Cover Page created by me, @msquaretk | Made on imarkup app

Cover Page created by me, @msquaretk | Made on imarkup app It's the day 3 of the fourth week of the trading competition. In this post, I'm going to be showing the token I'm trading today, the project background of the project, the wallets it can be stored, and the Exchanges it can be traded on. Then I'm going to be showing the technical analysis I did and the real trade on binance. I'm a member of the front line team. Thanks to my team leaders @abdu.navi03 and @shemul21 for the efforts in correcting our works and giving us suggestion so as to improve. So, follow me closely.

The name and introduction of the project token, and which exchange can be traded on, project/technical/team background

In this part of the task, I'm going to be giving a brief summary of the project background of the token I'm trading, the name of the token, the wallets it can be stored and the exchanges it can be traded on. The name of the token is Lumen (XLM)

XLM is a native token of steem network, a platform which enables users to trade, send and exchange cryptocurrency to Fiat and vice versa. The platform was created in the year 2014 and was launched in the year 2015. The brains behind the creation of the platform are McCaleb and former lawyer Joyce Kim. They were the ones who founded the platform. They Aimee at bringing finance of he world into a single network.

Although, Stellar network allows other cryptocurrencies and Fiat currencies to be operating on the network but it has its own native token which is known as lumen (XLM). This token is the network's foundation of the Stella network. Initially, the name of the token was reffered to as stellar, but it was later changed to lumen. And that's why people still call the name of the token stellar today. But the name of the token is Lumen because it had been changed, while the platform is called stellar.

Stellar network is managed by the stellar foundation development. The project was successful because they received funding from different organization and see of individuals who believed in the project. Some organization such as BlackRock, Google, etc supported the project by giving funding. The funds received was used for the growth and development of the project.

In the year 2018, the stellar foundation wanted to increase her capacity and signed agreement with TransferTo so she can become a cross border payment to many nations of the world. The aim of the foundation is to develop the economies and to include the individuals who are not banked into the technology. Many people and organizations have been using the platform. And interestingly, Stellar doesn't charge both the individuals and the organization the network fees.

In addition, Stellar focuses on reducing the transaction cost and make the transaction work effectively as possible, and increase the transaction speed. Stellar network uses a consensus protocol which is known as stellar consensus protocol. This protocol is capable of running on its own. Stellar is like ripple, however it's a bit different in the sense that ripple partners directly with the banks when doing transaction. But Stellar uses what's is known as anchor. Anchor acts as a bridge between the Stellar and the banks. These anchors are trusted intermediaries which the user uses.

Lumen can be stored both in hardware and downloadable wallets. Hardware you can store lumen include, Ledger Nano S and Trezor. While downloadable are keybase, dollar wallet, and lobstr. It can also be stored on wallet like coinbase.

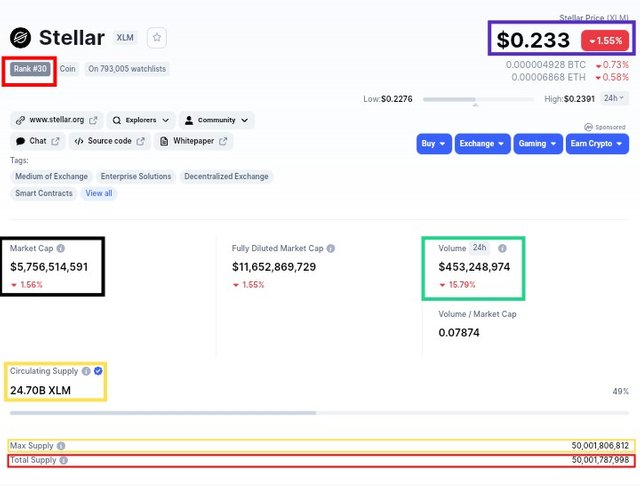

According to Coinmarketcap, Stella is ranked #30 and it's currently trading at $0.233.

It has a market capitalization of $5, 756, 514, 591;

Volume of $453, 248, 974;

Circulating supply of 24.70B XLM;

Maximum supply of 50, 001, 806, 813 XLM and

Total supply 50, 001, 787, 998 XLM

The screenshot below shows these details mentioned above according to Coinmarketcap platform.

Screenshot from Coinmarketcap platform | SOURCE

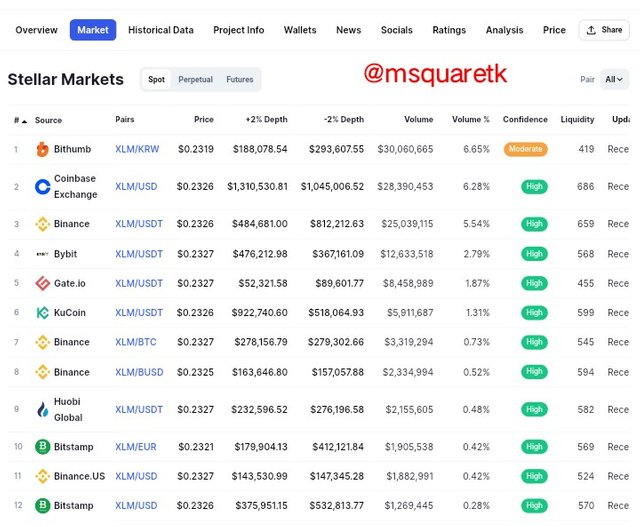

Exchanges It can be Traded on

Stella (XLM) has been listed on many exchanges. Some of the exchanges according to Coinmarketcap are:

- Binance

- Bithumb

- Kucoin

- Coinbase exchange

- Kraken

- Bybit

- Huobi Global

Etc

Let's take a look at some of these exchanges on he screenshot below. This is according to Coinmarketcap platform.

Screenshot from Coinmarketcap platform | SOURCE

Why are you optimistic about this token today, and how long do you think it can rise?

I'm optimistic about this token because of the analysis I did which shows that the price may experience a fall. The price is at a key resistance level and that level has resisted price for more than two times in the past. So, there's a very high probability that the price will fall from this level. Also, what i read about the project makes me interested in the token. According to my analysis, XLM, can fall to at least the closest support level at $0.2293

Having said that, let's now move to the technical analysis of the token, where I will be showing how I did the analysis on the trading view.

Technical Analysis of the Token, XLMUSDT

Here, I'm going to be showing how I did the technical analysis on the trading view platform and then how I took the real trade on my Binance exchange App. The technical analysis will show the reason why I took the trade and the strategy I used. I'm going to be using price action, support and resistance, candlestick pattern and technical indicator (Stochastic Oscillator)

Support and resistance are levels where price is likely to turn or bounce when it reaches the area. Stochastic oscillator gives sell and buy signals when its lines cross in the overbought and oversold region. So, stochastic will help confirming the signal from the price action.

Upon opening the chart of XLMUSDT to 15 minutes timeframe, I marked the support and resistance levels knowing that price is likely to bounce back when it touches these levels. On marking these, I realized that the price is currently on a resistance level and has already rejected the area. Also, a bearish engulfing pattern has formed on that resistance level.

Confirming this, I looked at the stochastic oscillator window. I could see that the stochastic lines have entered the overbought region, meaning that the sellers may take over the market since price is overbought. Also, the lines have crossed in this zone which is sell signal. Let's see the screenshot below.

Screenshot from Trading View platform | SOURCE

Going further to lower timeframes, on 3 minutes timeframe, I could see that the resistance has resisted the area and that a new trend is forming already. The market structure confirms that a downtrend is forming as the price is making lower lows and lower highs. In addition, a bearish engulfing candlestick pattern formed at the end of the last retracement leg. See the screenshot below.

Screenshot from Trading View platform | SOURCE

Then having these reasons:

- Price is at the the resistance level on 15 minutes timeframe,

- Reversal candlestick pattern formed on the resistance level,

- Stochastic oscillator overbought and its lines crossed which is a sell signal and

- New trend (downtrend) is already forming on 3 minutes timeframe

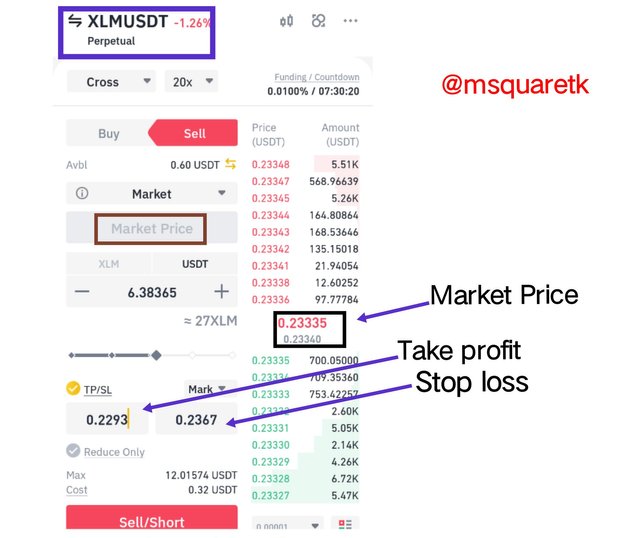

I marked the entry and exit price levels. Entry was made after the bearish engulfing pattern. Stop loss was placed above the resistance level at $0.2367 and stop loss was placed at the support level at $0.2293. See he screenshot below.

Screenshot from Trading View platform | SOURCE

Then, having the price entry and exit levels, I opened my Binance App to take a real trade. The future margin trading option was used. I set everything appropriately. Let's take a look at the screenshot below showing when I was placing the sell position on binance.

Screenshot from my Binance App

Then the screenshot below shows that i have successfully placed a sell trade position of XLMUSDT. I will monitor the trade and see how it's going to end.

Screenshot from my Binance App

Do you intend to keep it for a long time or when to sell it?

I'm not planning to keep the trade for a long time because the analysis I did is for short term, it's an intraday analysis. Also, I did the margin trading and in margin trading, you are not in possession of the asset. So, you can't hold it, you can only take advantage of the rise and fall in price and make profit. Once the trade hits the exit (take profit or stop loss), I will be out of the market and that will be the end of that trade.

Do you recommend everyone to buy? and the reasons for recommending/not recommending

Firstly let me say that I didn't buy the token I traded, rather I sold. I could recommend people to sell it, but that would be when I sold it. The reason it will be the time is because it's an intraday anlaysis and the price will not take long time before hitting the exit. Then, my reasons for recommending would be because of my analysis. Remember I told you that the price was on a key resistance level and I showed this to you when I was doing the technical analysis. Also, stochastic oscillator was also used to confirm the sell signal.

Conclusion

In this post, I have been able to complete the task for the third day of the fourth week of the trading competition. I have explained briefly the project background of the token, the team behind or the founders, the wallets it can be stored and the exchanges it can be traded. I also showed how I did the technical analysis on the trading view platform before moving to binance exchange app to take the real trade. Thanks to the Admins for this initiative and thanks to my team leaders @abdu.navi03 and @shemul21 for grading, and correcting our works.

Consulted Article 1 Source

Consulted Article 2 Source

Consulted Article 3 Source

CC:@abdu.navi03

Written by @msquaretk

You've got a free upvote from witness fuli.

Peace & Love!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit