing trend identified in step 1 is bullish; hence, the strong movement must break the last or previous low created by this trend. Then, we must wait for price to take a break. That's, price retracing back and then find an Engulfing candle pattern. Then, we must look for a bearish engulfing candlestick pattern. Once it's found, we mark the high and low of the engulfing candle with the horizontal lines and also draw vertical line on the engulfing candle so as to identify the candle when it's switched to 5 minutes TF

On the other hand, if the strong movement of price is to the upside, that means the prevailing trend identified in step 1 is bearish; hence, the strong movement must break the previous high created by this trend. Then, we must wait for price to take a break. That's, price retracing back and then find an Engulfing candle pattern. Then, we must look for a bullish engulfing candlestick pattern. Once it's found, we mark the high and low of the engulfing candle with the horizontal lines and also draw vertical line on the engulfing candle so as to identify the candle when it's switched to 5 minutes TF

Screenshot from MT4 App

Screenshot from MT4 App

4. Chart should be switched to 5 minutes to make the entry

After identifying the Engulfing candle pattern and marking it with horizontal lines and vertical lines on 15 minutes timeframe, the next thing is to go to the 5 minutes timeframe and make the entry. As we switch to 5 minutes, we make the entry at this zone. However, if on switching to the 5 minutes timeframe, the zone has been broken, we wait for the price to retrace back to the zone and as we see a red(black) candle forms at the this zone we make a sell entry (in case of a sell set up), stop loss should be put above the retracement level and take profit at the nearest support level. And as we see a green (white) candle forms at the zone we make a buy entry (in case of a buy set up), stop loss should be put below the retracement level and take profit should be placed at the nearest resistance level.

Screenshot from MT4 App

Screenshot from MT4 App

2. Explain in your own words the interpretation that should be given to a large strong movement in the market. What does the price tell us when it happens?

In this part of the task, I am going to be explaining the interpretation of a large movement in the opposite direction of the prevailing trend in our "price action and Engulfing candle pattern". Remember that I said the first thing to look out for when using the strategy is a very clear trend, where the impulsive moves and the retracement legs have the same or almost the same equal size. Then once this is established, we look for a strong counter move, that's a strong movement of price in the opposite direction. This move must be very strong that the candles must show a certain large body in this opposite directions.

If the prevailing trend is bullish, then that means, the large strong move will be bearish, towards the downside direction. And if the clear, healthy and harmonic prevailing trend is bearish, then the large strong move with be bullish, towards the upside direction. Now what does that move tell us? That's what i am about to explain vividly. The large strong movement in the opposite direction of the clear trend identified signifies the presence of whales. Who are the whales? They are large investors of cryptocurrency. They have accumulated enough coins. They have high percentage of the coin. So, when they come in to h market, their impacts is always felt. They have enough capacity to drive the price of he market to the direction the wish.

Now, it's important that I explain this at this moment: It is not the percentage or number of buyers or sellers that determine the direction of price. Sellers can be more in number than buyers and yet the price goes upward and in the same way, buyers can be more in number than sellers and yet the price follows downward direction. What actually determines the direction of price is the number of lots opened towards a direction. If the number of sellers is more than buyers and the lots opened by buyers is more than that of the sellers, the price will go upward. What's the significance or how does this find relevance in the large strong movement?

When whales come into the market, it doesn't matter the number of buyers or sellers which trade in the opposite direction of the whales, the whales will always drive price in h direction they want. This is because, they have enough capacity to open big lots. For example, a whale may have about 40% of the entire supply of the token or coin. So he can open as more lot as he wish.

Further, the strong movement in the opposite direction I a signal of the change of trend. What we see a strong movement like that, we should know that the momentum is shifting to the opposite side. In the screenshot below, you will see that there was a clear trend which shows the impulses and pullbacks are of almost or equal size or length. And a time came when the whales come in, and drive the price towards the opposite side.

Screenshot from MT4 App

We can see in the screenshot above, a clear trend was to the upside, showing a healthy and harmonic trend. A strong move appeared which is a signal that the whales have come in. The strong move broke the structure, which is also a signal of a change of trend. And we can see how the trend changed.

3. Explain the trade entry and exit criteria for the buy and sell positions of the trading strategy with Price Action and Engulfing Candlestick Pattern in any cryptocurrency of your choice (Share your own screenshots taking into account a good ratio of risk and benefit)?

In this part of the task, I am going to be explaining the trade entry and exit criteria for the sell and buy position. Now, we must follow the rules to be able to execute a successful trading. The steps to follow must be followed correctly; if one fails, the strategy may fail.

- Now, the first thing we must take note when we are setting up the strategy is that, we must look for a clear trend. Meaning the trend must show correct harmony. If the market is not trending, it is better to wait or look for a pair with a clear trend. Because if the market is ranging or flat, the strategy may fail.

For the sell set-up, we must look for a clear bullish trend with correct harmonic. That's the impulsive moves and the retracement legs must have almost or equal size.

For the buy set-up, we should look for a clear bearish trend with correct harmonic. That's the impulsive moves and the retracement legs must have almost or equal size

Screenshot from MT4 App

Screenshot from MT4 App

- Now after identifying the clear trend we need for our strategy, the next thing is to look for the large strong movement of price in the opposite direction.

For a sell entry position, the strong movement should be in the opposite direction (bearish) of the clear bullish trend previously identified. At least we should see three or four candles with force or strength, large body.

For a buy entry position, the strong movement should be in the opposite direction (bullish) of the clear bearish trend previously identified. At least we should see three or four candles with force or strength, large body. If this doesn't happen, then we should discard it and look for another setup.

Screenshot from MT4 App

Screenshot from MT4 App

- Next, after identifying the strong movement is to identify our Engulfing candle pattern at the retracement of the strong move. The engulfing pattern must be clearly and properly identified.

For a sell setup, we look for a bearish engulfing candle pattern. Then we mark the zone of the candle on 15 minutes timeframe by using horizontal lines to mark the high and low. And also draw a vertical line on the candle to be able to easily identify it on 5 minutes timeframe. Then we will change the timeframe to 5minutes timeframe

For a buy setup, we look for a bullish engulfing candle pattern. Then we mark the zone of the candle on 15minutes by using horizontal lines to mark the high and low. And also draw a vertical line on the candle to be able to easily identify it on 5 minutes timeframe. Then, we will change the timeframe to 5 minutes timeframe

Screenshot from MT4 App

Screenshot from MT4 App

- Now, upon switching to 5 minutes timeframe, we will look for the zone of the Engulfing candle which we marked on 15 minutes timeframe. If the some is not yet broken, we look for a clear break of the zone with momentum before placing our position. However, if it had been broken, we wait for the retest of the zone.

For a sell set up, the zone marked must break to the downside if it hasn't be broken, but if it has been broken, we wait for the retest. Then we place sell entry and the stop loss should be placed above the retracement and take profit should be placed at the nearest support zone.

For a sell buy setup, the zone marked must break to the upside if it hasn't be broken, but if it has been broken, we wait for the retest. Then we place buy entry and the stop loss should be placed below the retracement and take profit should be placed at the nearest resistance zone. For the take profit, if we can identify nearest support or resistance zone on 5 minutes timeframe, we can go back to higher timeframes to set the target. The risk reward should be at least 1:2

Screenshot from MT4 App

Screenshot from MT4 App

PRACTICE

Make 2 entries (One bullish and one bearish), using the “Price Action and Engulfing Candlestick Pattern” trading strategy. These entries must be made in a demo account, keep in mind that it is not enough to just place the images of the execution, you must place additional images to observe the development of these operations to be able to be correctly evaluated and see if they really understood the strategy.

Im this part of the task, I am going to be explaining my understanding of the "price action and Engulfing candle pattern" by placing two trades, one buy and one sell. Let's start with buy.

Buy Entry (XRPUSD)

The buy entry I am going to be placing is on the chart of XPRUSD. And the platform I will use is Mt4 app. Now, we know that, to trade the buy order with the strategy, we must first identify a clear and healthy harmonic trend. Meaning that, the impulsive moves and the retracement legs of the trend must be of equal size or length. So, for buy entry, we look for a clear harmonic bearish trend. In the screenshot below, you will see that I found this on the chart of XRPUSD.

Screenshot from MT4 App

Then, after identifying the clear trend, the next thing is to look for a strong move in the opposite direction. And that's what I looked for on the chart of XRPUSD. There's a strong move to the upside which signifies that the whales have come in and that the trend is likely to change to bullish. See the screenshot below.

Screenshot from MT4 App

Next, is to wait for a break. Then, at the retracement leg of the strong move previously identified, we will look for a bullish Engulfing candle pattern. On the screenshot below, you will see that the bullish Engulfing pattern formed. Then, on seeing it, I marked the high and low of the Engulfing candle pattern with the horizontal lines and drew the vertical line on it to be easily recognized it on 5 minutes timeframe. See the screenshot below

Screenshot from MT4 App

Then i switched to 5 minutes timeframe which is the next step on our strategy. Now, the zone i marked on 15minutes timeframe will be seen on 5 minutes timeframe. Now, to place a buy entry, the zone must be broken with a force candle to the upside. Then, if on switching to 5 minutes timeframe, the zone has been broken to the upside, we wait for price to retest the zone before placing a buy entry. In my case, I was there when the zone broke with force to the upside. Then I placed a buy entry and stop loss was placed below the retracement leg and take profit was placed at the nearest resistance level.

Screenshot from MT4 App

The screenshot below shows the entry, stop loss and take profit of the trade on the chart of XRPUSD.

Screenshot from MT4 App

Then, the trade is running nicely. On the screenshot below, you will see the trade of XRPUSD running. I will keep monitoring the trade to see how it's going to end. If it goes against my prediction, that means the setup is invalid, then we will look for new setup. And if it goes in my predicted direction, I will make profit.

Screenshot from MT4 App

Sell Entry (IOTABTC)

The sell entry I am going to be placing is on the chart of IOTABTC. And the platform, I will use is Mt4 app. Now, we know that, to trade the sell entry with the strategy, we must first identify a clear and healthy harmonic trend. Meaning that, the impulsive moves and the retracement legs of the trend must be of equal size or length. So, for sell entry, we look for a clear harmonic bullish trend. In the screenshot below, you will see that I found this on the chart of IOTABTC.

Screenshot from MT4 App

Then, after identifying the clear trend, the next thing is to look for a strong move in the opposite direction. And that's what I looked for on the chart of IOTABTC. There's a strong move to the downside which signifies that the whales have come in and that the trend is likely to change to bearish. See the screenshot below.

Screenshot from MT4 App

Next, is to wait for a break. Then, at the retracement leg of the strong move previously identified, we will look for a bearish Engulfing candle pattern. On the screenshot below, you will see that a bearish Engulfing pattern formed. Then, on seeing it, I marked the high and low of the Engulfing candle pattern with the horizontal lines and drew the vertical line on it to be easily recognized it on 5 minutes timeframe. See the screenshot below

Screenshot from MT4 App

Then I switched to 5 minutes timeframe which is the next step on our strategy. Now, the zone i marked on 15minutes timeframe will be seen on 5 minutes timeframe. Now, to place a sell entry, the zone must be broken with a force candle to the downside. Then, if on switching to 5 minutes timeframe, the zone has been broken to the downside, we wait for price to retest the zone before placing a sell entry. In my case, I was there when the zone broke with force to the downside. Then I placed a sell entry and stop loss was placed above the retracement leg and take profit was placed at the nearest support level.

Screenshot from MT4 App

The screenshot below shows the entry, stop loss and take profit of the trade on the chart of IOTABTC

Screenshot from MT4 App

Then, the trade is running nicely. On the screenshot below, you will see the trade of IOTABTC running. I will keep monitoring the trade to see how it's going to end. If it goes against my prediction, that means the setup is invalid, then we will look for a new setup and if it goes in my predicted direction, I will make profit.

Screenshot from MT4 App

Conclusion

There are many strategies traders have developed based on the price action. In fact, any strategy that has to do with price action may work well because. One of the strategies which is based on price action has been discussed in this task. Price action and Engulfing candle pattern is a strategy which had to do with clear trend which is the first thing we look for, the strong opposite move which signifies a change in trend and then we look for Engulfing candle and then switch to 5 minutes timeframe for take our entry.

In this task, I have shown my understanding of the strategy by explaining what it is, the trade exit and entry criteria, and place two trades to show my understanding. Thanks to Professor @lenonmc21 for the insightful teaching.

N:B – All screenshots weree taken from my MT4 App

CC: @lenonmc21

Written by @msquaretk

i invite you to join crypto trading community and post analysis there, thank you. https://steemit.com/trending/hive-171551

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit